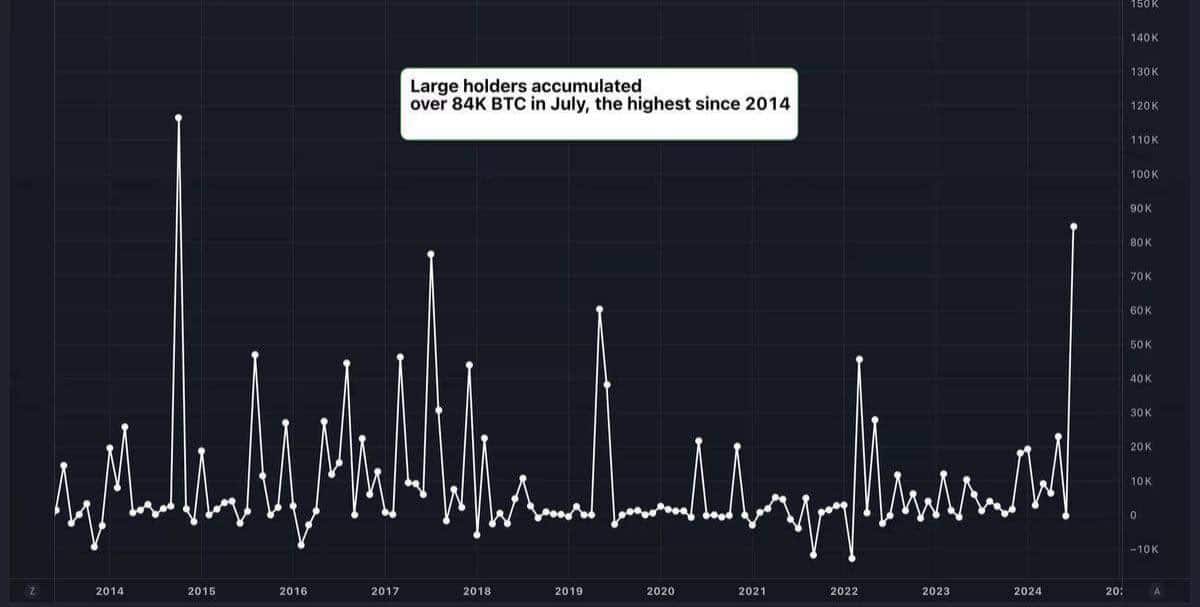

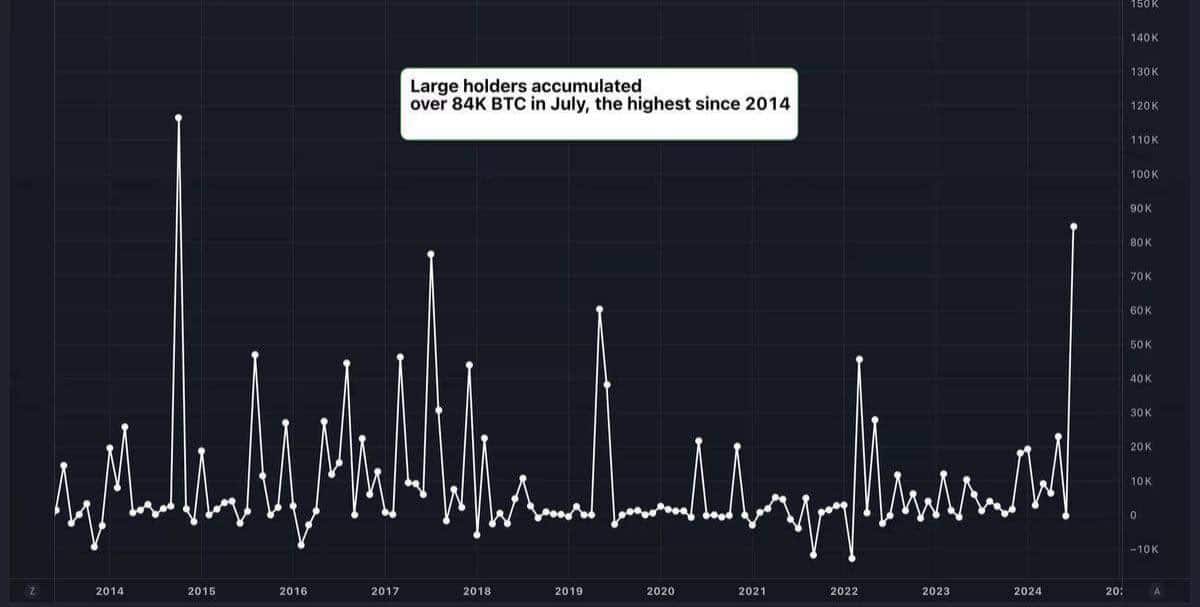

- Large holders collected 84,000 Bitcoins worth more than $5 billion in July.

