Arbitrum (ARB), a prominent governance token in the decentralized finance (DeFi) ecosystem, recently witnessed a decent price surge following renewed buying activity from a well-known DeFi whale address.

Large-scale investors often influence market sentiment and can significantly influence the price of a particular asset. However, as the rally progresses, questions arise about the sustainability of this upward momentum and its implications for Arbitrum’s future.

Whale’s unusual buying activity coincides with ARB’s rally

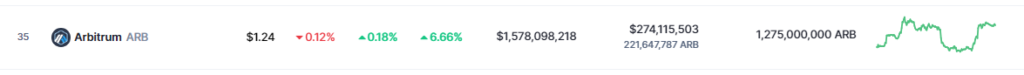

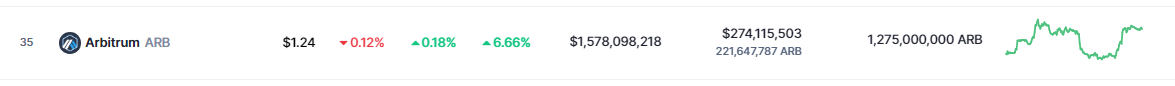

Arbitrum’s (ARB) current price of $1.24 on CoinMarketCap highlights its remarkable performance, with a remarkable 3.4% rally in the last 24 hours, followed by an impressive seven-day climb of 7%. Interestingly, this increase in value coincided with unusual buying activity associated with famed trader Andrew Kang’s crypto addresses.

Source: CoinMarketCap

Particularly noteworthy is the fact that Mechanism Capital co-founder Andrew Kang has made some interesting moves within the Arbitrum ecosystem.

Kang put $1 million worth of stablecoins in Arbitrum pools and allocated almost a quarter of the money towards the purchase of RDNT tokens. RDNT is the native token of the DeFi lending platform Radiant Capital.

BTCUSD currently trading at $27,150 on the weekend chart: TradingView.com

After filling his bags with RDNT, Kang then traded his newly acquired tokens and existing RDNT reserves for $867,000 worth of ARB.

These transactions were further followed by Kang depositing the proceeds into Radiant Capital, where he borrowed Circle’s USD Coin. These details have been revealed through data obtained from Look at chaina reliable data source.

Looks like Andrew Kang is using leverage to go long $ARB on @RDNTCapital.

To buy $ARB → Deposit $ARB → Borrow $USDC → Buy $ARBhttps://t.co/PQwi0Zj9TT pic.twitter.com/afXjeRtTpv

— Lookonchain (@lookonchain) June 2, 2023

Multiple whales seize opportunities as ARB price improves

In addition to Kang’s intriguing buying activity, another key player known by the address “0xf59b” has also recognized the potential in ARB’s upward trajectory. This whale made a strategic move by spawning 1.2 million ARB tokensequivalent to $1.5 million, in the popular cryptocurrency exchange OKX.

Whale “0xf59b” was finally waiting for the emergence of $ARB and 1.2 million deposited $ARB ($1.5 million). #OKX 30 minutes ago.

He withdrew 1.2 million $ARB by #OKX on May 8, and the purchase price could be around $1.2.https://t.co/cJReZfg007 pic.twitter.com/jFwBRtPUpK

— Lookonchain (@lookonchain) June 2, 2023

This whale’s decision to pull the tokens out of OKX on May 8 and potentially buy them for around $1.2 suggests a deliberate strategy of waiting for a price increase before profiting from their holdings. By carefully timing their actions, this entity sought to maximize their potential profit as ARB’s value rose.

These recent large-scale investments indicate a growing optimism all around Arbitrum’s Layer 2 solution, despite the challenges it has faced in the market lately. The renewed interest from both Kang and the whale behind the “0xf59b” address reflects belief in ARB’s long-term viability and potential profitability.

In addition, these strategic moves by multiple whales indicate broader sentiment within the crypto market. As the Ethereum network gradually recovers from the recent decline, activity on Layer 2 networks is increasingly expected to increase. This anticipation forms the basis for a potentially bullish cycle for these networks, including Arbitrum.

(The content of this site should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk)

– Featured image from The Conversation