- UNI is showing promising signs of a bullish breakout, with multiple reversal patterns forming.

- High transaction values and a majority of profit holders indicate strong investor confidence.

Uniswap [UNI] looks strong and could target higher levels above the $10 resistance. After performing terribly for weeks, the altcoin has seemingly seen a reversal pattern, which could potentially trigger a breakout.

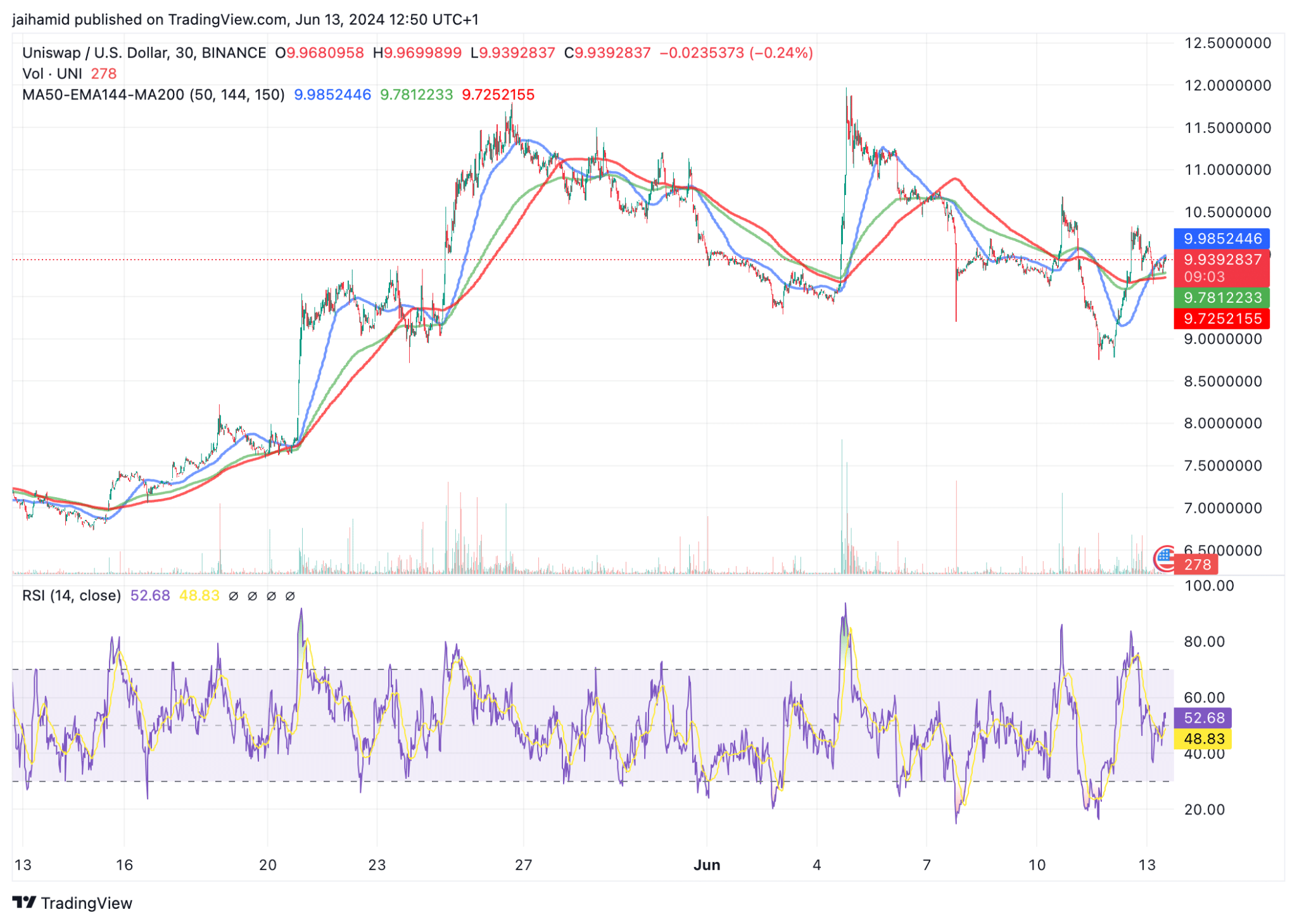

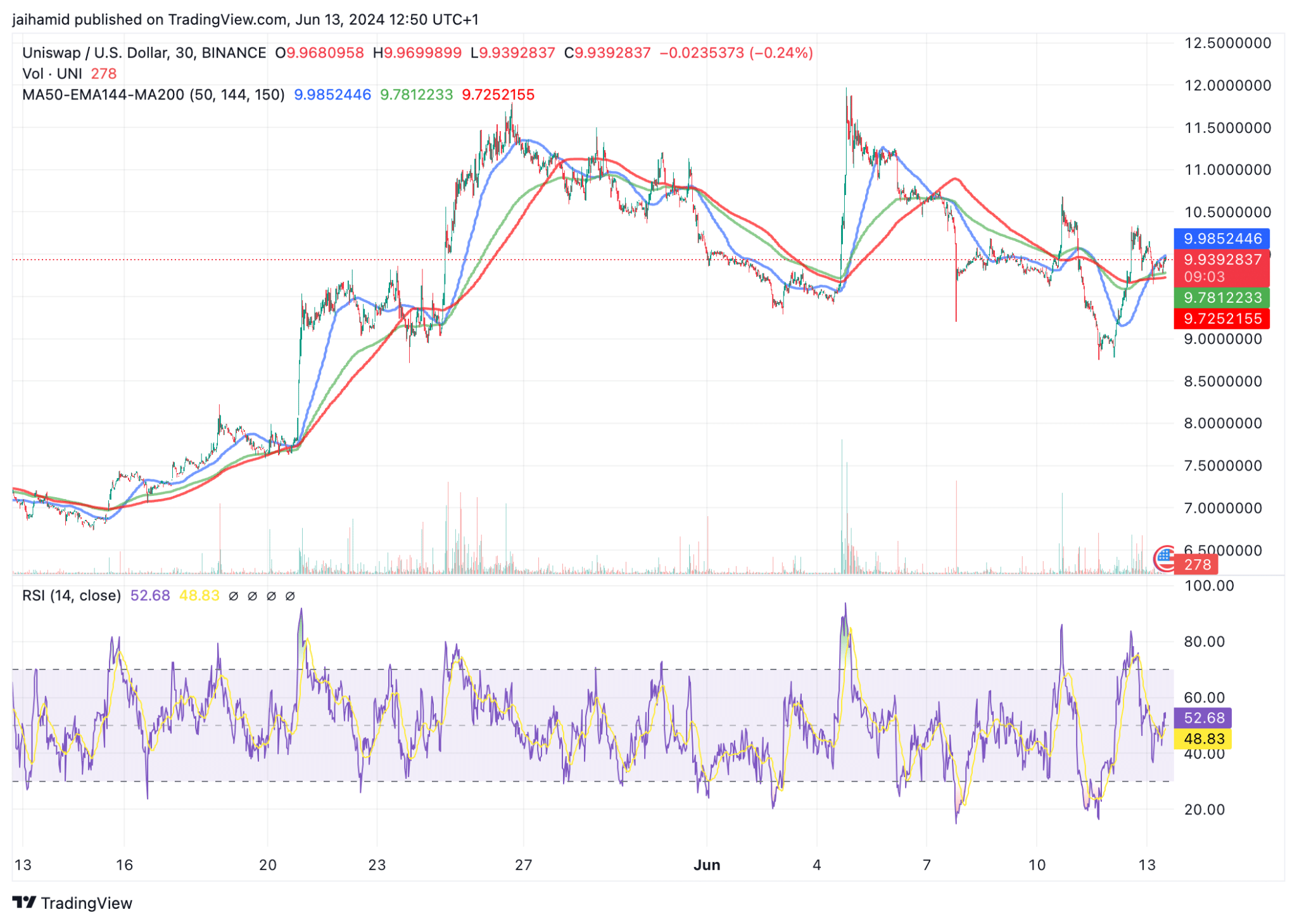

Source: TradingView

Recent price movements show a recovery from lower levels. The MA50 recently crossed the MA200 (red line), which is typically a bullish signal known as a ‘Golden Cross’.

