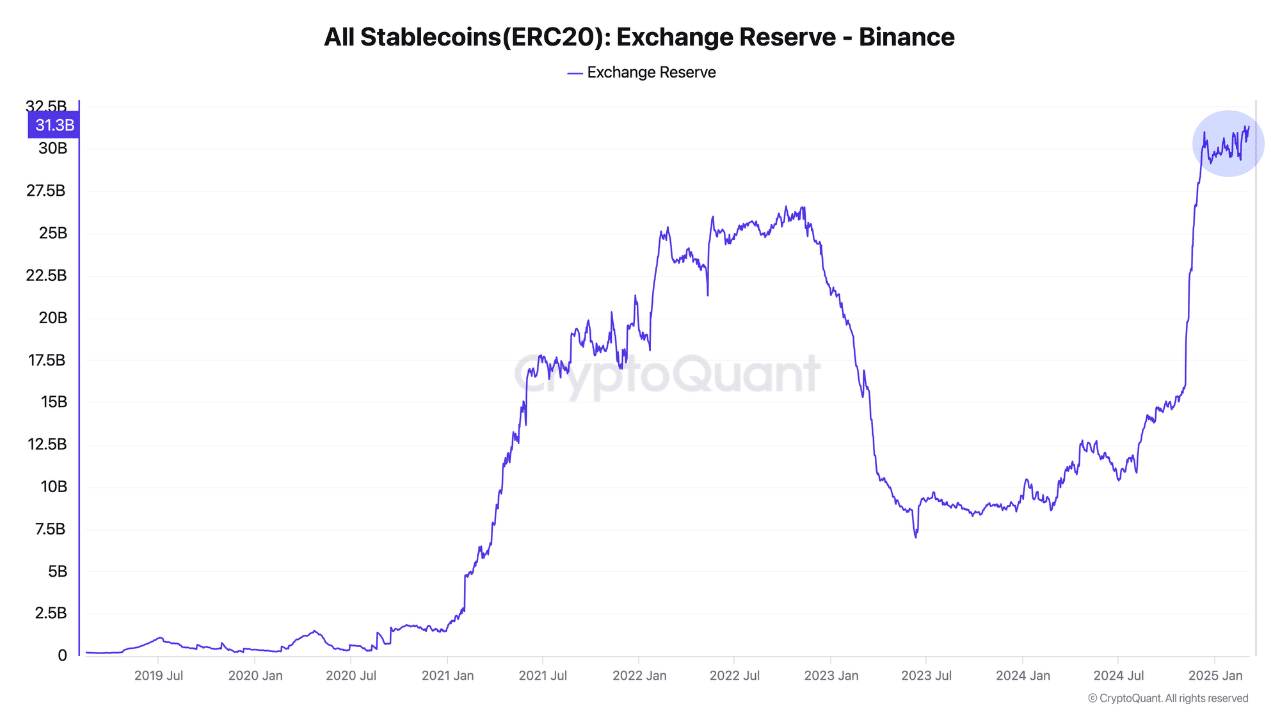

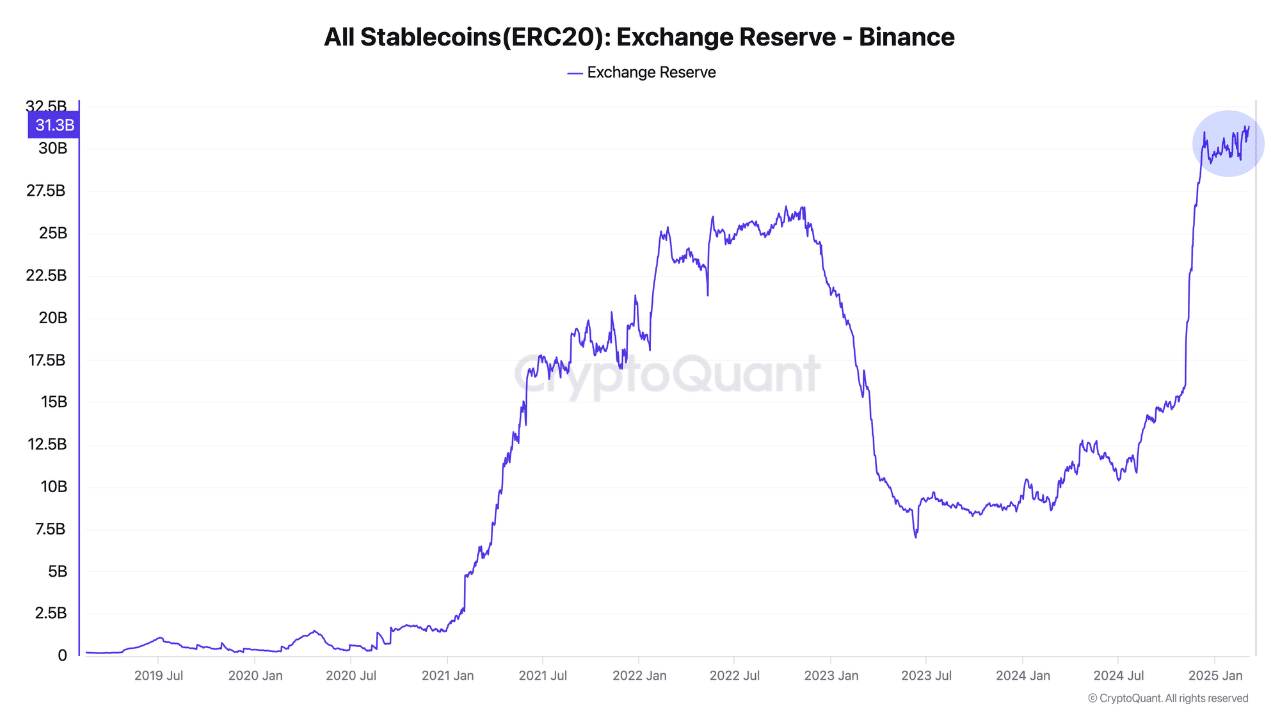

- Binance Stablecoins Reserve rose upstairs $ 31 billion.

- BTC price was filled in despite the founding of President Trump of a strategic BTC reserve.

Binance [BNB] Stablecoins have reached a record high of $ 31.5 billion, which encourages a cryptoquant analyst to project that an upward bitcoin could probably be. According to pseudonym Dark Fost, the increase in the stablecoin can be due to;

“Investors channel liquidity to Binance in preparation for market access, which is a reflection of trust in both the market and the exchange.”

Source: Cryptuquant

Fost added that Beyond Stablecoin -Spikes BTC increased.

“Historically, periods of rising Stablecoin rifles on Binance have often merged with, or even preceded, an increase in the BTC prices and a broader revival in the cryptomarkt.”

