- Uni fell by 21.9%last month.

- In the midst of market volatility, a cost basis of $ 7.3 remains a critical support.

In the past month, the cryptomarkt has experienced extreme volatility. In the midst of these market fluctuations, Uniswap [UNI] has not been spared. The Altcoin has seen its price levels fluctuate from a highlight of $ 15.2 to $ 6.4.

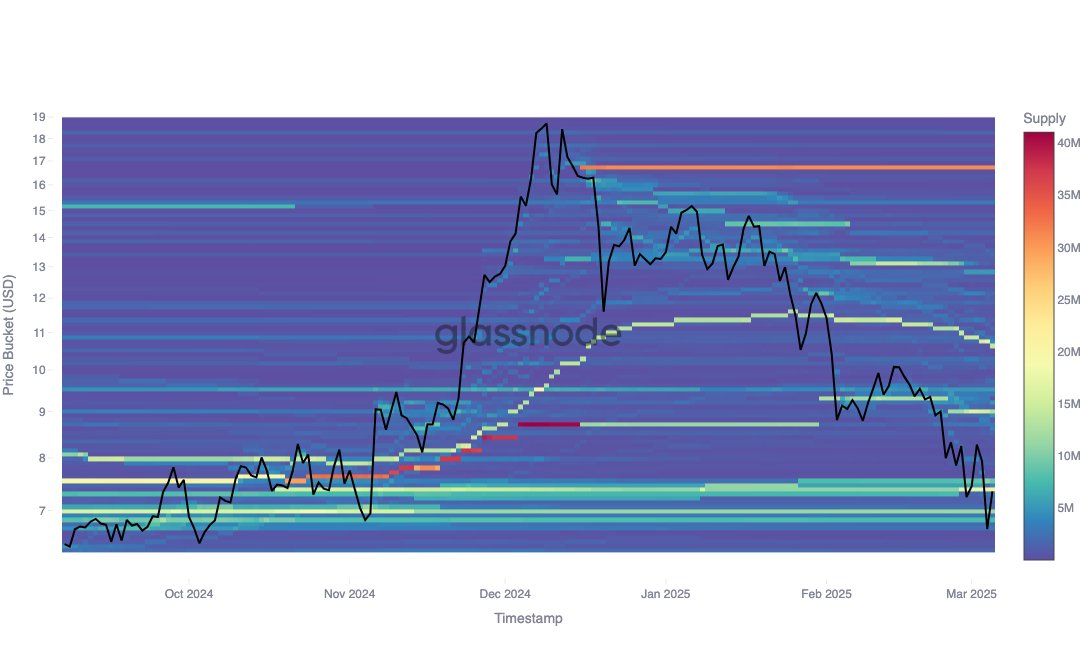

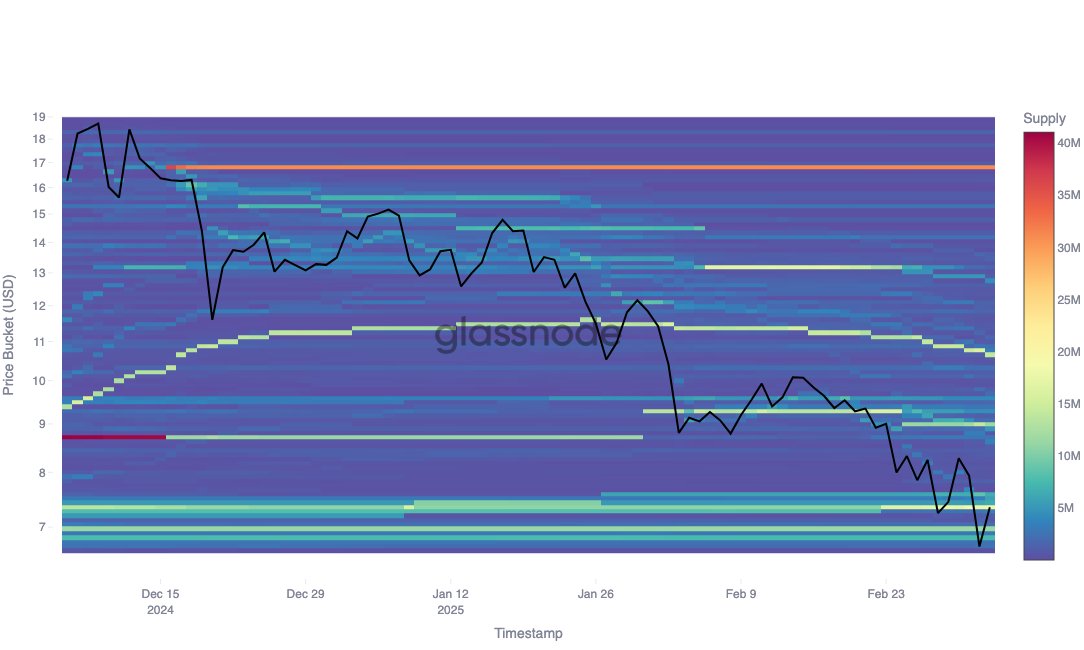

With this increased volatility, the question is how cost-basis distribution has changed in the past week. Glassnode -analysts suggest that the cost -based distribution has left $ 7.3 as a critical level of support.

Uniswap cost -basis distribution shift in the midst of volatility

According to Glass nodeUnisewap has seen a strong accumulation at the price level of $ 7.30. This increased accumulation has made this level a perfect candidate for a potential floor in the case of a retest.

Source: Glassnode

Similarly, the markets have seen a continuous involvement of the supply cluster of 14 million uniswap -tokens, with the cost -based $ 10.6 since February 2024.

The continuous involvement means that this cohort has remained active in the past year with both purchase and sales addresses.

