- In the second quarter, more institutions held and expanded positions in the US spot BTC ETFs.

- Morgan Stanley and Goldman Sachs are now the top five holders of BlackRock’s IBIT.

Institutional investors’ interest in American spot Bitcoin [BTC] ETFs have not declined despite the declines and volatility of digital assets in the second quarter.

According to Bitwise’s CIO Matt Hougan, the accumulation trend that we saw after the products that debuted in the first quarter remained ‘intact’ in the second quarter, with a 30% increase in the number of holders.

“I count 1,924 ETF pairs for holders across all ten ETFs, up from 1,479 in the first quarter. That’s an increase of 30%; not bad considering prices fell in the second quarter…Institutional investors continued to adopt bitcoin ETFs in the second quarter. The trend is intact.”

Institutions held BTC ETFs despite the Q2 dump

Hougan also noted that 66% of professional investors who purchased the products in the first quarter maintained or increased their holdings in the second quarter.

“Of the applicants in the first quarter, 44% increased their position in bitcoin ETFs in the second quarter, 22% remained stable, 21% decreased their position and 13% exited the market. That’s a pretty good result, comparable to other ETFs.”

This went against the perceived idea that they would capitulate and dump at the slightest volatility or plunge. For context, BTC plummeted 12% in the second quarter, falling from $72,000 to $56,000 before closing above $60,000.

As a result, the Bitwise manager called them “diamond” hands because they remained steadfast despite the headwinds.

Recently 13F applications also revealed that Goldman Sachs and Morgan Stanley were among the top five holders of BlockRock’s iShares Bitcoin Trust (IBIT).

As of June 30, Goldman Sachs held $238.6 million in IBIT, while Morgan Stanley held $187 million.

It is worth noting that Morgan Stanley and Goldman Sachs are among the major wirehouses (large dealers) that were expected to drive the second wave of adoption for BTC ETFs starting in the third quarter.

Morgan Stanley has already started recommending BTC ETFs to specific clients, which could provide further momentum adoption.

The trend could also increase the contribution of institutional investors to the AUM (assets under management) of the BTC ETF.

