- Bitcoin is facing critical resistance as market dynamics indicate potential volatility ahead.

- The dominance of stablecoins and fear indicators point to the growing caution of investors in the crypto market.

The cryptocurrency market is at a critical juncture as investors consider the potential for a broader market correction. With Bitcoin[BTC] as they struggle to regain key support levels and altcoins show signs of fatigue, concerns about a crypto crash are increasing.

By examining critical market indicators and sentiment data, we can assess the likelihood of a downturn and identify possible scenarios.

Bitcoin’s price is struggling to hold key levels

Bitcoin’s recent price action highlights the fragility of the market. AMBCrypto’s analysis shows that the cryptocurrency has fallen below the crucial $95,000 level, raising fears of a further downtrend.

Despite support remaining above the 200-day moving average, the Relative Strength Index (RSI) at 46.77 indicates waning momentum, teetering near bearish territory. Failure to recover the resistance at $97,500 could push Bitcoin into deeper correction territory.

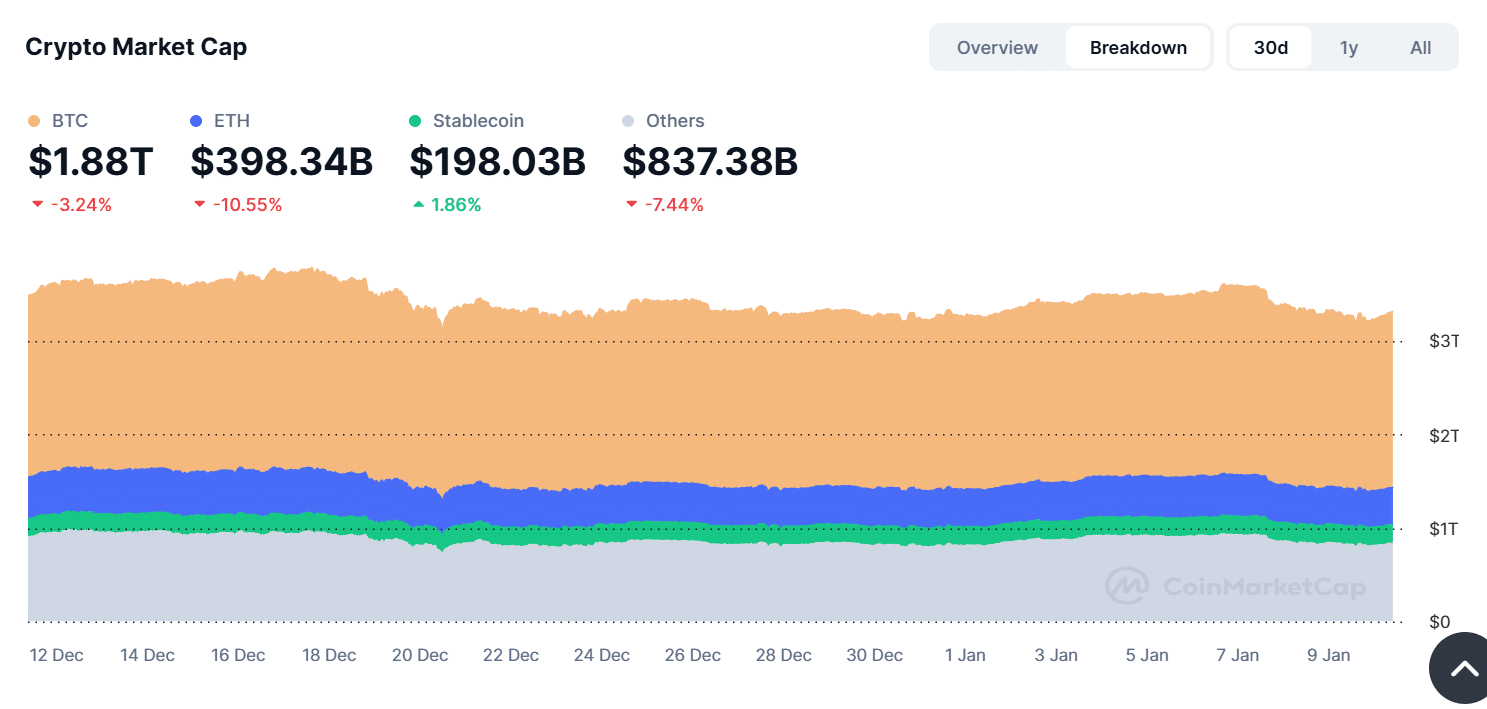

Market capitalization trends indicate consolidation

The total cryptocurrency market capitalization currently stands at $3.24 trillion, as shown by the Crypto Total Market Cap Chart. Over the past 30 days, the market capitalization has fallen by 3.24%, reflecting a market-wide consolidation phase.

