- CryptoQuant founder claims whales are preparing for altcoin season.

- Another market analyst, Benjamin Cowen, warns against such calls amid BTC’s increasing dominance.

There will be another round of Alt season calls in early August, just weeks away from a possible first Fed rate cut in September. The latest call is from CryptoQuant, a crypto data intelligence platform.

This is not the first altcoin season call from market analysts and may not be the last. We have observed these calls since this cycle began late last year, but none have materialized.

Will Whales Make This Alt Season Different?

So, what makes this final Alt season different? Whales, also called smart money.

According to the founder of CryptoQuant Ki Young JuWhales are positioning themselves for the next altcoin season in a big way.

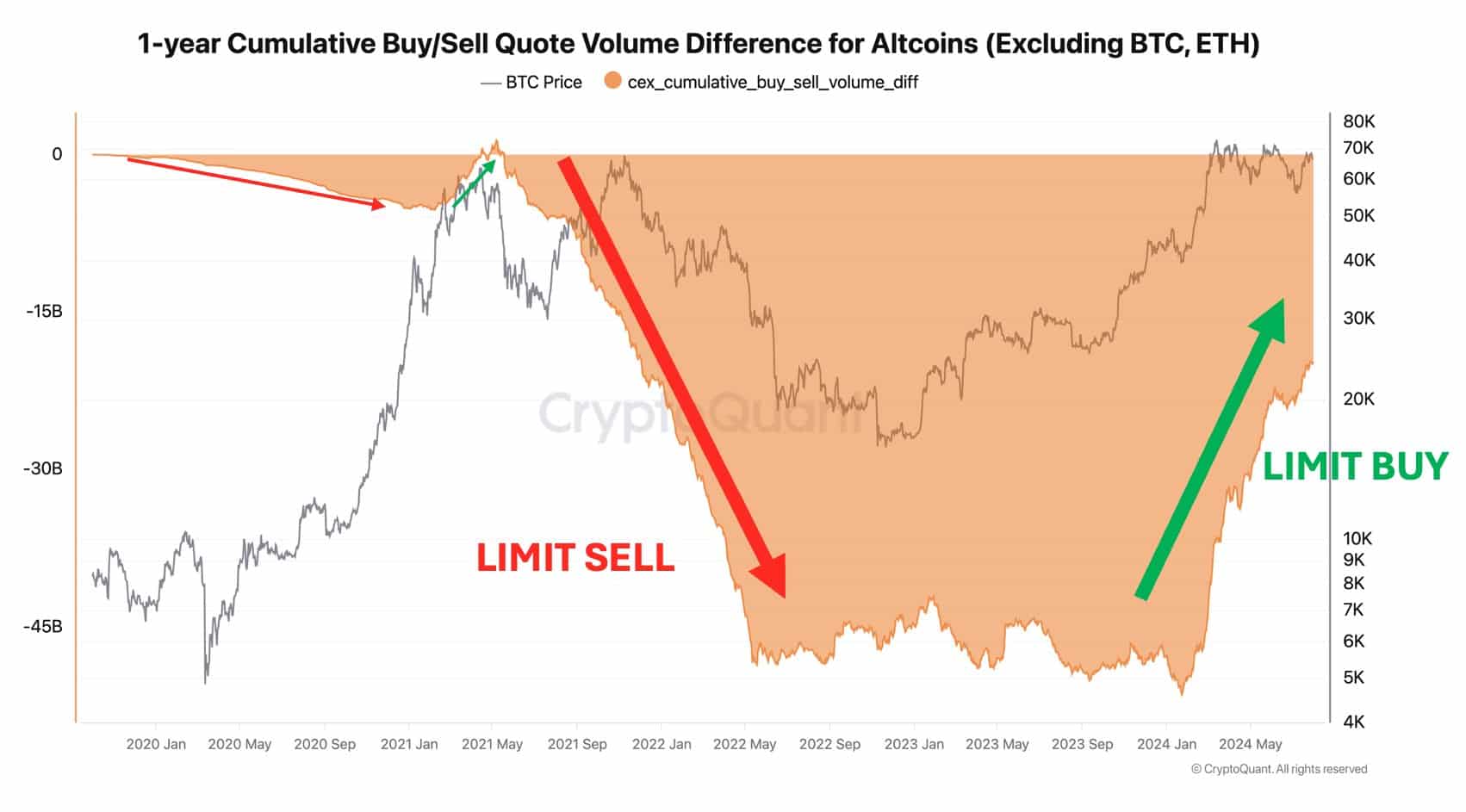

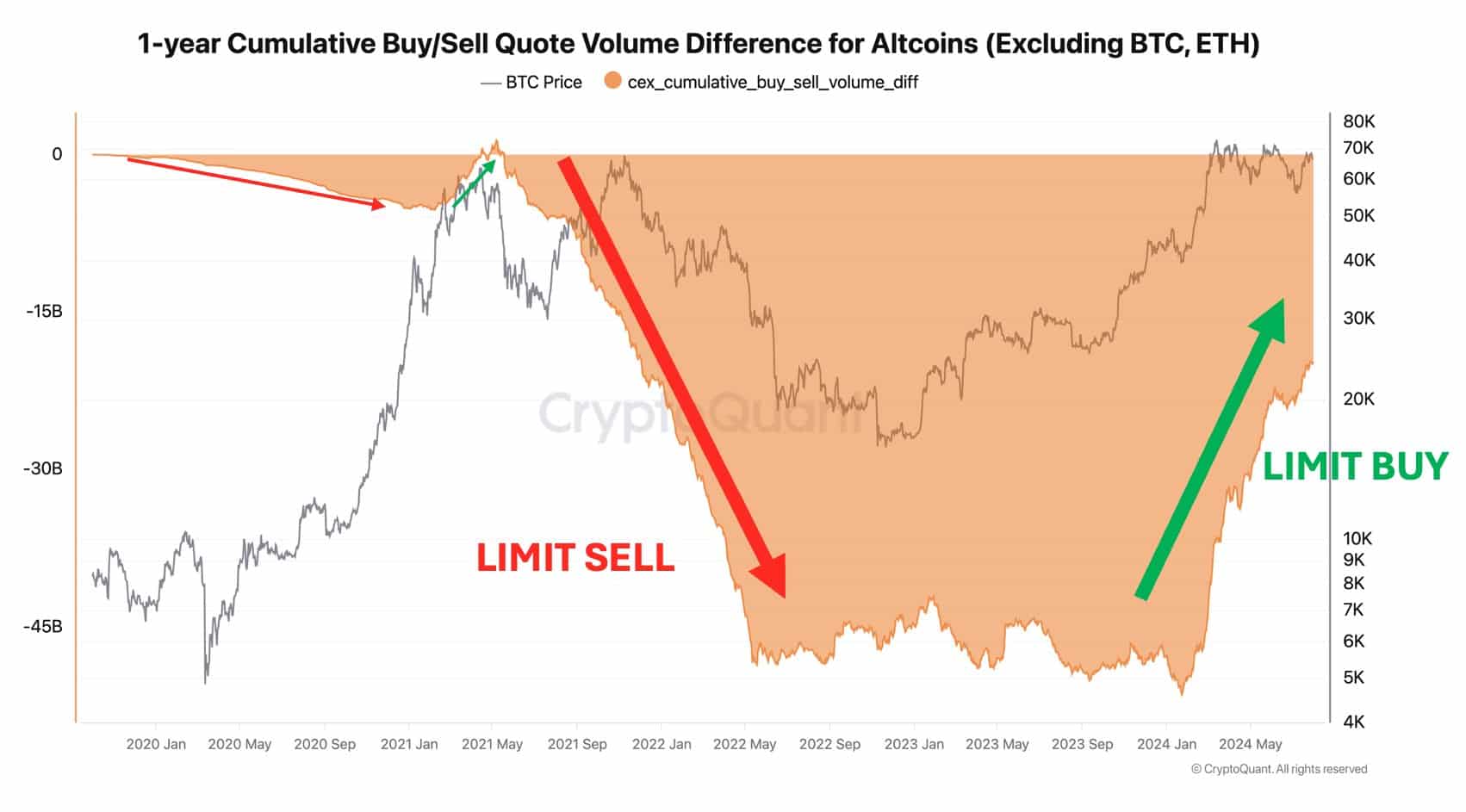

Source: CryptoQuant

Ju’s projection was based on increasing the one-year cumulative buy/sell quota volume difference for Altcoins.

This metric tracks demand for altcoins from whales and institutions. An upward trend indicates strong demand from whales, while a downward trend underlines lower demand.

The attached chart shows the value rising, indicating a huge whale appetite and position for a possible altcoin season.

SwissBlock, a crypto market insights company led by the founders of Glassnode, shared a similar Alt seasonal outlook. The company’s analysts said the current altcoin market reflects the trend from late 2020 – early 2021, which led to a 400% rally for altcoins.

The analysis was based on the correlation with US small caps (Mini Russell 2000 Index Futures). Other analysts, such as Quinn Thompson of Lekker Capital, have specifically cited the positive correlation between small caps and crypto.

However, not all analysts are buying into the Alt season call.

A renowned crypto analyst, Benjamin Cowen, offered a cautious outlook, citing that increasing Bitcoin The dominance could reach 60% by the end of the year, which could hinder the altcoin market.

‘You can see that #BTC’s dominance continues to slowly rise despite proclamations just about every week for ‘alt season’

Cowen added that ALT/BTC could fall lower, exposing Alts to more risks. According to Cowen, this trend was observed in 2019, a month before the Fed’s rate cut, and could repeat itself.

Source: Benjamin Cowen

In short, not all market observers have heeded the calls of altco season, at least not as of this writing. According to current measurements of 22 of the Altcoin Seasonal Indexthe market was still firm in Bitcoin season.