- Bitcoin mini workers liquidate more than $ 27 million and are concerned about BTC’s assets to retain its price momentum.

- BTC is confronted with key resistance at $ 87k while the sales pressure of miner is growing – Can bulls can absorb the impact?

Bitcoin [BTC] Miners have beaten significant companies and have cashed in more than $ 27 million in profit realized. This came at a time when BTC seemed to be adjusting within a core price class.

With miners who sell aggressively, questions arise about the potential impact on the next step of BTC. Will this sell Bitcoin Bitcoin’s advantage, or does the market absorb these liquidations?

Bitcoin Mijnwerkers Spike’s profit

According to Recent recent informationEarly Bitcoin miners have realized more than $ 27.2 million in profit, because BTC floated around $ 83,000 $ 84,000.

This meant an important liquidation phase, especially after the recent withdrawal of Bitcoin of its highlights above $ 90,000.

Source: Cryptuquant

Historically, such a profit can indicate a cooling period in the short term for the Bitcoin rally, which leads to consolidation or a potential retracement.

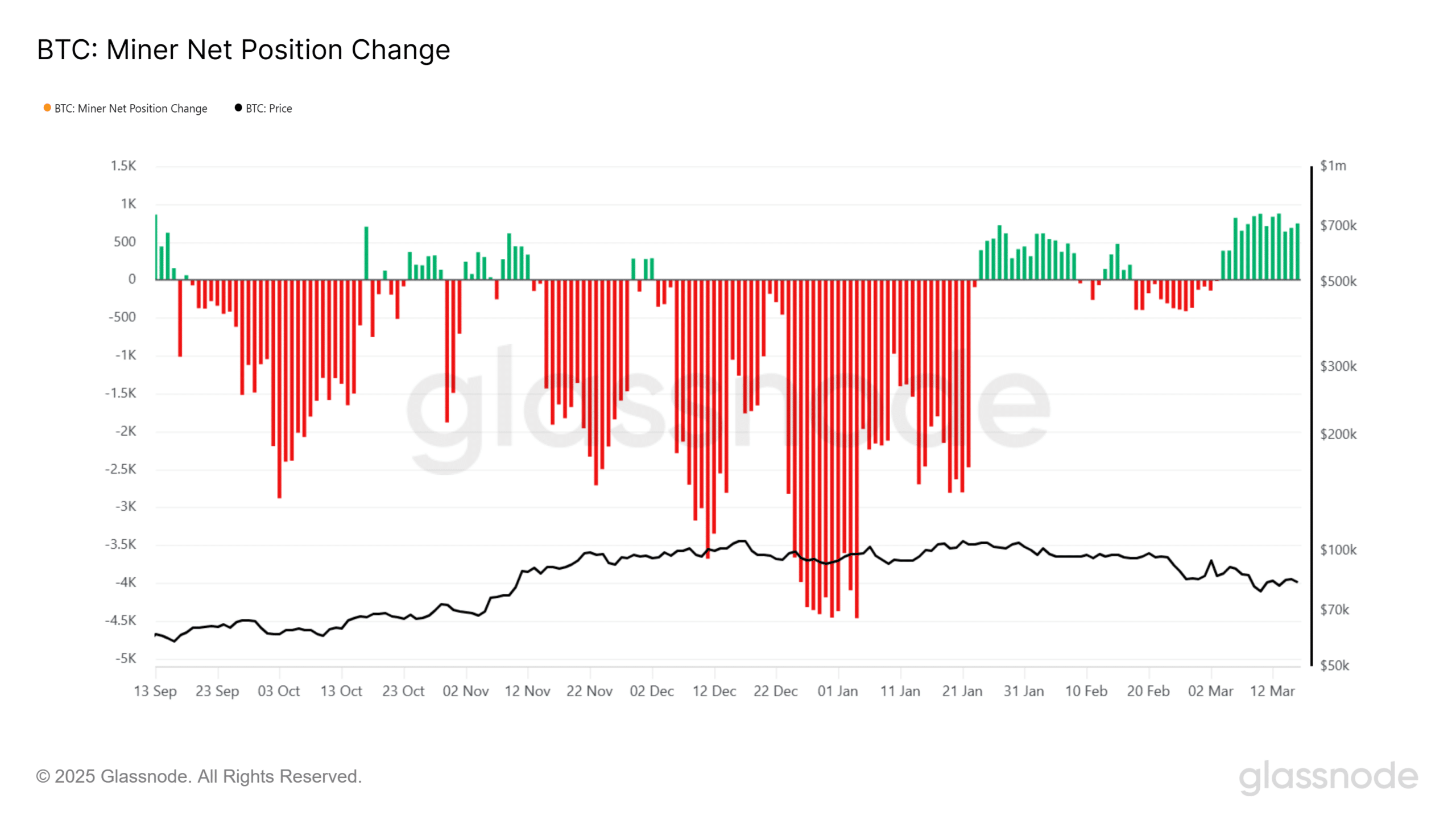

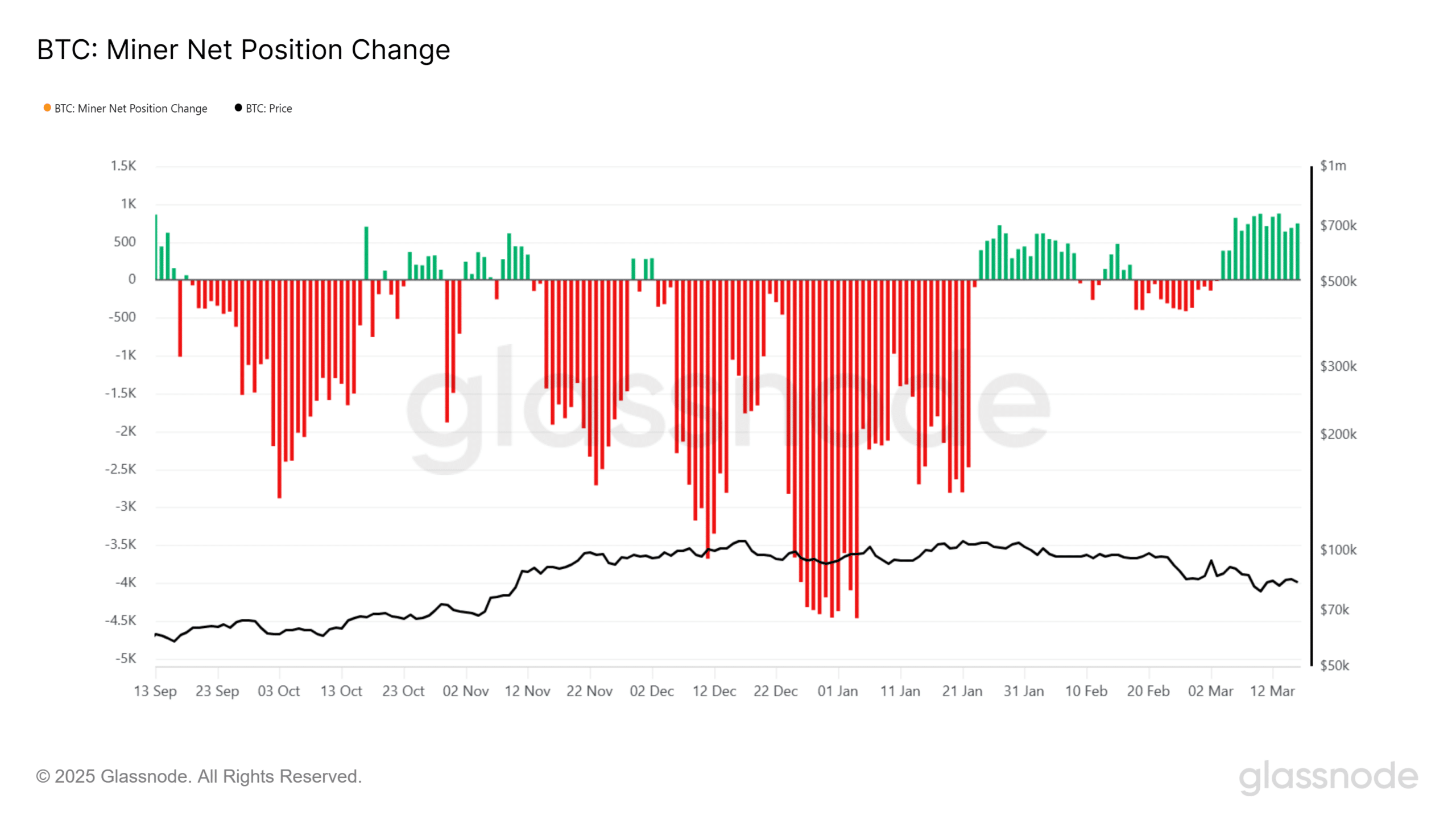

Glassnode’s Miner Net Position Chart shows continuous sales pressure, with outflows that surpass the inflow.