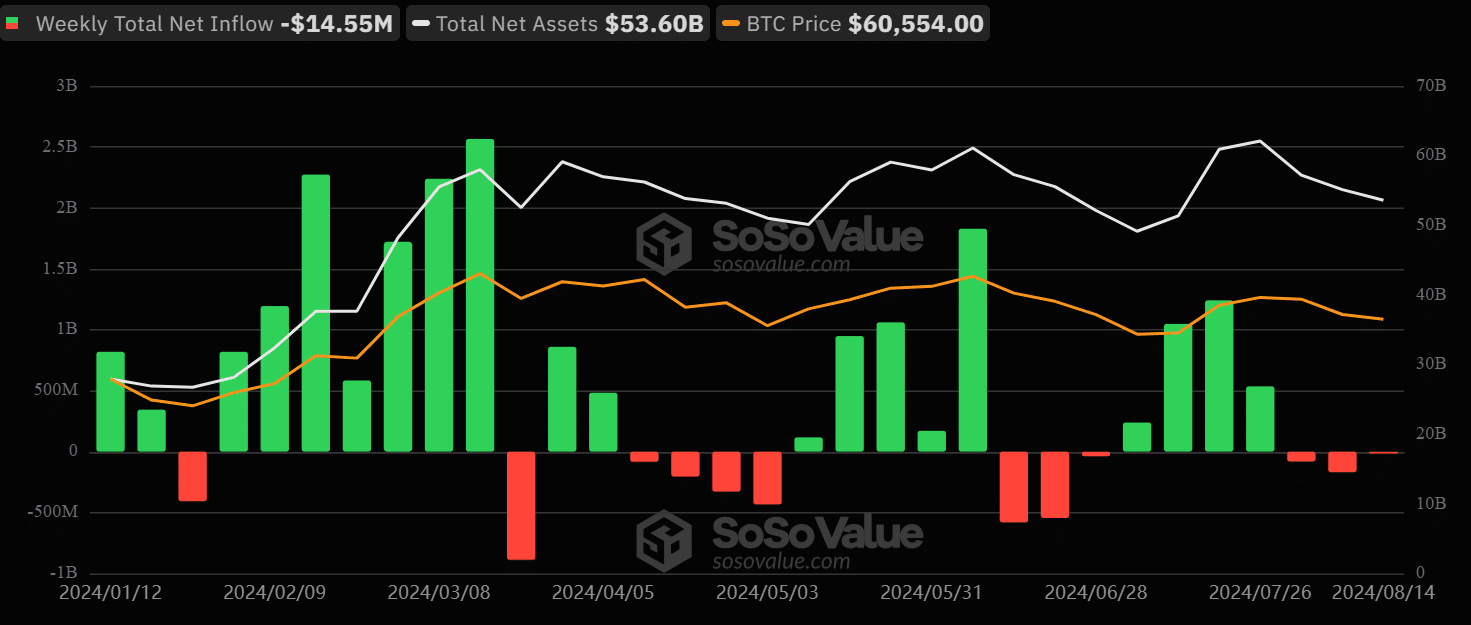

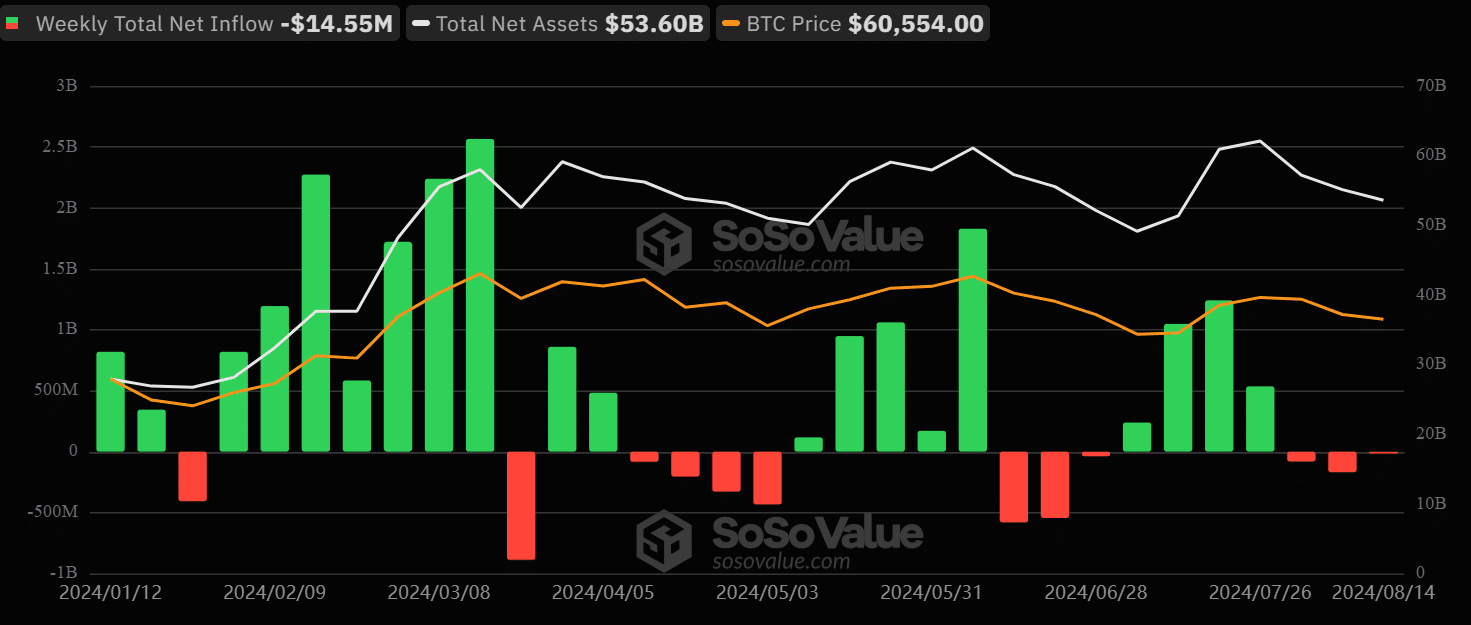

In the first quarter, institutions accounted for $3-$5 billion (7%-10%) of the BTC ETF’s total assets under management, which was then $50 billion. At the time of writing, the BTC ETF’s total assets under management stood at $53.6 billion.

