- Litecoin’s price action indicated a lack of enthusiasm or low accumulation.

- On-chain data still supported growing accumulation as swing and retail traders exited.

Litecoin [LTC] has been described at some point in the past as the silver Bitcoin [BTC] gold. However, this digital silver has been lending itself more to the bears lately, with weak bullish attempts here and there.

A look at Litecoin’s recent history, especially after March 2024, indicated low bullish confidence. This also turned out to be the case after the recent crash, despite the slight recovery.

The brief dip below $50 indicated that the price broke below a major support level that has remained unbroken since November 2022.

The break in support, followed by low accumulation and a lack of robust price excitement, indicated relatively low demand for LTC. But could this be a short-lived outcome?

Our analysis showed that Litecoin could soon find the necessary momentum for a strong comeback.

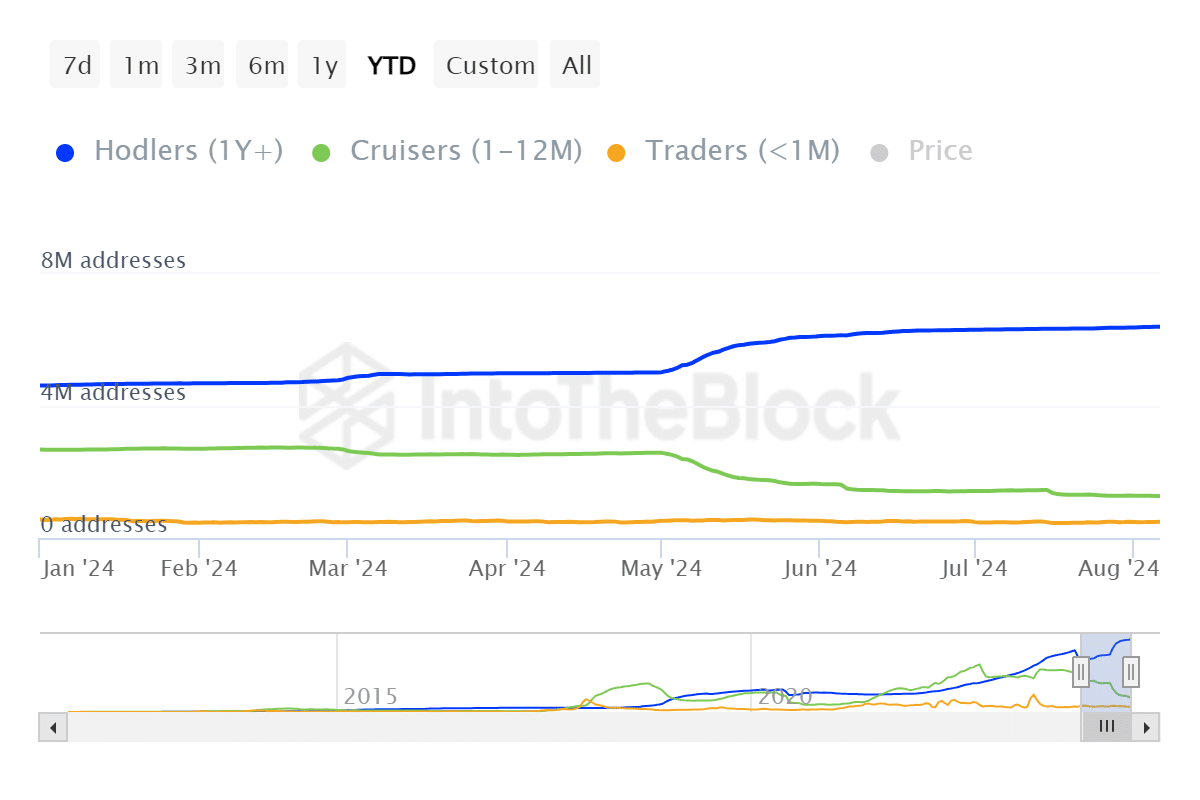

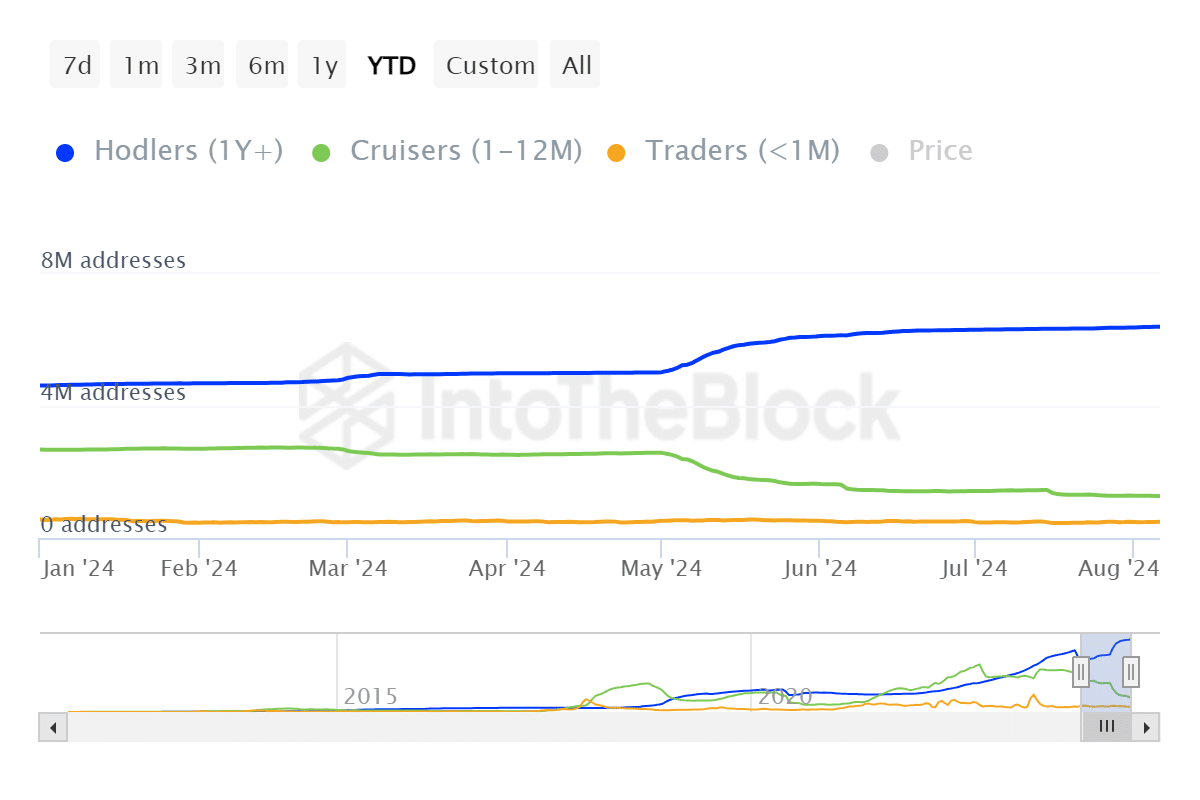

Litecoin holders are shifting to a long-term focus

Short-term profit-taking has contributed to the suppression of bullish. Litecoin ownership statistics show that this suppression may be coming to an end.

The number of HODLers in the past seven months has increased from just 4.62 million to 8.16 million addresses as of August 6.

Meanwhile, the number of cruisers, or swing traders, fell from 2.68 million in early 2024 to 1.25 million more recently.

Source: IntoTheBlock

Retailers experienced a more modest decline from 564,000 to just over 488,000 addresses. These changes indicated a growing focus on long-term HODLing as prices got lower.

A decline in the number of swing and retail traders indicated that selling pressure could weaken in the near term.

