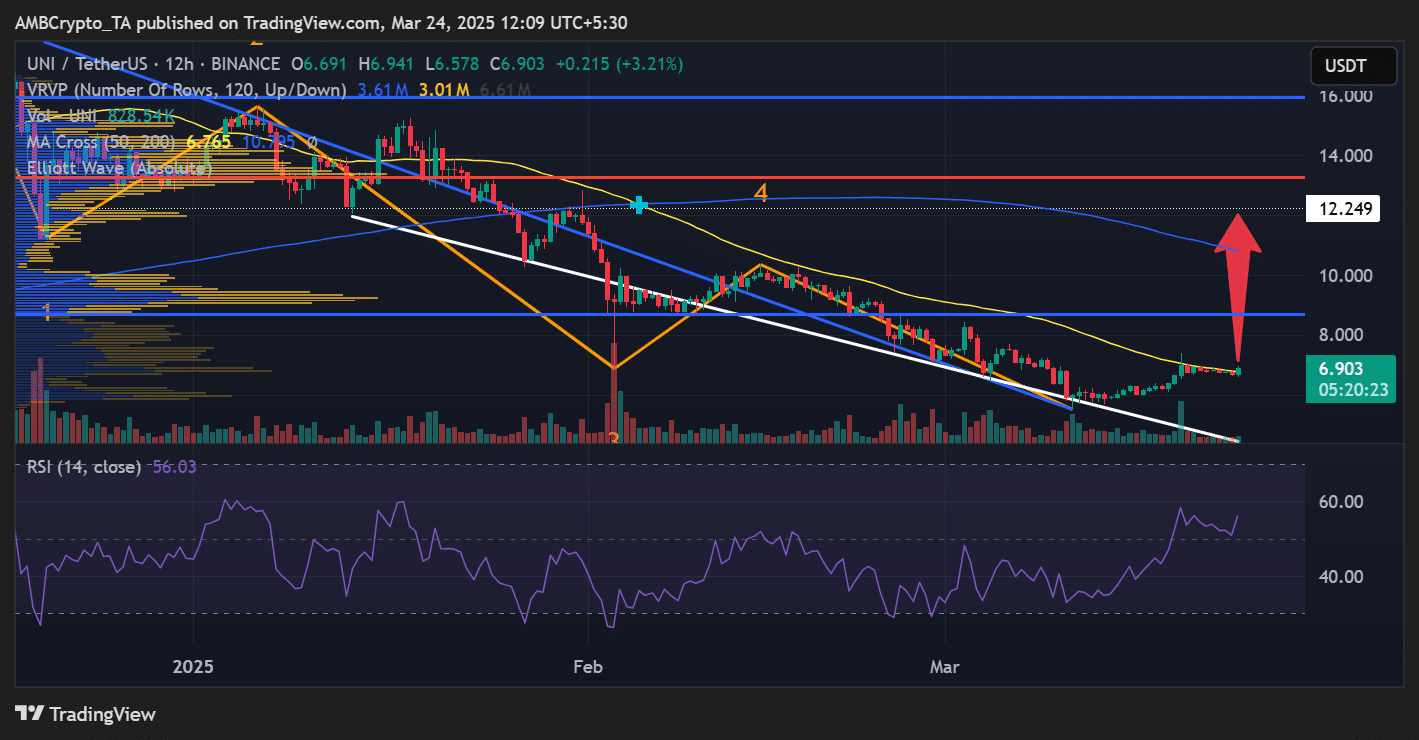

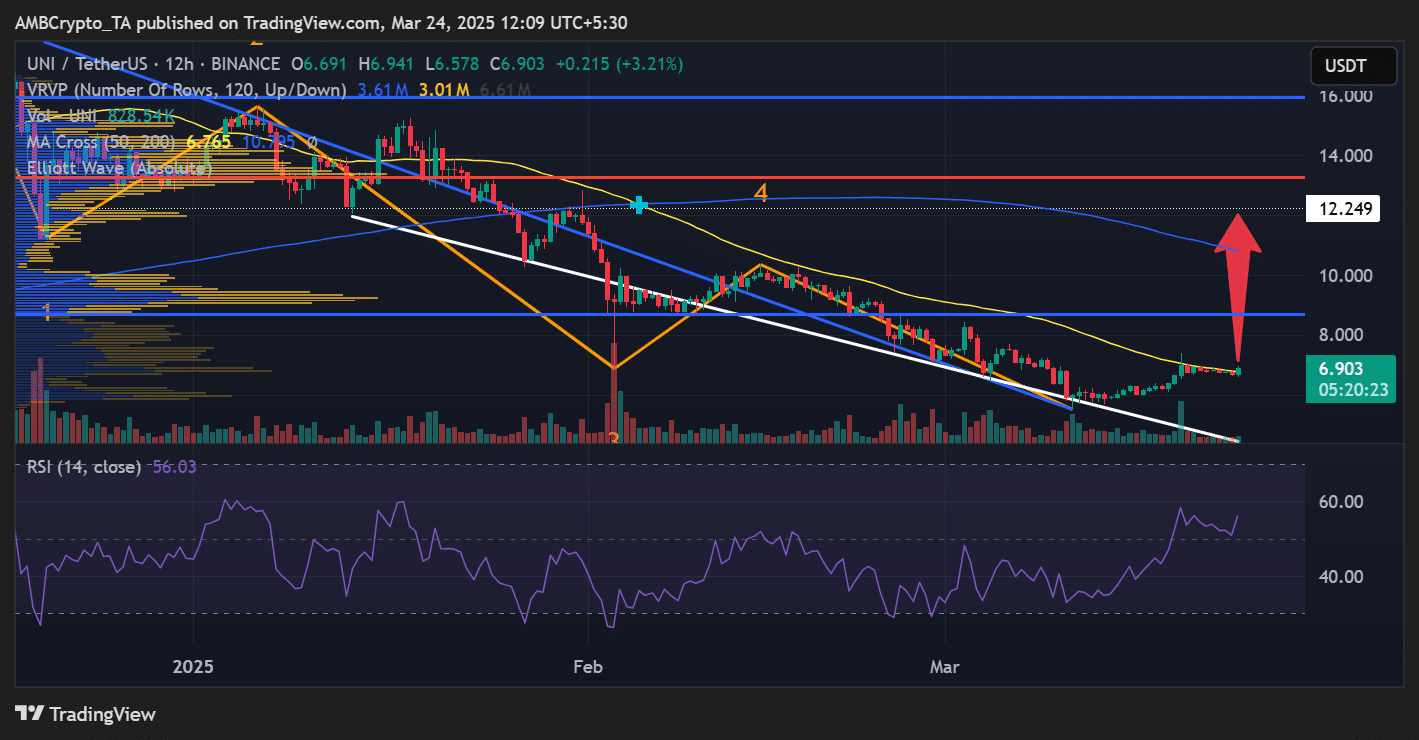

- Uni rose past $ 6.90 and broke from a downtrend of several weeks with RSI at 56 and increasing volume.

