- Stablecoins have received a renewed interest following the SEC lawsuits

- Rise in unique active addresses and weekly senders underlined the growing interest in stablecoins

After months of declining interest in stablecoins, there seems to be renewed interest in the stablecoin sector. This follows growing uncertainty fueled by the Securities and Exchange Commission (SEC) lawsuits.

Investors are starting to look for stability

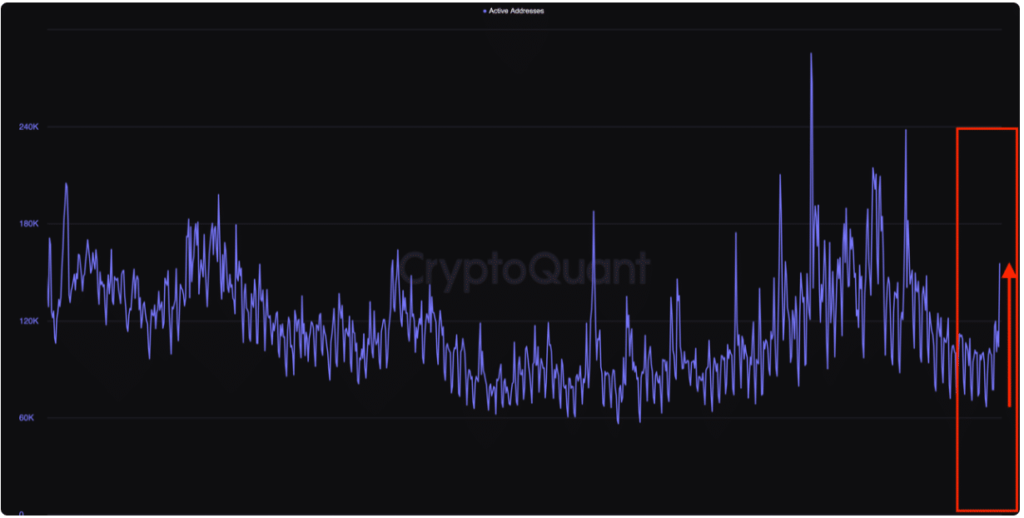

An indication of this growing interest can be shown by the proliferation of unique active addresses in stablecoin transactions.

This is reported by analyst CryptoQuant chained, for example, these active addresses have steadily increased following the SEC’s lawsuits earlier this week.

Source: CryptoQuant

Consequently, there is a significant spike in the number of weekly stablecoin senders. In fact, data from Dune Analytics showed that the number of weekly senders on the network reached 489,384 at the time of writing.

Source: Dune analysis

The analyst attributes this surge in interest in stablecoins to several factors. First of all, legal uncertainty is a major driver, as the SEC’s lawsuits against prominent exchanges created a sense of ambiguity within the cryptocurrency market. This has led investors to view altcoins as riskier assets due to possible regulatory implications and associated legal risks.

Risk reduction also played an important role. According to onchain, in times of legal scrutiny, investors tend to take a risk-averse approach by shifting their investments from altcoins to stablecoins. This strategy enables them to reduce exposure to potential regulatory action and protect their capital.

Maintaining trading opportunities is another motivating factor for these traders. Investors who want to maintain their market share can convert their altcoins into stablecoins. This approach allows them to minimize exposure to potential regulatory hurdles while maintaining exposure to the cryptocurrency market, ensuring they are well prepared for future trading opportunities.

USDT takes the lead

Currently, USDT leads the market in terms of market capitalization. While USDC and DAI lag USDT, both stablecoins have registered increases in their market capitalization in recent weeks.

Source: Sentiment

The increase in market capitalization can be attributed to the growing network growth of these stablecoins, which indicates that new users are showing interest in the stablecoin market.

Source: Sentiment

In terms of supply, USDT has reached a record high always high of $83.35 billion. Conversely, USDC has seen a drop in circulation.

Source: glasnode

In addition, Tether has used the proceeds generated by USDT’s dominance to buy BTC. This could potentially have a positive effect on Bitcoin as a whole in the future.