- Bitcoin market buzz intensified ahead of Trump’s inauguration, marking a pivotal moment for investors

- The market capitalization of cryptocurrencies has fallen by more than 3% in the past 24 hours

As the crypto market gears up for a historic moment, Bitcoin investors are keeping a close eye on developments upcoming inauguration by Donald Trump on January 20, 2025. Known for his recent shift to pro-crypto policies, Trump’s second term could herald significant changes for the cryptocurrency landscape.

The market is abuzz with speculation as to whether this political event will trigger another rally for Bitcoin or result in short-term profit taking.

Market optimism surrounding Trump’s inauguration

Donald Trump’s second term as US president has revived optimism in the cryptocurrency market. His pro-crypto position, which is a sharp departure from his previous skepticism, has raised expectations for policies that could favor digital assets. Following Trump’s victory in the 2024 election, Bitcoin rose significantly, surpassing $73,000 to rise to $108,000 as investor confidence grew.

This optimism stems from the potential for clearer regulatory frameworks and greater institutional adoption under his administration. Such factors have led to increased speculation that Bitcoin’s rally could continue, especially against the backdrop of better institutional participation.

Bitcoin’s post-election performance and investor sentiment

Since Trump’s victory in 2024, Bitcoin’s price has risen above $90,000, reflecting strong investor sentiment. Institutional inflows have played a crucial role, with the adoption of Bitcoin spot ETFs serving as a catalyst for bullish momentum.

On-chain data, such as net outflows from exchanges, indicated significant accumulation by whales and institutional investors, boosting long-term confidence in BTC.

