- At the time of writing, Uniswap was up over 4% in just 24 hours

- L2 trading volume and Grayscale’s forecast seemed to have an impact on the price action

Uniswap (UNI) is one of the best decentralized protocols in the cryptocurrency market, known for facilitating large trading volumes using smart contracts to create liquidity pools.

At the time of writing, UNI was on the tail end of some promising performance, with its stock rising 4.16% to $7.47 on the charts. In addition, 24-hour trading volume increased by 22.13%, to $156 million. This resulted in a volume-to-market ratio of 3.5%.

Simply put, this underlined UNI’s potential as a solid investment option.

Uniswap price prediction

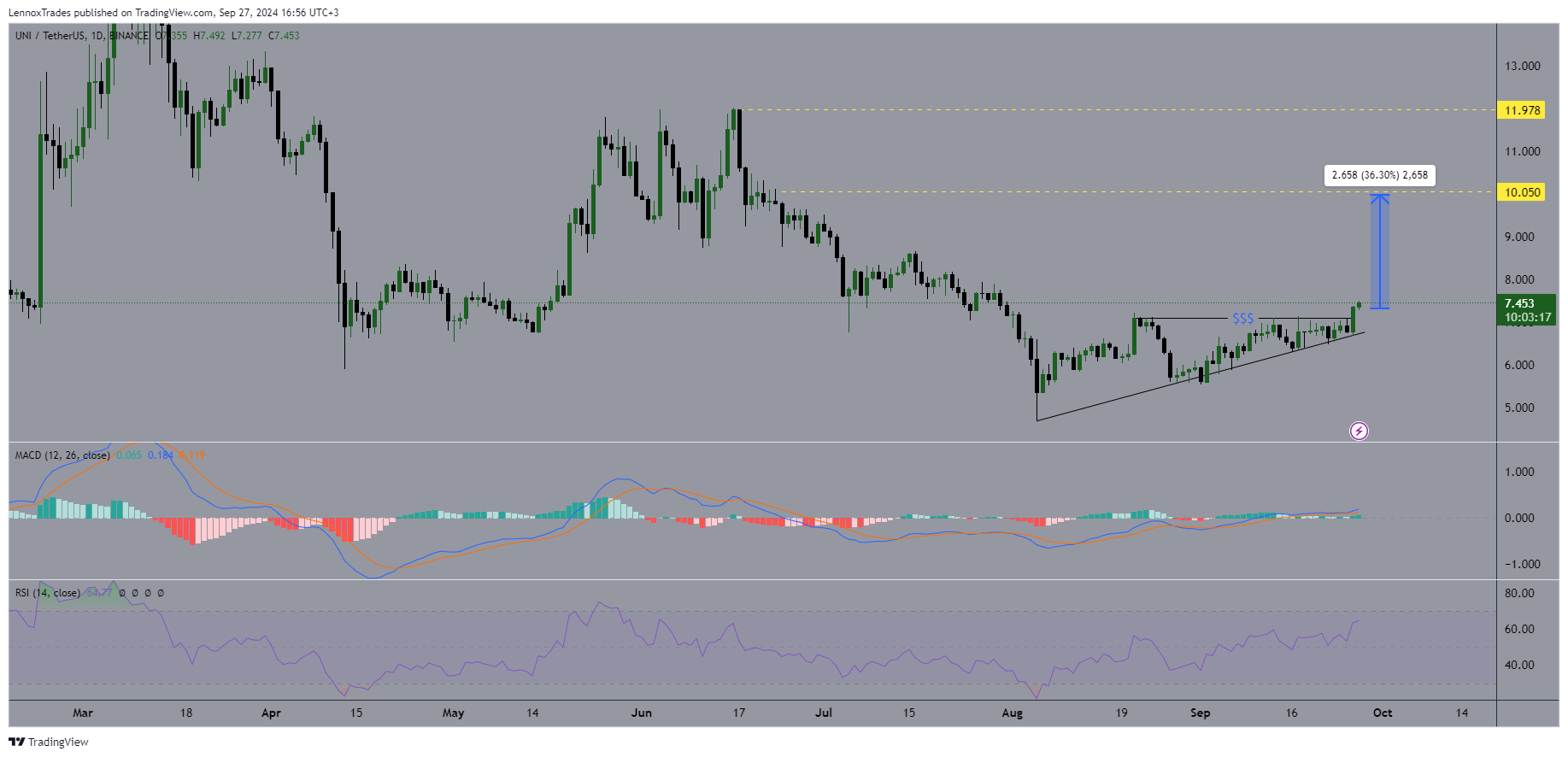

When analyzing the UNI/USDT pair, the technical indicators pointed to a bullish trend for UNI as it recently broke out of an ascending triangle pattern. Such patterns often indicate accumulation, which indicates that large investors and institutions are entering the market.

This particular pattern had been forming for a month and the breakout led to a price increase of more than 10%. However, the performance over the last 24 hours has been offset by a gain of 4% – a healthy consolidation.

Source: TradingView

So the question remains: can UNI continue its upward trend? Well, external factors are aligning, with the potential for the price to reach $10 in the fourth quarter of 2024, giving a gain of 36% from press time price.

The MACD also turned bullish, confirming that buyers remain in control. The histogram bars also indicated positive momentum, even if it was not yet at its peak.

Furthermore, the RSI revealed that UNI was overbought but still had room for further gains before reaching the reversal level. These factors together indicate a bullish outlook for UNI in the near term.