- BTC’s Second Highest Trading Volume as Bitcoin ETF Inflows Soar.

Bitcoin [BTC] whales collected 84,000 bitcoins, totaling $5 billion in July, marking the highest monthly increase since 2014. Such significant purchases often indicate a major market shift.

This unprecedented activity suggests that Bitcoin could be on the verge of a substantial move. Historically, large accumulations of whales have often preceded major market changes. It is a crucial time for investors to stay alert.

Source: Ash Crypto on X

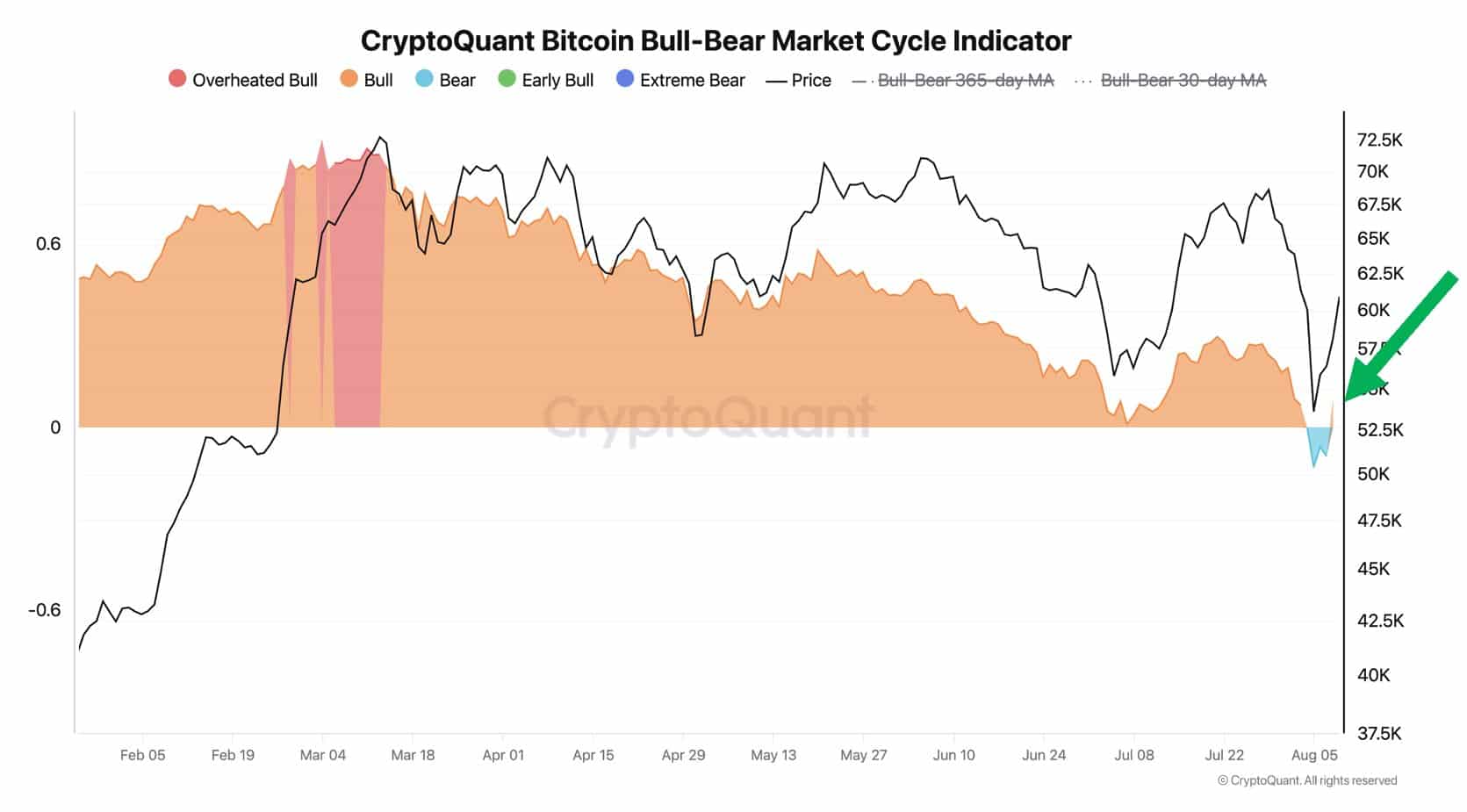

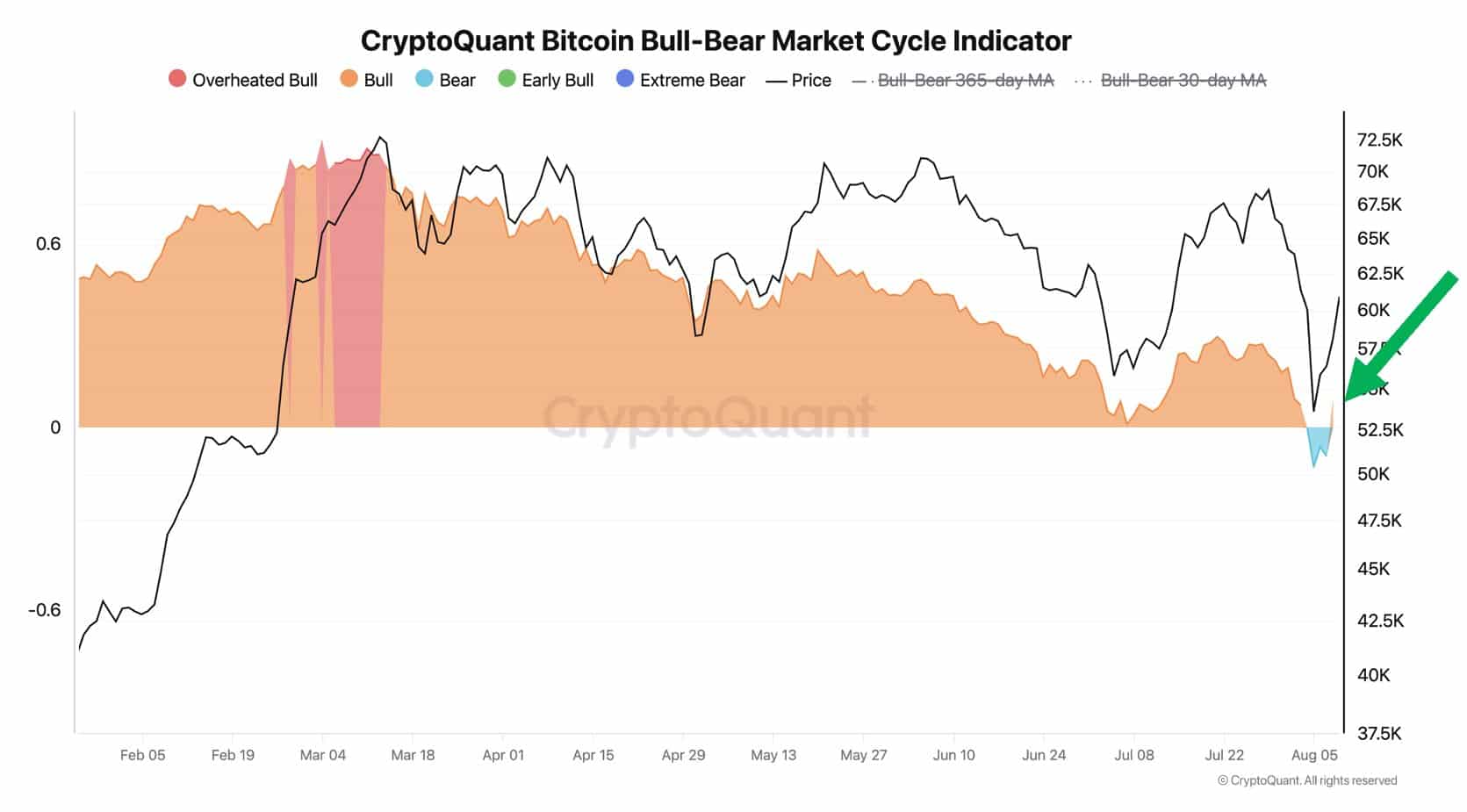

Bitcoin’s on-chain cyclical indicators indicate a bull market

Moreover, most Bitcoin Indicators, including the bull-bear market cycle indicator, that were close to a downturn are now showing a bull market again.

