This article is available in Spanish.

After recent developments, the crypto market is confronted with renewed volatility and uncertainty Bitcoin price crash under the $100,000 limit. As a result, a crypto analyst has done just that shared a fairly lengthy X-post (formerly Twitter) outlining what to expect after this significant drop. He warns of critical levels to watch the selling pressure increasesnoting that both macro and technical indicators paint a mixed picture of Bitcoin’s short-term price trajectory.

Important levels to watch after the Bitcoin price crash

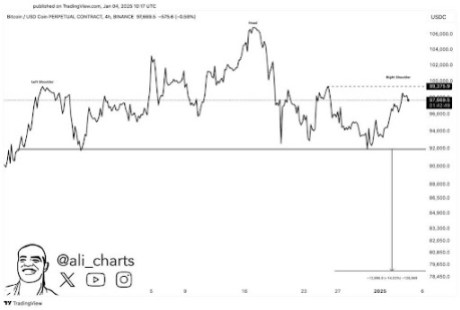

According to prominent crypto analyst Ali Martinez, the Bitcoin price is once again trading below $100,000 after surpassing this milestone earlier this week. Martinez revealed that Bitcoin hit the right shoulder of a the day before Head and shoulders patterncompletely negating the bearish stance at the time. However, in just 24 hours, the cryptocurrency erased these significant gains, bringing the price back below the right shoulder of the technical pattern. the resurgence of bearish sentiment.

Related reading

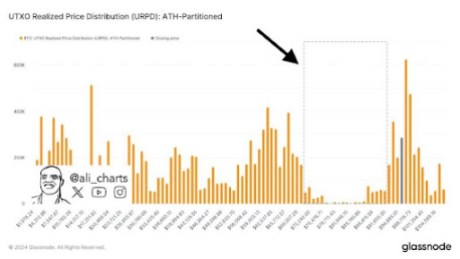

With its enormous crashes below $100,000Bitcoin has now fallen significantly below the key demand zone between $95,000 and $98,000, an area where approximately 1.77 million wallet addresses had purchased over 1.53 million BTC, which is worth over 141.3 billion at the current market rate.

While many investors typically buy and hold BTC for profit, Bitcoin’s recent price crash has raised concerns that owners of the 1.77 million wallet addresses may be forced to sell their belongings to limit potential losses. Martinez warns that increasing selling pressure could push the Bitcoin price below $92,000, potentially triggering an even sharper and faster decline, with limited support until the $74,000 mark is reached. Notably, the analyst calls a drop below $92,000 a “free fall area,” meaning Bitcoin could continue to crash. panic selling intensifies and liquidity dries up.

In addition to the ongoing uncertainty, Bitcoin’s reversal below the right shoulder of the Head and Shoulders pattern, combined with current bearish market conditions, has reignited fear, leaving many investors bracing for a deeper price crash.

Rebound on the horizon or more pain ahead?

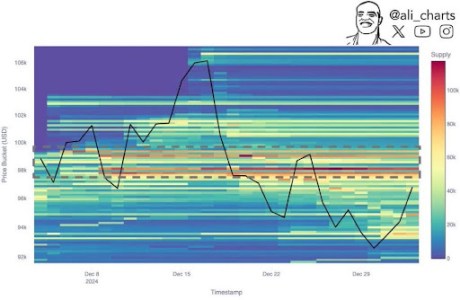

Despite Bitcoin’s current bearish outlook, Martinez assures members of the crypto community that a price rebound is possible. The analyst revealed that Bitcoin’s TD sequential indicator recently showed a buy signal on the 4-hour chart, indicating that there is a potential price recovery and recovery may be ongoing.

Related reading

Interestingly enough, Binance traders remain bullish on Bitcoin, with this bullish sentiment pointing to a short-term recovery towards $98,600, a price level with a $35 million liquidation zone that market makers are coveting. Martinez emphasizes that there is an ongoing breakthrough above the $100,000 limit is critical to debunking Bitcoin’s current bearish outlook and paving the way for new all-time highs.

However, if Bitcoin fails to regain this psychological level and falls below $92,000, it risks a further downtrend, possibly correcting to new lows between $78,000 and $74,000. At the time of writing, the Bitcoin price is trading at $94,154, meaning a fall from these lows would mean a massive decline of 17.16% to 21.41%.

Featured image created with Dall.E, chart from Tradingview.com