Monthly L2 trading volume and UNI v4 update

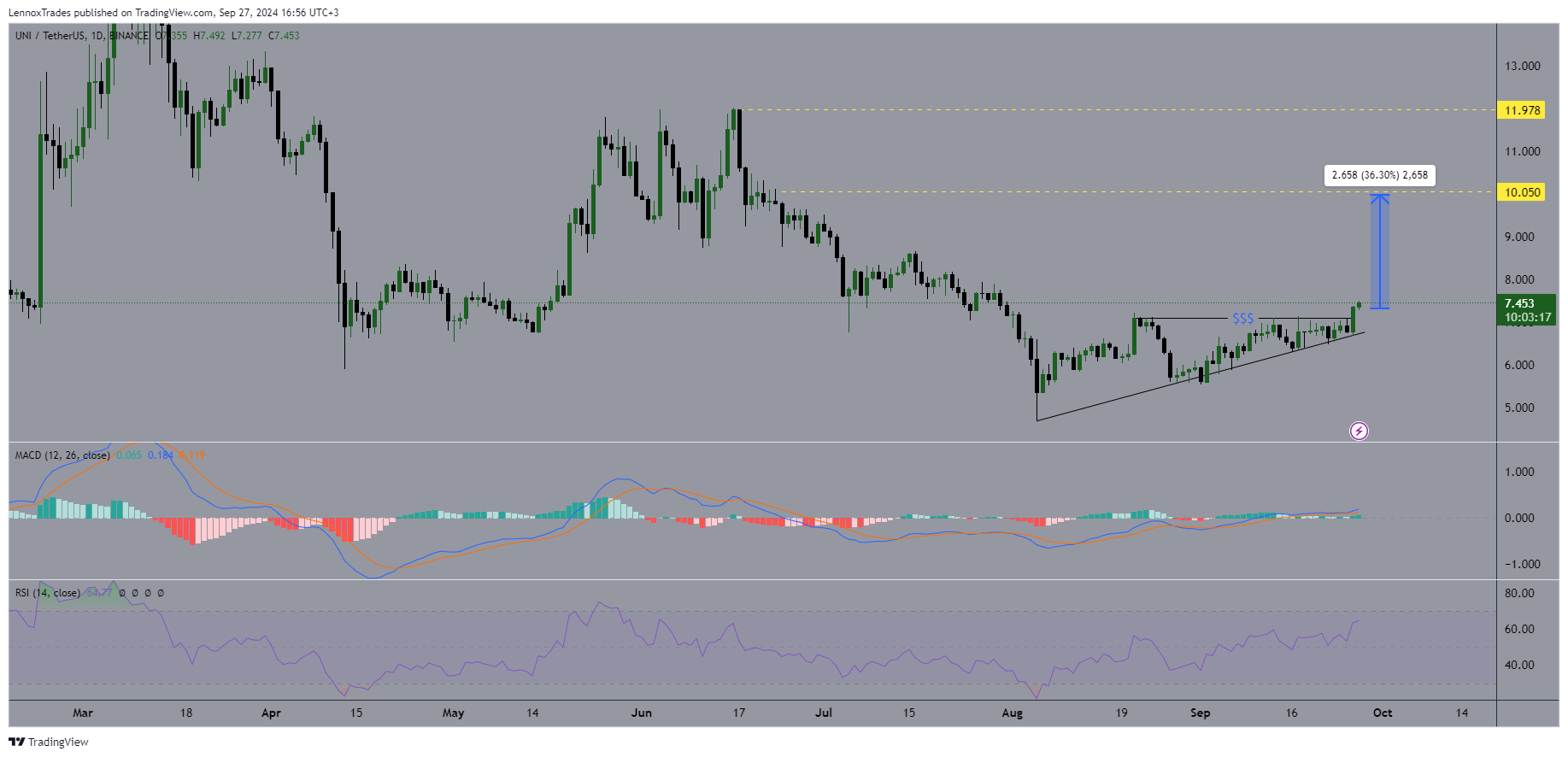

Uniswap’s on-chain numbers also supported this positive outlook. Monthly Layer 2 (L2) volume on the Uniswap protocol has almost tripled compared to last year, and the month isn’t even over yet.

This significant increase in L2 trading volume is a sign of growing interest and activity on Uniswap.

Source: Uniswap/X

Additionally, Uniswap’s upcoming v4 update will introduce ‘Hooks’, a new feature that allows liquidity pools to set specific requirements.

This opens the door to several useful features, but also raises concerns. Especially since a community-created ‘KYC’ hook would restrict access to only those with a verified KYC wallet.