Liquidity conditions relax

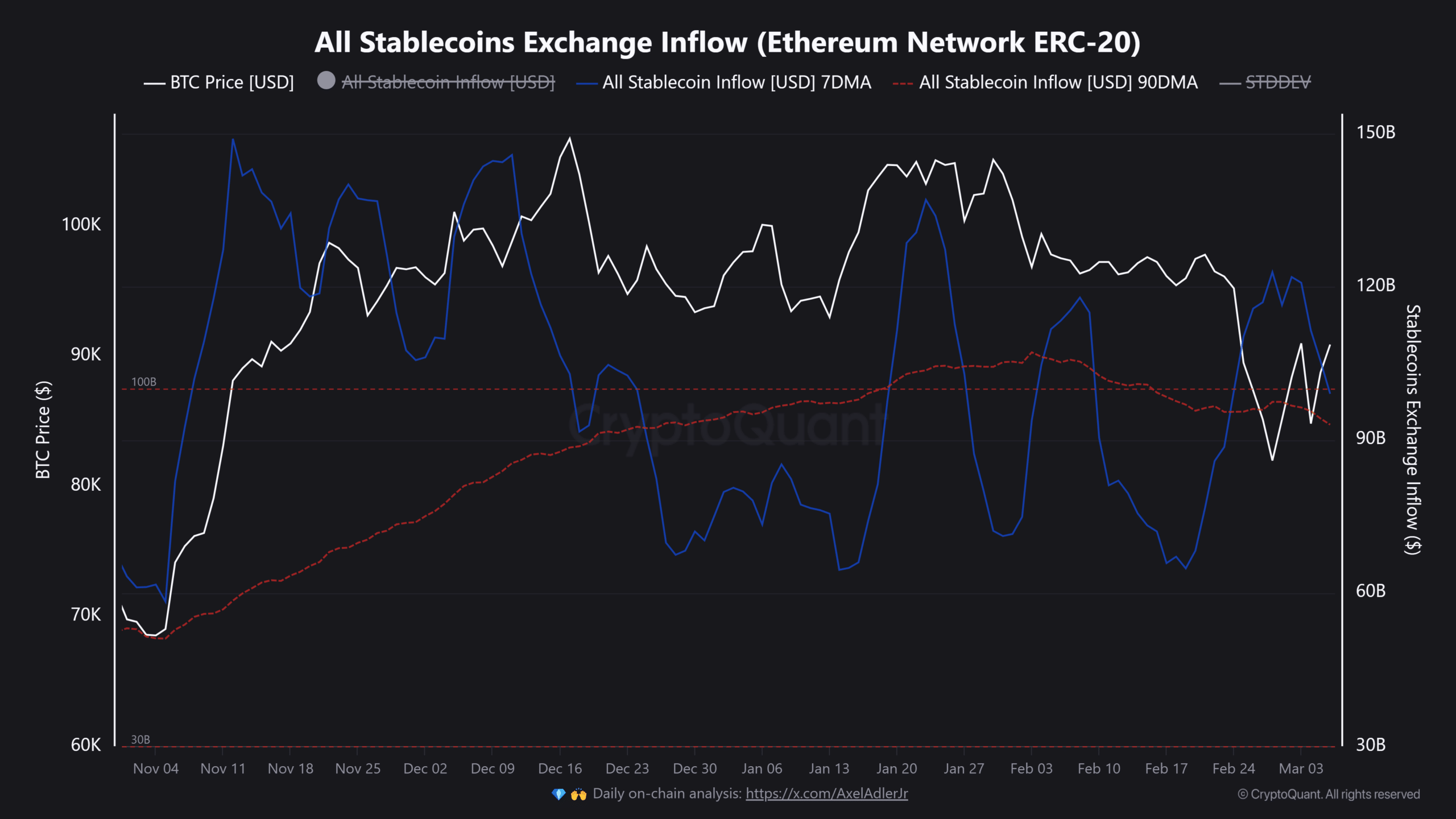

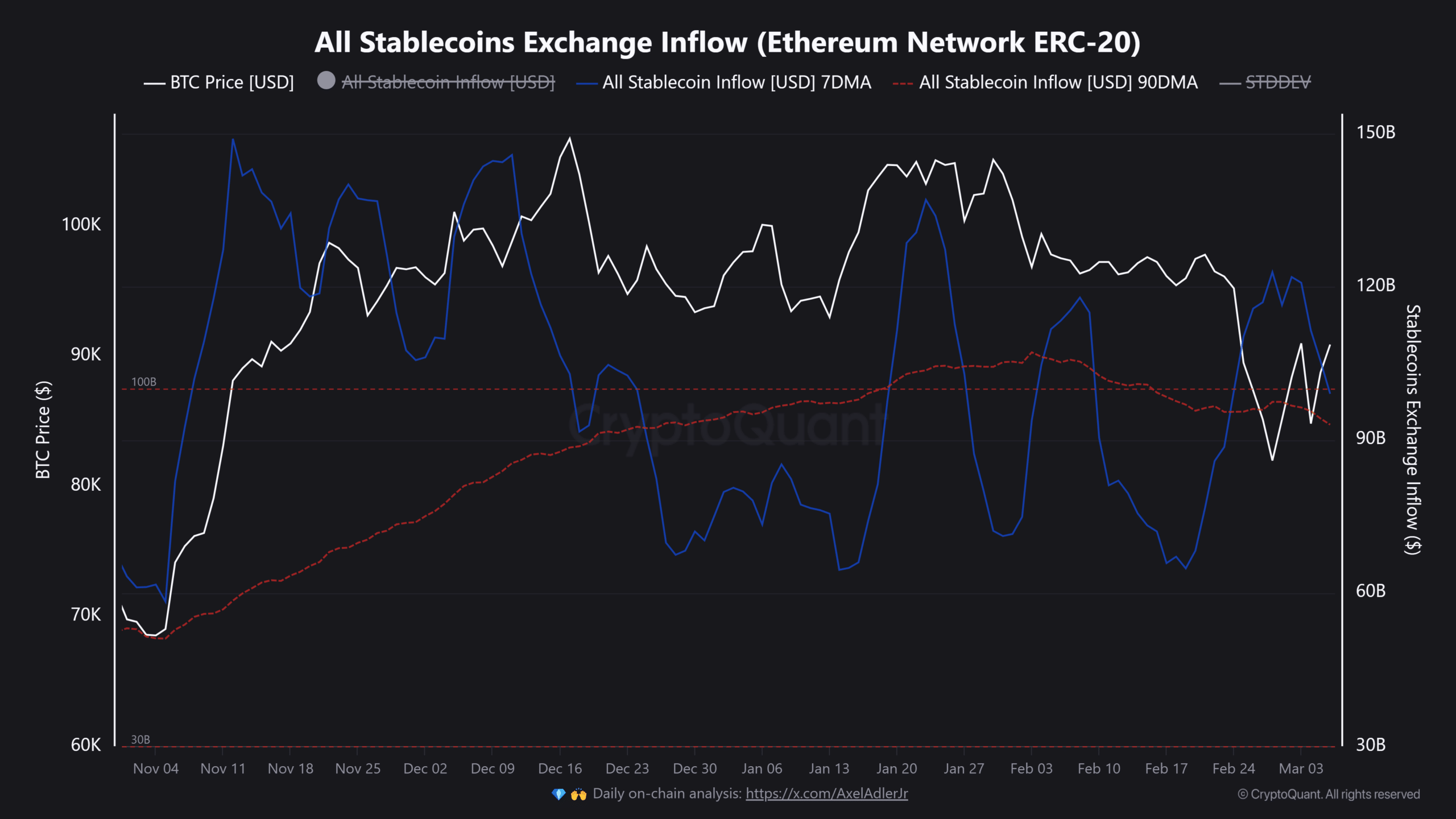

Despite the bullish potential of the Stablecoins of Binance, the total liquidity conditions have decreased somewhat.

According to cryptoquant, Stablecoins exchanged the inflow (which follows the liquidity of the chain) from $ 121 billion to $ 99 billion at the beginning of March.

Source: Cryptuquant

The liquidity decreases have limited BTCs upward movement, while the liquidity stabs have activated bounces, as observed in November and January.

In 2025 the liquidity conditions between $ 60 billion and $ 120 billion were rocked, which reflects market volatility. Glassnode emphasizes that locally Opterse Momentum can only be above $ 92k, the average cost basis for holders in the short term.

However, a long-term downward risk can force bulls to defend the $ 70k $ 71kk as the next important support. The company stated”

“Strong confluence between the price structure and important on-chain statistics indicate that the $ 92k remains a critical level for Bitcoin to restore an up momentum, while the level of ~ $ 70k seems to be a key zone for the bulls to build support when it is achieved.”