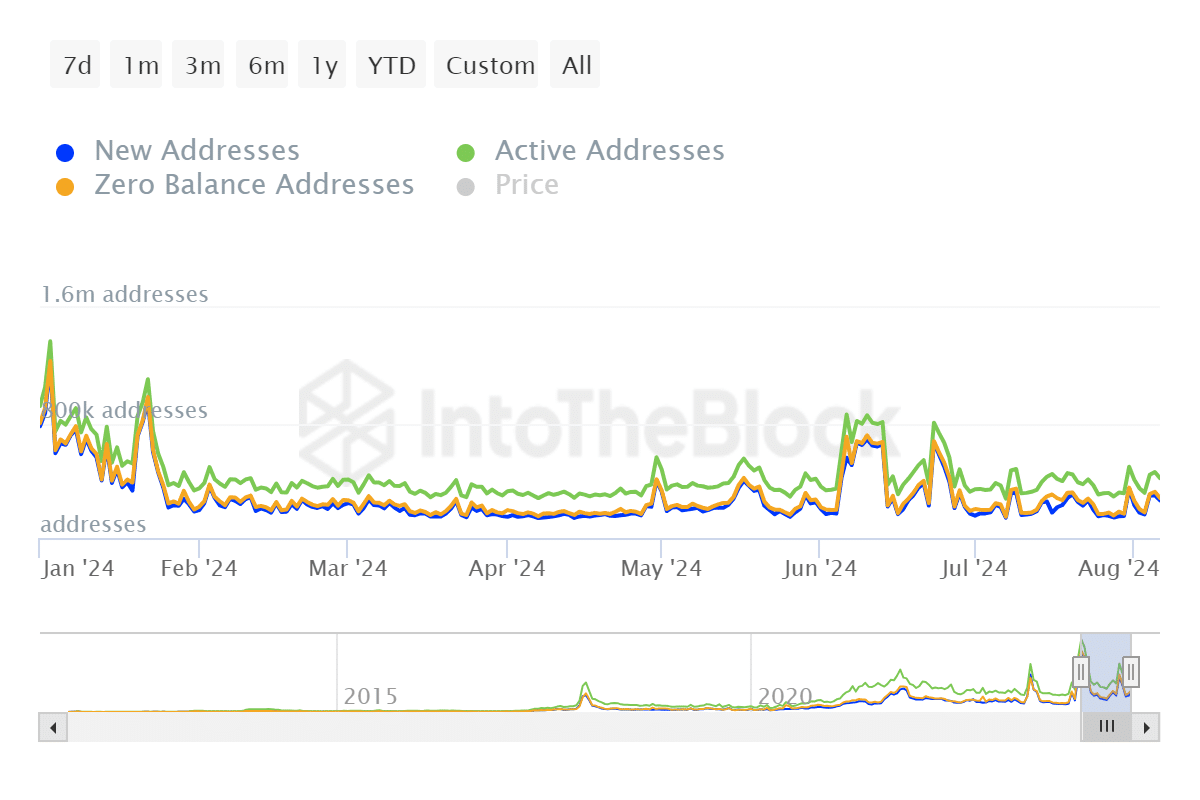

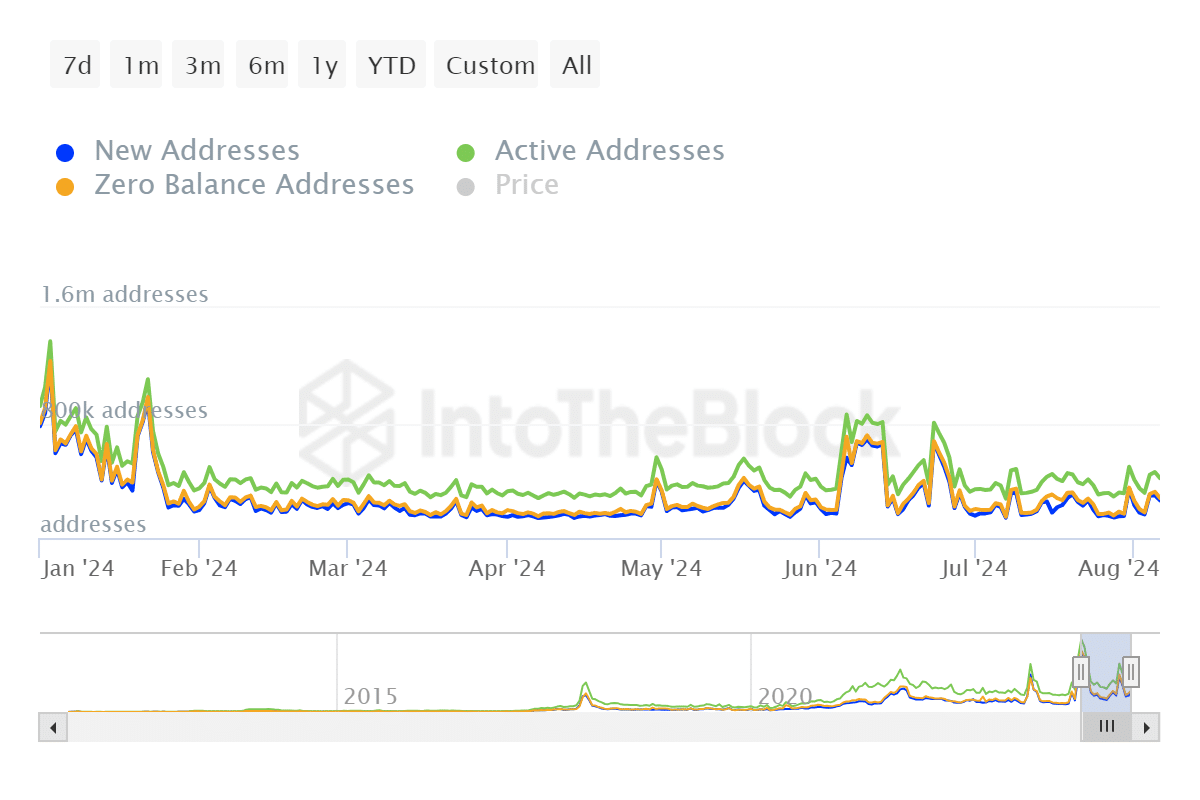

Address statistics indicated that new, active and zero balance addresses have decreased recently compared to the situation at the beginning of the year.

Nevertheless, the number of active addresses and new addresses have remained relatively stable. Recently there have been more than 400,000 active addresses and on average there were more than 250,000 new addresses.

Source: IntoTheBlock

It is striking that the number of addresses with a zero balance was on average between 150,000 and 350,000, much lower than the figures at the beginning of this year (more than 1 million addresses).

This could also indicate that the outflow is decreasing.

