- Virtual saw more than $ 567K in Netto intake, but price promotion did not pass an outbreak

- Stable wallet growth refers to rising trust

Virtual [VIRTUAL] has taken the spotlights under AI agent -tokens, with the highest net inflow in the last 24 hours. Although this is a sign of strong interest from market participants, a deeper view of the data evokes whether the price trend justifies the increase or whether something else is going on.

Netflows Spike as a virtual is at the top of the rankings

According to Last dataVirtual saw the net inflow of $ 567.05k, Verde over other tokens in his category. The inflow came as the total inflow reached $ 7.01 million, normally larger out of $ 6.44 million. This kind of net movement usually means the increasing demand, especially when the inflow outweighs against taking the profit.

And yet, despite all this momentum, the price of the Altcoin has only seen a modest increase of 2.72% in the last 24 hours. In fact, it acted at around $ 0.722. On the surface this did not seem to reflect the number of capital that moved in the token.

Price promotion emphasizes hesitation

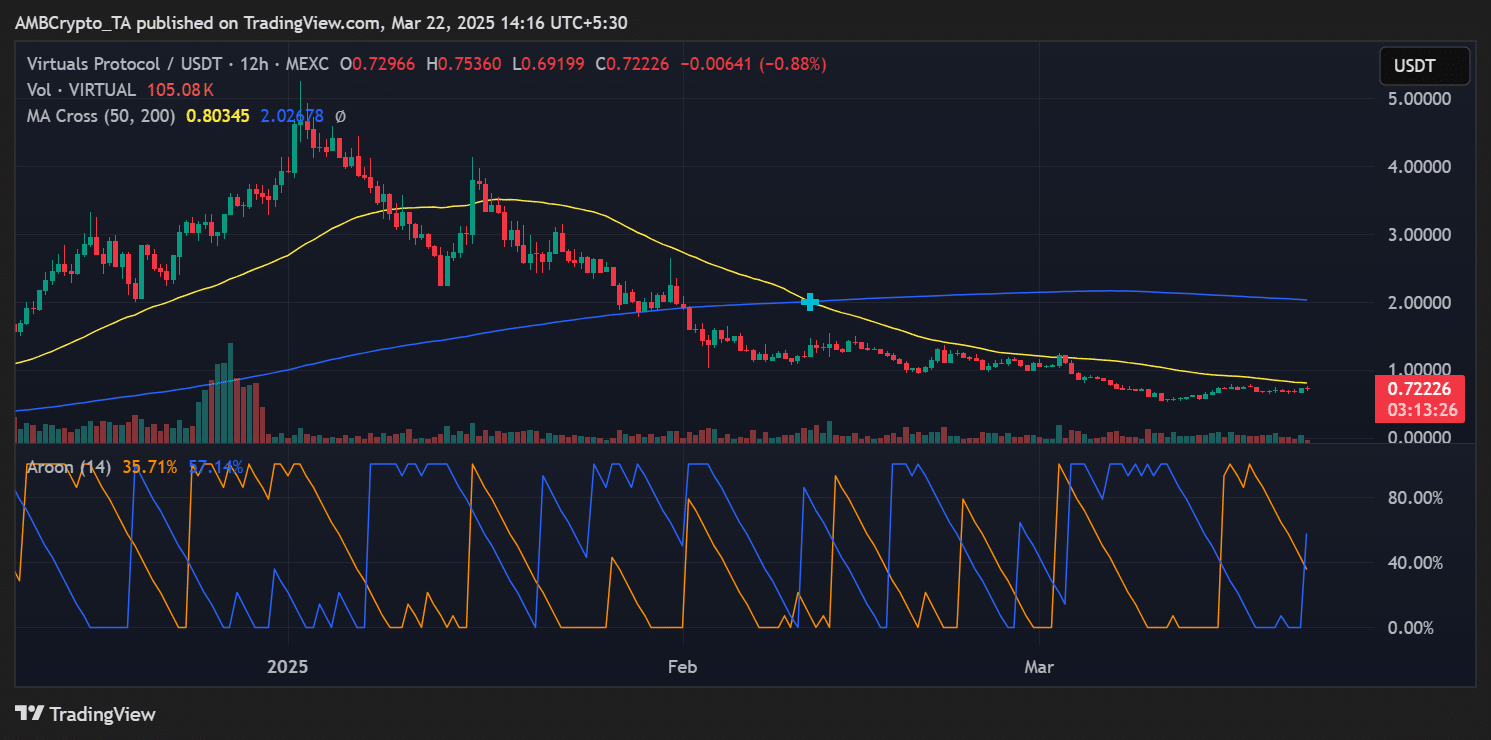

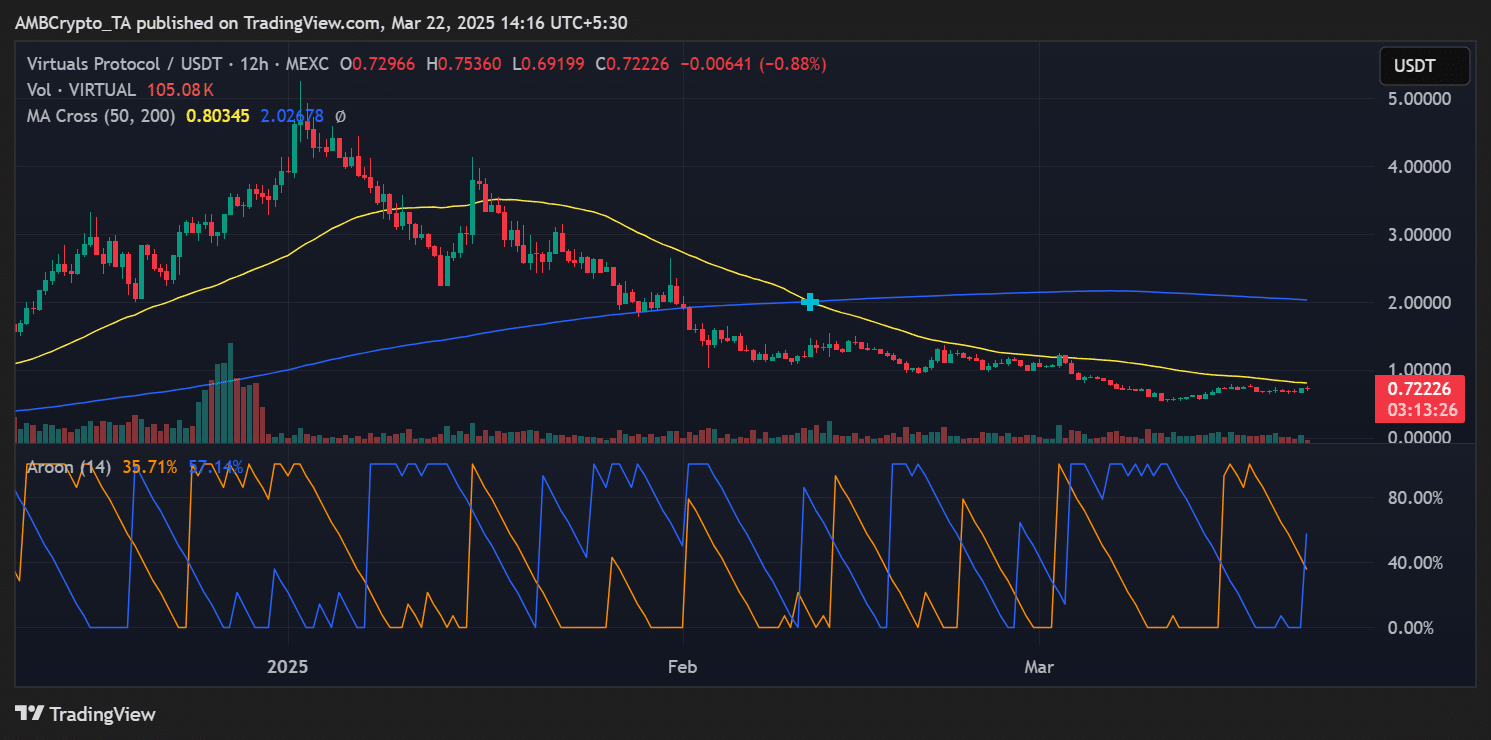

A glance at the 12-hour graph painted a photo of consolidation.

The Altcoin still traded under 50 EMA at $ 0.803 and it was well under 200 EMA at $ 2.02. This indicated that it was still anchored at the time of the press in a long -term downtrend.

Source: TradingView

The Aroon -indicator unveiled the Aroon down [orange] lean up the Aroon [blue] – A sign that Beerarish sentiment remains intact.

Moreover, the buyers seemed active but not dominant. This hinted on accumulation, without breakout confidence on the charts.