Miners seemed to reduce their participations instead of hoping for themselves, which strengthens the possibility of price weakness in the short term.

How much BTC still holds miners?

Despite the selling spree, Bitcoin mini workers still retain a considerable number of BTC. However, the rate with which Holdings Decline indicates their prospects for price movements.

The data suggests that although some miners make a profit, others may stick to BTC pending another bullish leg.

Source: Glassnode

If BTC maintains its current support levels, a revival of buying interest can stabilize prices.

On the other hand, if miners continue to liquidate, Bitcoin may have difficulty breaking beyond the most important resistance levels, in particular almost $ 87,000- $ 90,000.

Main levels to view

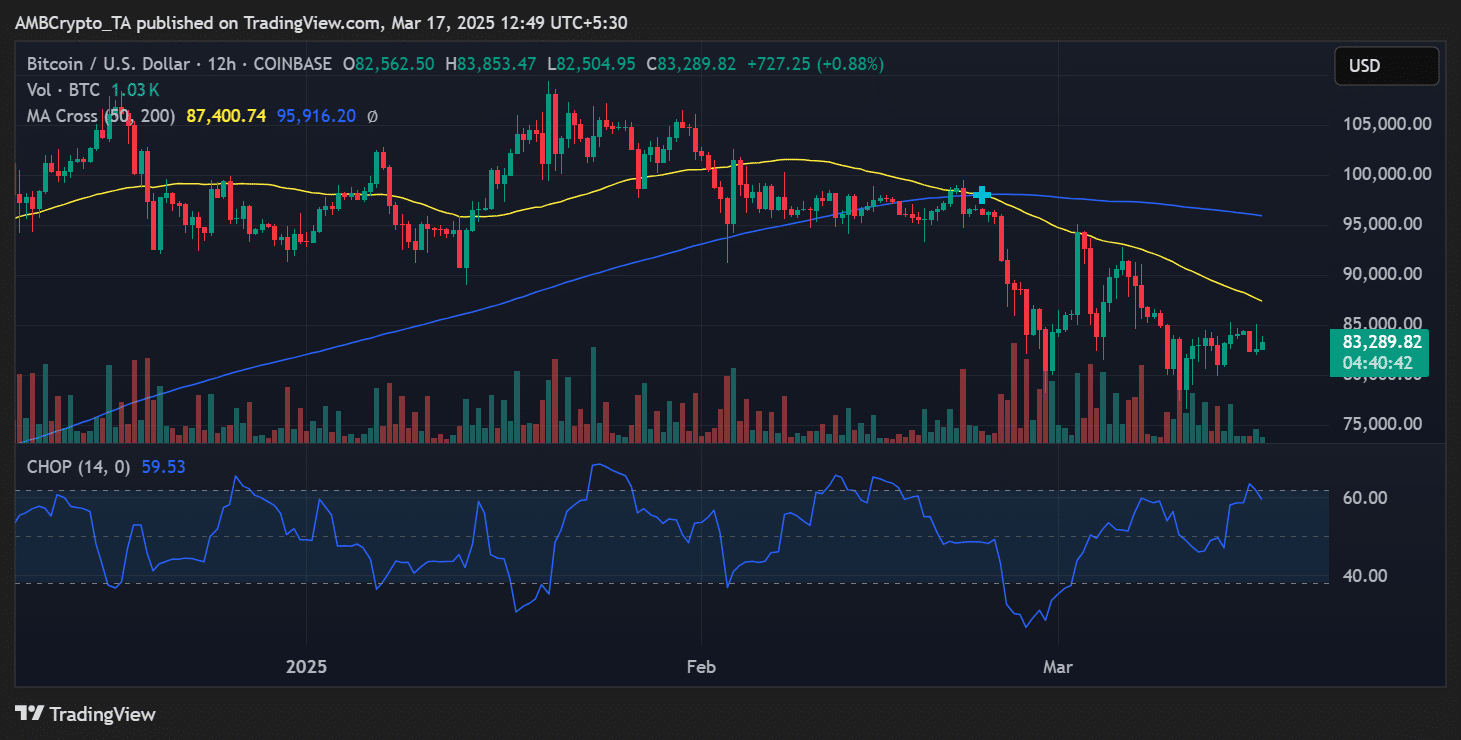

