- A market cap of $100 billion – two crypto giants have achieved this, but cannot sustain it.

- Does this open the door for their rivals to seize the moment and take the lead?

In the crypto market, diversification is a go-to strategy for investors managing risk, with top tokens often becoming the ‘next big thing’ like Bitcoin [BTC] peaks.

Since November, the landscape has changed dramatically, with some high-cap tokens surging as “Trump pump” winners and climbing higher, while others plummeted and lost their positions.

But the story is far from over. With 2025 bringing more uncertainty, investors are likely to reshuffle their portfolios as the year comes to a close. Which high-cap token will be the next to reach a $100 billion market cap? And is it now time to seize the ‘dip’?

Breaking down the competition

Interestingly, out of the vast sea of crypto tokens, only three currently have a market capitalization of over $100 billion. Competition is fierce, and with the market defying mainstream projections, it’s anyone’s guess whether more tokens will come – or if the list will shrink even further.

Still, some names have a great chance of breaking through. With Solana [SOL] with a market cap of $93 billion and Binance Coin [BNB] With a $96 billion lead, these two are poised to take a stab at the $100 billion mark. The real question now is: who will get there first?

But here’s the kicker. After reaching an all-time high of $264 in mid-November, Solana’s market cap rose to $125 billion. However, since then the market has taken a bearish turn and SOL is struggling to break the $220 barrier.

On the other hand, BNB had its best December yet, reaching an all-time high of $793 and a market cap of $112 billion. But here’s the catch: sustaining this level has proven difficult, and BNB is at a crucial crossroads.

Now that SOL and BNB are still leading the way suit – with no other high-cap tokens even coming close to their positions – the path to $100 billion seems clear.

But don’t get too comfortable: the November to December cycle has been anything but predictable, keeping even the most seasoned investors on their toes.

So, what comes next? Should you take the plunge and go long on these contenders, or is the market about to surprise us all again in 2025?

Rivals are lurking, eyeing the $100 billion market cap

The crypto market is a mix of ‘winners’ and ‘underdogs’. In November, an underdog, Ripple (XRP), made a surprising leap, breaking through two resistance levels and reaching a market cap of $130 billion.

XRP has clearly shaken Solana’s dominance and attracted capital in ways no one expected. But the race for power is far from over.

Solana, also called the ‘Ethereum Killer’, still has a strong lead with its fast blockchain and real-world examples. So it doesn’t seem far off to call the current downturn just a ‘blip’.

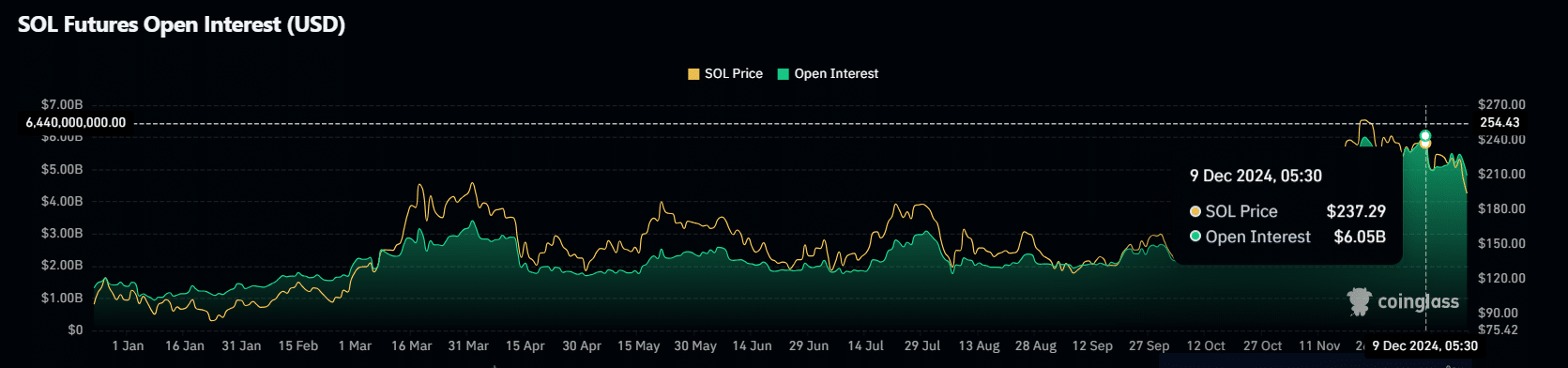

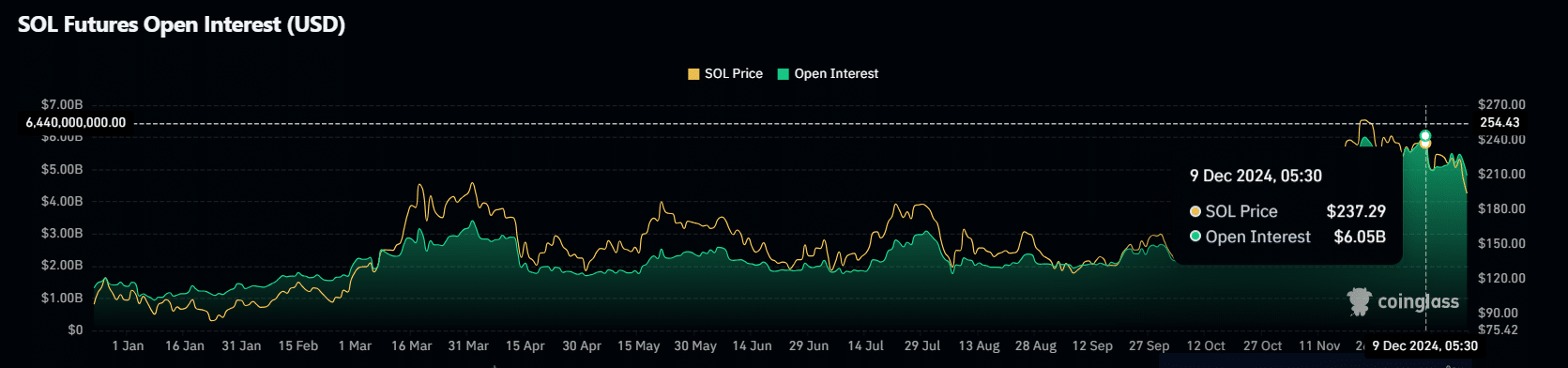

Even futures traders seem to agree. Solana’s Open Interest (OI) has remained stable between $5 billion and $6 billion, with each price spike causing a surge in long positions.

Source: Coinglass

So if you bet on SOL, prepare for a test of patience. Are basics are rock solid, and with years of resilience behind them, it is still in the running to break the $100 billion market cap mark.

Is your portfolio green? View the SOL Profit Calculator

BNB, with a break near $800, also looks strong. As for XRP, its future is uncertain. Is the recent wave a flash in the pan or the start of something bigger? We will know in 2025.

Looking ahead, SOL and BNB are the frontrunners to reach the $100 billion mark. With solid fundamentals backing them, this could be the perfect time to buy the dip. Just make sure you’re in it for the long haul and not chasing short-term gains.