- So far this year, there has been a decline in Polkadot’s network activity.

- The price of DOT has fallen by double digits over the past 30 days.

According to The Block Data dashboardnetworking activity on the Polkadot [DOT] blockchain has experienced a significant decline, reaching its lowest level yet this year.

The steady decline in user activity on the network indicated a decline in demand for the chain since the beginning of the year.

As a result of this and the general market correction following the ETF’s approval, DOT’s value fell 21% last month, data from CoinMarketCap showed.

A drop in network activity

According to data from The Block, Polkadot’s daily number of transactions, as measured by a seven-day moving average, has fallen since January 1.

On January 27, the network closed the day with a number of transactions of 12,000, a drop of no less than 60% compared to the 30,000 transactions the chain registered on New Year’s Day.

The decline in the daily number of transactions on Polkadot is due to the steady decline in the number of unique addresses active on the network daily, either as a sender or as a receiver.

Data from the chain shows that this year to date (YTD) is down 56%.

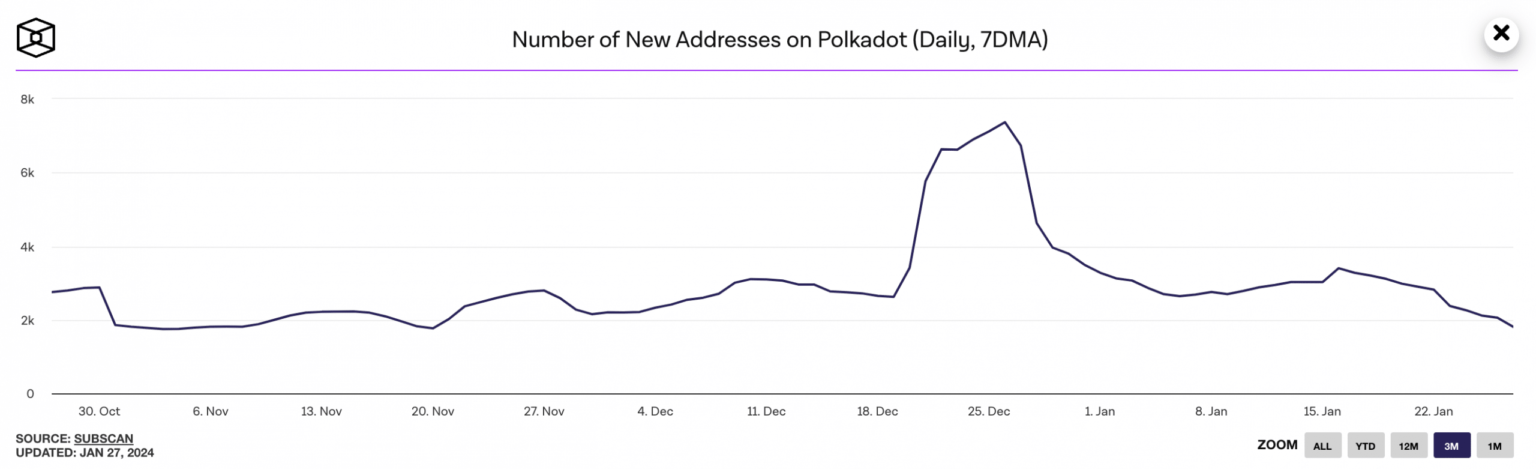

In terms of new demand for the chain, the number of unique addresses that first appeared in a transaction on Polkadot rose to a two-year high on December 26, 2023.

However, this was immediately followed by a decline. The daily number of new addresses on the Polkadot blockchain has fallen by 75% since then. On an annual basis this has fallen by 44%.

Source: Het Blok

Due to low user activity on the chain over the past month, Polkadot’s fees and revenues from it have been significantly impacted.

According to data from Token terminaltransaction fees on the network last month were $71,000, a drop of 97%.

Similarly, revenue from these fees was $56,480, also a corresponding decrease of 97%.

DOT is suffering

AMBCrypto’s review of DOT’s daily chart showed a steady decline in On-Balance-Volume (OBV) since the beginning of the year.

At the time of writing, the altcoin’s OBV returned a value of 60.98 million, down 28% from the 85 million recorded on January 1.

Read Polkadots [DOT] Price forecast 2023-24

Confirming high selling pressure, DOT’s Chaikin Money Flow (CMF) rested at the zero line and was on the verge of breaking it at the time of writing.

A CMF value below zero is taken as a sign of weakness in the market because it is a sign of increased liquidity exit.

Source: TradingView