- Graphic patterns suggest that if the recent executive order – by far expected to make BTC rally – is probably in addition to trends from the course of the hand, a decline is likely.

- For now, investors – retail and traditional institutions – have actively selling because it does not create optimism on the market.

In the last 24 hours, Bitcoin’s [BTC] Movement has not tailored itself to market expectations, in particular with the executive order that brings a strategic BTC reserve to life.

During this period it actively fell by 4.05%, which interrupts BTC’s performance in BTC last week in BTC. High trader skepticism is currently dominating the market sentiment, which contributes to the overwhelming performance of BTC.

Trump’s earlier influence on Bitcoin fades

President Donald Trump has previously positively influenced BTC, but this effect decreases as the skepticism of investors increases.

After his American victory in the US presidential election, BTC rose from $ 66,780 to $ 109,350, which marked an increase of 63.75%. Since then, BTC has difficulty offering extra rally options, which reflects a display of a shift in market dynamics and sentiment.

Source: TradingView

After Trump had announced a presidential working group on January 23 to create a BTC control framework, it actively fell by 27.08%.

This decrease is unusual for such a phase and reflects the growing skepticism of investors, so that many are probably kept on the sidelines. If BTC reflects trading patterns that are seen after previous executive orders, this can fall another 33% to the range of $ 58,000.

What drives the decline?

The recent decline of Bitcoin stems from skepticism under American retail and institutional investors, usually expected to be large buyers.

This skepticism continues to exist despite the establishment of a strategic Bitcoin reserve that is linked to their country. The Coinbase Premium Index, which controls the investor activities of the retail trade, confirms that retail investors sell instead of buying.

The index remains in a historic bearish range and registers a negative 0.01, generally recognized as a sales indicator.

