The Bitcoin price is currently in a vulnerable position. Meanwhile, recent on-chain data suggests Bitcoin whales are piling up, but contrary to popular belief, BlackRock is not among them. Meanwhile, analysts are divided on whether the worst is over for Bitcoin’s price.

Whales collect Bitcoin, but it’s not BlackRock

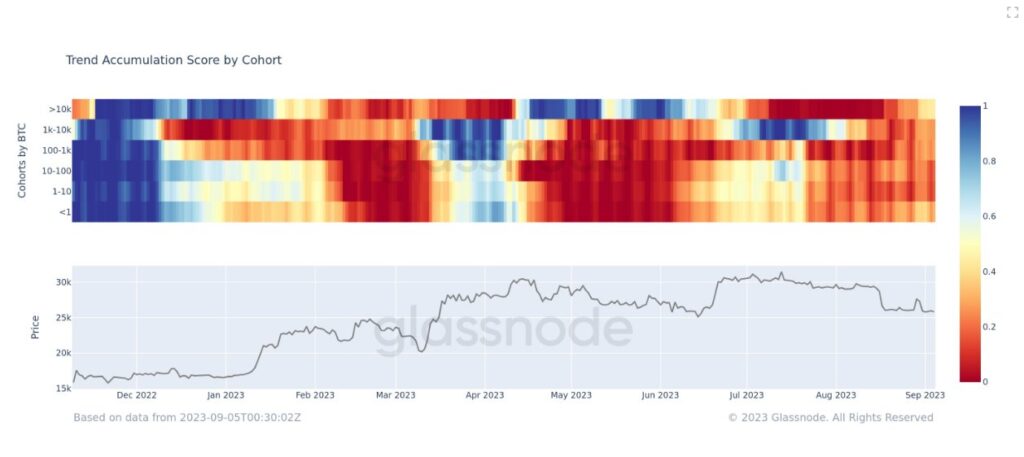

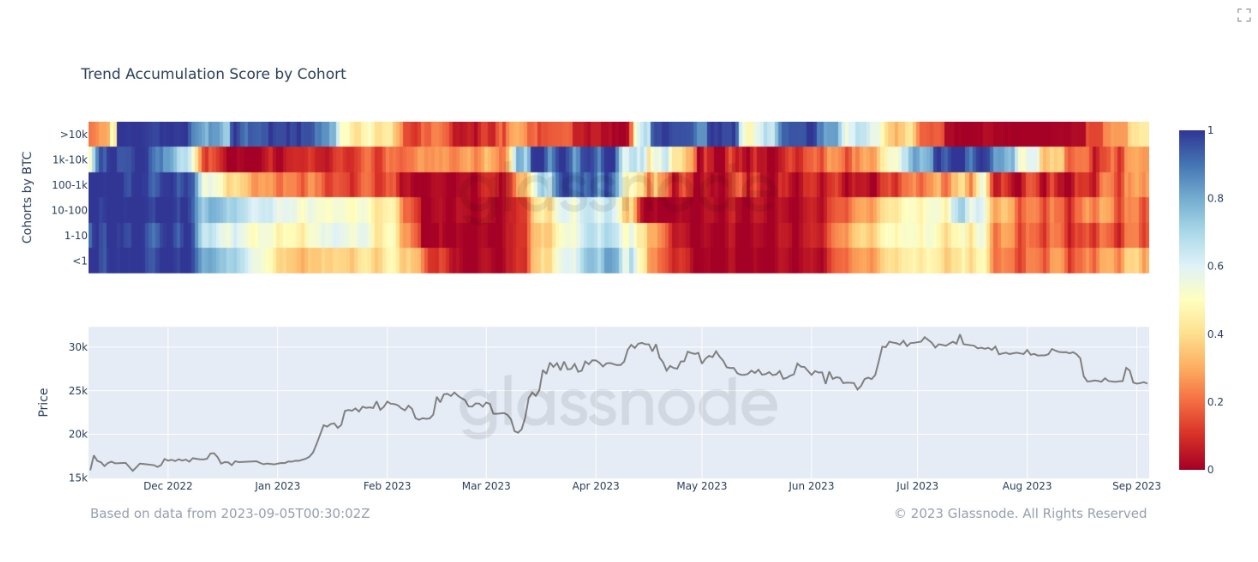

On-chain analyst James V. Streets recently marked a trend in the accumulation score per cohort diagram. He commented: “It appears that Bitcoin’s peak distribution is behind us as we can see a slight increase in accumulation. This is the most aggressive accumulation since June/July for whales holding more than 10,000 BTC.”

However, the waters have been clouded by rumors of BlackRock’s involvement. There is plenty of speculation that BlackRock has suppressed Bitcoin prices in order to buy cheaply. But these claims are baseless. “Many people don’t realize that BlackRock needs real Bitcoin to back their Spot ETF. They may have bought their Bitcoin months ago when prices were lower,” is a statement that has been debunked.

The reality is that BlackRock, a financial giant that manages people’s money, undergoes audits every three months. This means they cannot hide Bitcoin purchases from accountants. If they were to invest in Bitcoin, it would be through an exchange-traded fund.

