- USDR and Tangible’s native token TNGBL collapsed in a move similar to the 2022 LUNA crash.

- The team told users it was working on recovery, but holders had swapped their coinsS.

In the real world, an asset backed by the real estate market is considered strong. But in the unpredictable world of crypto, there are real USDs [USDR] The collapse may lead market players to question other projects with such fundamental characteristics.

Another day, another disconnection

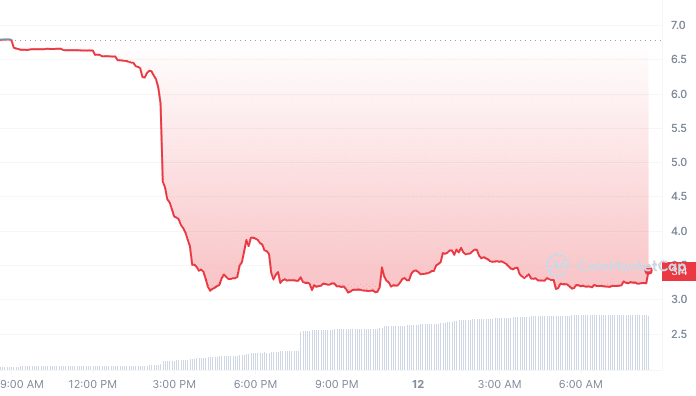

At the time of writing, the USDR, which was supposed to have a 1:1 dollar peg and exchanged using a 1:1 DAI coin, had fallen to $0.53. According to CoinMarketCap, the decline represents a decline of 44.43% in the past 24 hours.

However, the slump may be surprising to holders of the stablecoin. This is not only due to the supposed solid foundations. On October 10, TangibleDAO, the team behind the yield-generating stablecoin, posted a message on

Usually these types of statements build confidence among the holders. In some cases it even goes so far as to attract new participants, mainly because it seems transparent. Unfortunately, not many people predicted that doom was imminent for USDR.

Essentially, RealUSD doesn’t base its tokenomics solely on real estate. Instead, it claimed that the project thrives on a value accrual system designed to give USDR holders 5% to 10% APY.

Like USDT, Tangible’s native token TNGBL also crashed. According to CoinMarketCap, the value of the token was $3.42 – a value of 49.57%. limpness in the last 24 hours.

Tangible’s antics seem unclear

The crash of TNGBL and USDR was similar to the crash of TNGBL and USDR Terra USD [USTC] And Terral Luna [LUNA] collapse of 2022. Remember, LUNA’s founders were guilty, and on-chain data seemed to confirm this USDR bias.

First, Emperor Osmo, a crypto research specialist, advised USDR holders to consider exiting their positions. This was because the asset had become highly illiquid and DAI support seemed to have disappeared ‘overnight’.

$USDR has had a big depeg.

Everyone holds on $USDR should consider leaving their positions.

The assets that support this are highly illiquid and $DAI The support seems to have disappeared overnight. https://t.co/x6YrzceumJ pic.twitter.com/aKJ5596B3L

— Emperor Osmo🧪 (@Flowslikeosmo) October 11, 2023

A thorough review of Tangible’s treasury revealed that it contained no DAI, and its only remaining liquid assets were a $6.2 million insurance fund. From all indications, the collapse of the Polygon-backed project appeared to be a case of pre-arranged back-pull.

For context, as a short form of “pulling out the rug,” a rug pull occurs when fraudulent developers lure unsuspecting investors into what appears to be a legitimate and lucrative project. When investors have enough confidence in the project, the developers disappear with the liquidity provided, leaving holders with little to nothing.

However, TangibleDAO has denied being involved in any form of cheating. According to the project, the decoupling from the USDR was due to the aforementioned redemptions, in addition to real estate liquidations and panic sales.

Take an example from LUNA’s playbook?

While acknowledging the current challenges, the DAO noted that the project was working toward a solution. To start, Tangible said it would liquidate its Protocol Owned Liquidity (POL) and insurance fund assets and make them available to affected investors.

It also announced that it would be launching a pool of tokenized real estate called “Baskets.” According to Tangible, Baskets would be an essential part of the USDR repayment. But it also highlighted that this could be a slower path to liquidity for users.

As we have all seen, USDR has undergone a serious depeg.

In a short time, all liquid DAI from the treasury was redeemed.

This led to an accelerated decline in market capitalization.

Combined with the lack of DAI for redemptions and the liquidation timeline on real… pic.twitter.com/1sgRPfpIT0

— Tangible 🏠💙 (@tangibleDAO) October 11, 2023

While the project encouraged its users to follow it on the revival journey of USDR and TNGBL, most had not. To many, the public statement was similar to Terra founder Do Kwon’s reassurance about “stable labs, deployment of capital” before LUNA and USTC all went under.

Meanwhile, a large number of USDR holders have started counting their losses. According to Polygon scanthere was an increase in the number of USDR USDC exchanges. Therefore, it is likely that the value of the stablecoin could fall below $0.53.

Even then, Tangible’s wallet showed it still held about 32.85% of USDR’s total supply, worth $8.16 million.

Source: Polygon scan

In a related development, Tom Wan, research specialist at 21co, provided his insights on the USDR decoupling. According to Wan, using illiquid assets to back liquid assets was a wrong move by Tangible. So it was inevitable that DAI liquidity would run out after a huge redemption had taken place.

Why the USDR Decoupled Despite Being Fully Supported: The Use of Illiquid Assets to Support Liquid Assets

– USDR is 100% supported. 50% of this comes from stablecoins and the rest comes from Real-Estate

– When a bank run happens (huge redemption of USDR), Stablecoin liquidity in the… https://t.co/xOrsa5gpKU pic.twitter.com/OYhQ0twUUd

— Tom Wan (@tomwanhh) October 12, 2023