- The CRypto market showed resilience, which expected Trump’s trade war in the long term profits.

- Bitcoin holds strong while pro-Crypto-sentiment builds in Washington.

After the long -awaited ‘Liberation Day’ rates, the cryptocurrency market has experienced remarkable volatility, powered by geopolitical developments and regulatory actions.

As the dominant one active through market capitalization, Bitcoin [BTC] Continues to set the tone for a broader crypto market sentiment.

BTC traded at $ 84.121 when BTC registered a modest increase of 0.65% compared to the previous closure.

Despite concerned about a potential “market -wide” correction, the expected sale has not been raised. As a result, the market remains in the Green, which maintains the upward process.

What happened today in Crypto?

Let’s take a step back to analyze the aftermath of the trade war. The Volatility Index (VIX) spiked Up to eight months high, due to an increase in market uncertainty and risky appetite.

All three most important US stock indices saw enormous sale, the erasing of trillions in market capitalization, with the beautiful seven Trade shares 34% under their respective all-time highlights.

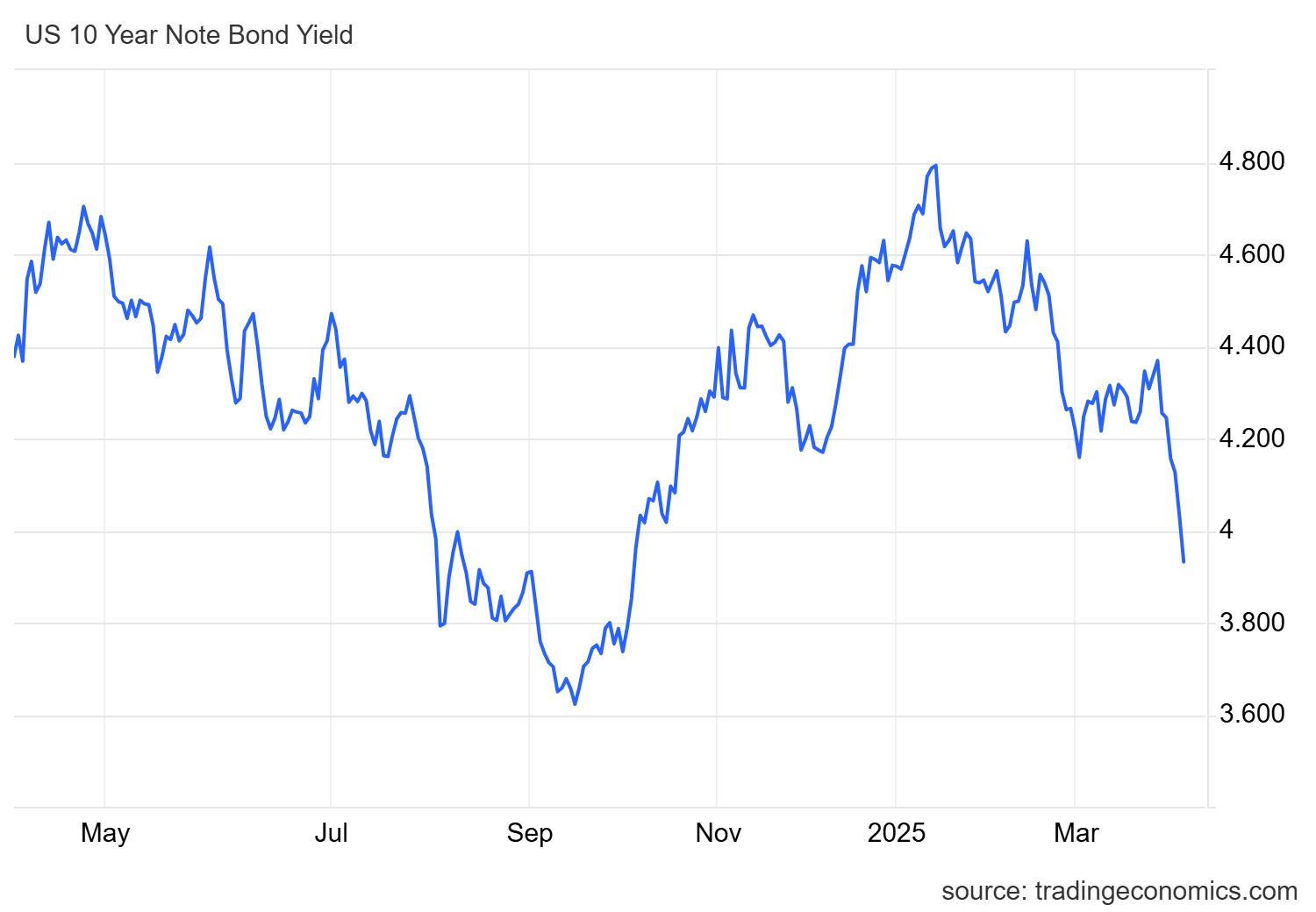

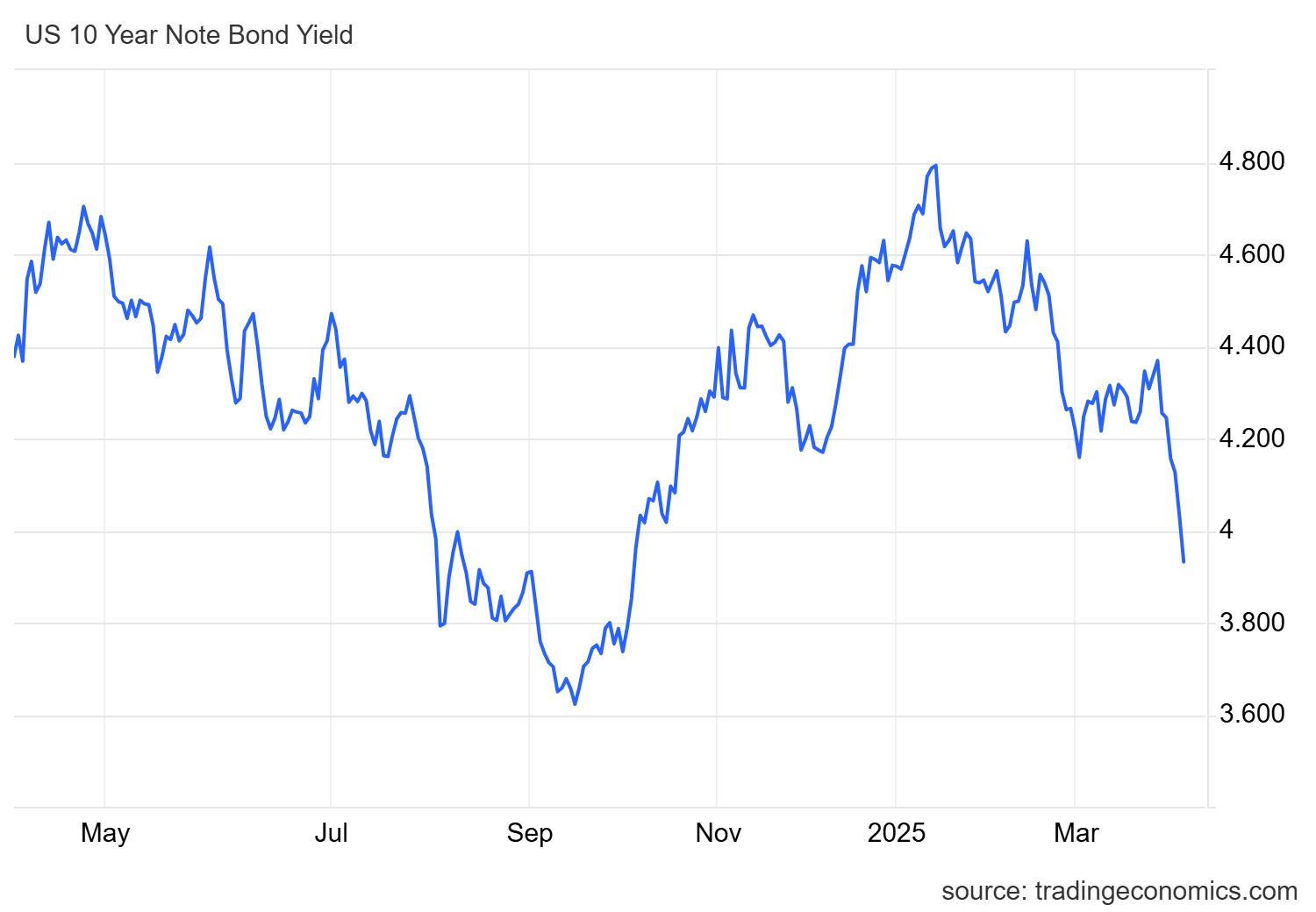

In the meantime, the 10-year-old treasury (the interest rate that pays the US government to borrow money) withdrew to pre-election levels and dropped by -90 basic points (BPS).

Usually investors, when the proceeds fall, often move money to safe assets such as treasury bonds, anticipating a lower economic growth in the second quarter.

Source: Handelsconomy