Source: Cryptuquant

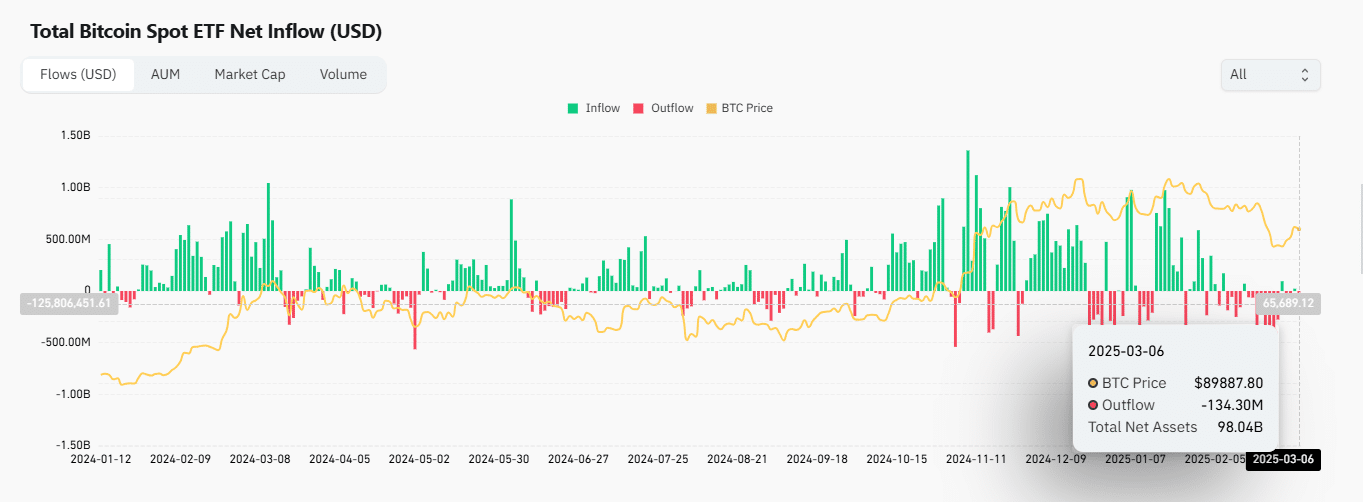

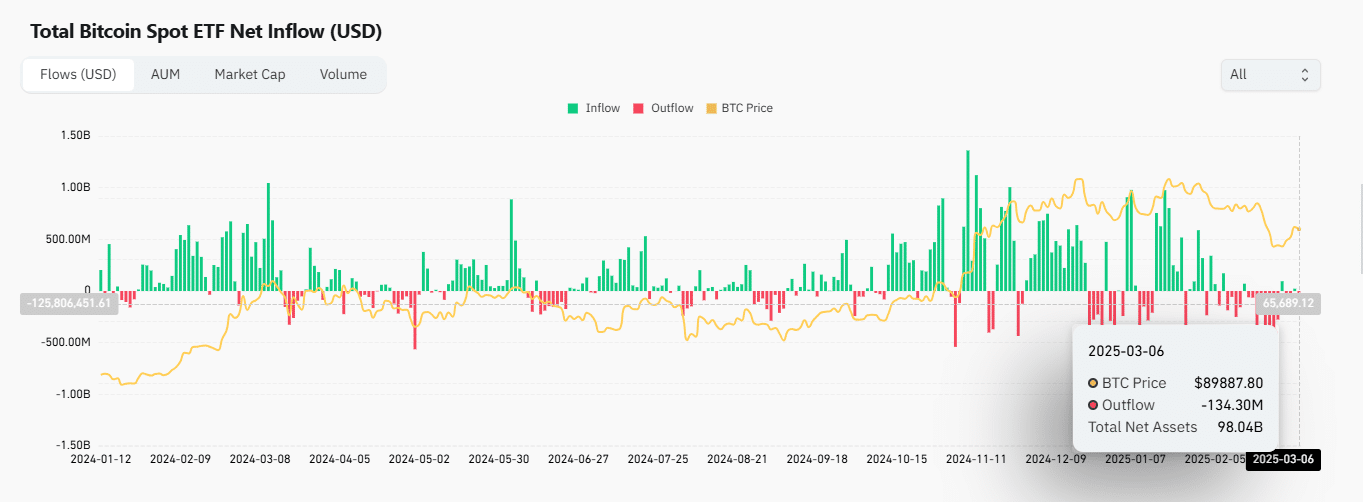

In the meantime, BTC Exchange-Traded Fund (ETF) Netflow data shows that institutional investors also sell in the current market environment.

On the last day, the Exchange Netflow became negative because institutional holders sold $ 134 million to BTC. This is surprising, because profit -controlled investors usually consider BTC’s price of $ 88,200, against the press, if a buy option during important events would consider.

In contrast to expectations, however, they choose to sell, which further contributes to Beerarish market activity.

Source: Coinglass

Bulls continue to exist, but with a low momentum

Some market segments remain bullish, but the momentum seems weak.

In the Derivatenmarkt, the financing percentage indicates a somewhat bullish bias, whereby Longs or Short’s position pay premiums.

At the time of writingIt was 0.011. This indicates that buyers pay premiums, anticipating a price increase. However, enthusiasm seems to decrease.

The financing speed is slightly above the Bearish threshold (below 0) and has fallen compared to the high of the previous day of 0.0042.

