- The sharp decline in USDT supply reflected regulatory scrutiny and macroeconomic uncertainties.

- Bitcoin faced reduced buying pressure, with the contraction of USDT limiting liquidity.

The market is navigating uncertain waters like Tether [USDT]the industry’s leading stablecoin, has seen its circulating supply drop by more than $1.3 billion in just ten days.

As the lifeline of crypto liquidity, the sudden contraction of USDT raises alarms about possible shifts in market dynamics.

Whether caused by regulatory scrutiny, declining investor confidence, or broader market adjustments, the decline comes at a critical time, with Bitcoin teetering near key support levels.

The question now is whether this means a temporary slowdown in trading activity or a deeper recalibration of the market.

Curtailment of USDT supply

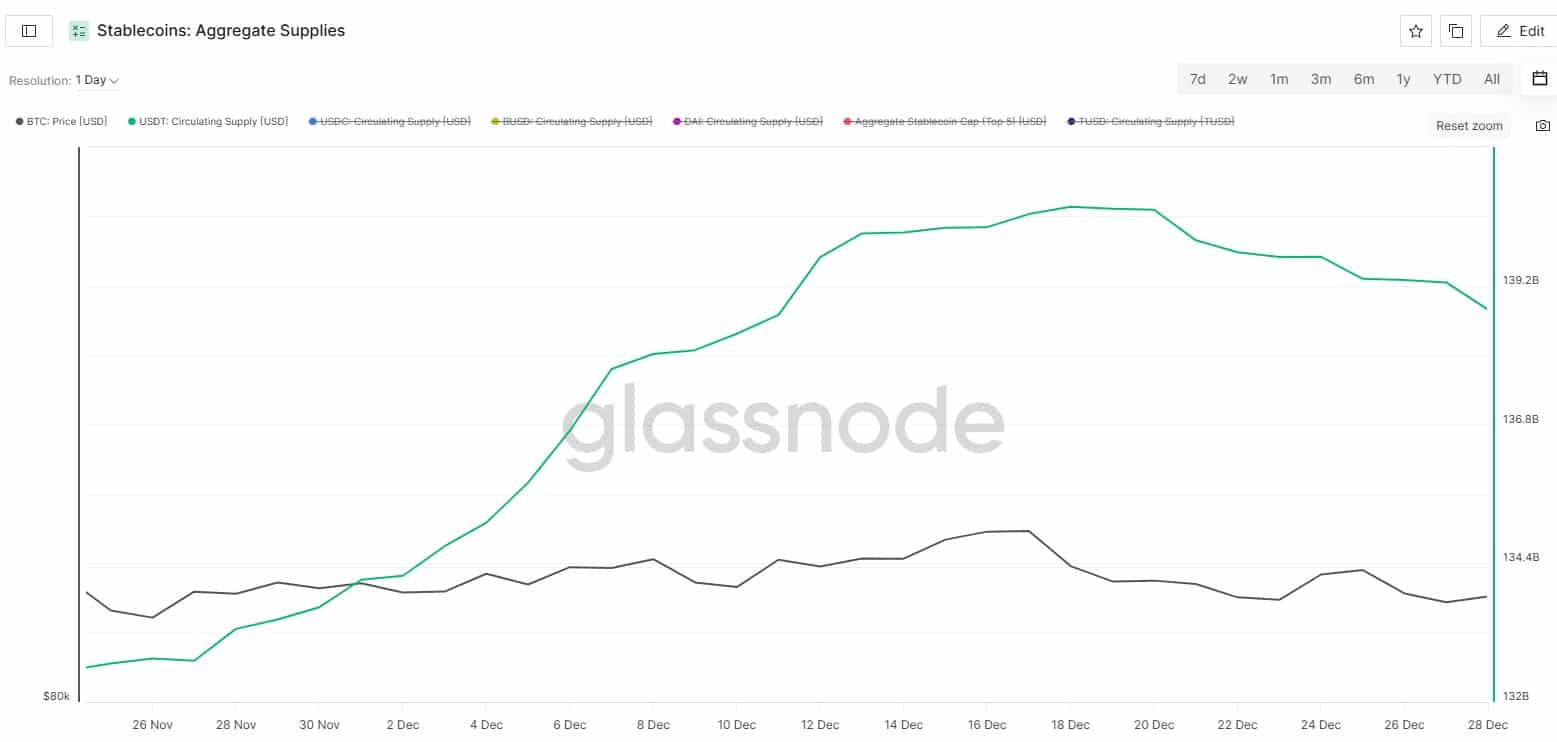

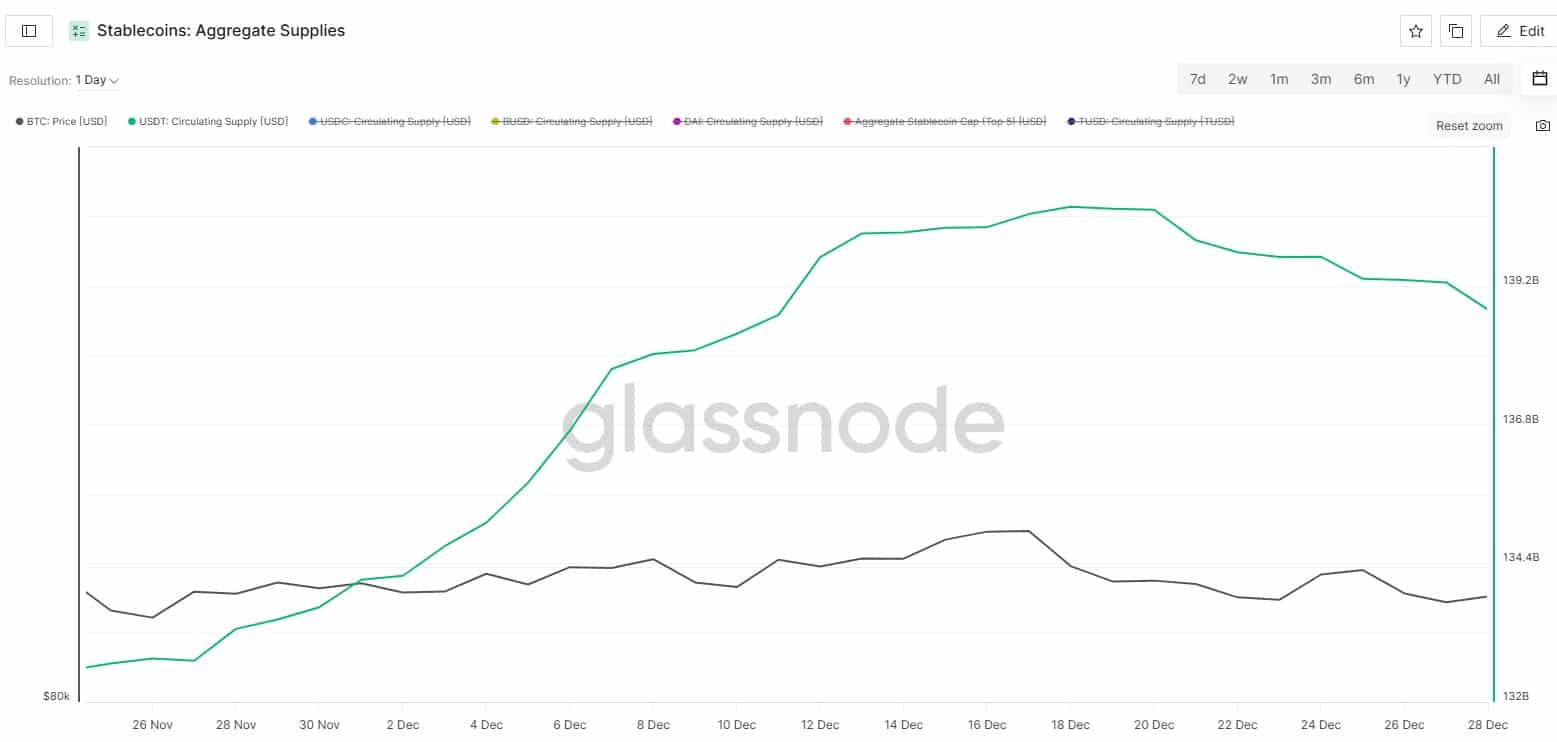

Recent data showed a sharp decline in USDT’s circulating supply, from a peak of around $140.5 billion to $139.2 billion in ten days. This contraction likely reflects a combination of factors.

First, increased regulatory scrutiny, especially in the US following the collapse of the FTX, may have prompted redemptions as investors seek safer fiat alternatives.

Source: Glassnode

Second, reduced trading volumes on major exchanges indicate reduced demand for stablecoin liquidity, which correlates with Bitcoin’s recent price stagnation near key support levels.

Finally, macroeconomic uncertainties, including rising Treasury yields and a stronger dollar, are driving capital out of risky crypto markets.

The sharp drop in USDT supply underscored the changing sentiment, suggesting the market may be recalibrating amid these headwinds rather than experiencing a temporary slowdown.

Bitcoin Price Action Amid a USDT Supply Drop