In response, market participants fast priced in a probability of 20% of three cuts in 2025, higher than previous expectations of two.

Why? Analysts speculate that the US’s demand can delay as the effects of the rates are maintained, which could cause the Federal Reserve to lower the rates. This could make more cheap capital flow into the market.

In the cryptomarkt, investors clearly identified value in the long term, especially in Bitcoin, given the shifting economic landscape. In contrast to shares, cryptocurrencies showed resilience.

Bitcoin Dominance saw an increase of 0.30% after the announcement, which reflects a shift in the sentiment of investors and a flight to “digital assets” as an alternative value shop.

Crypto -market optimism in the midst of legal shift

The banking committee of the US Senate has approved Paul Atkins as the next SEC chairman in a 13-11 mood, making it a scene for a major shift in Crypto-Regulation.

Known for its pro-market approach, ATKINS is expected to send the SEC away from strict enforcement and to a clearer, industrial policy. This shift has reinforced the confidence of investors in long -term in crypto markets.

Bitcoin remains above $ 80k, large altcoins have critical support levels and the high chance of the quantitative relaxation of the Federal Reserve – combined with a legal shift in the SEC – has enabled the crypto markets to absorb recent macro volatility.

Source: Coinmarketcap

If these conditions persist, the appetite can increase, determining the stage for stronger institutional intake and a potential market -wide rally in the coming quarters.