Source: Cryptuquant

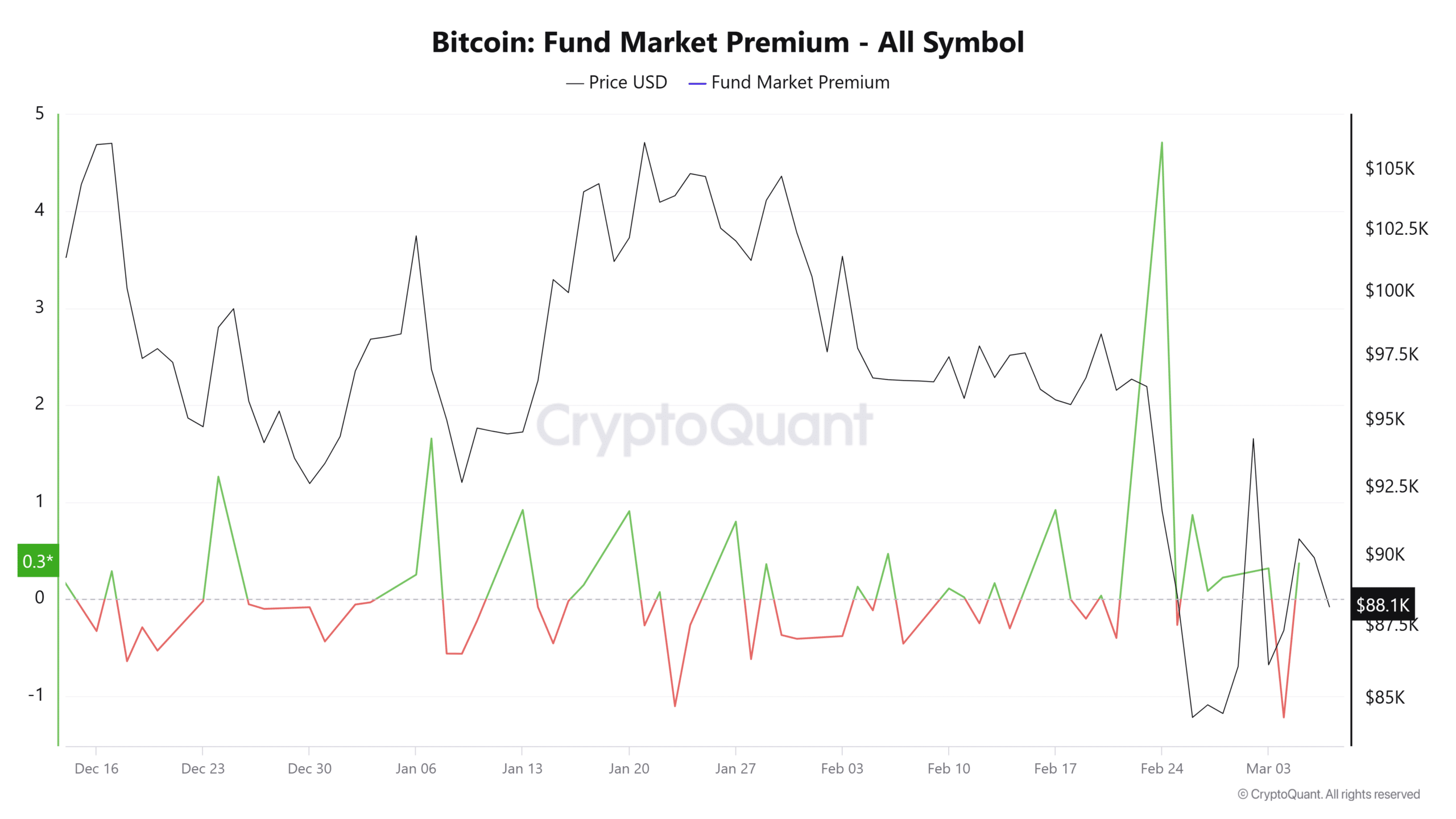

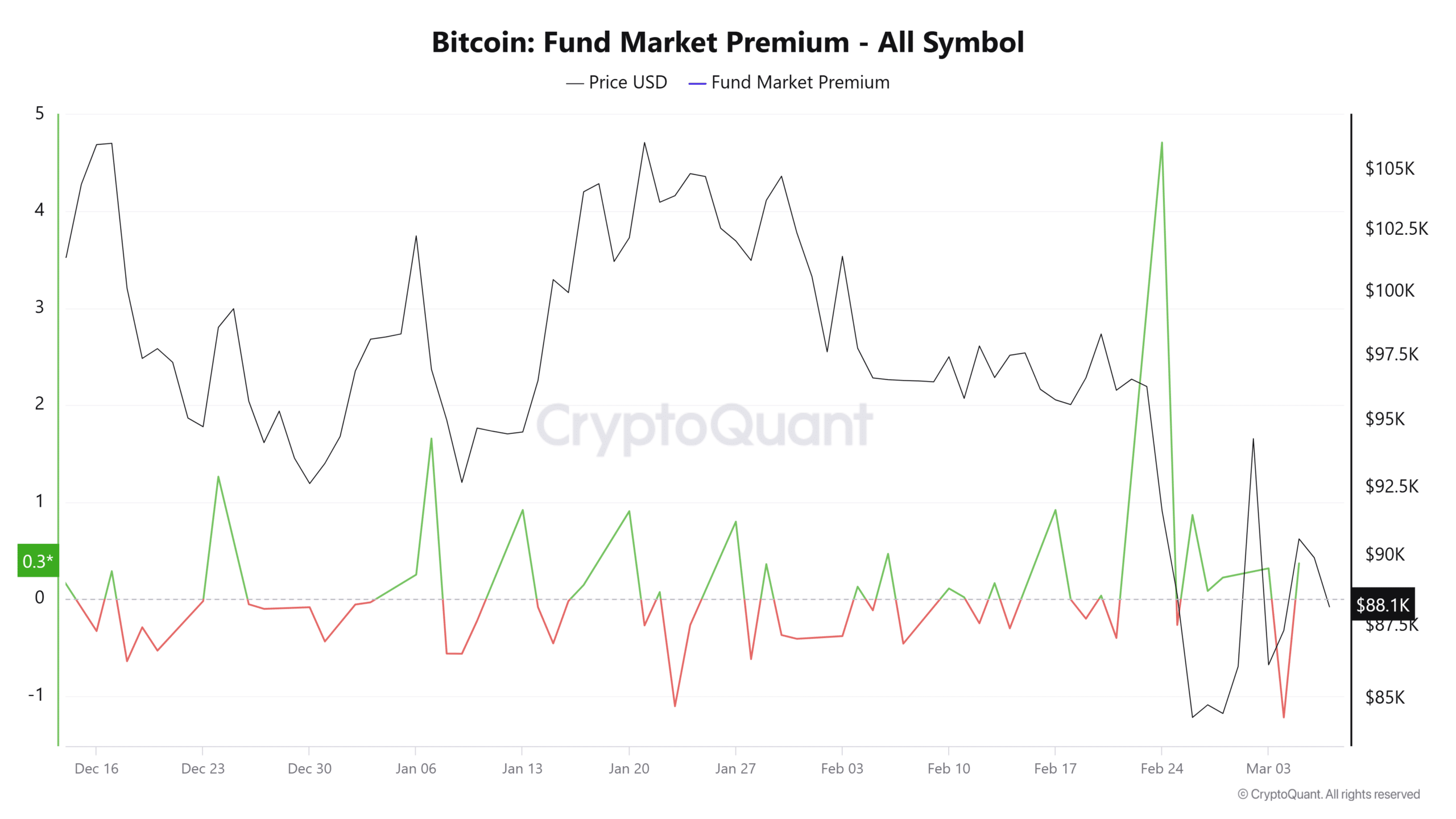

Likewise, The market premium of the fund shows that crypto investment funds such as GBTC are buying, although their pace remains slow.

The metric is currently 0.3, slightly above the neutral and bearish zone, which is careful.

If the Derivatenmarkt and Crypto -investment funds become BEARISH, the price of Bitcoin could further fall compared to its current level.