- Threat to Uniswap market sentiment arises due to controversy over FRENS token developers

- However, UNI has shown resilience in the midst of setbacks

Uniswap [UNI], a pioneering DEX within the DeFi sector, has consistently maintained its position as the dominant player in the space. However, recent developments involving the developer of the FRENS token have introduced an element of uncertainty into Uniswap’s market sentiment.

Read Uniswap’s price forecast for 2023-2024

We did not start the “fire”.

In response to the negative revelation, the founder of Uniswap took to Twitter to address the situation and revealed that the person responsible for the FRENS token had been removed from his role.

I wanted to let people know that this person is no longer with the company.

No behavior that we support or condone. https://t.co/sxVowwIR3Q

— hayden.eth 🦄 (@haydenzadams) August 12, 2023

The person in question, known as AzFlin, had been identified as the developer behind the meme token FrensTech (FRENS). Shortly after deploying the FRENS token, AzFlin executed a transfer of 14 WETH (equivalent to approximately $25,800) from the Base network and proceeded to liquidate the tokens obtained from the liquidity pool.

Allegations emerged that AzFlin engaged in a practice commonly referred to as back-pulling, which involves withdrawing liquidity from a project immediately after launch. Investigations revealed that AzFlin accessed the funds through the HOP protocol, effectively removing the ETH liquidity, amounting to 14 ETH, that had been contributed as fees.

AzFlin, however, disputed the carpet-pulling allegation, acknowledging only the removal of 1 ETH in liquidity from the project.

Address this ridiculous FUD now.

Yes, I created this token. NO – I HAVE NO MEAT.

Liquidity was blocked from the start. I removed 1 ETH of liquidity that I provided with funds from my own developer wallet. https://t.co/np5Jxji9TZ

— AzFlin 🦎 (unemployment arc) (@AzFlin) August 12, 2023

While AzFlin denied an intentional carpet pull, he confirmed the sale of some of the FRENS tokens coming from the liquidity pool. He justified this action by claiming that the tokens were originally obtained with personal money.

Interestingly, the FRENS token incident is not an isolated event within the Base network. In a similar fashion, the BALD memecoin saw significant interest and reached a market cap of $85 million before falling victim to a carpet-pulling campaign conducted by the operator in July.

A slowdown in activity

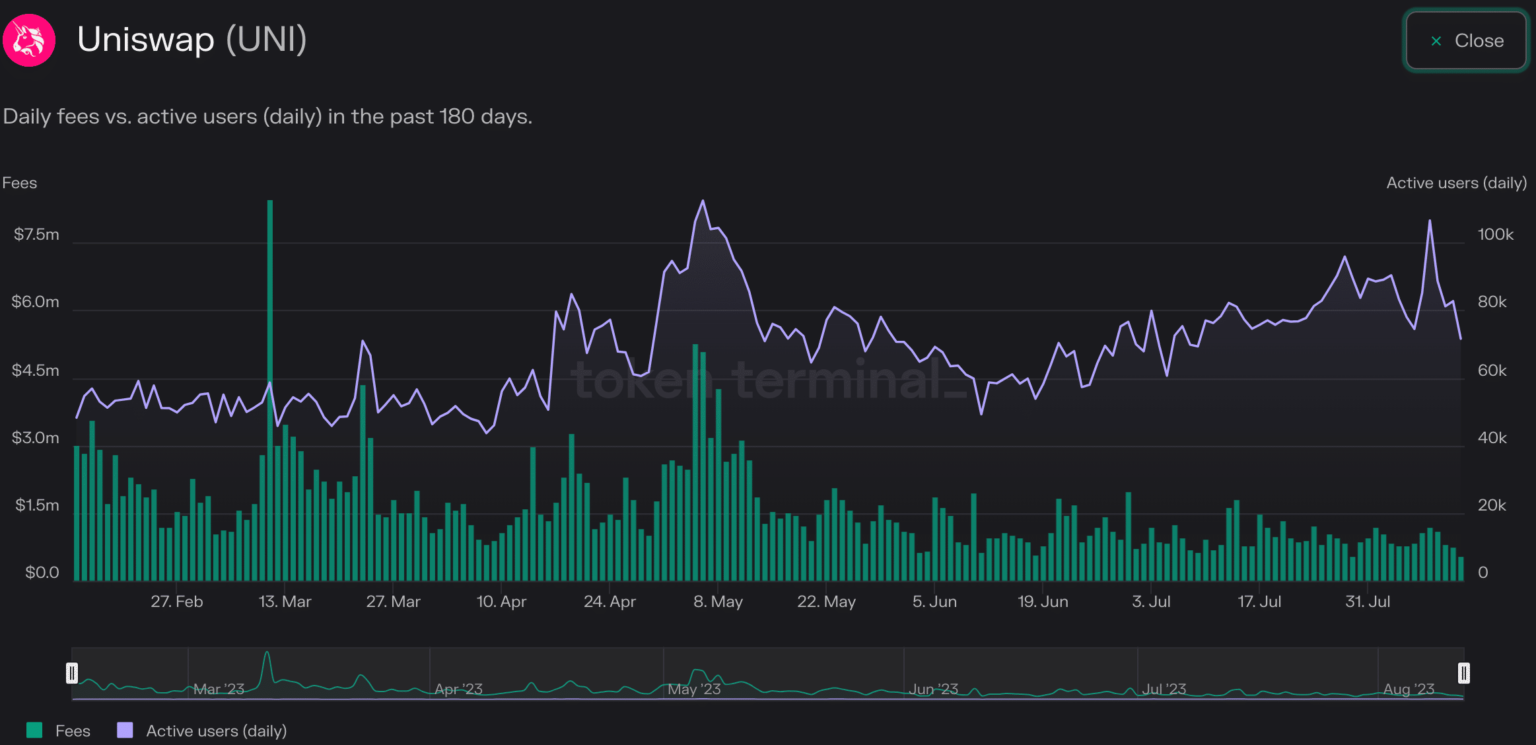

Despite founder Hayden’s efforts to address concerns and fears surrounding Uniswap, the protocol experienced setbacks. Within the space of 24 hours, Uniswap’s activity plummeted by 27.3% along with a 13.5% drop in fees collected.

Source: token terminal

Conversely, UNI showed signs of growth as the price rose from $5,793 to $6.15. Here, the price increase can be attributed to an increase in the number of UNI holders over the past week.

Realistic or not, here is UNI’s market cap in terms of BTC

Source: Sentiment