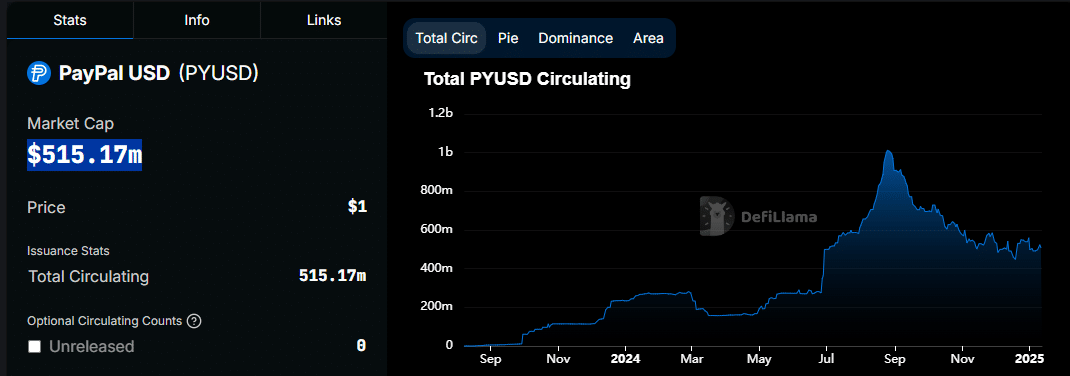

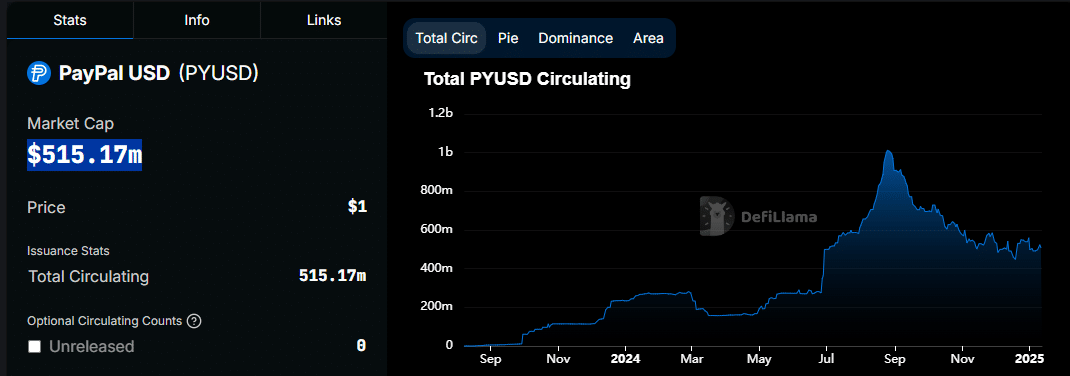

- PayPal’s USD market capitalization has fallen significantly from its historical peak

- Despite the recent recovery, this may not be enough in the long term

PayPal USD made a big impression on the market in the second half of 2024 for several reasons. It was the first time a traditional payment provider engaged with Web3 in a mainstream way. It also marked a new dawn for tokenized assets.

Expectations for PayPal USD were high, but fast forward to the present and it appears that the story on tokenized assets is running out. The initial excitement after the launch on Solana was reflected in the performance, which remained the same since it cooled.

PayPal’s USD market capitalization peaked at $1.01 billion on August 25. Since then, interest rates have gradually fallen, even falling below $500 million in December. PYUSD had a market cap of $515.17 million at the time of writing.

