- Uniswap saw FOMO that ushered in a price correction.

- BTC has fallen out of the $69,000 price range.

The price development of Uniswap [UNI] fueled the Fear of Missing Out (FOMO) on June 10, suggesting a possible correction. This correction has already begun, but it may not be solely due to FOMO.

Bitcoin [BTC] also saw a notable decline, and its trend tends to impact the broader market.

Uniswap and Bitcoin: To compare social statistics

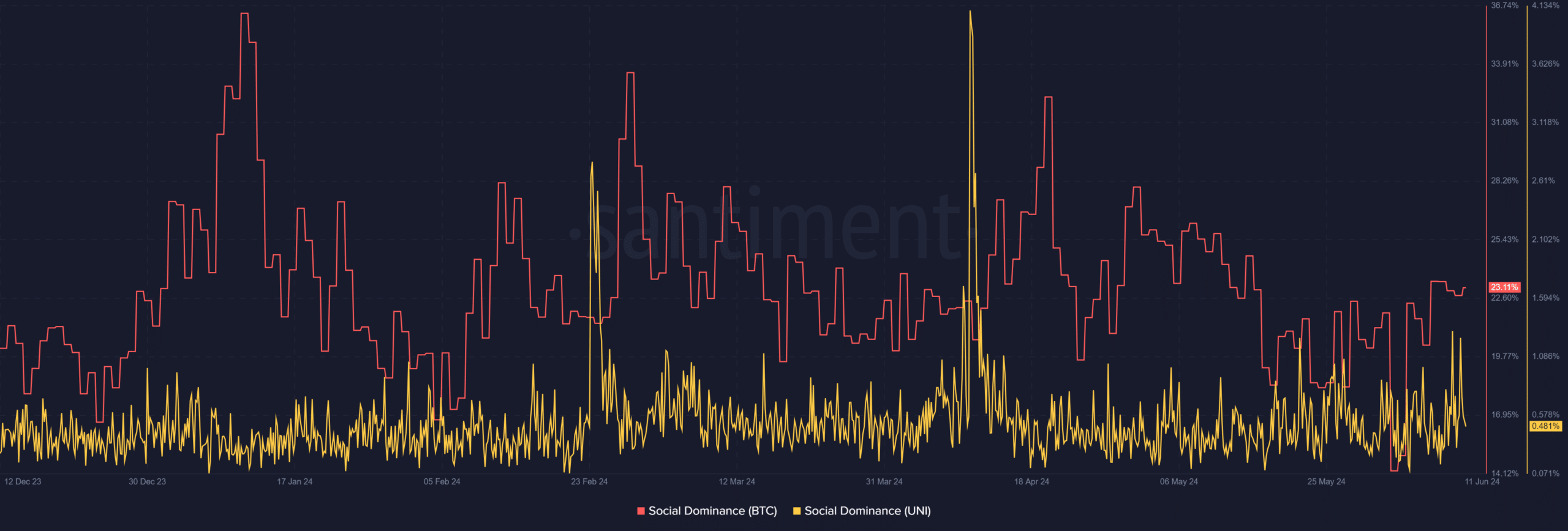

According to recent data from SantimentUniswap saw a spike in its social dominance on June 10. The data showed that UNI was the most notable among the assets that saw an increase on the day.

The price increase brought significant attention to UNI, creating FOMO.

However, the rise in price and social dominance was more of a bearish signal than a bullish one, especially given Bitcoin’s simultaneous decline, which typically affects broader market sentiment.

Source: Santiment

AMBCrypto’s analysis of Bitcoin’s social dominance trend showed that there was no significant movement in the same time frame.

Although Bitcoin maintained a higher social dominance than UNI, the trend seemed relatively normal. At the time of writing, BTC’s social dominance is around 23%, while UNI’s is around 0.5%.