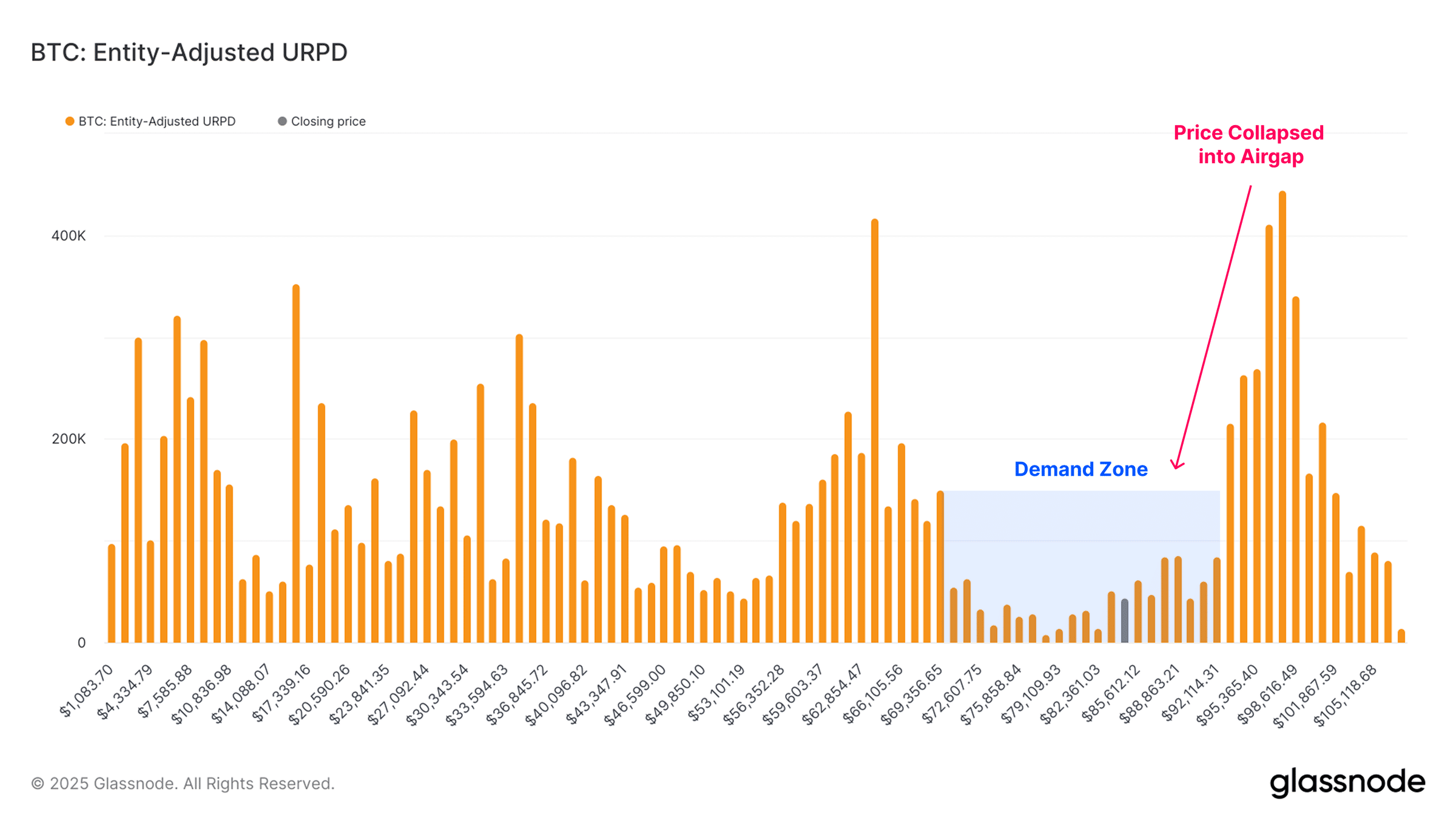

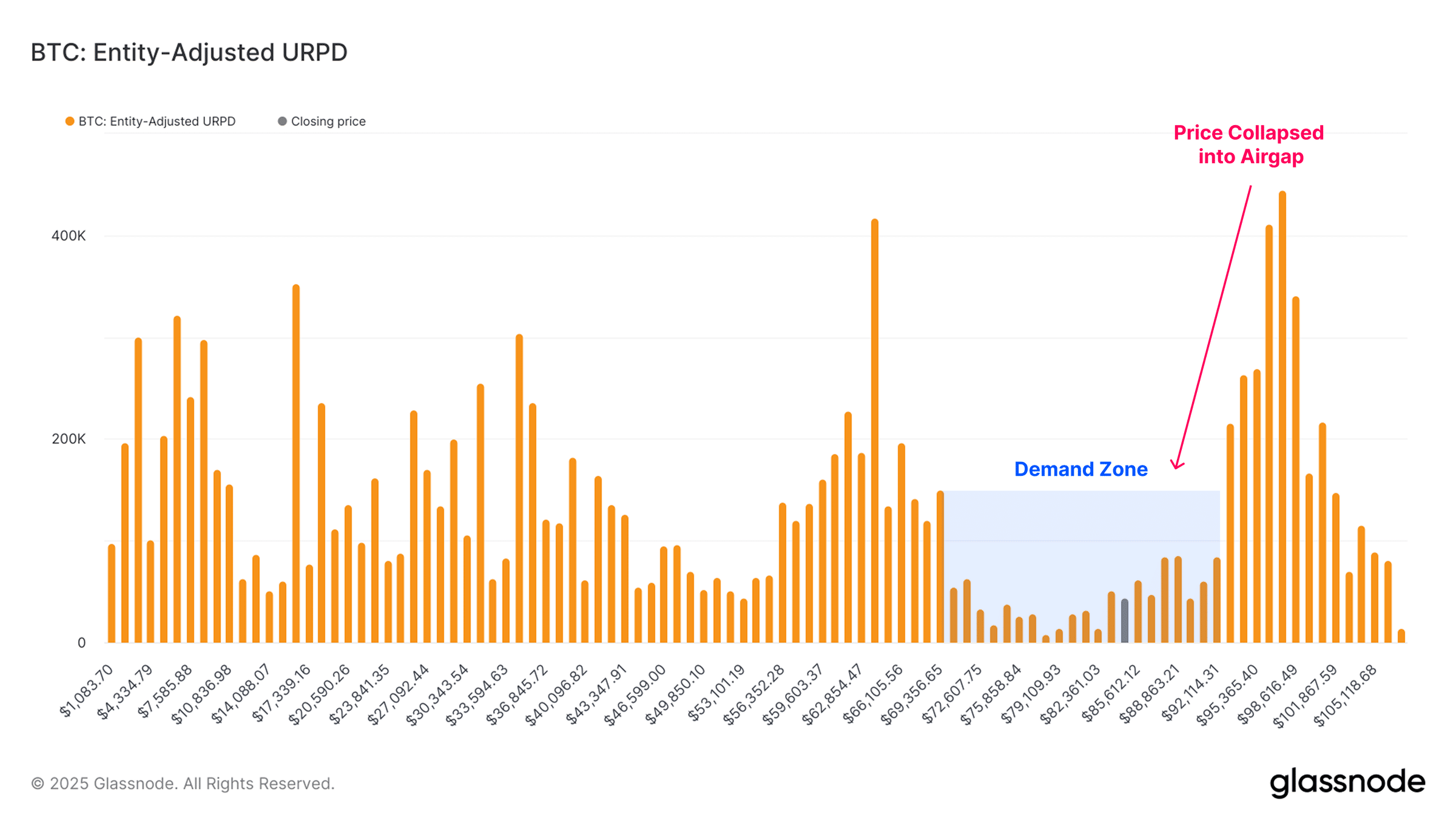

Source: Glassnode

The Blockchain -analyzed company reported that more than $ 14 billion was bought in BTC when prices fell below $ 86k, which marked this as a demand zone.

