- According to VanEck’s CEO, BTC could reach $350,000 per coin.

- Peter Brandt recommends both BTC and gold as a store of value.

Jan Van Eck, CEO of $107 billion asset manager VanEck, expects Bitcoin to reach $350,000 as quantitative easing begins among major central banks.

In a recent interview with Fox BusinessAccording to the CEO, the price target could be achieved if the digital asset reaches half the market capitalization of gold.

“Eventually the Fed will start easing, and that’s great for gold and Bitcoin. Bitcoin is maturing. It would eventually amount to half of gold’s total market capitalization. So that’s $350,000.’

To an extreme extent, Van Eck predicted that BTC could reach $2.9 million by 2050 if central banks adopted BTC and it became part of the monetary system.

The above projection was similar to Michael Saylor’s recent price target at the Bitcoin 2024 conference. Saylor claimed that in a bear-case scenario, BTC could reach $3 million by 2045, especially if BTC reached 5% of global wealth.

Can Bitcoin Overtake Gold?

Van Eck’s $350,000 was related to BTC’s ability to attract at least half of gold’s market cap. At the time of writing, BTC was ranked number 9 based on the top global assets per market cap ($1.27 trillion).

On the other hand, gold held the top position with a market capitalization of $16.8 trillion. That means that gold’s market cap was 13x more than BTC’s.

However, BTC could soon eclipse Silver’s market cap, which stood at $1.6 trillion and ranks 8th globally by market size.

Given VanEck and Saylor’s reported bullish outlook for BTC, would you store value in gold or BTC?

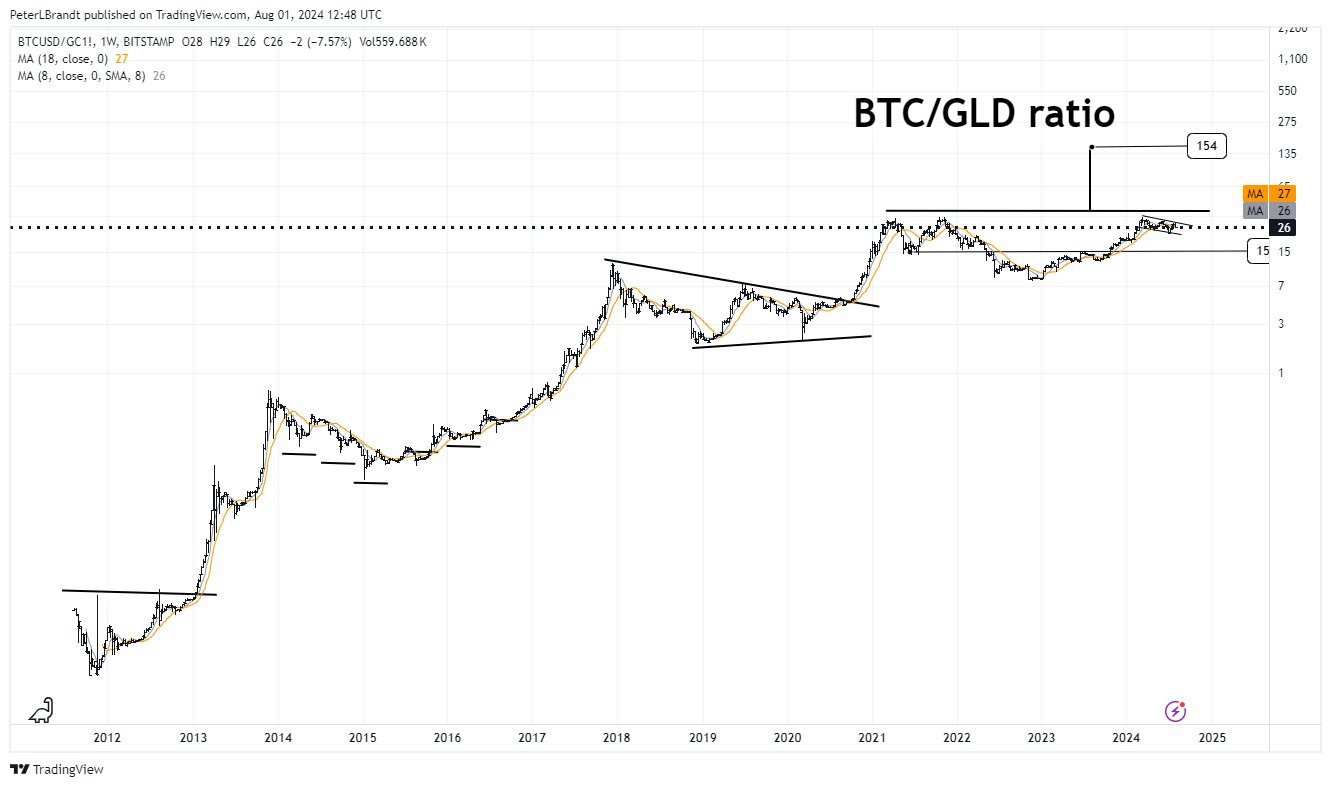

Renowned market analyst, Peter Brandt, would rather buy both assets than be forced to side with one. Using the BTCGLD ratio,

Brandt found that the ratio could drop to 15 in a worst-case scenario, or rise to 154 in a bull market scenario.