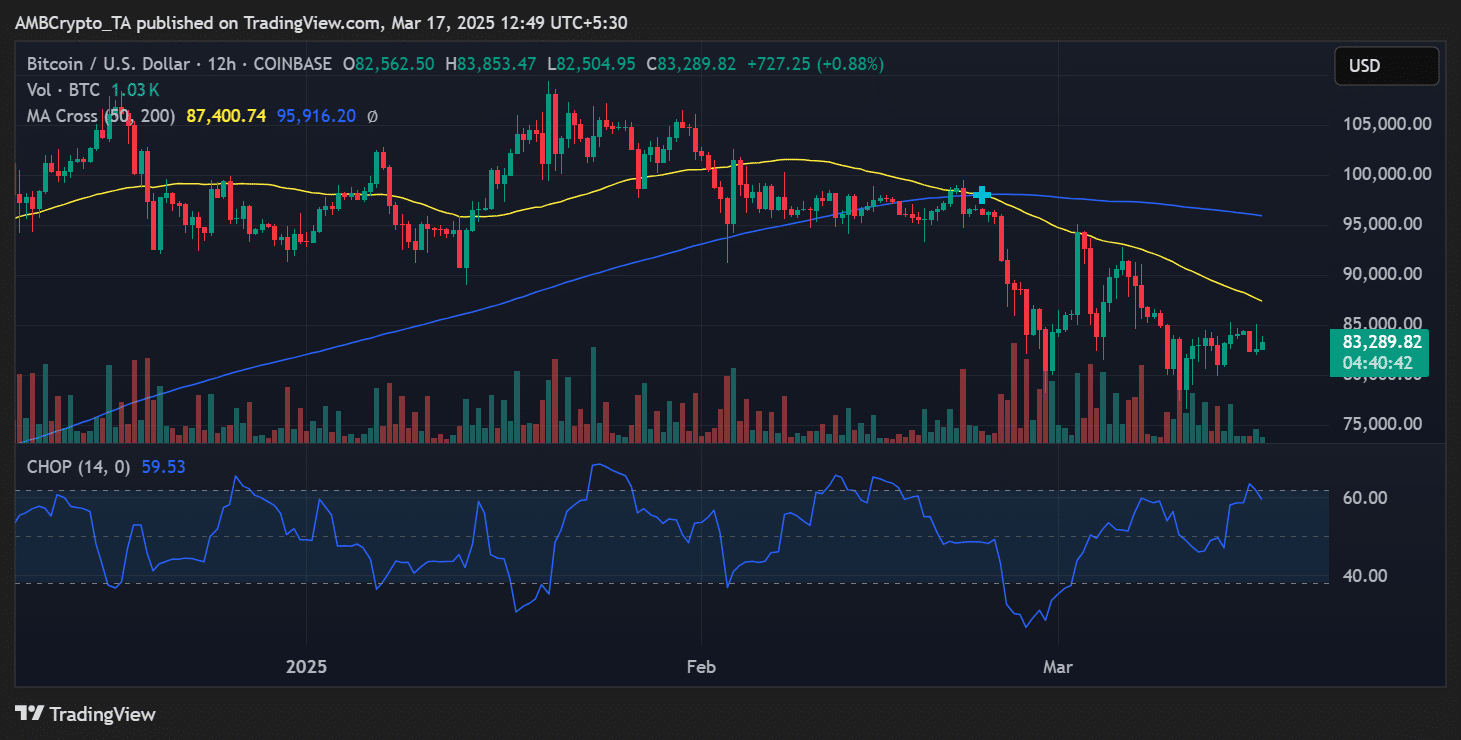

At the time of around $ 83.289, Bitcoin acted with the 50-day advancing average positioned at $ 87,400 and the 200-day advancing average near $ 95,916.

These levels serve as critical resistance points that BTC must surpass to reclaim Bullish Momentum.

Immediate support was $ 82,500. A breakdown below this level can open the doors to take further to $ 80,000.

The most important resistance was $ 87,000. A decisive movement above this figure could cause a renewed bullish momentum.

Source: TradingView

Now that Miner is selling, the ability of BTC to keep its land will be crucial in determining the next step.

Traders must look forward to shifts in my work behavior, because continuous sale could block the benefit of Bitcoin, while stabilization can pave the way for a rebound.