The chart highlighted that of Bitcoin [BTC] struggling to maintain stability as USDT supply contracts decline. Bitcoin’s price is hovering around $94,900, with decreasing volume indicating easing buying pressure.

The RSI at 45.44 indicated bearish sentiment and fell below the neutral 50 line. Meanwhile, the OBV dipped to -90K, indicating net capital outflows as market participants reduce risk exposure.

Source: TradingView

This alignment of metrics implies that USDT supply contraction correlates with reduced liquidity, limiting Bitcoin’s upward momentum.

In addition, market caution may be fueled by macroeconomic headwinds and regulatory uncertainties, increasing selling pressure.

Bitcoin’s inability to reclaim previous support levels reflects a broader recalibration phase, with declining stablecoin liquidity serving as a key limiting factor.

Consequences for the liquidity of the crypto market

USDT’s shrinking supply signals potential liquidity constraints heading into 2025. Stablecoins like USDT act as an intermediary, allowing seamless capital flows between assets.

A USDT contraction of $1.3 billion limits market depth, increasing slippage risk and volatility. This could deter institutional traders who rely on high liquidity, potentially reducing trading volumes on exchanges.

Additionally, tighter liquidity has a disproportionate impact on altcoins, increasing the volatility of smaller assets.

Read Bitcoin’s [BTC] Price forecast 2025-26

As market participants look for stability, Bitcoin and Ethereum [ETH] may maintain dominance, but speculative growth in the DeFi and NFT markets could stagnate.

Unless the supply of stablecoins replenishes, driven by renewed investor confidence or regulatory clarity, the market risks entering a period of subdued activity, with fewer arbitrage opportunities and delayed price recovery during recessions.