Source: CoinMarketCap

While Bitcoin remains a major player, Ethereum[ETH] and altcoins have suffered sharper declines, contributing to the overall market contraction. This pullback raises concerns about the resilience of the broader market, especially if bearish sentiment continues.

The Crypto Market Cap Composition chart shows a rise in stablecoin dominance, which is up 1.86% over the past 30 days. In contrast, Bitcoin and Ethereum have seen a decline, indicating a flight to safety as investors look to protect their capital.

This growing allocation to stablecoins signals increased caution, often a harbinger of broader market instability.

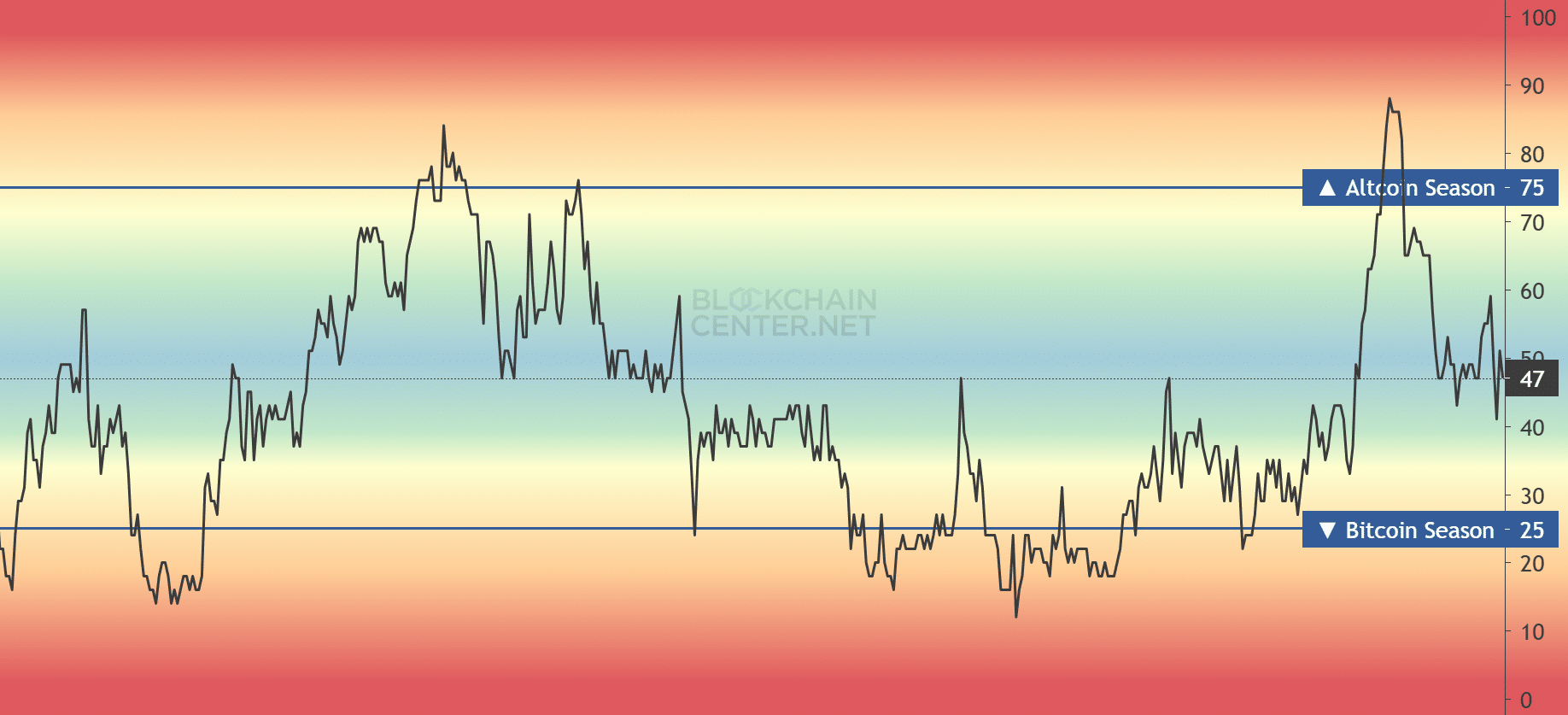

The Altcoin Season Index reflects the neutral sentiment

The Altcoin Season Index has fallen to 47, indicating a neutral stance. Analysis of the metric shows that the market is neither firmly in Bitcoin season nor altcoin season, highlighting the growing uncertainty.