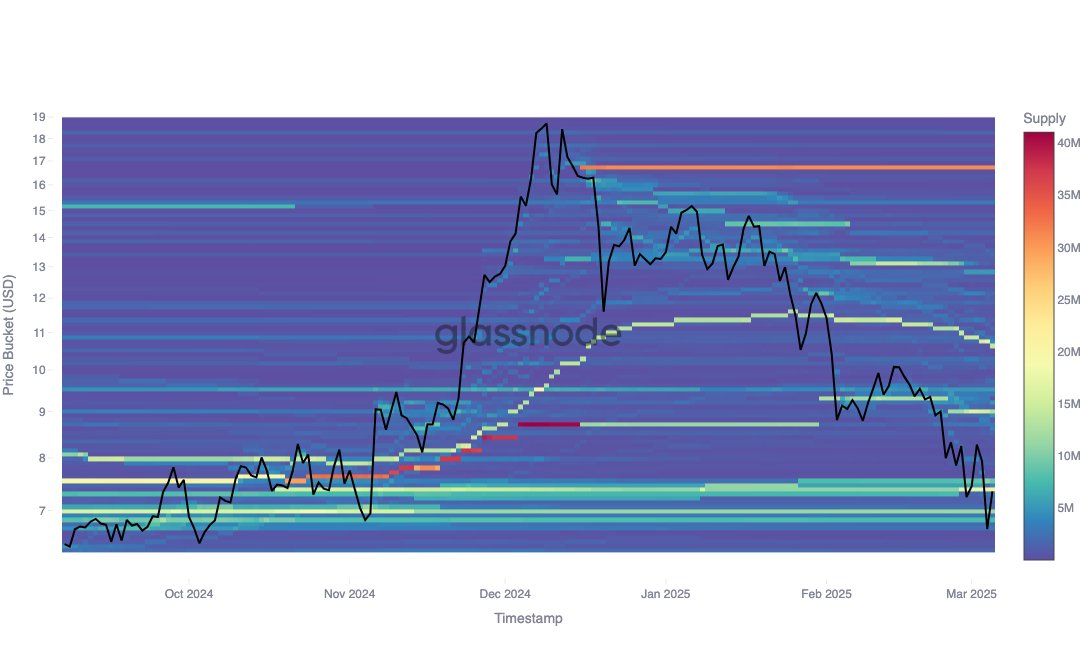

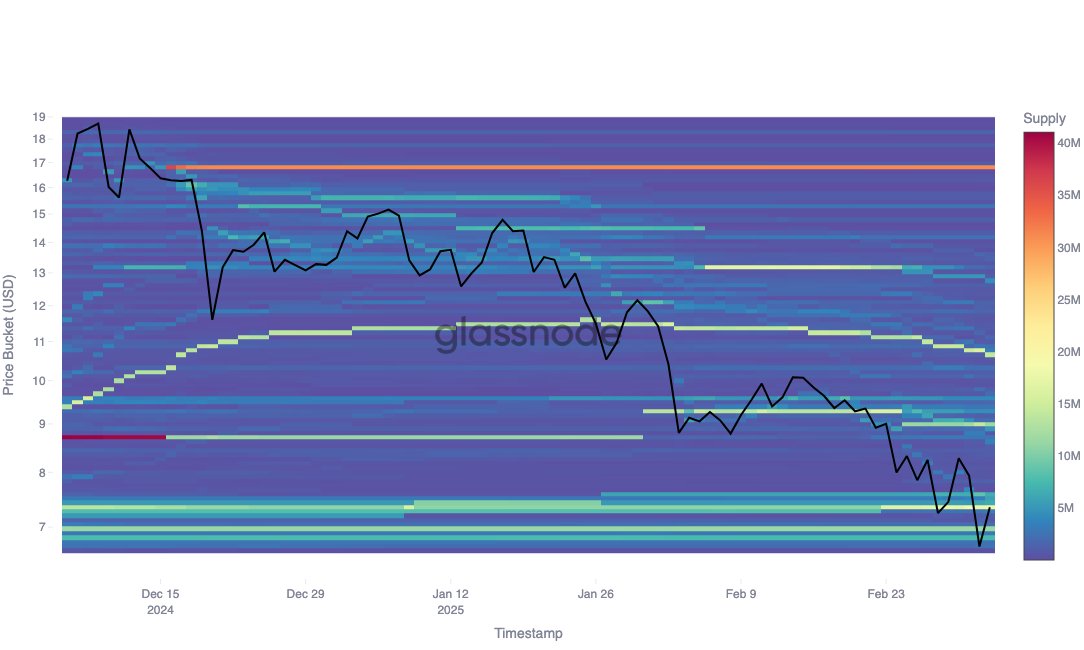

Source: Glassnode

However, the largest delivery cluster above the spot price is concentrated at the level of $ 16.81, from around December 15.

Addresses with this cost basis hold 31.01m $ uni and have been retained by recent market volatility.

On this price, Uniswap holders chose not to sell because this would lead to more than 50% losing. This group keeps their assets out of necessity, not willing to sell with a loss, pending better price levels.

Their holding behavior has contributed to alleviating the sales pressure on the price charts of Uni.

What it means for uni

The continuous involvement of the delivery cluster with a cost -based cost basis of $ 10.6, while a cost base of $ 16.81 continued to apply, suggests that Uniswap investors are still optimistic.