This indicates that the shorter-term momentum is becoming more bullish relative to the longer-term trend. The EMA is currently below the MA50, reinforcing the short-term bullish reversal.

The RSI at 52.68 means that Uniswap is neither overbought nor oversold, leaving room for potential moves in either direction without immediate pressure from traders looking to sell an overbought asset or buy an oversold asset.

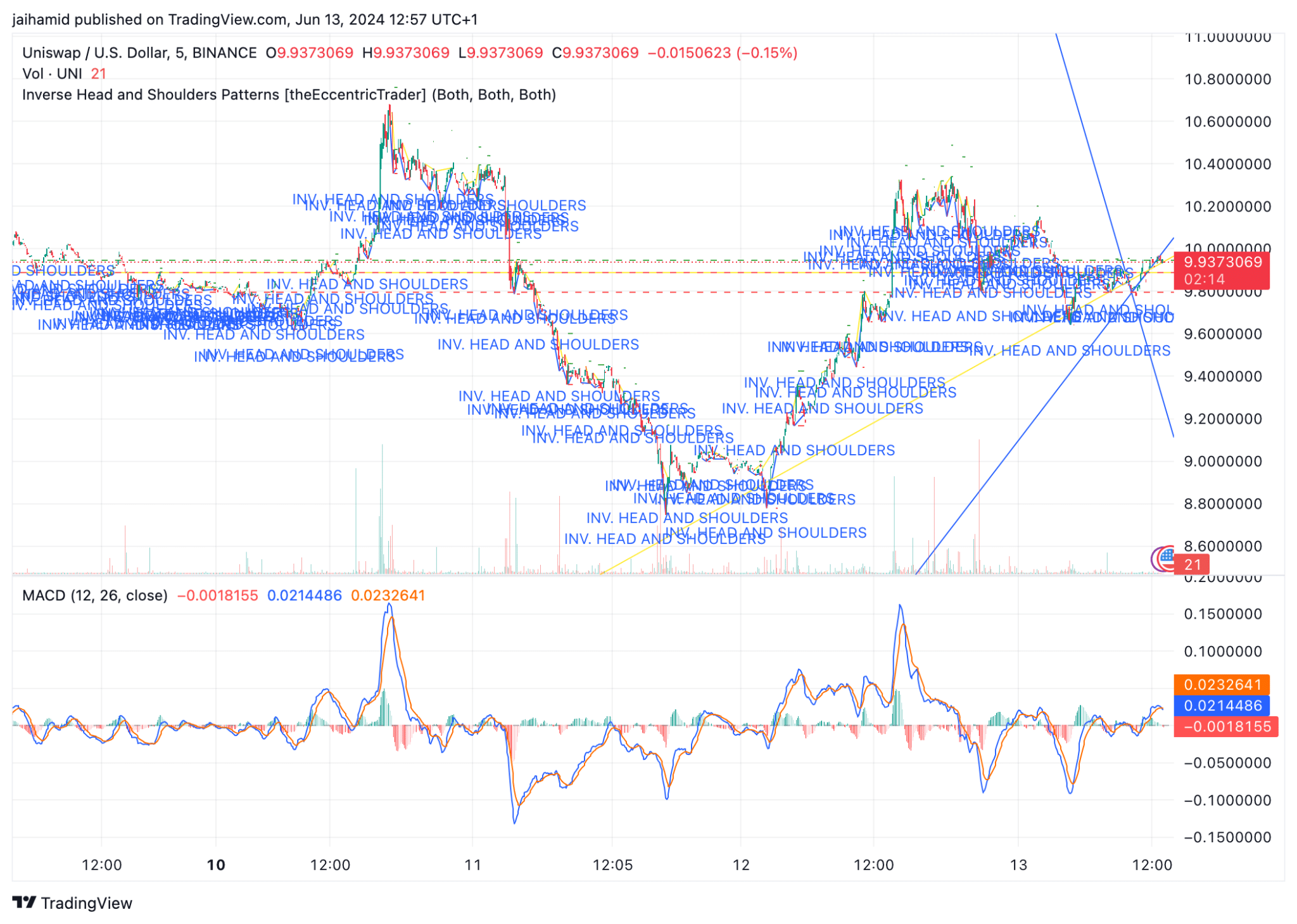

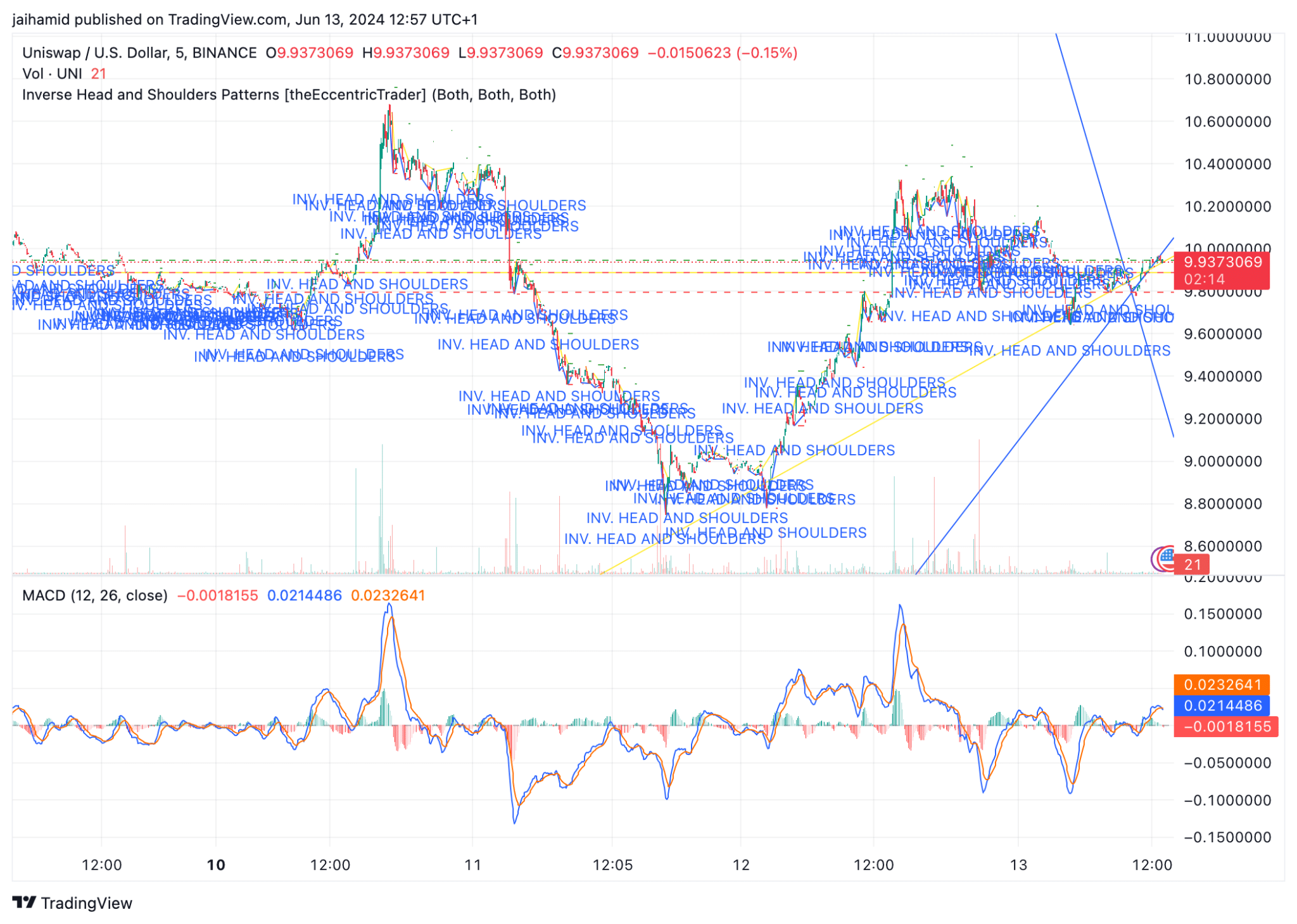

Source: TradingView

UNI break out?

Several inverted head and shoulders patterns can be seen on the UNI/USDt chart. These patterns are typically considered bullish reversal setups. Completing the patterns always leads to a bullish phase.

However, the effectiveness of the patterns in predicting an upward move depends on their confirmation, namely that decisive break above the neckline (indicated by the dotted lines) with significant volume.

The MACD line (blue) running above the signal line (orange) is visible at several points on the chart. This crossover is a traditional buy signal within the context of MACD analysis, and typically comes immediately afterward with a bull takeover.

Furthermore, each double-bottom pattern on the chart signals a turning point where buying interest is strong enough to prevent further declines and push prices higher, triggering a bullish trend reversal.