In fact, BlackRock has already shown interest in this space by investing in Bitcoin mining stocks and MicroStrategy as a proxy. Remarkably, BlackRock is a major shareholder in 4 of the 5 largest Bitcoin mining companies.

Is the worst behind the BTC price?

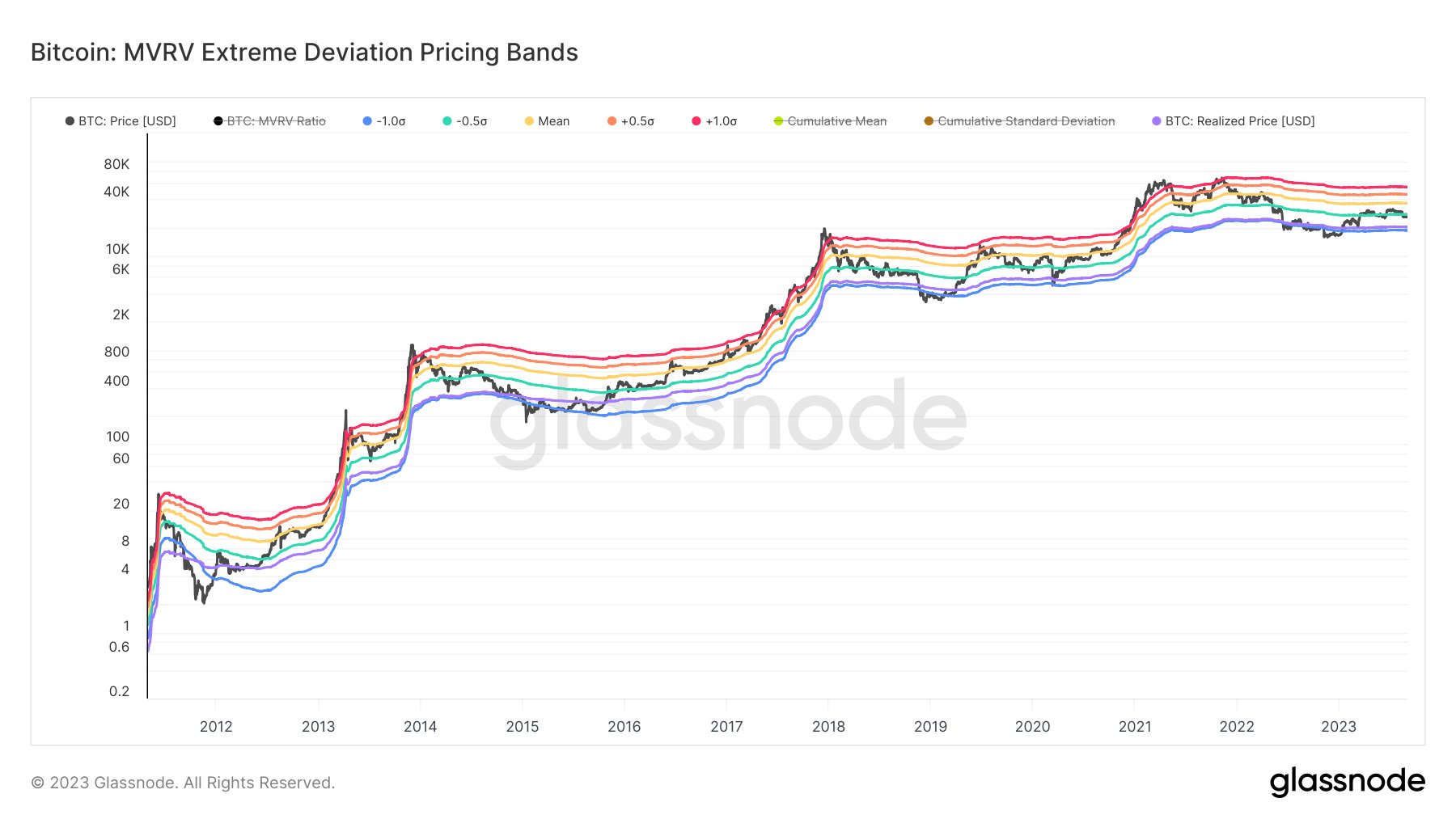

The Bitcoin price trajectory remains a subject of intense debate among analysts. Will Clemente, a prominent figure in space, shared the diagram below and commented“From a valuation perspective on a high time frame, Bitcoin’s position is complicated. While not overheating relative to historical values, there is a tangible risk of retesting lows similar to Q1 2020.”

He further highlighted the prevailing apathy in the market, pointing to the lowest aggregate trading volume since 2020, declining Google search trends for Bitcoin at multi-year lows and realized volatility, implied volatility and weekly Bollinger Bands all reaching near record lows .

Blockware Solutions’ Joe Burnett chimed in with a compelling comment observation“A whopping 94.6% of all Bitcoin remained stationary over the past 30 days. At the end of August we reached a record high, which may soon be surpassed. Historically, bear markets end when supply dries up. Just a spark of demand could ignite the next explosive bull market.”