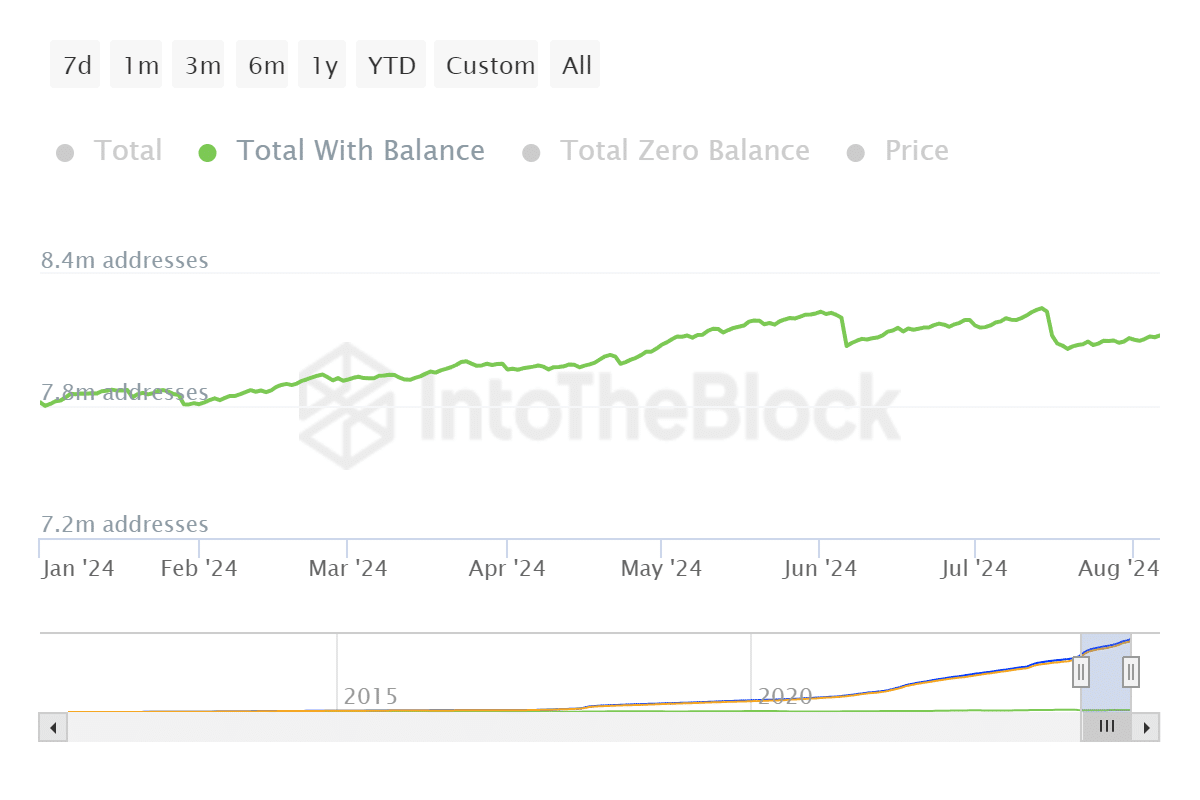

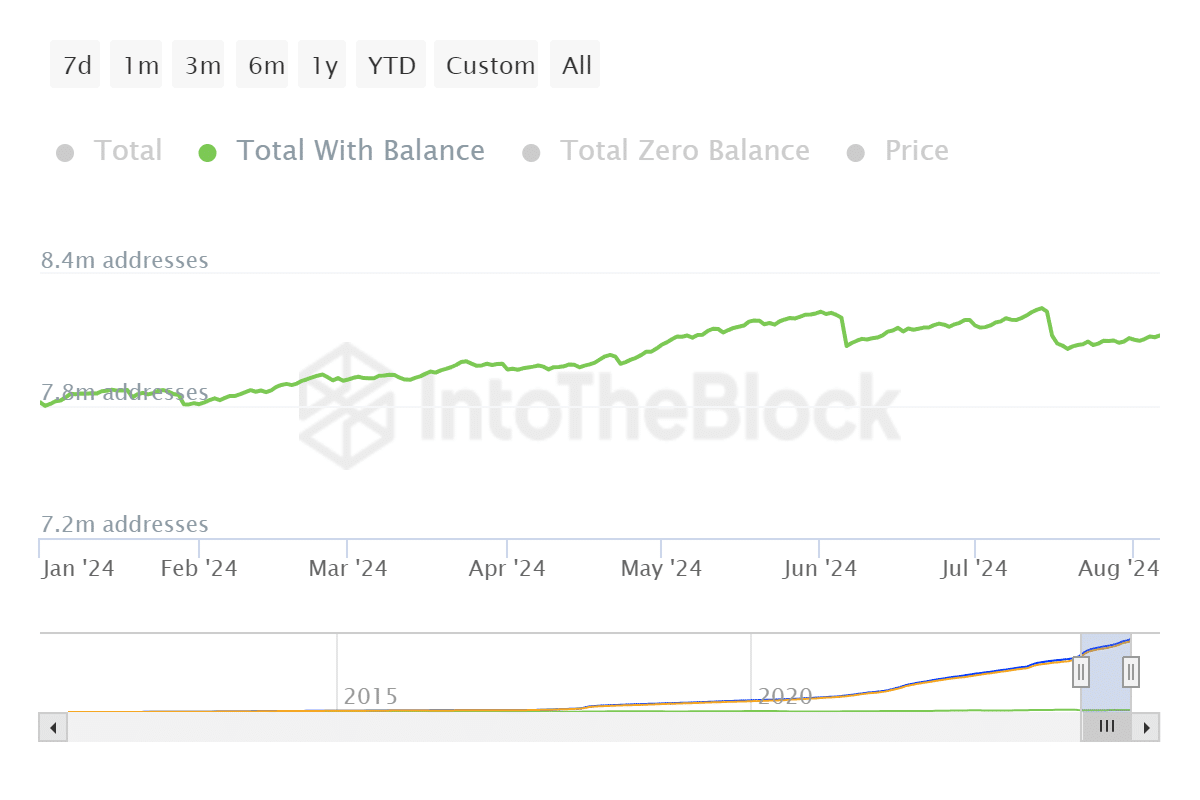

Looking at the overall number of addresses, AMBCrypto observed an overall positive upward trend in the total number of Litecoin addresses.

Source: IntoTheBlock

Litecoin had a total of 7.82 million addresses at the beginning of 2024. That figure has since risen to a press-time number of 8.11 million addresses. These observations indicated that Litecoin was still growing, albeit at a slow pace.

Is your portfolio green? View the LTC Profit Calculator

The low excitement could also be due to the fact that it was overshadowed by its larger and more popular counterparts, especially ETFs and memecoins.

A Litecoin ETF has yet to become a reality, and memecoins have stolen the hype towards Solana [SOL].