Source: Coinglass

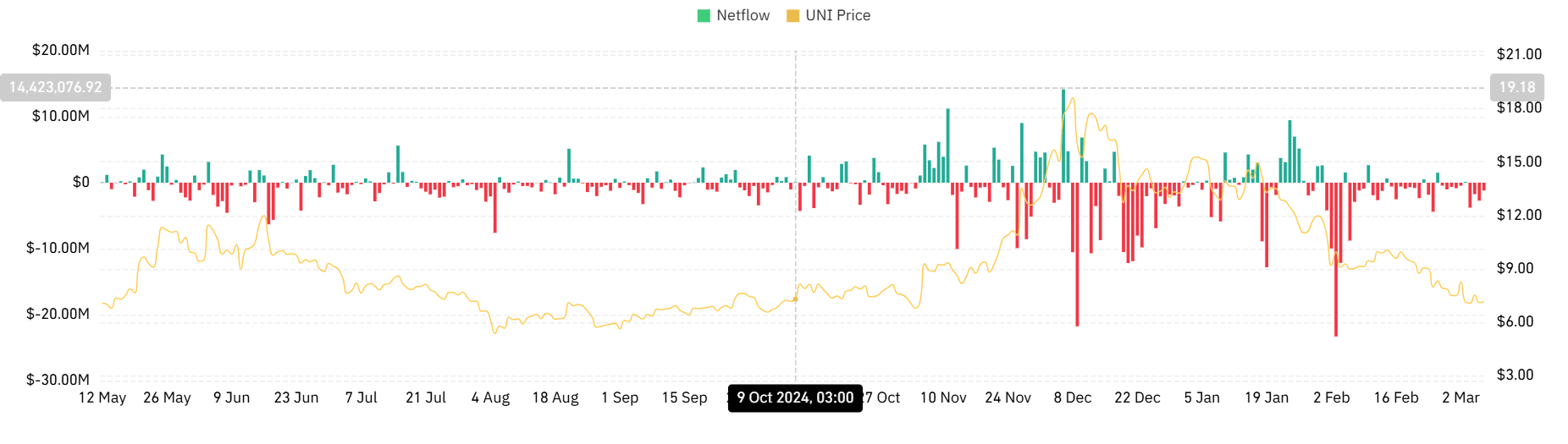

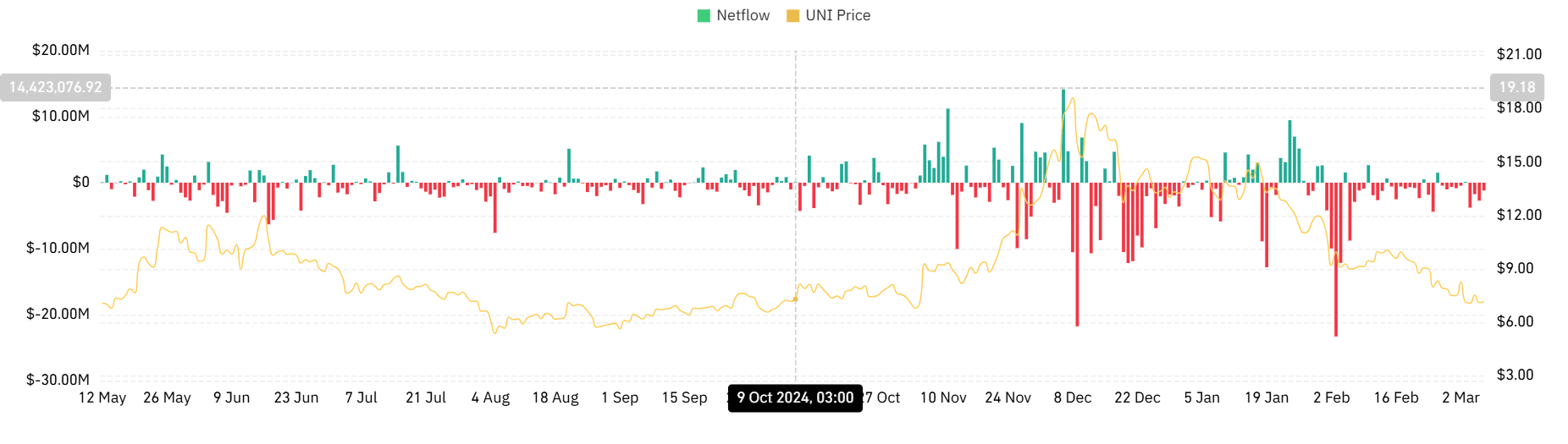

Analyzing Spot Netflow reveals that these addresses have actively purchased the Altcoin. Uni Spot Netflow has remained negative since 25 February 2025, indicating raised buyer activity on the market.

A persistent negative spot -netflow suggests more of stock markets than inflow, indicating the continuous accumulation by buyers.

Source: TradingView

The Positive Chaikin Money Flow (CMF), which has been adopted in the past two weeks, confirms a strong purchase activity on the market.

A positive CMF indicates that buyers are more active than sellers, which suggests that an increased demand for the active. Recent market volatility seems to have created the buying options for Uniswap investors, with buyers accumulating at lower prices.

This trend helped to stimulate the Uni prices higher, and if buyers maintain their positions, Uni could reclaim $ 8.3. However, if Uni does not hold the support level of $ 7.3 and falls to $ 7.2, this runs the risk of falling further to $ 6.5.

For a bullish prospect, UNI must maintain the support level of $ 7.3, where strong purchase activity has been observed.