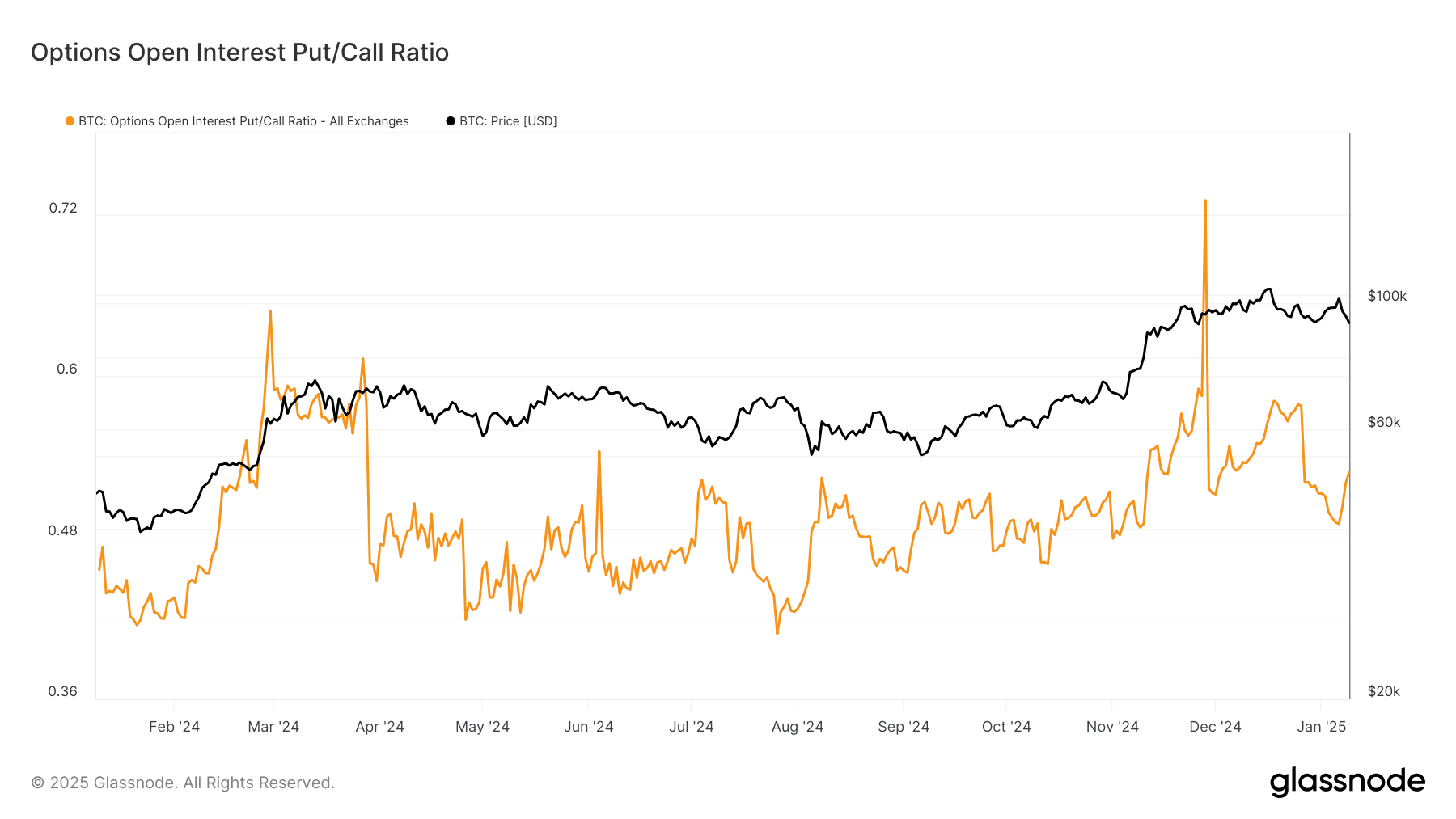

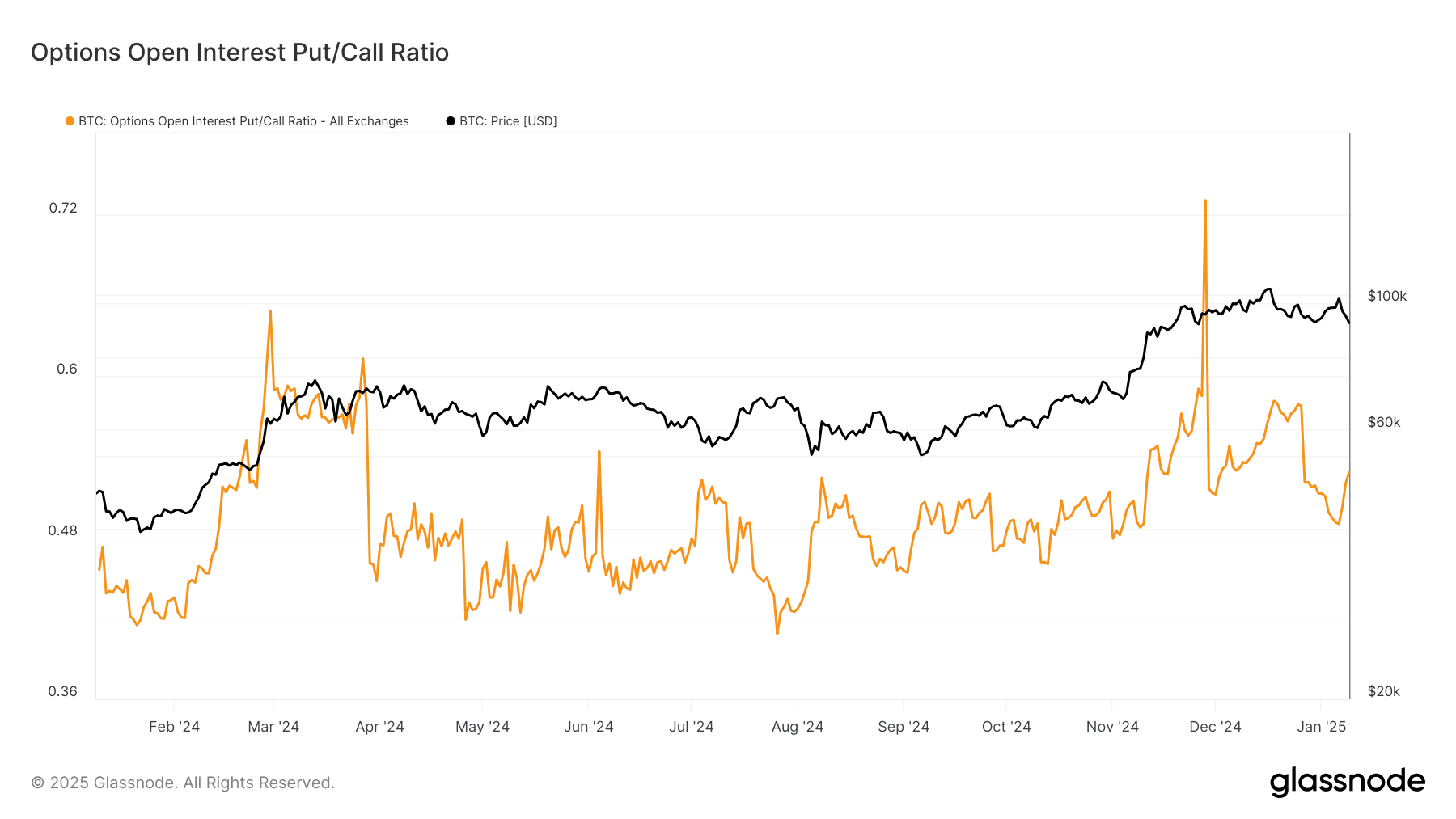

Source: Glassnode

The Options Open Interest Put/Call Ratio revealed an interesting shift in market sentiment. The increasing preference for call options indicated growing optimism about further price increases. This trend was in line with expectations of favorable policies and innovation under Trump’s leadership.

