- The Uniswap wallet got off to a great start in its first two weeks, marked by strong user growth.

- UNI struggles to bounce back after a short-term retest.

Two weeks have passed since the Uniswap wallet was launched and the initial data shows that it has got off to a healthy start. The founder of Uniswap revealed that despite the sluggish market conditions, the wallet already saw strong acceptance and strong volumes.

Is your wallet green? Check out the Uniswap Profit Calculator

The Uniswap wallet reportedly attracted more than 20,000 unique users within the first two weeks of its launch. In addition, trading volumes within the wallet were rapidly approaching the $10 million milestone.

The same two weeks were marked by sluggish market conditions. Uniswap’s founder expected the wallet to deliver a more robust performance as things improve.

🦄 Uniswap wallet is growing like crazy

It’s only been ~2 weeks since launch and yesterday there were over 20,000 unique users and almost $10 million in trading volume

And we’ve only just begun. We aim to ship like crazy this year – expect constant improvements 🚀

— hayden.eth 🦄 (@haydenzadams) May 3, 2023

Uniswap wallet performance reflected the state of the DeFi platform. Uniswap’s network growth also registered strong growth within the same two weeks.

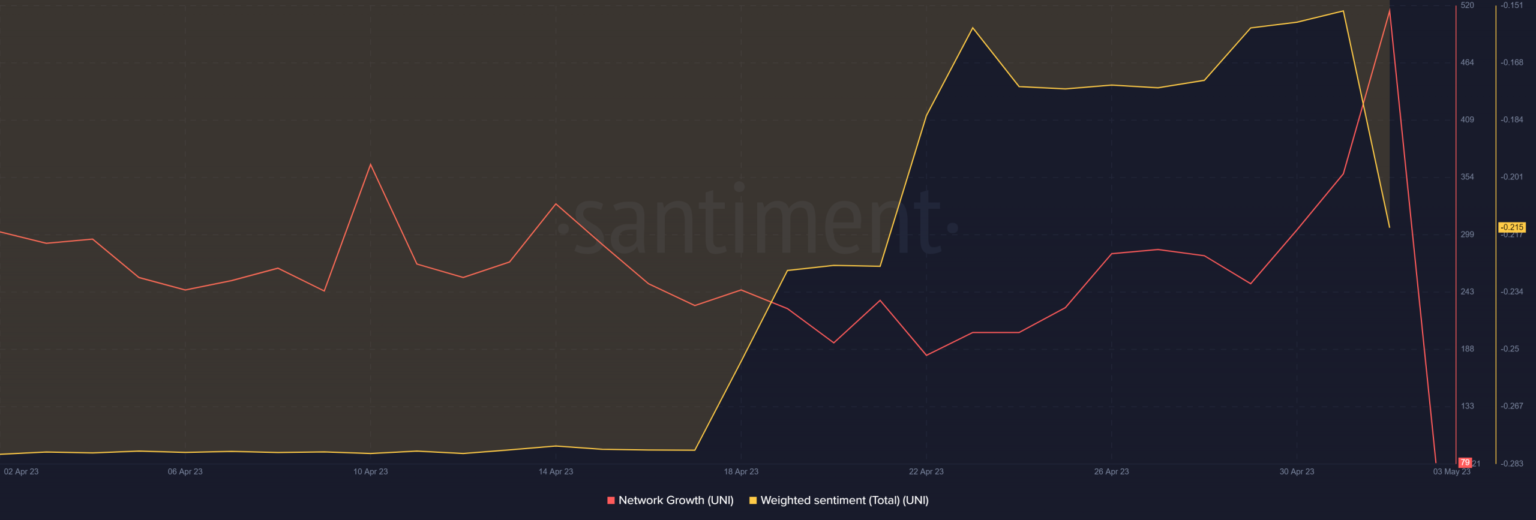

But can the network sustain this trajectory? Uniswap’s network growth metric recorded a sharp drop in the past 24 hours. Similarly, weighted sentiment also fell after previously signaling a bullish consensus.

Source: Sentiment

The declining sentiment and network growth were likely impacted by a sharp slowdown in activity as investors awaited FOMC data. This suggested we could see a resurgence in network activity now that the much-anticipated economic event is over, but that remains to be seen.

Evaluate the chances of UNI bulls regaining dominance

The slowdown in network activity reflected the low volumes seen over the past few days. Uniswap’s native token UNI’s volume was hovering near its current 30-day lows at the time of writing. This confirmed a lack of excitement among traders.

Source: Sentiment

It was also worth noting that lower volumes were observed after a marked drop in the supply of prime addresses in the last week of April. As a result, UNI fell back to the near-term support level in recent days. It was trading at $5.31 at the time of going to press.

Source: TradingView

Realistic or not, here is Uniswap’s market cap in terms of BTC

UNI’s low volume and declining investor confidence could give way to the bears and a possible break below the current support level. A summary of UNI’s supply flow revealed that exchange supply has increased net over the past 30 days, while off exchange supply has declined.

Source: Sentiment

So, what should investors expect? We could see a resurgence in rising demand, especially with the FED just announcing its next move in terms of rate hikes. This means that there is a significant chance that UNI will come out of near-term support, subject to demand recovery.