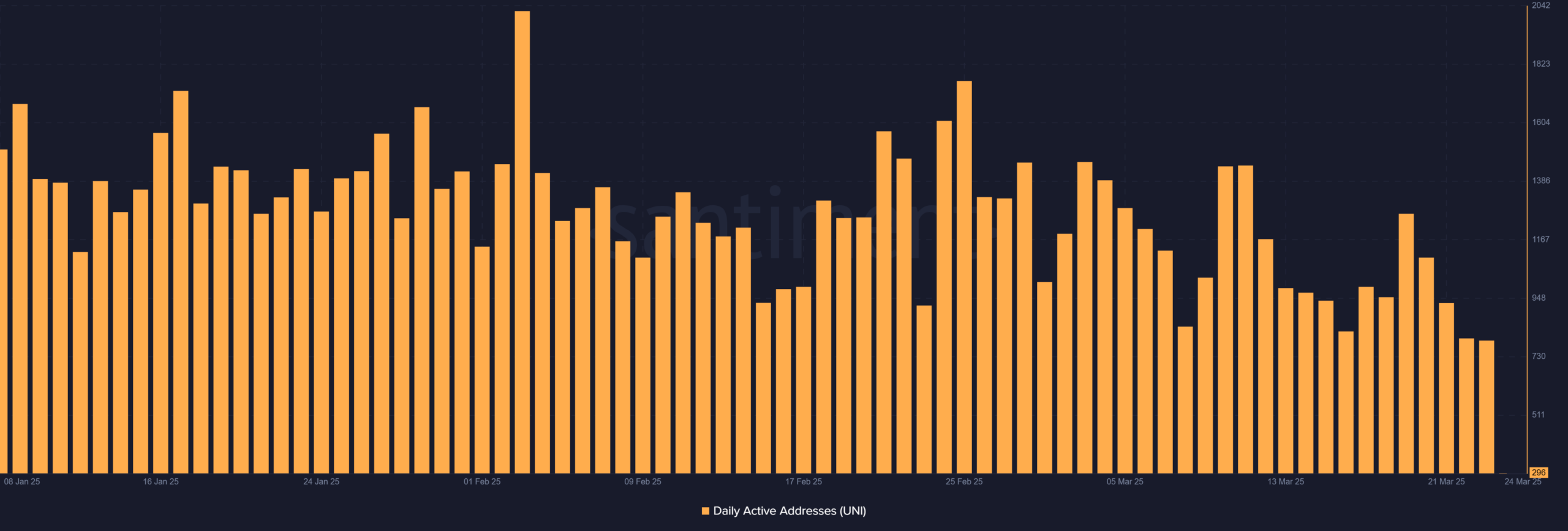

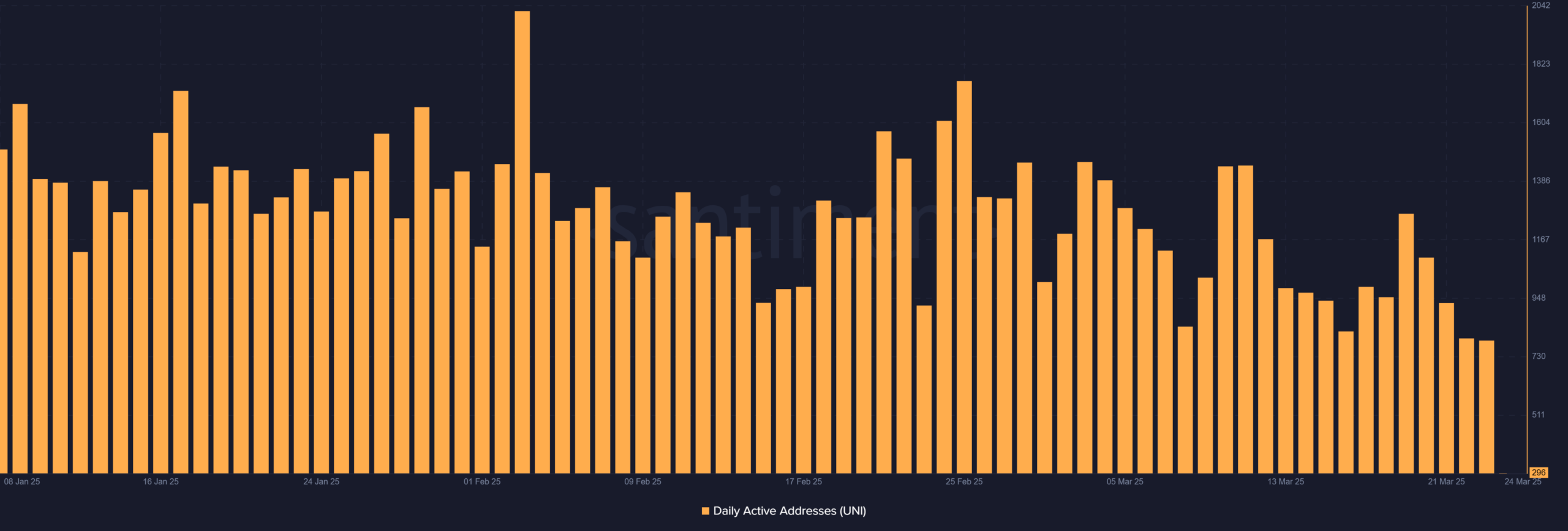

- Despite the rally, daily active addresses fell to 296, which raised the sustainability of doubts.

After a long -term downward trend, uniswap [UNI] Eventually broke above a key -different resistance level, which caused the hope for a potential bullish reversal.

The breakout, supported by increased purchasing pressure, could push uni to higher resistance levels if the trend continues.

An outbreak supported by Momentum

Uniswap traded at $ 6.90 and registered a profit of 3.21% in the last 12 hours. What is even more important is it escaped from a decreasing channel pattern that the price movement had closed since the beginning of February.

The outbreak came after the Altcoin recovered the 50-day advancing average (MA) for $ 6.26, historically become an important level of resistance.

Source: TradingView

From a technical point of view, the Relative Strength Index (RSI) lecture of 56.03, at the time of the press, suggests the growing bullish momentum but not yet overbought territory. In addition, the volume profile shows a significant peak in the activity near the Breakout zone, which enhances the power of the movement.

The next important target for Bulls is the 200-day MA near $ 10.25, while immediate resistance is around $ 8.00 at the volume bend. A nearby $ 8.00 can accelerate a movement to $ 12.24, a high for the last time in January.

Unniswap Active addresses don’t confirm enthusiasm – March

Despite the positive price promotion, the activity in the chain did not respond in the same way. According to Santiment Data, the daily active addresses of Uniswap fell on March 24 to 296 – the lowest in more than three months.

This divergence between price and user activity can increase caution in the short term.

Source: Santiemt

Usually an outbreak, accompanied by rising participation in chains, offers a more reliable confirmation of sustainable momentum. The current mismatch can indicate a hesitation between network participants or a speculatively driven rally.

What kind of uni now?

Although the price promotion of Uni is technical bullish, the ability to retain more than $ 6.90 and to violate the $ 8.00 zone, the key to retailing momentum. If the activity on the chain is restoring and interaging more addresses with the network, this would strengthen the continuation for continuation to $ 10 and then.

Conversely, it cannot maintain the breakout level, especially if the daily active addresses continue to fall, lead to a retest of support of $ 6.20.

Bulls have the upper hand for the time being, but Uniswap needs a wider user participation to convert this breakout into a trend in the longer term.