Source: DeFiLlama

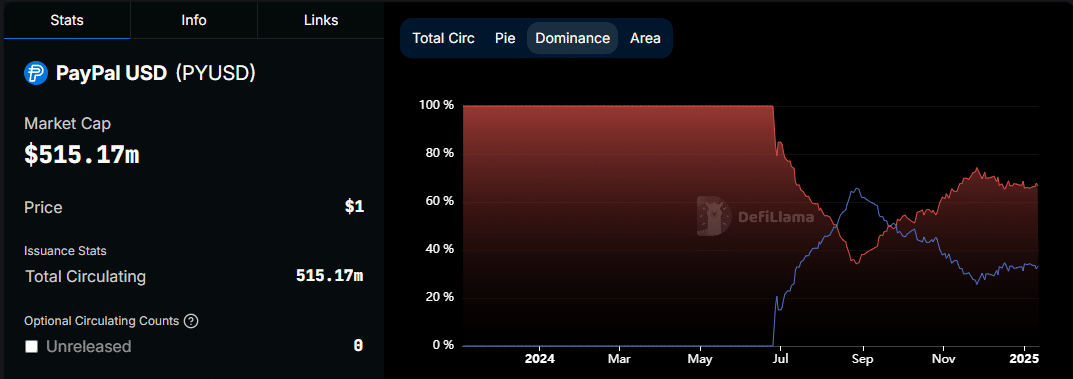

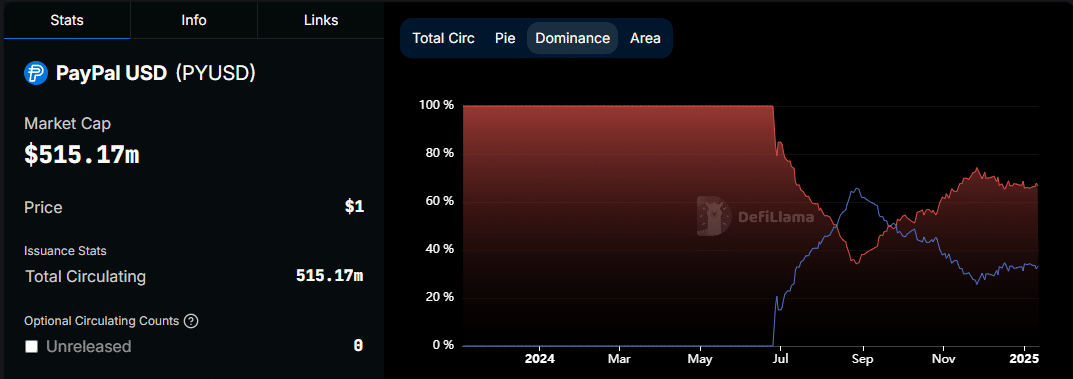

The decline in PayPal’s USD market capitalization occurred around the same time that PayPal’s dominance over Solana began to decline.

The initial excitement allowed PayPal USD market cap to outperform Ethereum earlier on on Solana. At its peak, the market cap on Solana was 65.79% on August 29. Solana blockchain dominance hit a low of 25.42% on November 27.

source: DeFiLlama

The total PYUSD market cap matched Solana’s dominance. This finding confirmed that its usefulness on the Solana network was not sustainable. In fact, at the time of writing, Ethereum held 67.21% of the circulating PayPal USD supply.

What fueled PayPal’s initial USD market cap growth and what’s different now?

The PYUSD market cap began to decline as the crypto market began to see robust demand. Before that, the price rallied from June 26 to August 30, 2024. This was just before the market frenzy. There were more stablecoin holders at the time and the PayPal stablecoin offered attractive returns on Solana.

However, as the market has turned extremely bullish, yield miners may have withdrawn their liquidity and pumped it into crypto. The fact that PayPal USD was still relatively new meant that it had also failed to achieve sustainable transaction volumes.

While the above could explain why the PayPal-related stablecoin has lost liquidity, this could border on speculation. In fact, the stablecoin still enjoys significant on-chain activity. For example, circulating supply on both networks has increased significantly over the past 30 days.

For example, it rose 5.31% against Ethereum and 4.12% against Solana in the past four weeks. This seemed to confirm that there is still some demand for the stablecoin. However, it is only limited to the two networks and this has been a barrier to adoption.