- Vitalik Buterin transferred 1.3 million STRK tokens, sparking speculation and market movement.

- STRK’s share price rose 4.53% after Buterin’s transfer, indicating a possible rally.

Recently Ethereum [ETH] co-founder Vitalik Buterin moved 800 ether worth over $2.1 million into a multi-signature wallet, sparking rumors of a possible massive sell-off.

Vitalik Buterin moves STRK

On September 4, Buterin also unlocked and released 1.268 million Starknet resources. [STRK] tokens, worth $470,000, from Starknet’s Locked Token Grant contract.

This news was brought to light by Wu Blockcahin’s X-post, which noted:

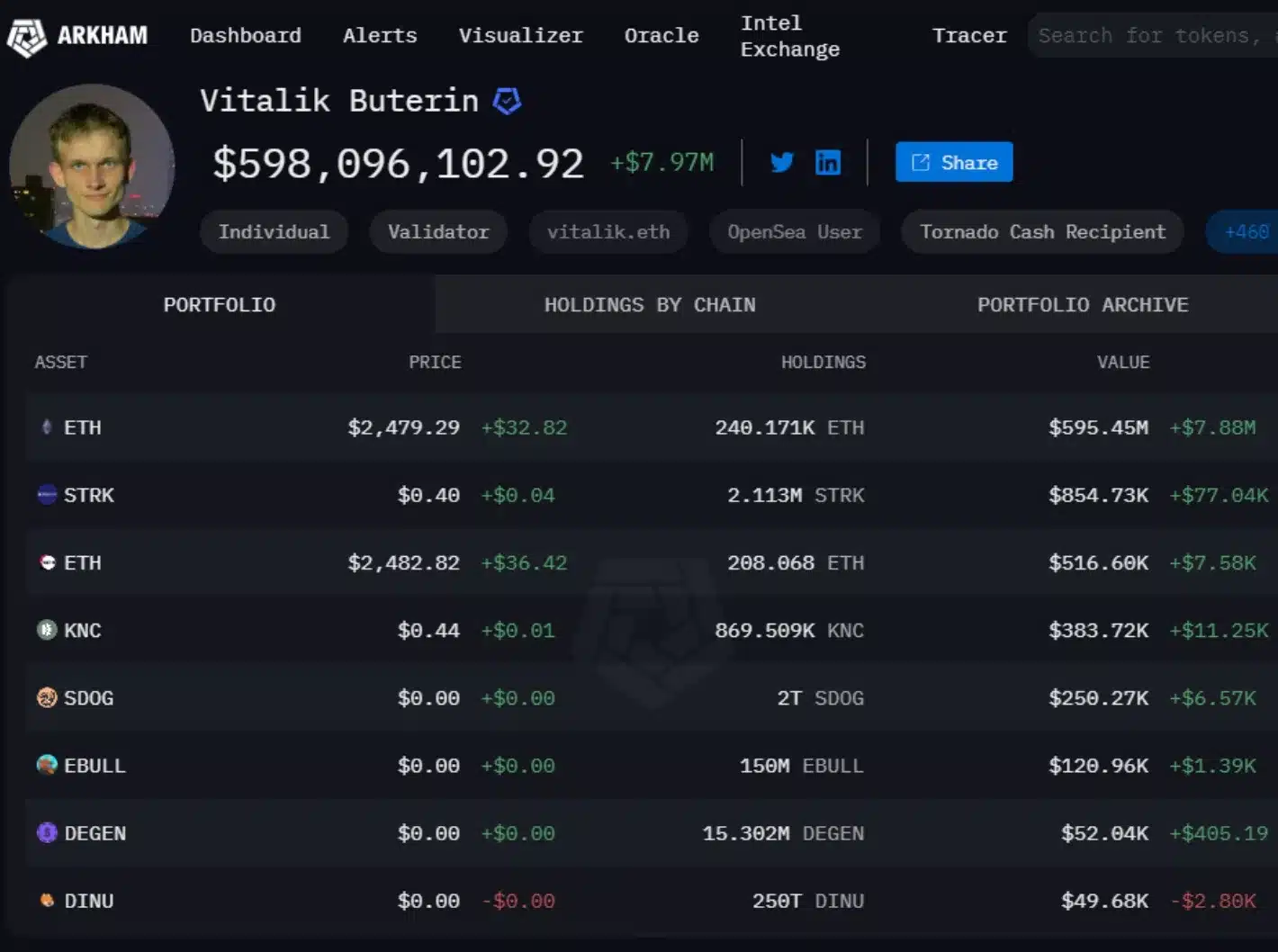

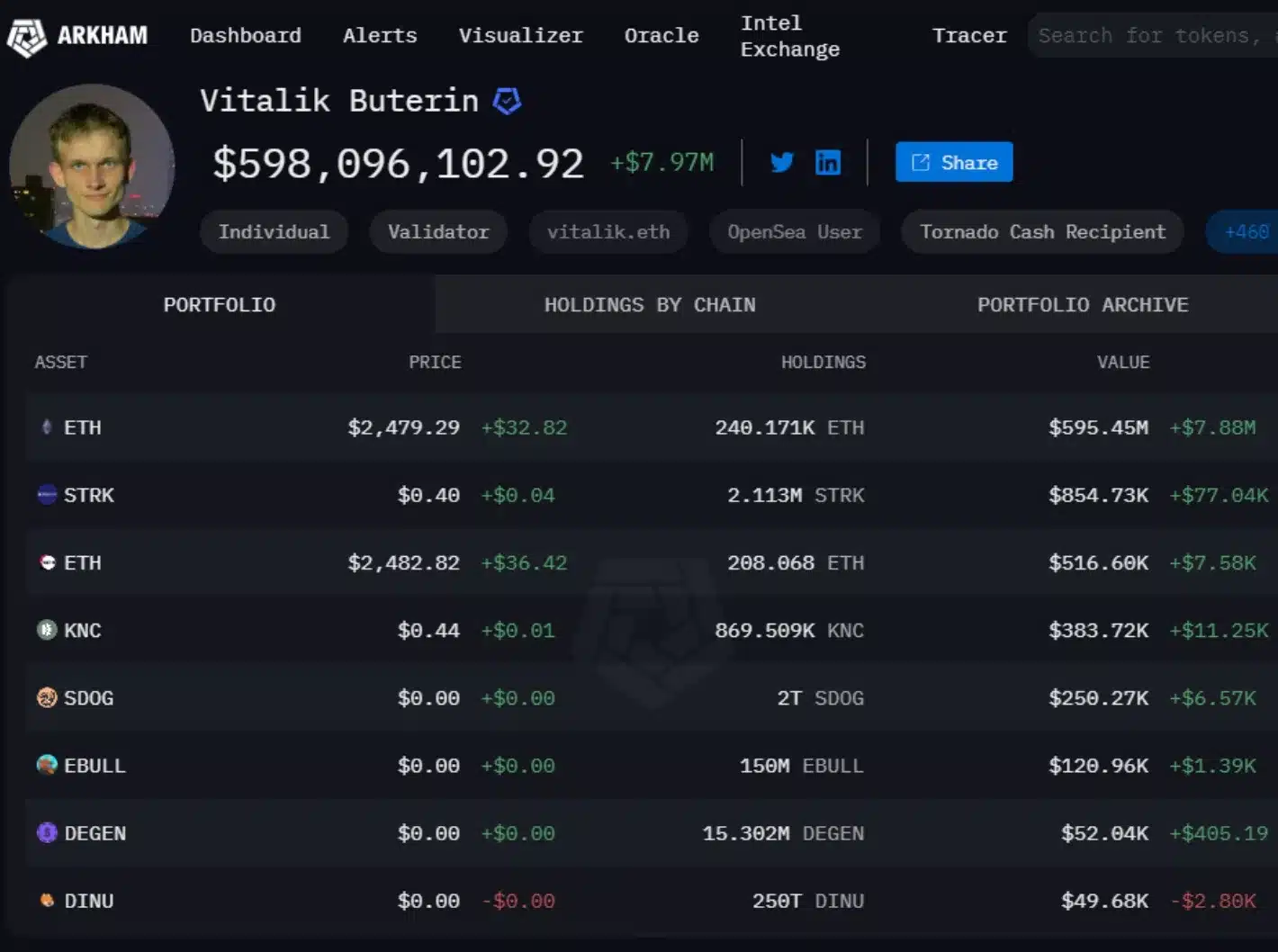

“Vitalik Buterin currently holds a total of 2,113 million STRK, worth approximately $781,000, which is his most valuable token next to ETH. Vitalik Buterin is one of the first investors in StarkNet.”

This increase is valued at $854,730 at $0.39 per token and has sparked curiosity about Buterin’s plans.

Source: Arkham Intelligence

STRK has now become Buterin’s second largest token holding after Ethereum. Also, Buterin made a similar transfer of 845,205 STRK tokens in May, leading to a notable increase in the token’s price.

Impact on STRK token

The recent transfer appears to be causing a similar market reaction. According to the latter CoinMarketCap Update: STRK is up 4.53% in the last 24 hours to trade at $0.3983.

AMBCrypto’s analysis of TradingView data indicated cautiously bullish sentiment, with the RSI slightly above neutral at 51, indicating potential upside momentum.

However, as the RSI fell slightly, this bullish outlook remained uncertain.

On a more positive note, the position of the MACD line above the signal line confirmed the presence of bullish activity.

However, it also suggested that a continued rally could be in store if STRK surpasses its resistance at $0.43.

STRK- Trading View

The other transfer from Vitalik Buterin

Before this withdrawal of STRK tokens, Vitalik Buterin moved several tokens, including PIKA, ETH, DIMO, and POKT, between his wallets, raising questions about his future intentions.

Some speculate that these transactions indicate a new charitable donation, following his past patterns.

Others see these moves as strategic realignments within his portfolio.

Whatever the motive, Buterin’s actions are arousing curiosity about his broader plans, leading the market to anticipate further developments.