Crypto traders are also keeping a close eye on key levels. @DaanCrypto noticed the significance of the $26K-26.1K range as it marks the daily, weekly and monthly open, high volume node and weekly VWAP. Therefore, for bulls, this is the line of action, and for bears, the fortress to defend.

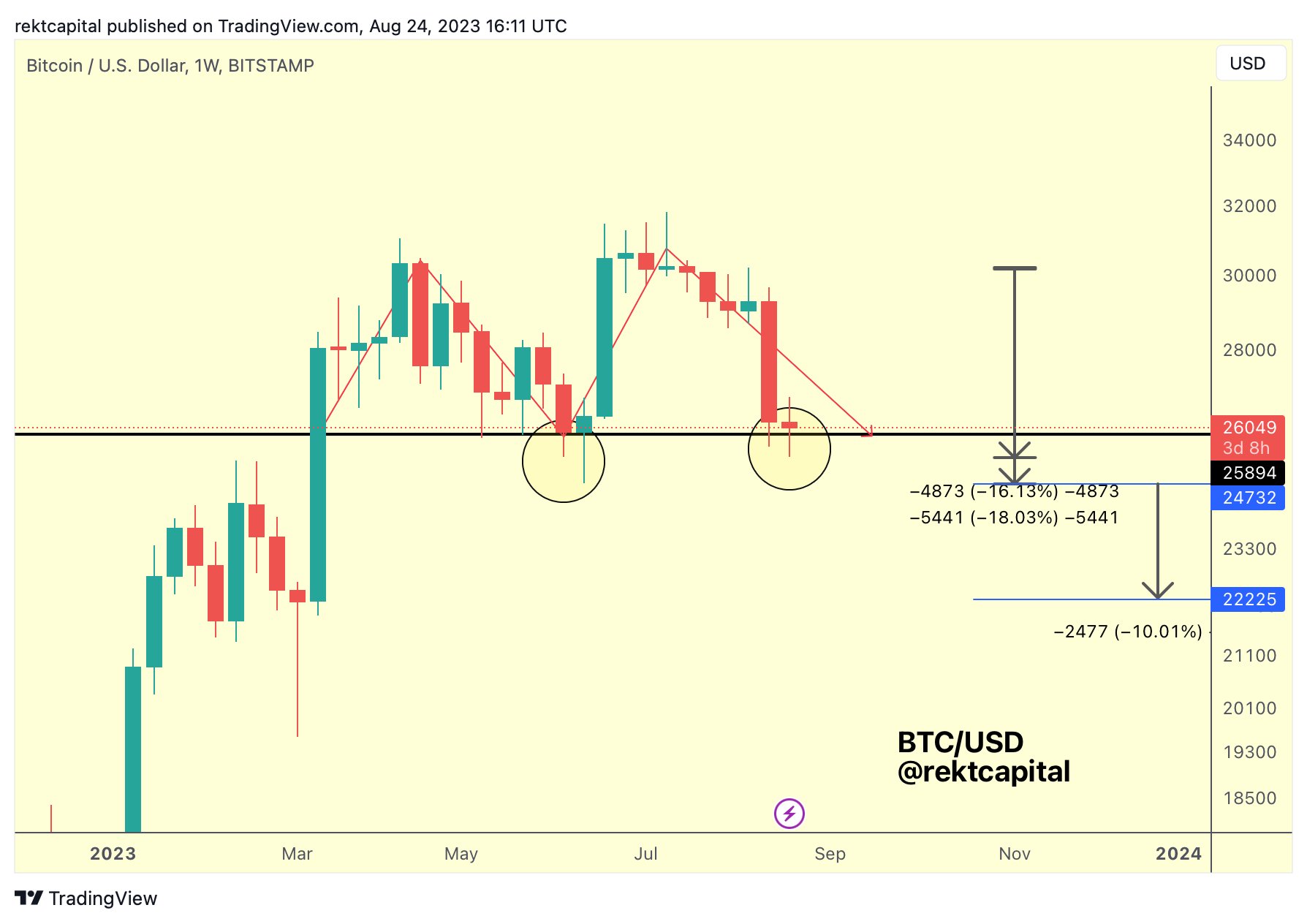

Rekt Capital, a renowned crypto analyst, has been closely monitoring Bitcoin’s price action, especially in relation to volume dynamics. He too highlights the importance of the $26,000 support level on the weekly chart, suggesting that Bitcoin’s price is fluctuating around this point, even after recovering most of its gains from the previous grayscale rally.

However, the simultaneous drop in volumes on both the buy and sell sides is cause for concern, suggesting that the market is currently lacking direction. “The falling sales volume in combination with a moderate buyer volume is worrying. Without a volume breakout, either from sellers or buyers, the market has no momentum,” the analyst said.

Turning to the double top, a traditional bearish pattern, Rekt Capital indicated that a break below $26,000 on the weekly chart could potentially send BTC tumbling to $22,000. However, he also alluded to a silver lining: an inverted head-shoulder pattern observed earlier this year. If Bitcoin approaches the $24,000 mark, which serves as the neckline for this pattern, it could act as a robust support and potentially signal a bullish reversal.

At the time of writing, BTC was trading at $25,734.

Featured image from Mike Doherty / Unsplash, chart from TradingView.com