- Metaplanet buys another $3.3 million worth of BTC.

- The recent purchase is part of the company’s Bitcoin accumulation strategy.

Over the past seven months, major crypto companies have turned to Bitcoin to boost their holdings.

Amid increased institutional interest as companies bet on the future value of Bitcoin, Japan’s Metaplanet has been busy buying to accumulate as much BTC as possible.

Metaplanet buys BTC worth ¥500 million

Source:

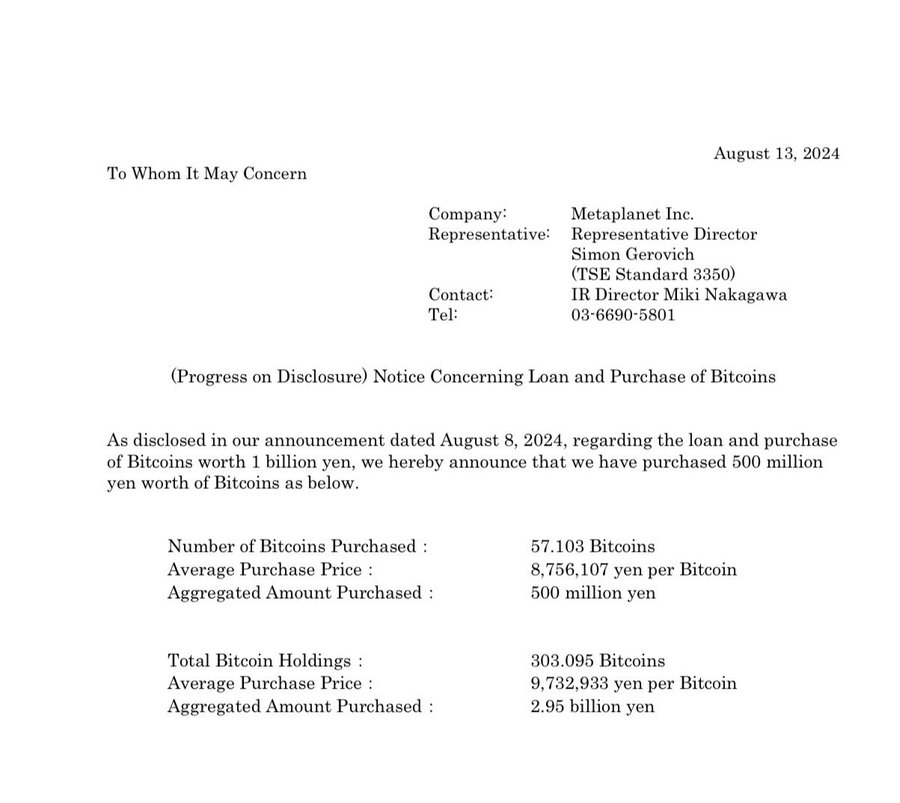

Just a week ago, Metaplanet received a ¥1 billion loan to acquire more BTC. The CEO of the company, Simon Gerovichshared via his official X page (formerly Twitter),

“Always set #bitcoin.”

The recent acquisition is part of the broader company’s strategy to accumulate BTC. The company hopes to deploy its future value in something like the US MicroStrategy on BTC.

Metaplanet’s BTC Strategy

As previously reported by AMBCrypto, Metaplanet is in the process of buying shares to increase its total BTC holdings through long-term accumulation.

The recent purchase of 57,103 Bitcoins worth $3.3 million brings the company’s total BTC inventory to 303.95 Bitcoins worth $18 million. The purchase is part of several purchases in recent months.

On May 28, the company purchased $1.6 million worth of BTC. In July, it bought 19.87 BTC worth $1.7 million. In June, it bought $1.59 worth of Bitcoin.

With another 21,877 BTC purchases, the company has ensured continued accumulation and ownership of BTC.

Impact on Metaplanet

Source: Google Finance

In particular, Metaplant’s Bitcoin strategy has made the Japanese one of the most important players among global institutions.

According to data from CoinGecko, Metaplanet ranked 20th among the largest institutional holders of BTC.

Therefore, this strategy has paid off as the company’s stock prices have increased exponentially. Google Finance said its shares are up 82.87% in the past five days.

This strong increase has caused the share to rise by 600.63% year-on-year. This increase shows that the strategy is paying off for the company.

Metaplanet has seen significant upside over the past seven months, and with BTC’s expected value, its accumulation is positioned to make the company a major player.

Source: Market Screener