The correlation of BTC with gold and DXY

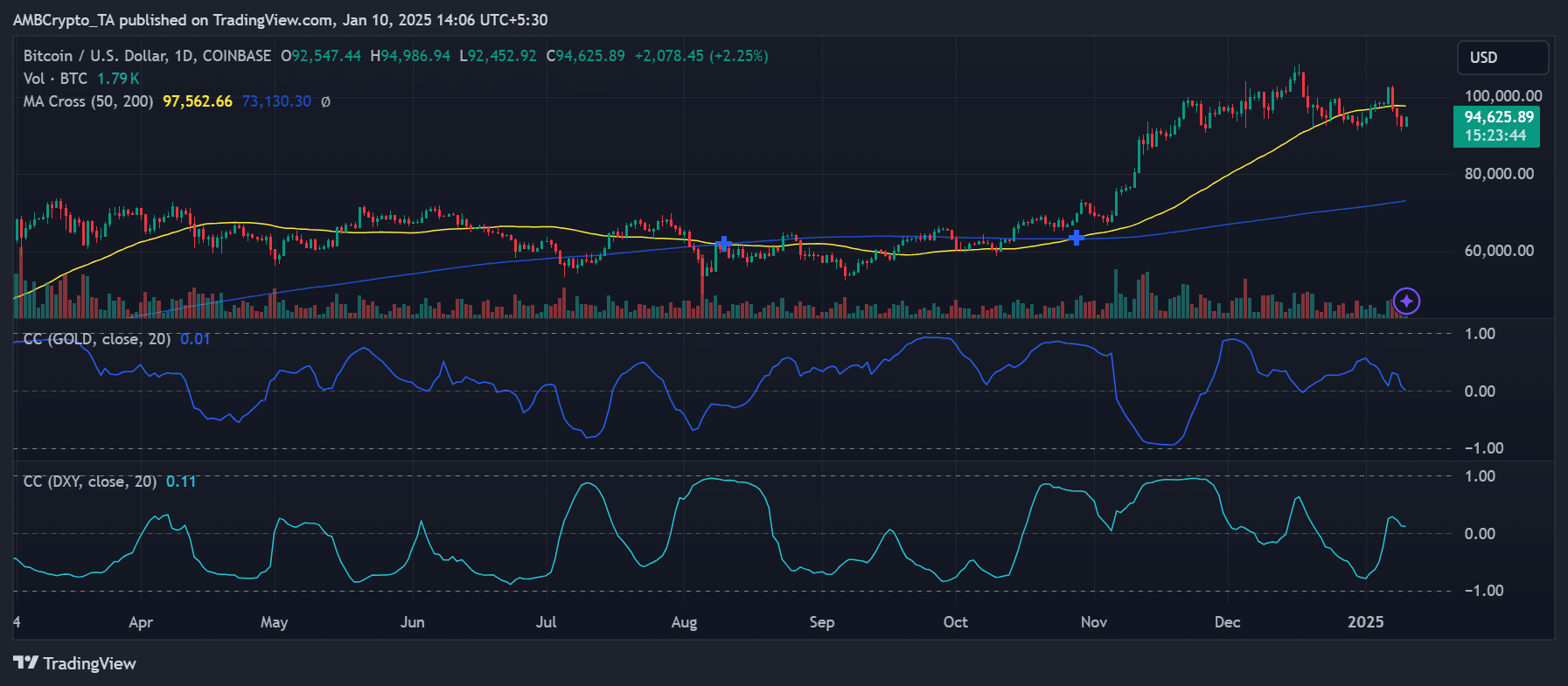

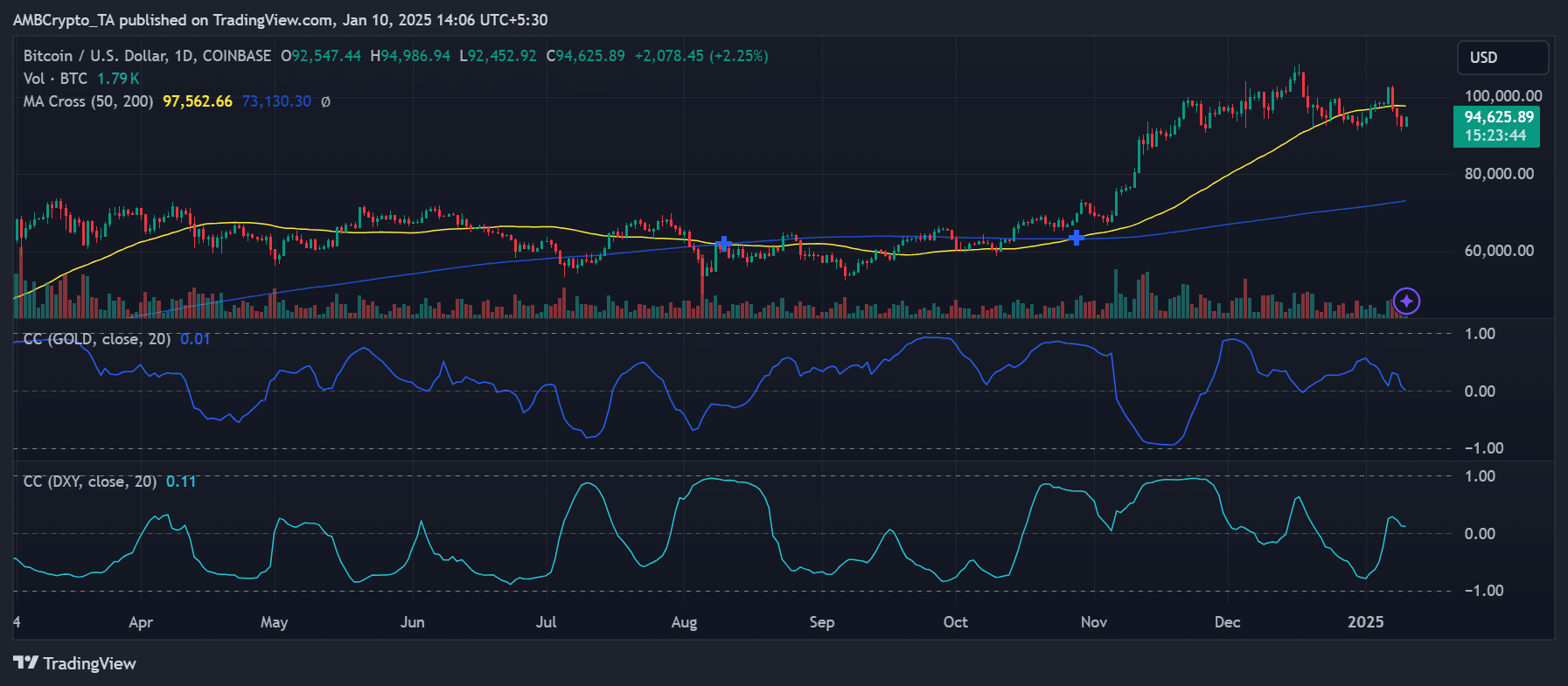

An analysis of Bitcoin’s correlation with gold and the US Dollar Index (DXY) provided some critical insights into current market dynamics. The chart highlighted Bitcoin’s positive correlation with gold, underscoring its role as a hedge against economic uncertainties.

At the same time, the inverse correlation with the DXY reflected Bitcoin’s sensitivity to dollar movements, where a weakening dollar could act as a tailwind for BTC.

Source: TradingView

These correlations underscore Bitcoin’s evolving story as both a safe haven and a speculative investment, depending on macroeconomic conditions. This duality uniquely positions BTC within the financial ecosystem and is attractive to many investors.

Cautious Optimism – A ‘buy the news’ or ‘sell the news’ event?

Despite the optimism surrounding Trump’s pro-crypto rhetoric, caution is advised. Historical trends suggest that major events often lead to profit taking, which leads to short-term market volatility. The potential for a ‘sell the news’ scenario cannot be ignored, especially given the speculative buying that has driven Bitcoin’s recent rally.

Moreover, there are major uncertainties about Trump’s actual policy implementations. While his campaign rhetoric was crypto-friendly, the market awaits tangible actions to validate these expectations. Any missteps could dampen the prevailing enthusiasm.

What lies ahead for Bitcoin and the crypto market?

The period leading up to Trump’s inauguration will be a mix of optimism and uncertainty. Key factors such as regulatory clarity, institutional behavior and macroeconomic trends will determine Bitcoin’s trajectory. While the Trump administration is expected to provide a supportive backdrop for digital assets, the sustainability of the current rally depends on how the market digests these developments.

– Is your portfolio green? Check out the Bitcoin profit calculator

Bitcoin’s unique position, with correlations to both gold and the DXY, adds an intriguing layer to the price dynamics. As the market anticipates Trump’s policies, Bitcoin could emerge as a standout in 2025, combining the characteristics of both traditional safe havens and fast-growing assets. Investors are now watching closely to determine whether Trump’s inauguration will catalyze a new crypto era or trigger a short-lived speculative spike.