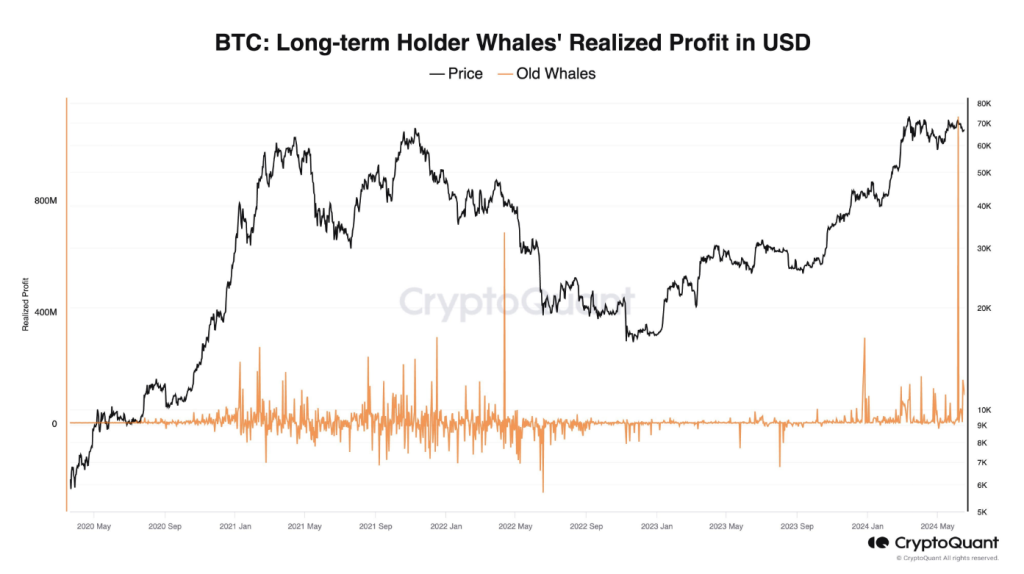

Bitcoin appears to be entering an air pocket. Over the past two weeks, whales have lost their digital assets in large quantities. This exodus, which totals more than $1.2 billion according to CryptoQuant, is a cause for concern for many landlocked investors.

Related reading

Where the whales go, the market can follow

The reasons for this sudden sell-off remain murky, but analysts point to a confluence of factors. One theory suggests a shift in the priorities of miners, the powerful machines that secure the Bitcoin network and earn rewards in the form of new coins.

#Bitcoin Long-term whales have sold $1.2 billion in the past two weeks, likely through brokers.

Net flows from ETFs are negative, with outflows of $460 million over the same period.

If this ~$1.6 billion in sales liquidity is not purchased OTC, brokers can make a deposit $BTC on trade fairs, which has an impact on the market. pic.twitter.com/oYeKsRqKeF

— Ki Young Ju (@ki_young_ju) June 18, 2024

With the booming artificial intelligence (AI) sector offering a potentially more lucrative goldmine, miners could cash in on their crypto rewards to invest in the future of computing.

The appeal of AI is undeniable, says Lucy Hu, senior analyst at crypto fund Metalpha. The enormous processing power required for the development of AI fits perfectly with the capabilities of mining platforms. It appears that miners are strategically diversifying their income streams.

This potential exodus of miners from the Bitcoin ecosystem could have a domino effect. As miners sell their rewards, this increases the total supply of BTC in circulation, potentially lowering the price.

This is consistent with the observed decline in the “UTXO age” – a metric used to track buying and selling patterns. A drop in UTXO age indicates increased selling activity, which is not a reassuring sign for investors hoping to ride the Bitcoin wave.

Traditional markets beckon and leave Bitcoin on the beach

Adding fuel to the fire is broader market sentiment. The recent one strength of the US dollar and a general flight to ‘safer’ assets such as traditional stocks has put a damper on riskier investments such as Bitcoin.

This risk aversion is further reflected in the net outflow of more than $600 million from US-listed Bitcoin ETFs – the worst performance since late April.

Related reading

Is This a Bitcoin Failure or a Temporary Hiccup?

The combined effect of these factors is a steady decline in the price of BTC. From a lofty level of $71,000 just a few weeks ago, Bitcoin has baptized to just over $65,000. Some analysts are warning of a possible freefall to a low of $60,000 if the tide of negative sentiment continues to flow.

Whales solve a ton of Bitcoin. Is this a sell-off, a big discount to buy Bitcoin, or a warning that things are going to be tough for Bitcoin? Investors are waiting to see if this is a good time to buy or if they should get out before the price drops even further.

Featured image from Getty Images, chart from TradingView