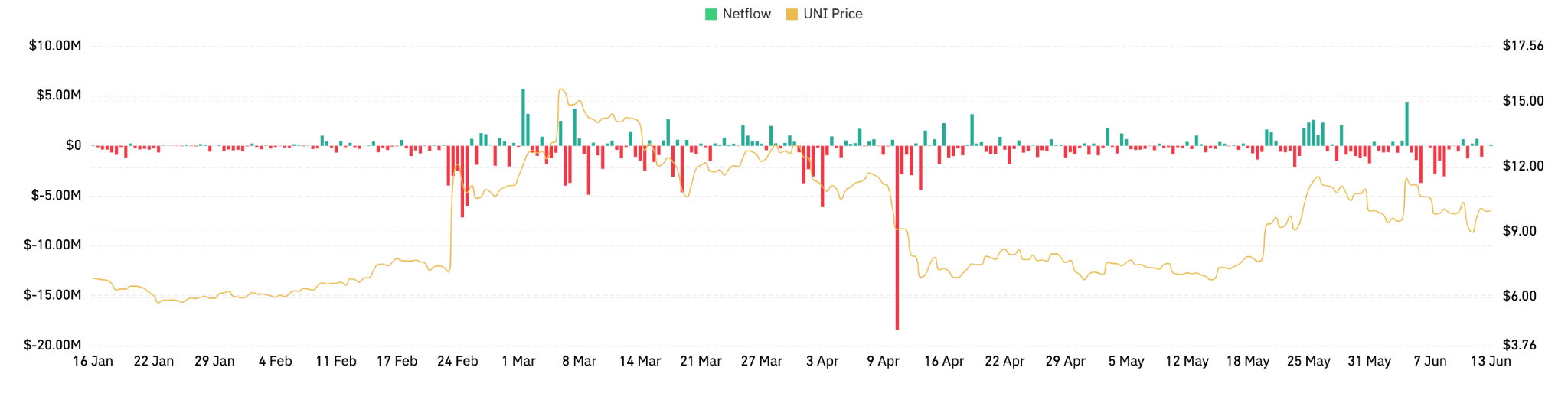

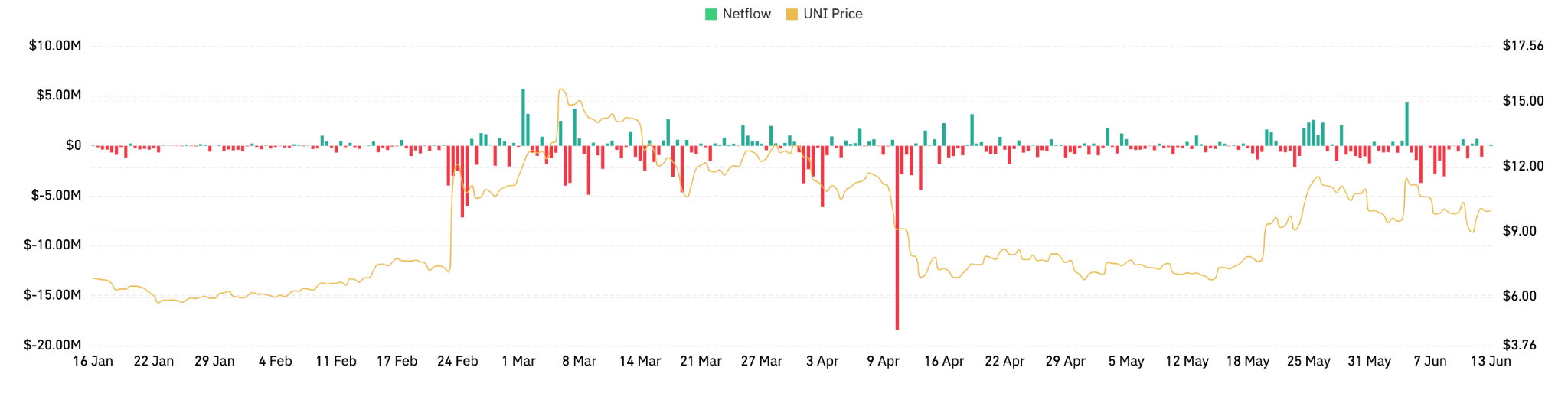

There is also a dramatic spike in net inflows, indicating a sudden increase in the number of tokens being moved onto exchanges.

