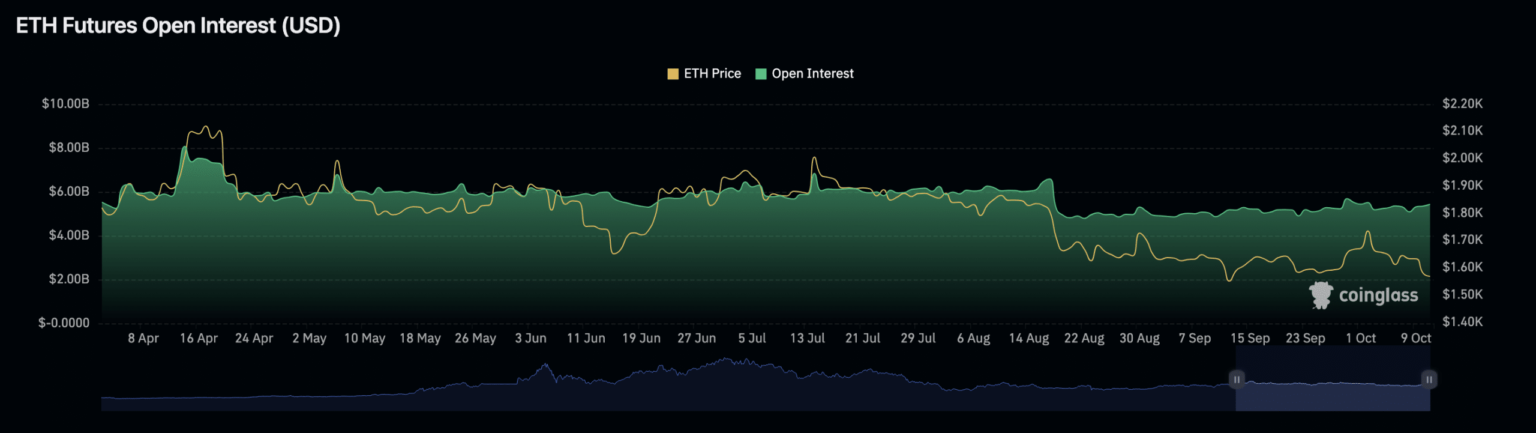

- Ethereum Open Interest has been steadily rising since early September.

- With prices down 5% this month, spot market traders continue to hold on to accumulation.

Ethereum [ETH] futures Open Interest has risen 9% since the beginning of September, despite the currency’s limited price movements during that period.

Read Ethereum’s [ETH] Price forecast 2023-24

According to data from Mint glassThe leading altcoin’s Open Interest at the time of writing was $5.43 billion.

Source: Coinglass

Open Interest refers to the total number of outstanding contracts on a derivatives market. It is a measure of the overall activity in a market and can be used to gauge investor sentiment.

When ETH open interest increases, it means that the total number of ETH Futures contracts that have not yet been settled has increased. It is a bullish signal as it suggests that more investors are opening new positions in ETH and that there is increasing demand for this asset.

However, the month-long increase in Open Interest has been accompanied by “neutral to negative” funding rates, crypto research firm Kaiko noted in a recent post on X (formerly Twitter).

#ETH Open interest has increased since early September.

The financing rate remains neutral to negative, which indicates that the market has no direction. pic.twitter.com/EHESMQMncw

— Kaiko (@KaikoData) October 10, 2023

Positive financing rates indicate that buyers are paying sellers to keep their contracts open, indicating that the market is bullish.

On the other hand, negative financing rates indicate that sellers are paying buyers to keep their contracts open, indicating that the market is bearish.

When an asset observes a neutral to negative funding rate in its futures market, it indicates that the market lacks clear direction or bias. It implies that there is no strong bullish or bearish sentiment dominating the market, and traders remain unclear about the market’s next direction.

The downward trend is clearly visible on the coin’s spot market

At the time of writing, an Ether coin was selling for $1,560, according to data from CoinMarketCap. The month so far has been marked by a decline in the value of ETH. After a brief period above $1700 on October 2, the alt price has since moved lower. Over the past week, the price of ETH fell by 5%.

The steady decline in the value of the alt has reinforced the downward trend in the coin’s spot market. At the time of writing, the price of ETH on a daily chart was trading dangerously close to the lower band of the Bollinger Bands indicator.

When an asset’s price trades this way, it indicates that selling pressure is significantly outweighing buying momentum.

While it signaled potential oversold conditions and an impending price rebound or retracement in the near term, ETH’s key momentum indicators, which were below their respective neutral lines at the time of writing, did not indicate that this could happen anytime soon.

How much are 1,10,100 ETHs worth today?

Likewise, the coin’s Aroon Down Line (blue) was fixed at 100% at the time of printing. This indicator is used to identify the trend strength and potential trend reversal points in the price movement of a crypto asset.

When the Aroon Down line is close to 100, it indicates that the downtrend is strong and that the most recent low was reached relatively recently.

Source: ETH/USDT on TradingView