Wallet growth means signals sticky hands

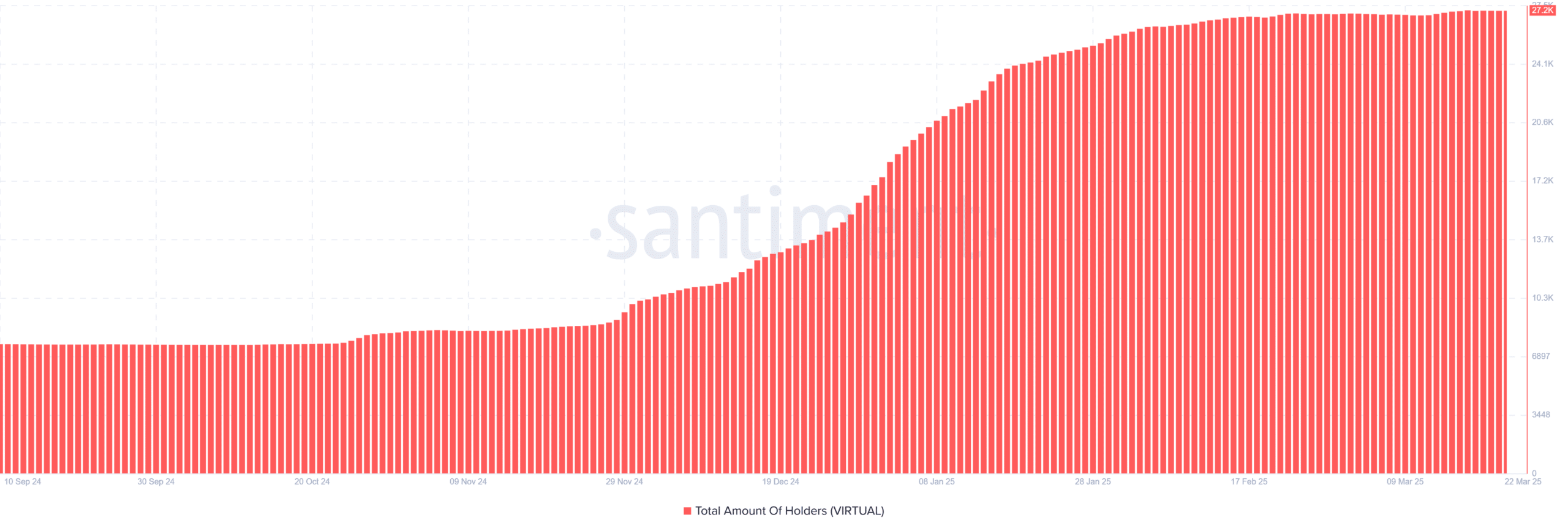

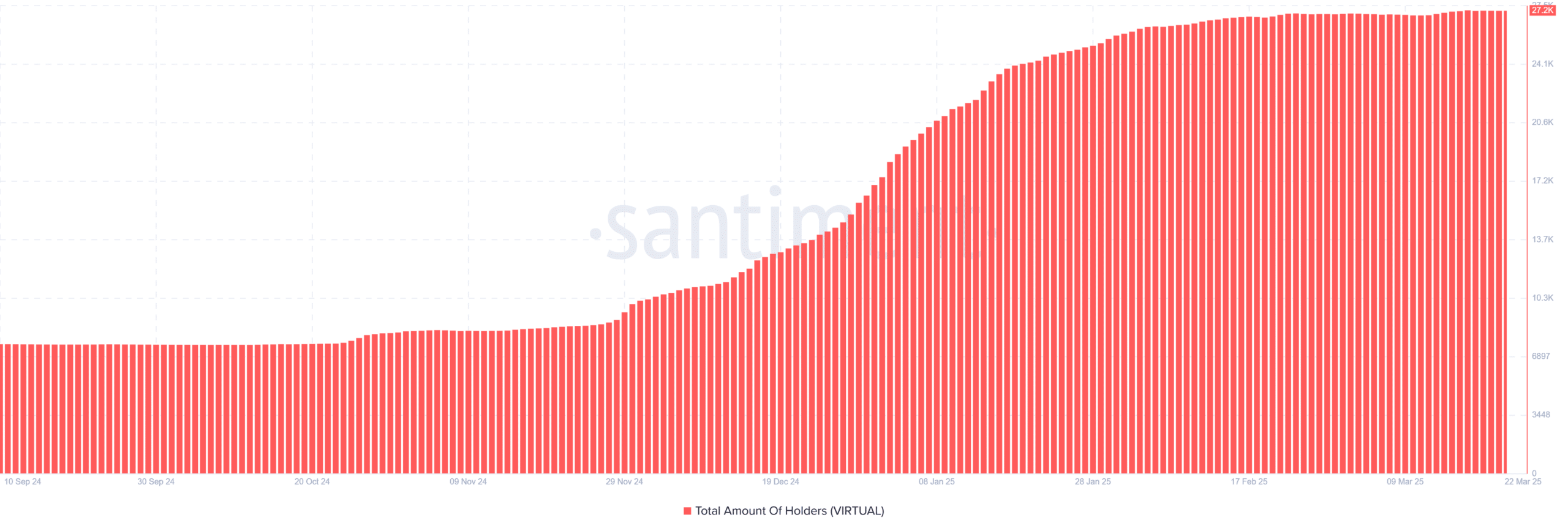

The steady walk with the number of holders is a striking metric that could explain this pattern.

Santiment data revealed that the total number of virtual holders has consistently increased to a peak of 27.2k, without visible signs of sharp sale or leaving the mass portion.

Source: Santiment

What implies this is that the inflow is delivered with conviction, instead of speculative churn.

That said, the lack of movement between zero-balance hinted portfolios that although a few leave, some new speculative traders also come in aggressively.

Conclusion

The high Netflows of Virtual emphasizing rising interest rates, but the lack of a price drop and stagnating technical technical means suggested that investors can be collected carefully instead of having to chase a quick profit.

Unless the price breaks above the most important resistance levels, the accumulation mode can remain virtually, despite the leading of the AI -Token package.