‘The longer-term chart indicates that BTC could (won’t) go to 150+; I believe in owning both gold and Bitcoin.”

Source: X/Peter Brandt

For perspective, the BTCGLD ratio tracks the relative performance of BTC in terms of gold. The ratio has risen higher since 2023 and stands at 26.

This means that BTC has outperformed gold over the past year and is worth 26x more than gold.

Based on Brandt’s chart, a drop to the low end of the BTCGLD ratio of 15 would mean gold is outperforming BTC, just as it has in recent weeks.

However, an increase to 154 could not be overruled. It suggests that BTC could still outperform gold by 154x over the long term.

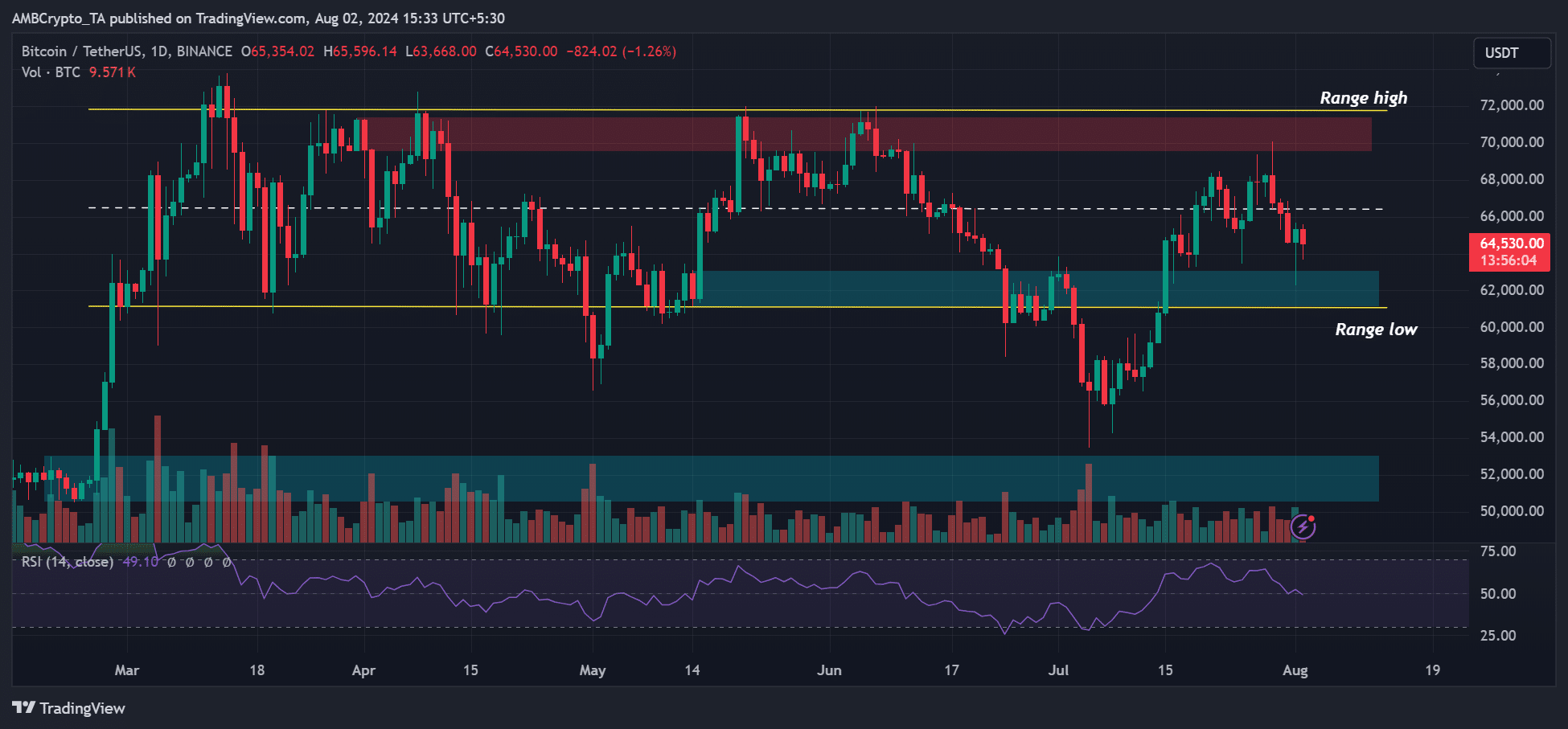

Meanwhile, BTC had recovered well on the demand and bullish order block around $62,000 (cyan), ahead of the US Jobs report.

Whether the July US jobs report will prompt BTC to reverse recent losses remains to be seen.

Source: BTC/USDT, TradingView