Source: Sosowaarde

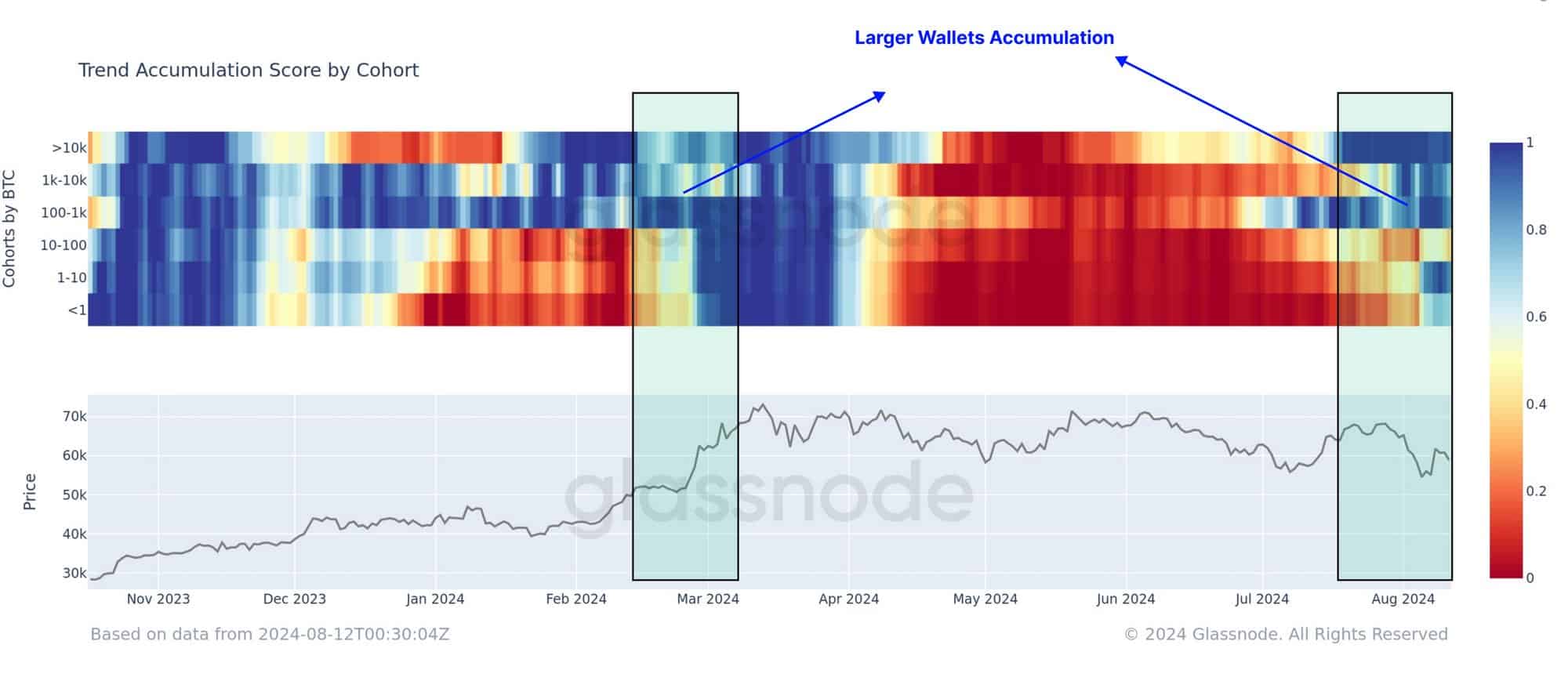

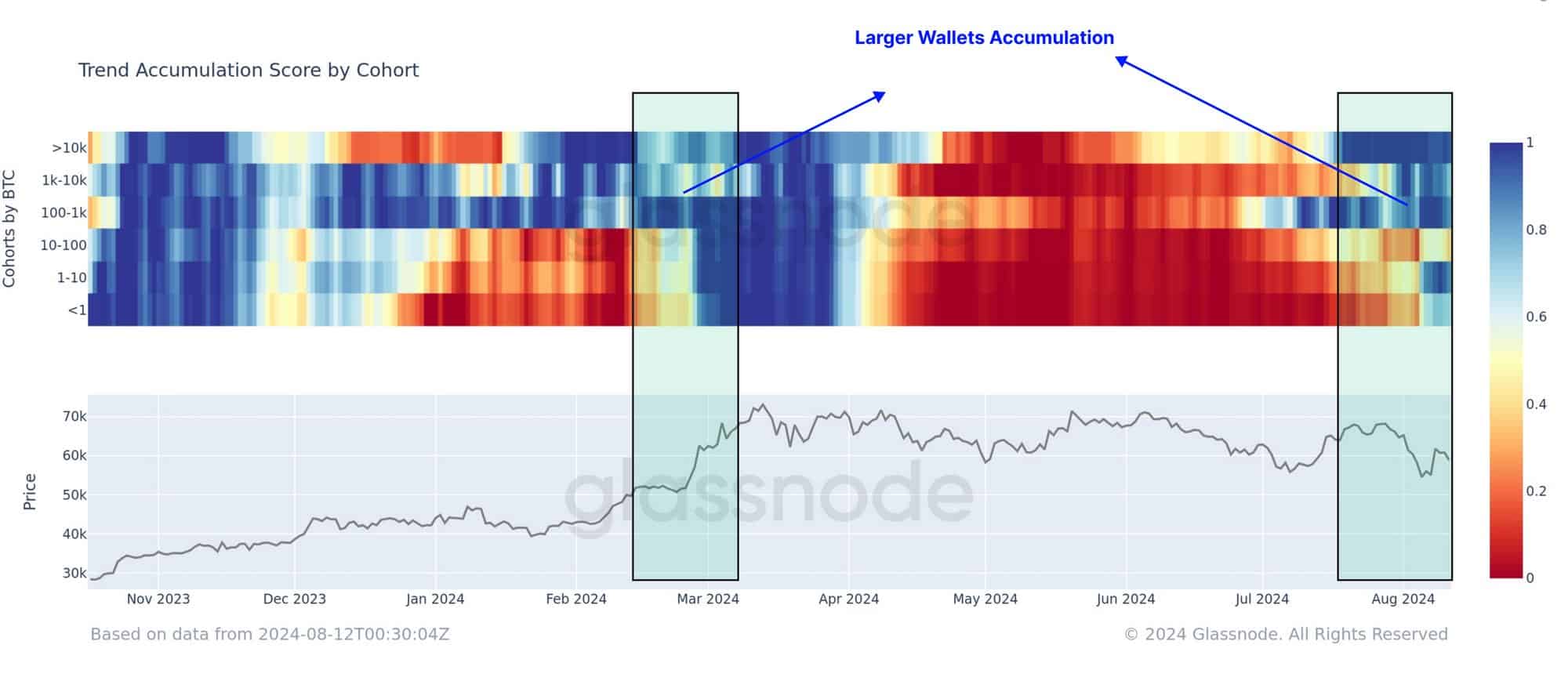

Interestingly, BTC ETF accumulation by institutional investors also gained momentum in the third quarter.

According to Glassnode factslarge ETF portfolios have been ramping up accumulation, a trend observed in March that pushed BTC to reach an ATH of $73,000.

“Recently, this trend (supply distribution) has shown signs of reversal, especially among the largest portfolios, often linked to ETFs, which are now returning to accumulation.”

Source: Glassnode