Bitcoin’s price was briefly reduced for just three days. Given this data, the bull market appears solid. The market is expected to bounce back within two weeks.

Source: CryptoQuant

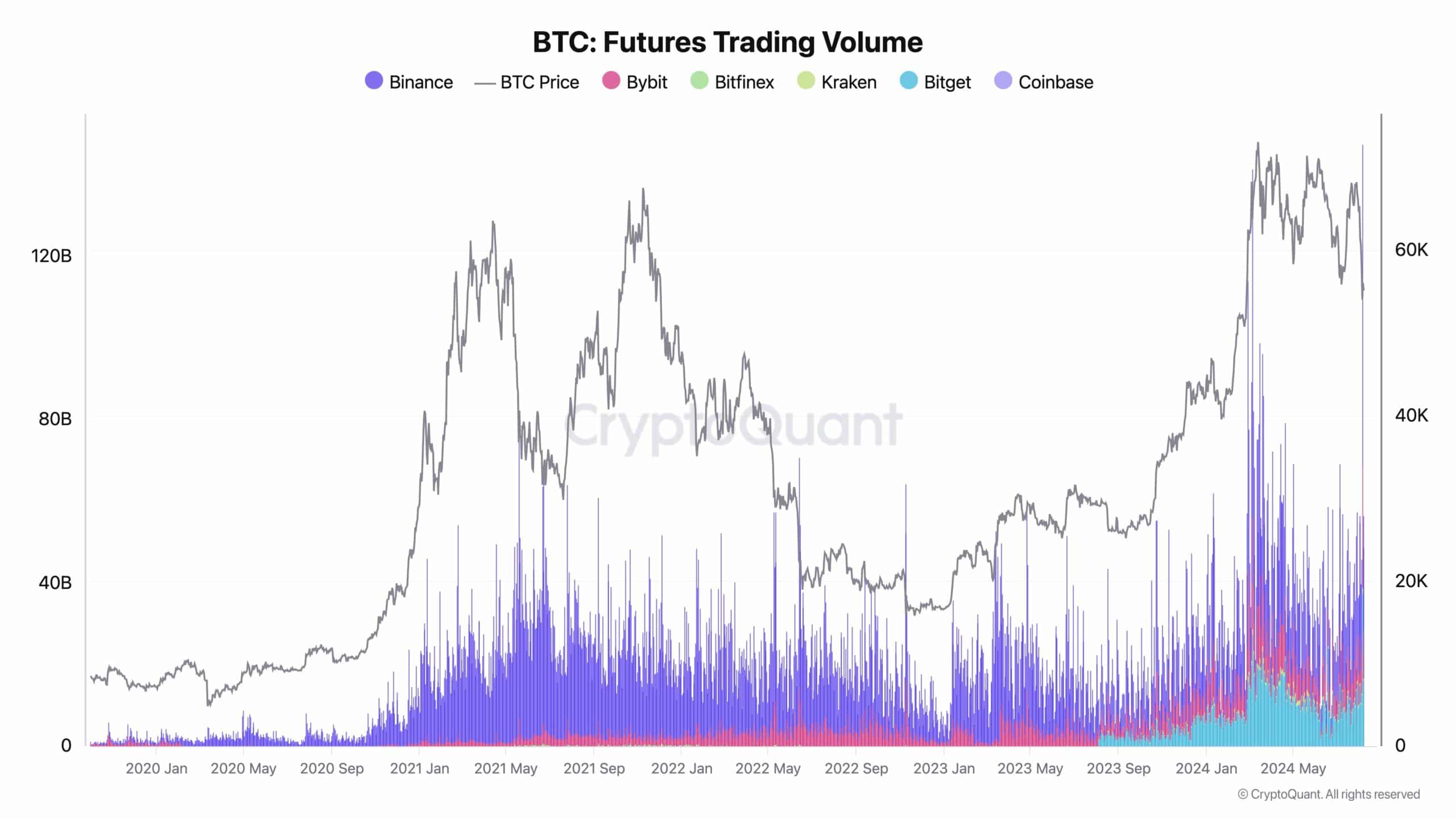

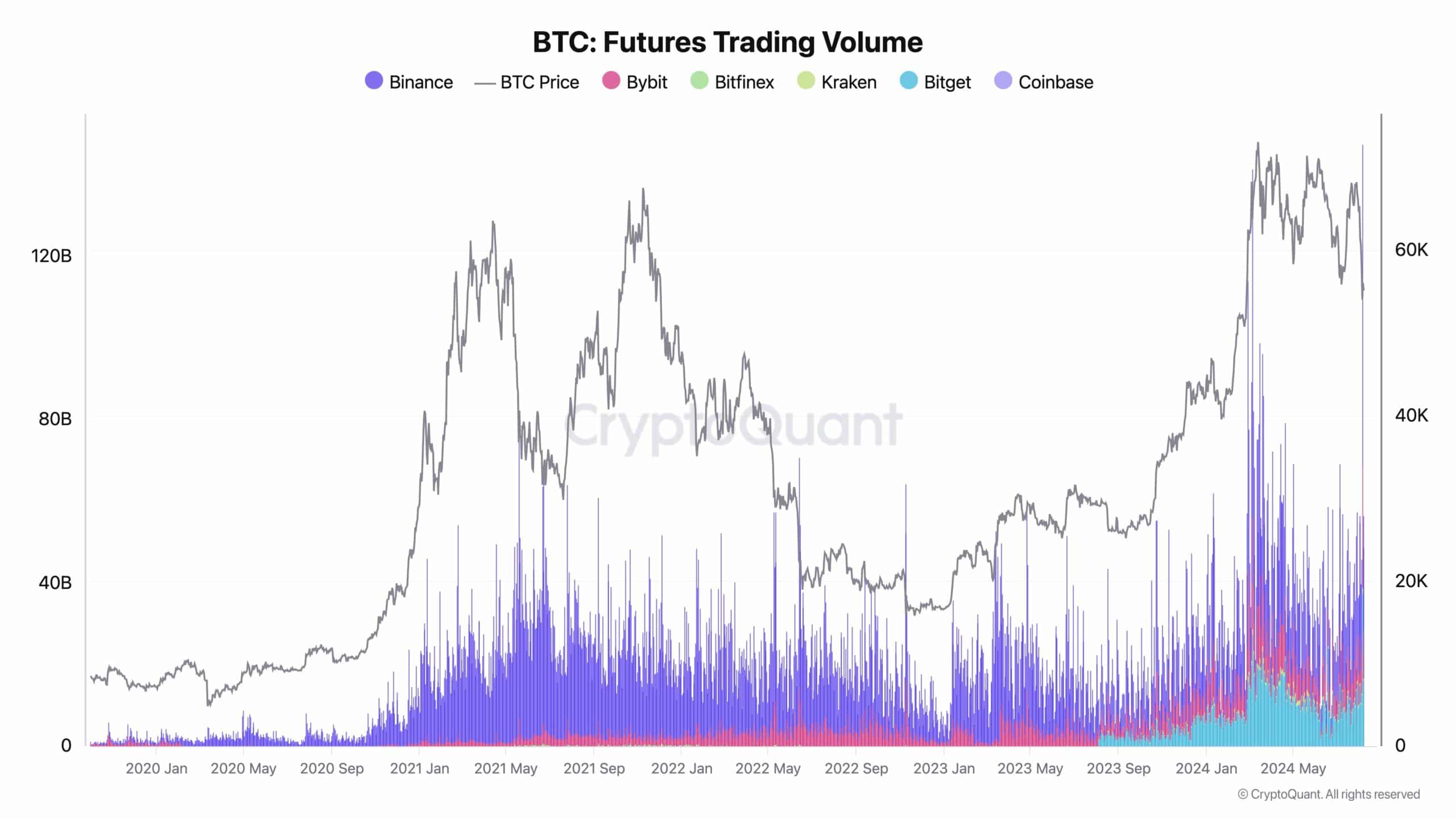

BTC futures and spot trading volume reach ATH

As Bitcoin fell to $50,000, futures trading volume rose to a record $154 billion and spot trading volume reached $83 billion, the second highest ever and fueling more convergence.

This dramatic decline was followed by a strong recovery, with Bitcoin’s price rising by over 23% from its weekly low.