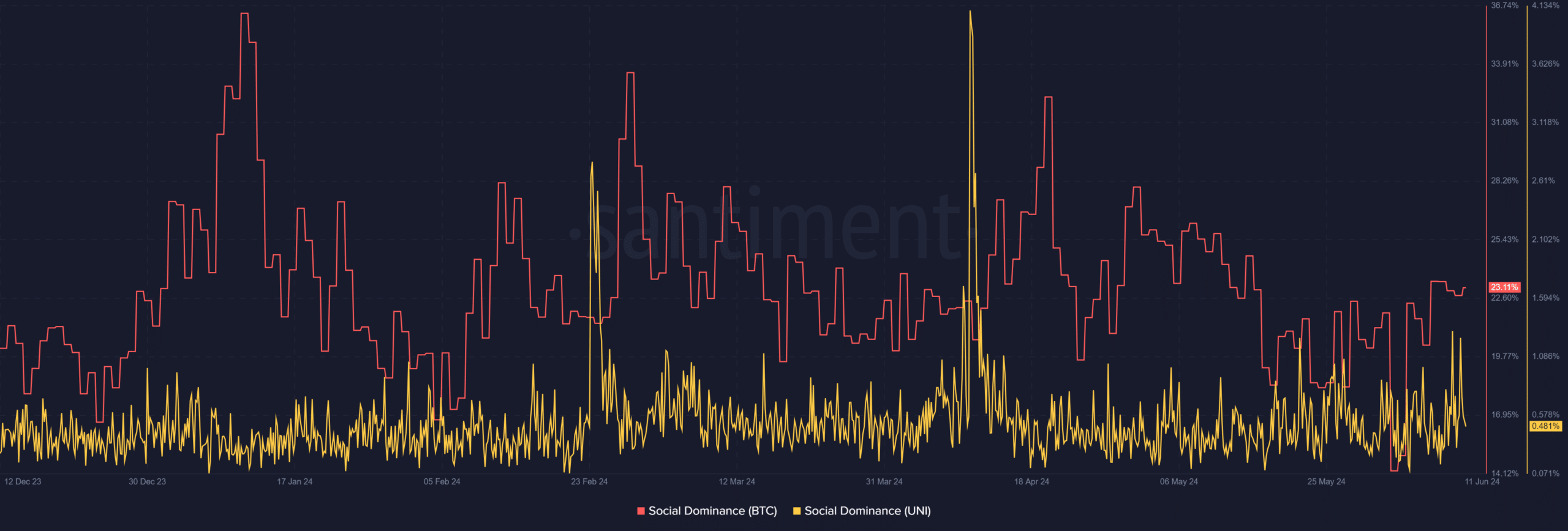

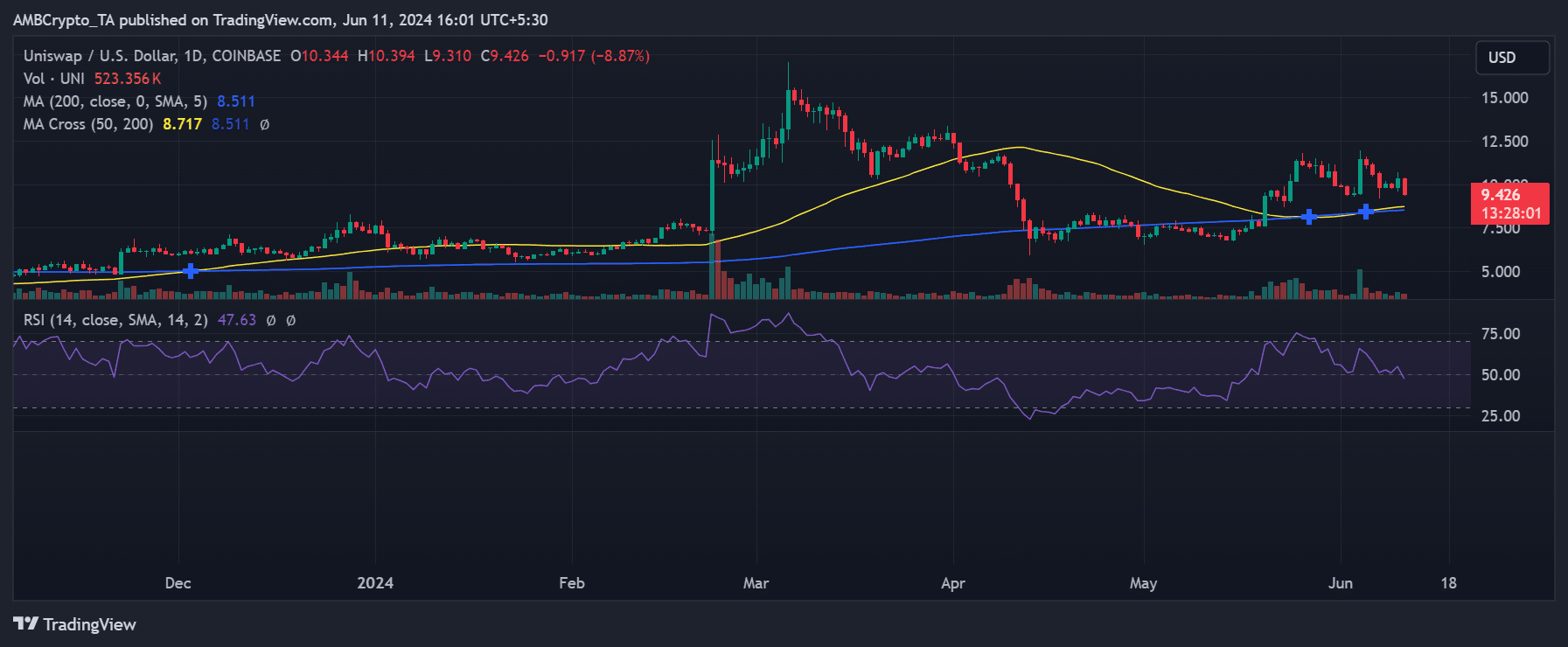

How UNI was trending

A look at Uniswap’s daily price showed a 5% increase on June 10, from about $9.80 to $10.30. However, these gains and more have since been wiped out.

At the time of writing, Uniswap was trading around $9.40, down over 8%.

Source: TradingView

The decline has pushed Uniswap into a bear trend. The Relative Strength Index (RSI) shows that it is currently below the neutral line.

This decline is attributed to the rise in FOMO and Bitcoin’s recent decline.