Grayscale’s last call

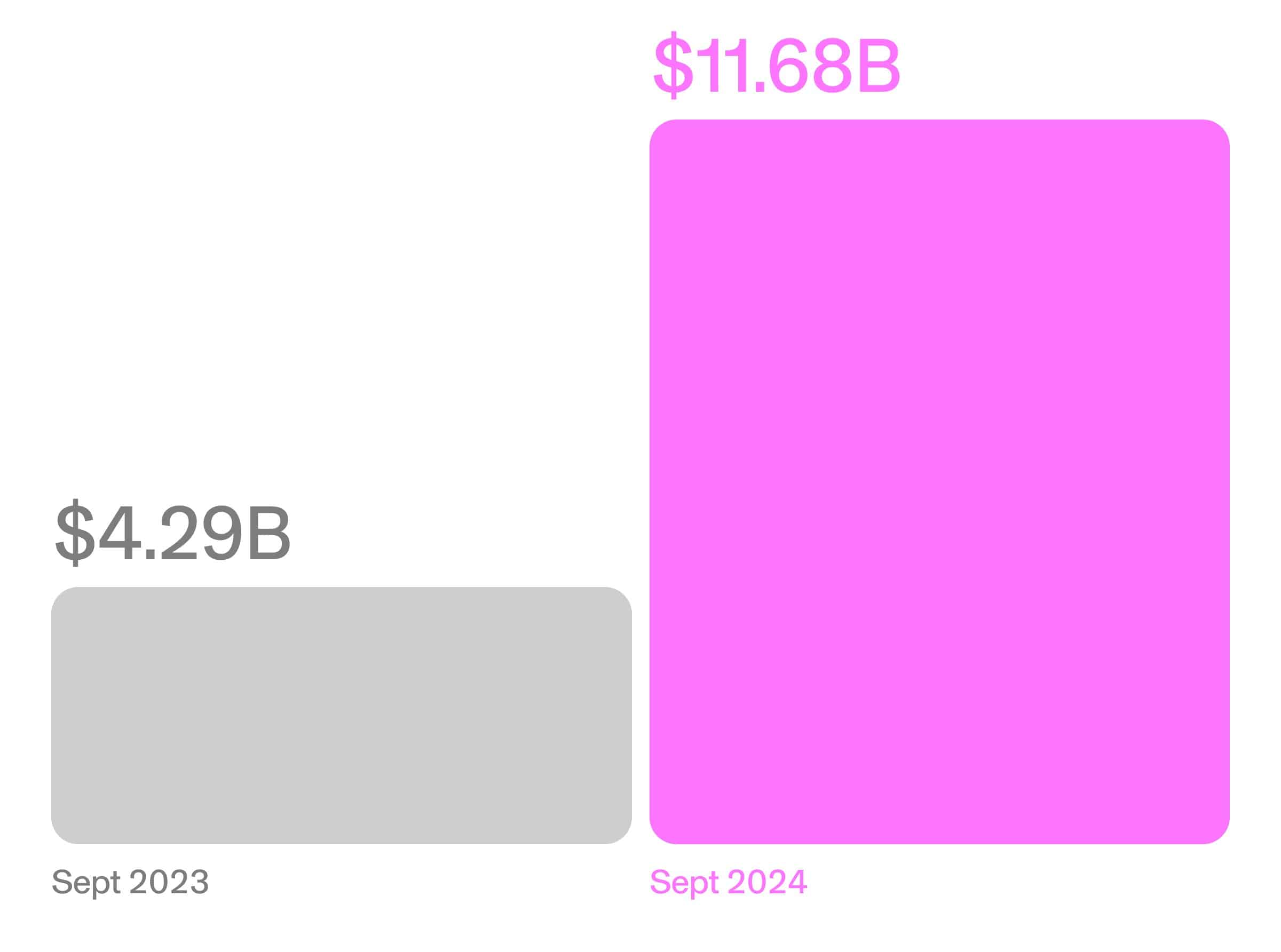

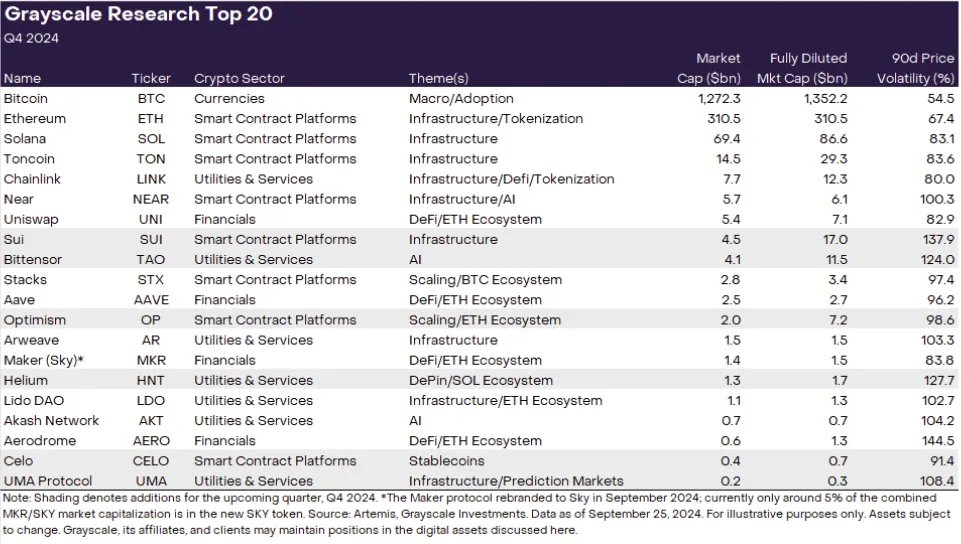

Finally, Uniswap continues to attract the attention of top research teams. Grayscale recently added UNI to the list of cryptocurrencies expected to perform well in the fourth quarter.

The list includes other promising assets such as Sui Network (SUI), BitTensor (TAO), and Optimism (OP). On the contrary, some tokens, such as Render (RENDER) and THORChain (RUNE), have been removed from the list.

Source: Artemis, Grayscale Investments

Uniswap’s price action at the time of writing, technical indicators and on-chain metrics all suggested a bullish outlook for the fourth quarter of 2024. With increasing trading volumes and strong market positioning, UNI could now be poised for further gains.