Source: Blockchaincenter

Historically, such neutral readings precede market shifts, with altcoins typically being more vulnerable during corrections.

This uncertainty puts additional pressure on the performance of altcoins, increasing the likelihood of a downturn if Bitcoin fails to lead a recovery.

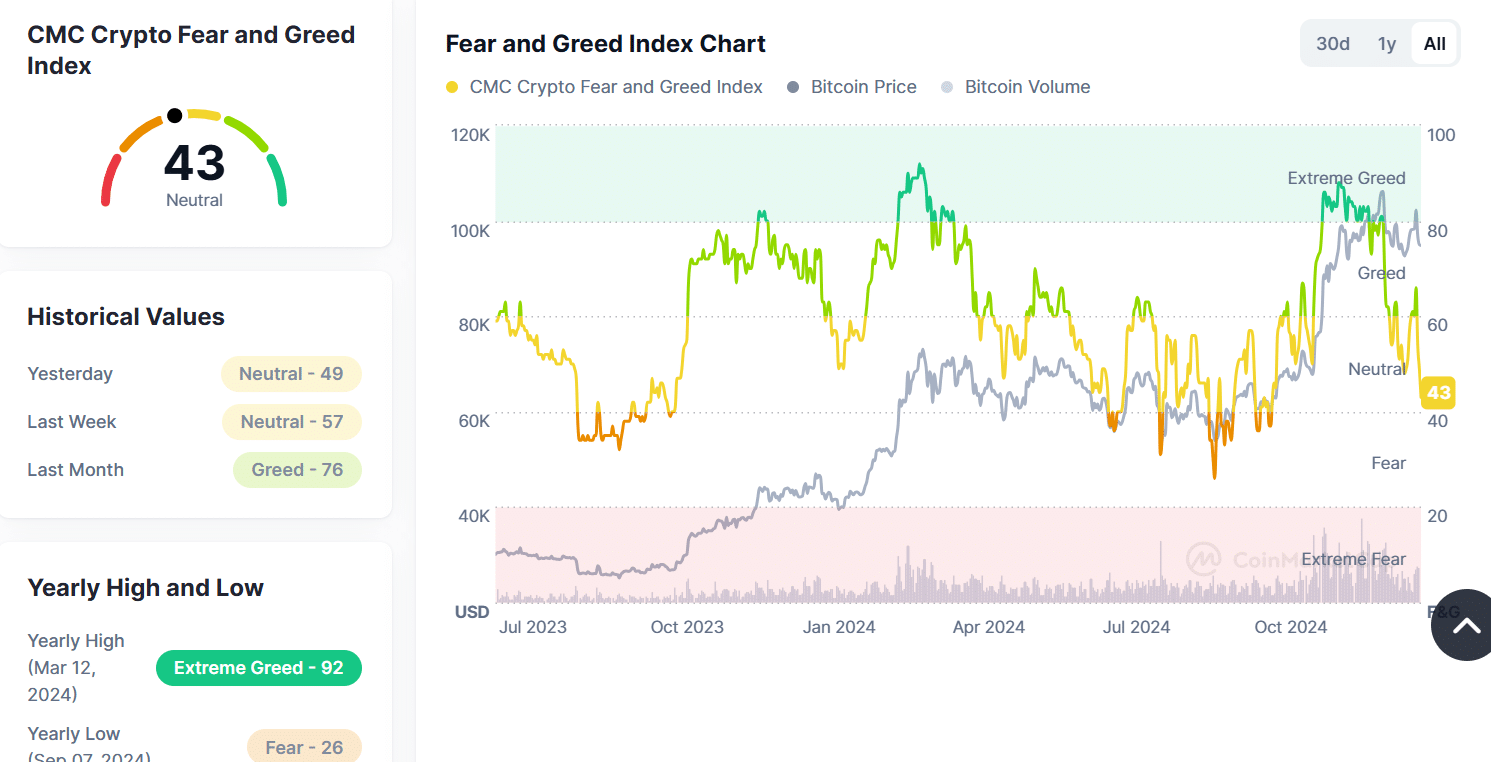

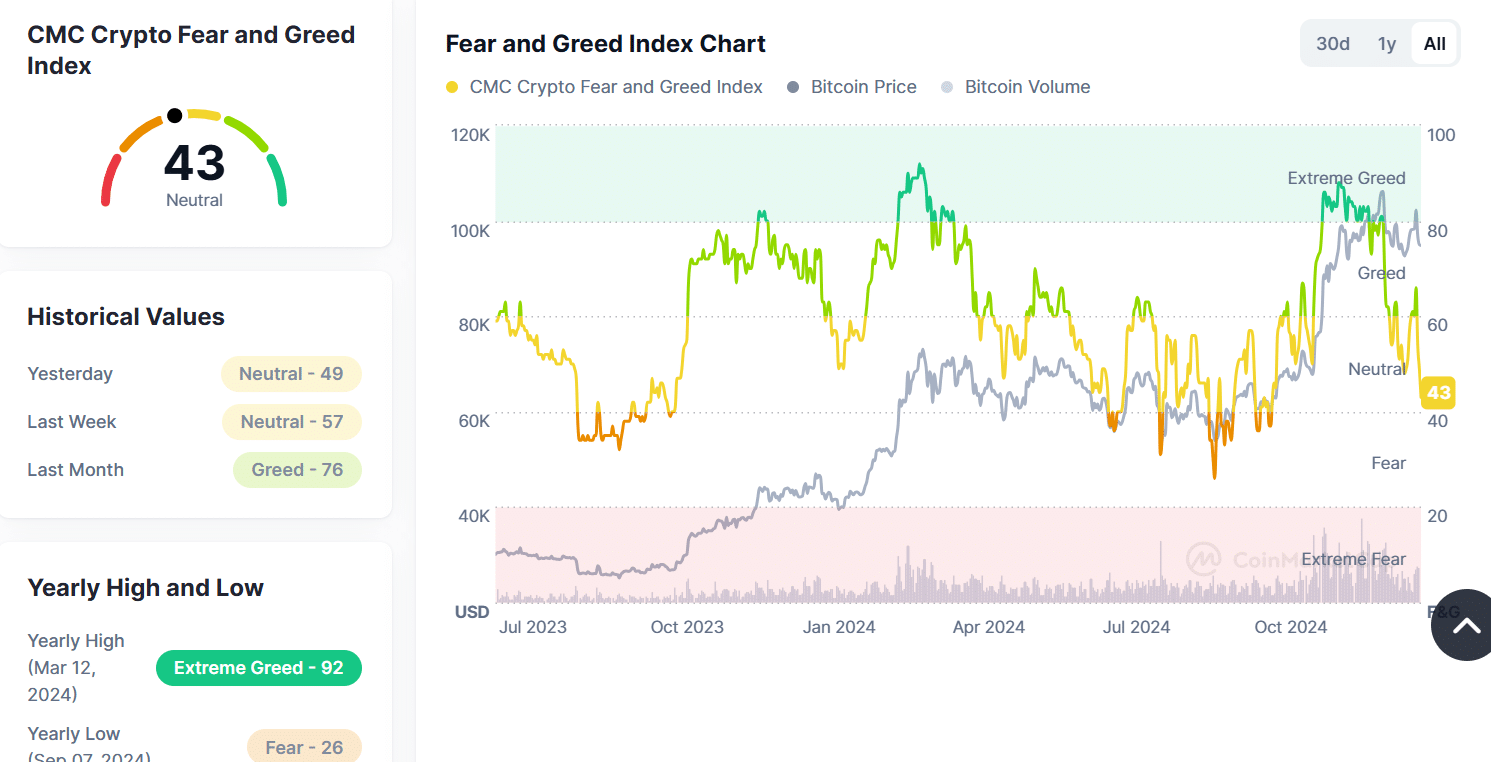

Sentiment weakens: the index of fear versus greed

Investor sentiment has cooled considerably. The Fear and Greed Index now stands at 43, a sharp drop from last month’s 76 (indicating “greed”).

This shift to a neutral stance reflects increasing caution among investors and signals that profit-taking may be taking place. Historically, such changes in sentiment have often been a harbinger of greater market volatility and potential sell-offs.

Source: CoinMarketCap

Is a crash likely?

While a definitive crash is not guaranteed, market indicators suggest increased caution. Bitcoin’s struggle to regain critical levels, combined with a consolidating market cap and declining sentiment, point to a precarious situation.

Altcoins remain particularly vulnerable, while the rise in allocations to stablecoins underlines investor unease.

The likelihood of a significant crash depends on Bitcoin’s ability to stabilize above key support levels. Investors should prepare for increased volatility and consider risk management strategies to navigate this period of uncertainty.