Source: CryptoQuant

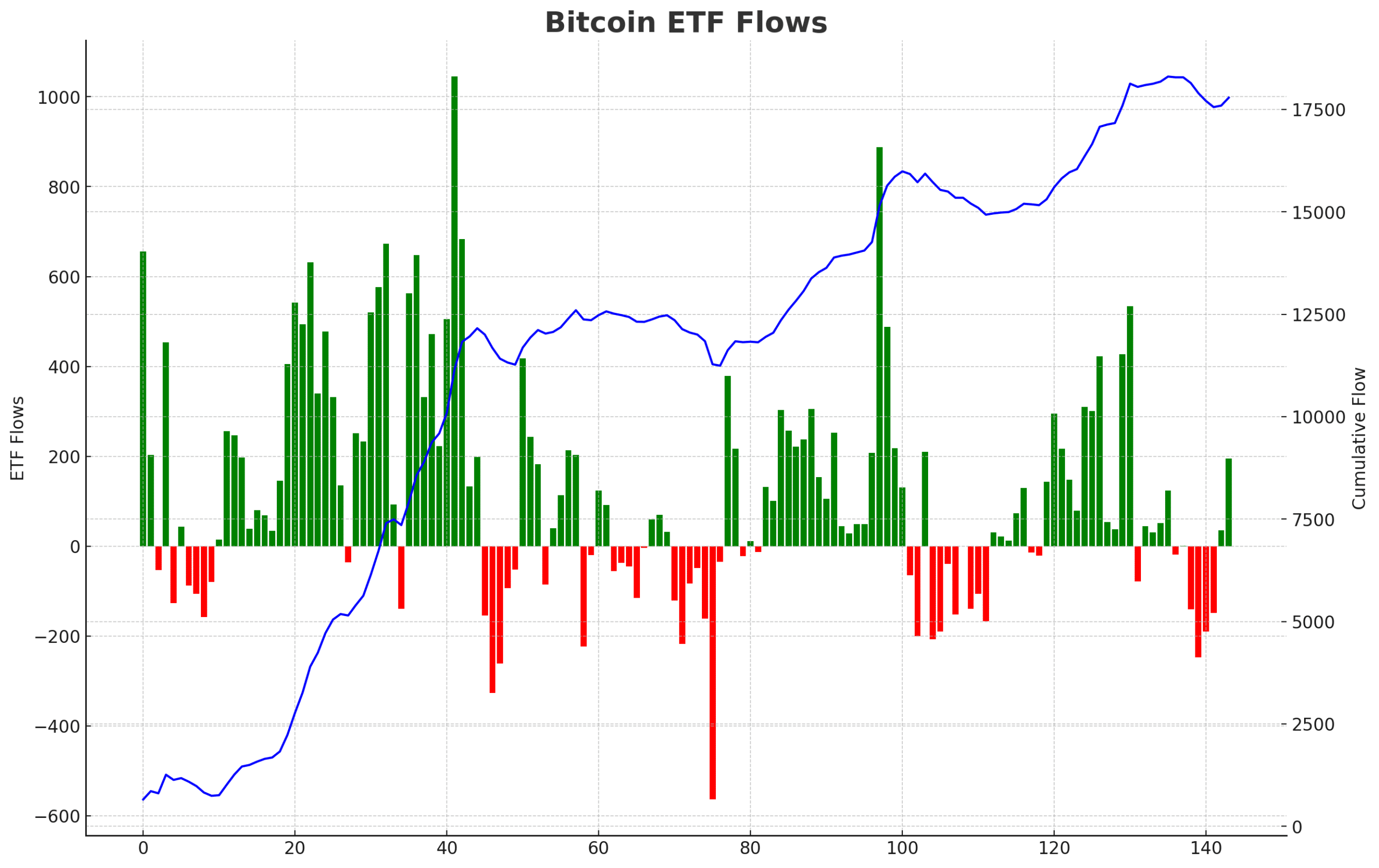

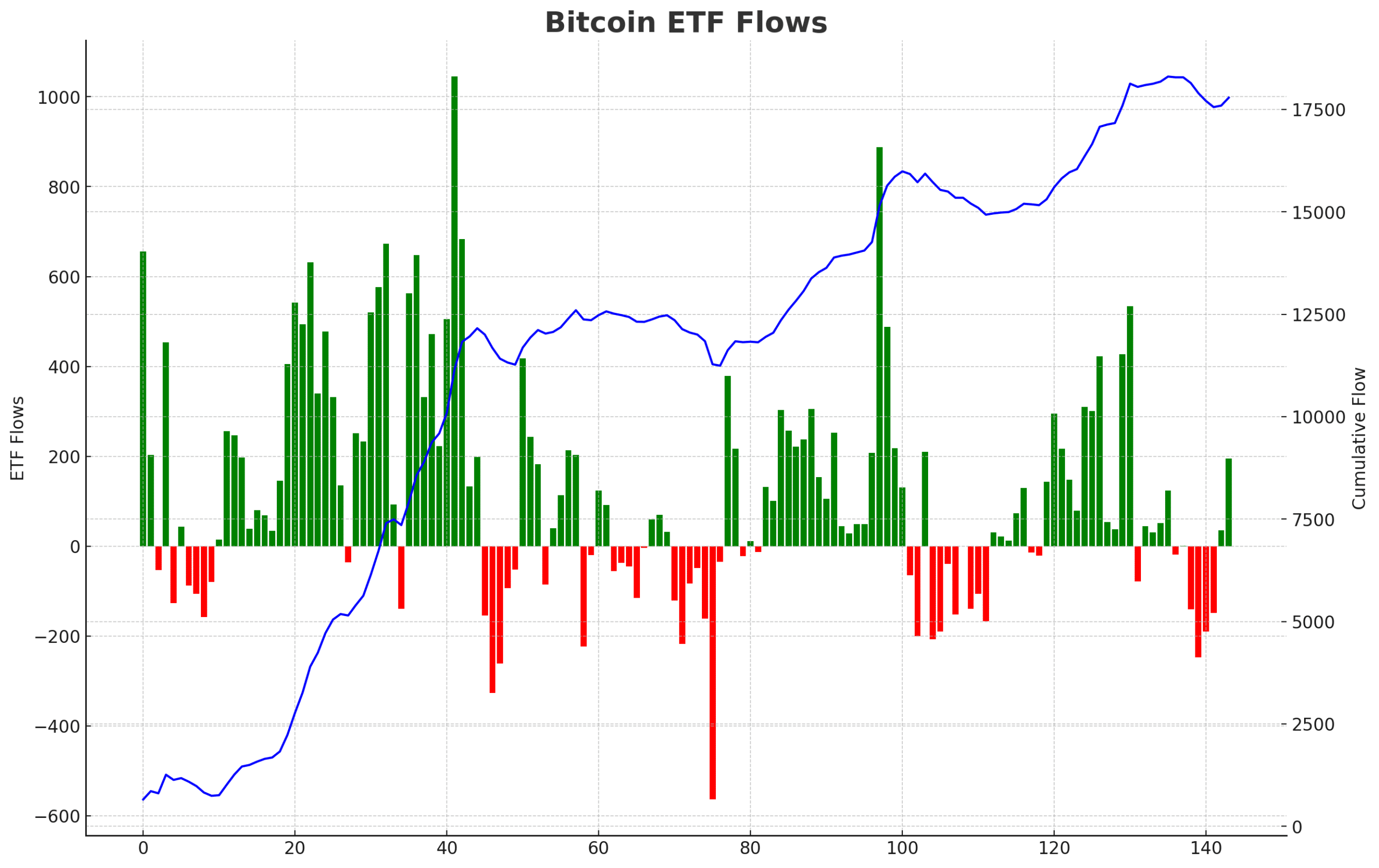

The inflow of ETFs is increasing sharply

Despite Bitcoin’s fluctuations, BlackRock’s remains Bitcoin ETF has had just one day of outflows since its launch in January, with more than $20 billion locked up.

Recently, BTC ETFs saw $194 million in inflows after five days of outflows. Notably, every time BTC drops near $50,000, ETF inflows increase significantly.

This pattern has repeated itself, with large inflows occurring every time BTC fell into the lower $50,000s. This trend indicates that big investors are buying the dip.

Source: Bitcoin archive on X

Liquidity on the sell side of Bitcoin increased

Bitcoin has also shown an interesting pattern around the 5th of the month. In both July and August, yields fell sharply for five days at the beginning of the month but then rallied significantly.

While this may be a coincidence, it is notable that BTC has likely absorbed sell-side liquidity, which could signal a potential rally. Analysts generally view the $70,000 peak as a short-term high.