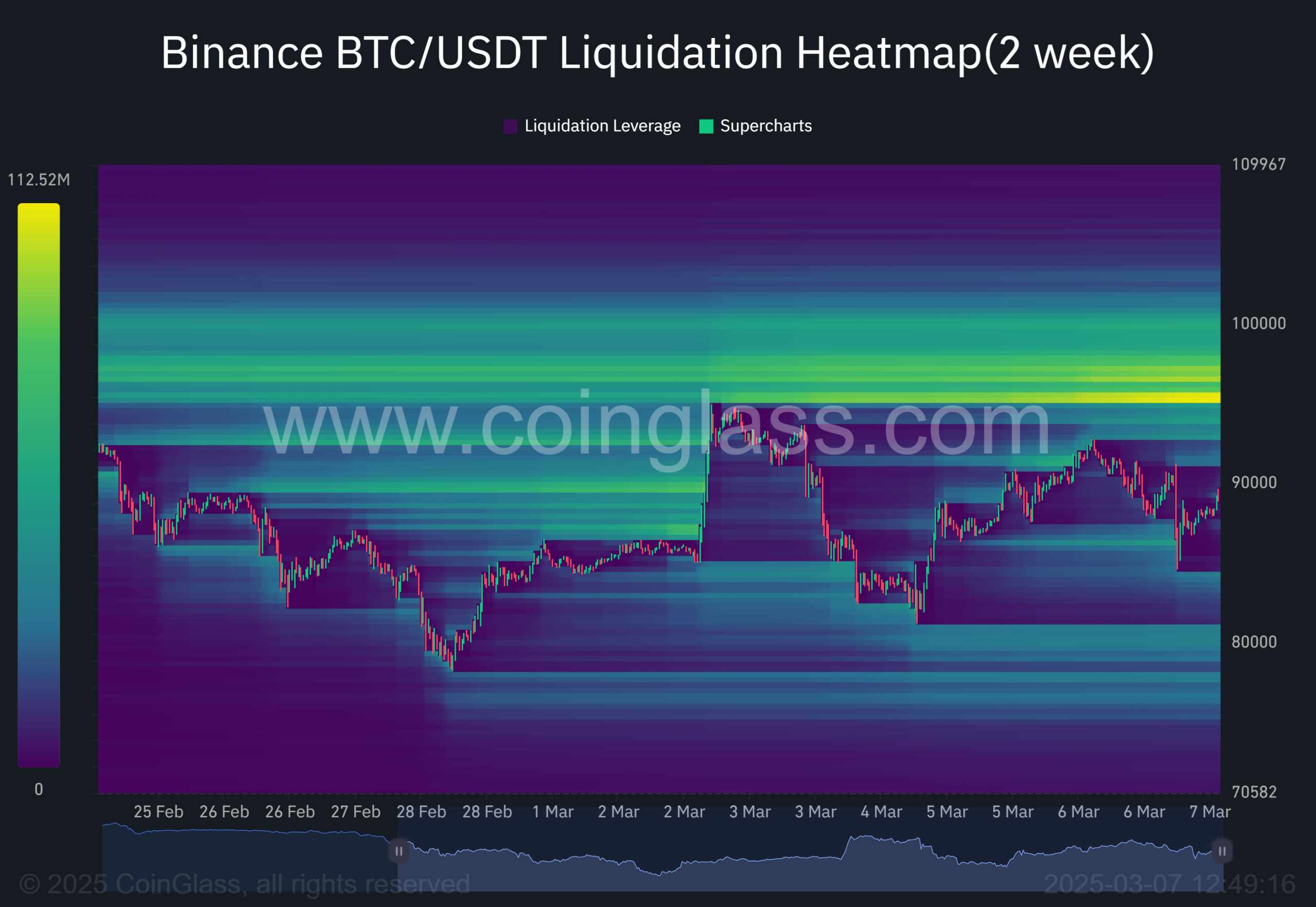

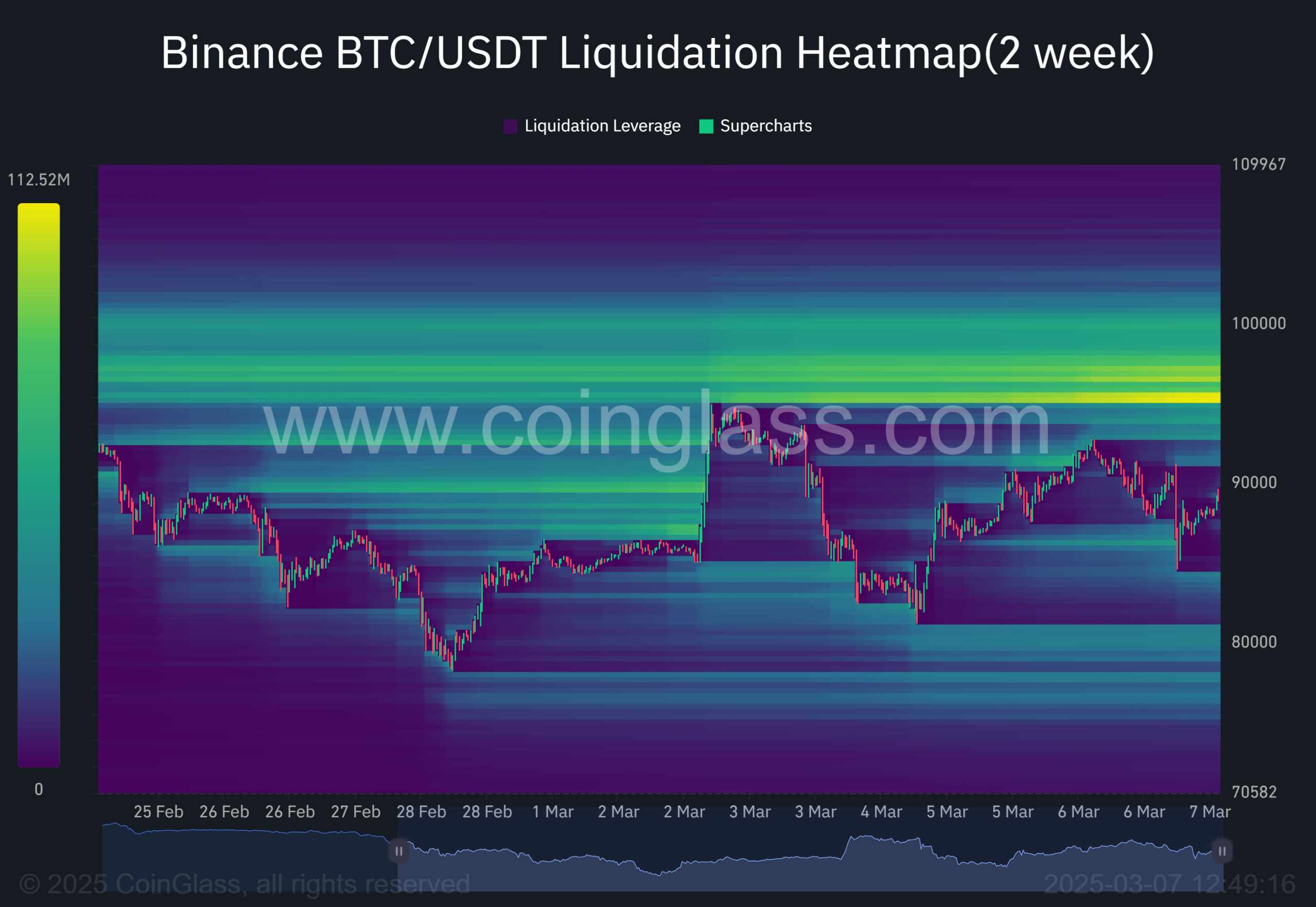

This indicates that the area above $ 70k could act as a strong level of support. From the perspective of the liquidation, considerable liquidity was observed at $ 95k on the two -week graph.

In addition, long liquidation levels gathered in the range of $ 75k $ 77k, which strengthens Glassnode’s analysis of potential support above $ 70k.

Source: Coinglass

In the meantime, the biggest crypto on the press was appreciated at $ 89k, despite the observed bullish creation of President Trump of one Strategic BTC -Reserve.