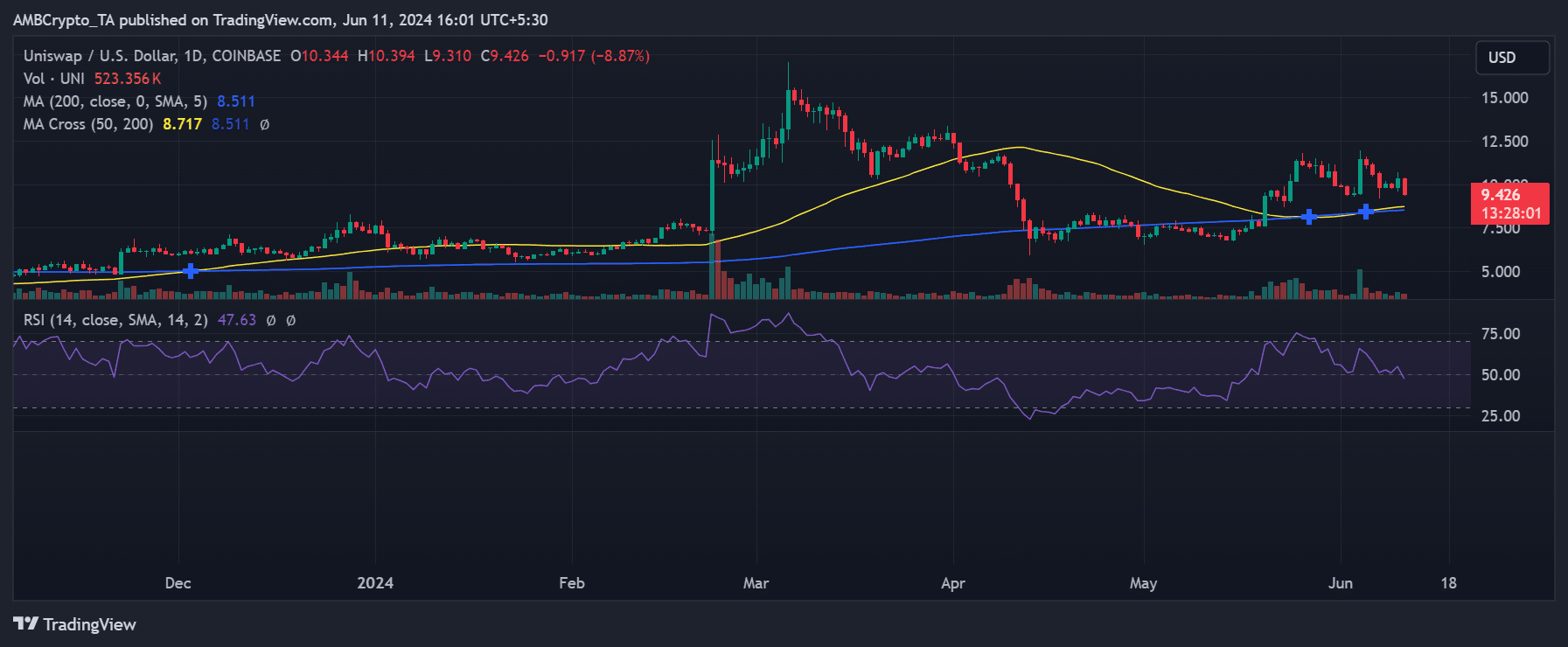

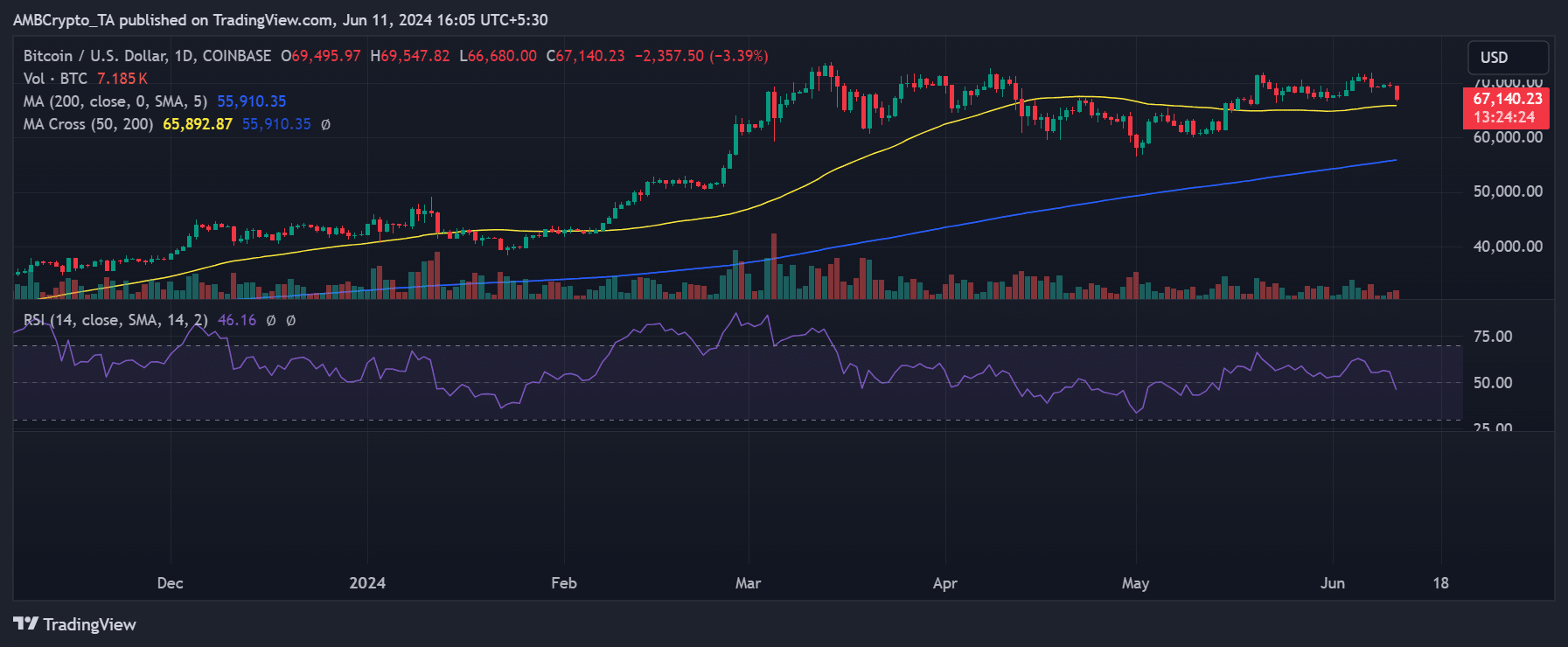

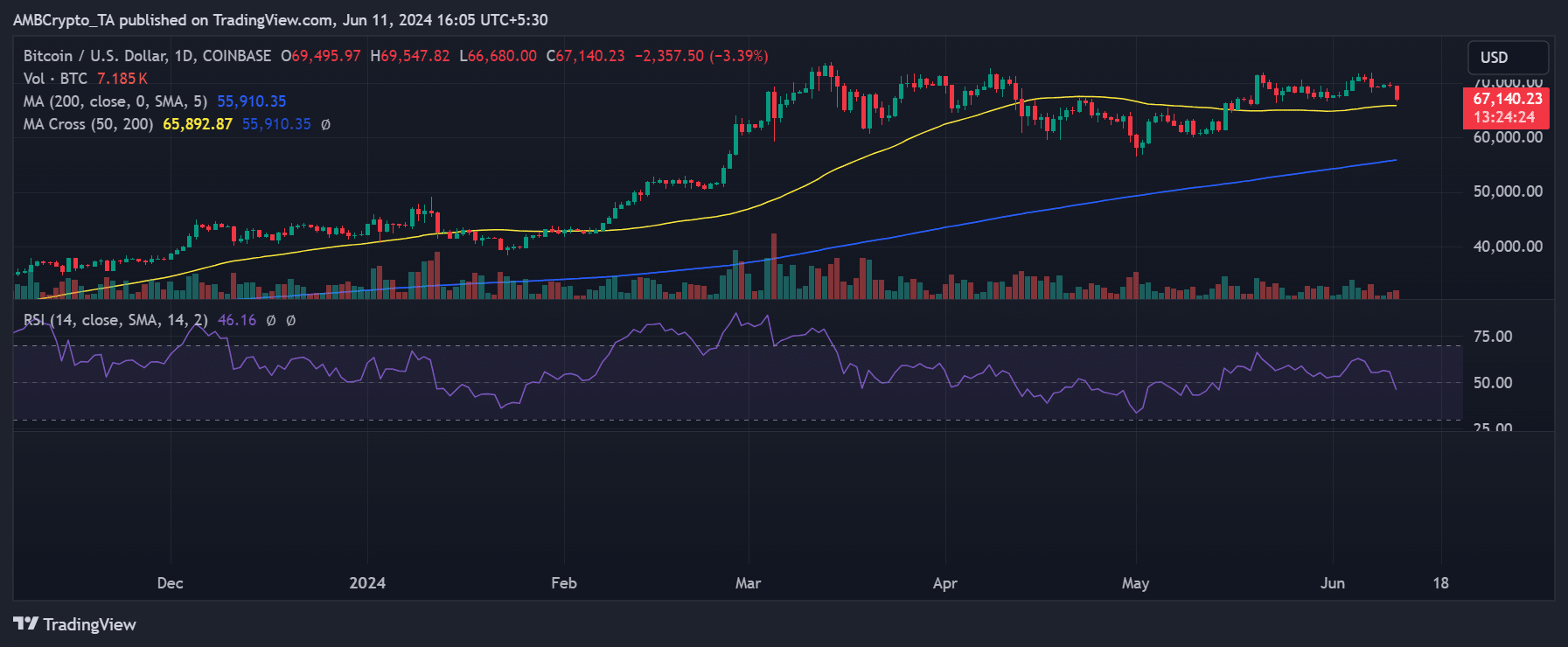

How has Bitcoin fared?

AMBCrypto’s analysis of Bitcoin showed that it is down 0.2% over the past 24 hours despite the absence of FOMO, unlike UNI. At the time of writing, the king coin was trading for around $69,497.

Source: TradingView

Is your portfolio green? View the UNI Profit Calculator

At the time of writing, this downward trend has continued, down more than 3% around $67,400.

An analysis of the Relative Strength Index (RSI) showed that it is now below the neutral line, indicating a bear trend.