Source: Coinglass

Is your portfolio green? View the UNI Profit Calculator

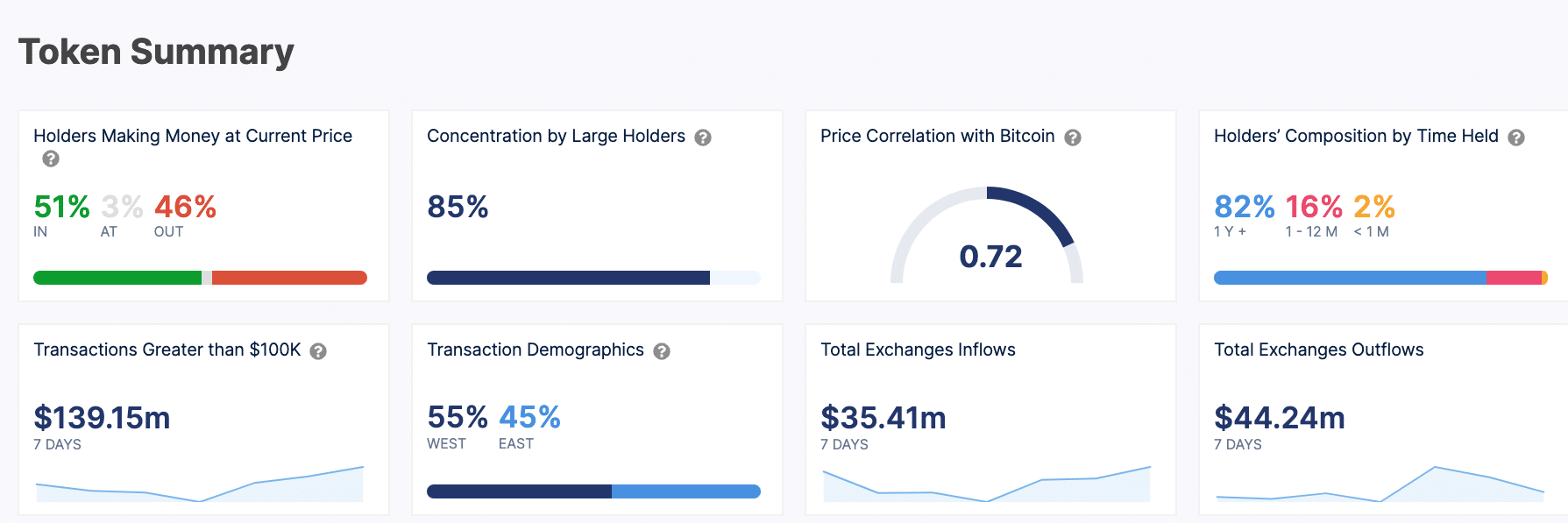

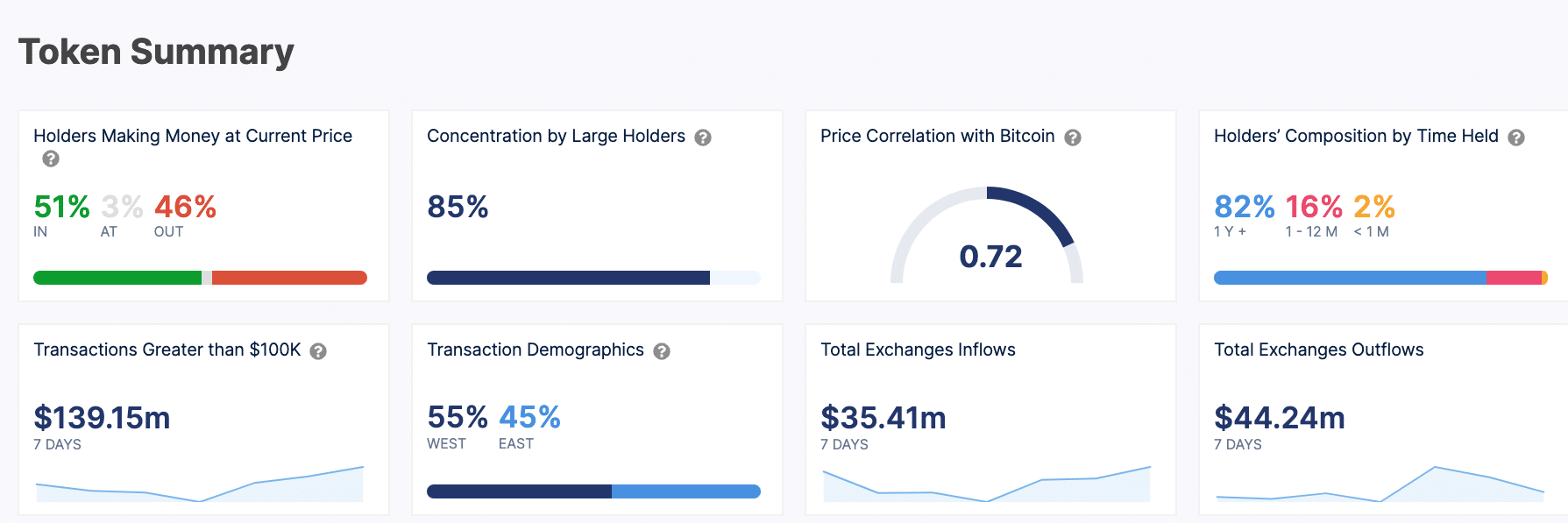

A slight majority (51%) of Uniswap holders are currently making a profit at existing price levels, which could provide a psychological incentive to hold on to their investments in anticipation of further price increases.

Source: IntoTheBlock

The high transaction values also indicate huge interest from larger investors and institutions, which could lead to higher price movements for UNI.