- Trump seemed to test the most important support at $ 23.88, with the RSI at 32.79 signalings over -sold circumstances

- Market sentiment was careful as the social volume dropped and the open interest rate dropped by 4.54%

Official [TRUMP] Can be on the edge of a rebound, because the TD -sequential indicator flashed a purchase signal on the daily graph. After a long -term downward trend, this can mark the start of a potential recovery phase.

If the purchasing pressure increases, the price can try to reclaim the most important resistance levels. However, uncertainty continues to continue while the market conditions continue to fluctuate. Will this signal cause a persistent bullish reversal in the coming days?

A constant controversial debate

The Trump -Token has fueled heated discussions in the crypto community, whereby some people see it as a bullish catalyst and others warned of potential instability. On the one hand, the launch showed the growing interest in political memecoins, which can attract new liquidity.

However, critics claim that the capital has deposited from more renowned assets, leading to volatility in several markets. At the time of the press, the Altcoin traded at $ 24.27, a decrease of 5.98% – a sign of mixed investor sentiment.

Trump’s price promotion – Testing important support levels

The price of the Memecoin is consolidated for $ 23.88 in a critical support zone – a level that could determine the next major movement. If Bulls succeed in pushing it above $ 28.13, an increase of $ 40 could follow, giving traders renewed confidence.

Moreover, the relative strength index (RSI) was at 32.79, indicating that Trump can approach over -selling territory. If the RSI rises above 37.51 in the short term, buying Momentum can strengthen, which improves the opportunities for an outbreak.

Source: TradingView

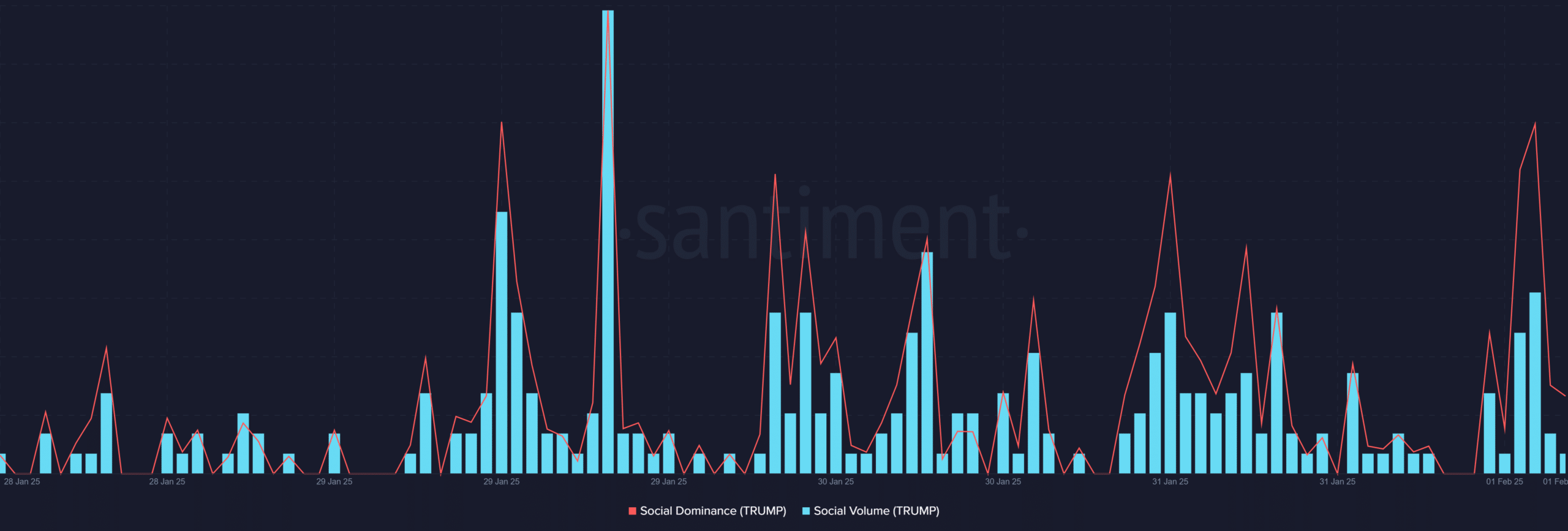

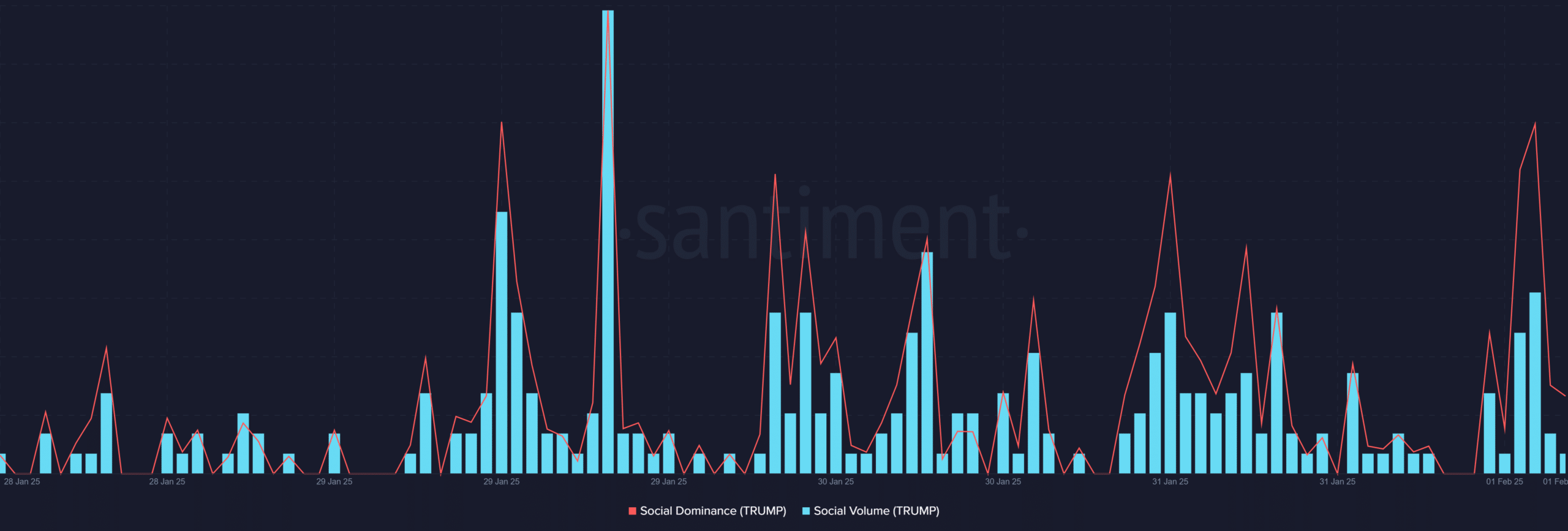

Trump Social Volume and Dominance – A fading hype?

While Trump initially received a huge grip, recent data hinted with a decrease in his social volume and dominance. Santiment Analytics even revealed that social volume peaked at 2.0 entries per hour on January 29. However, since then it has fallen considerably.

Moreover, social dominance fell to 0.33% – a sign of a fall in trading discussions around token. This reduction in the hype can mean a weaker buying pressure, making it more difficult for bulls to support an upward trend in the charts.

Source: Santiment

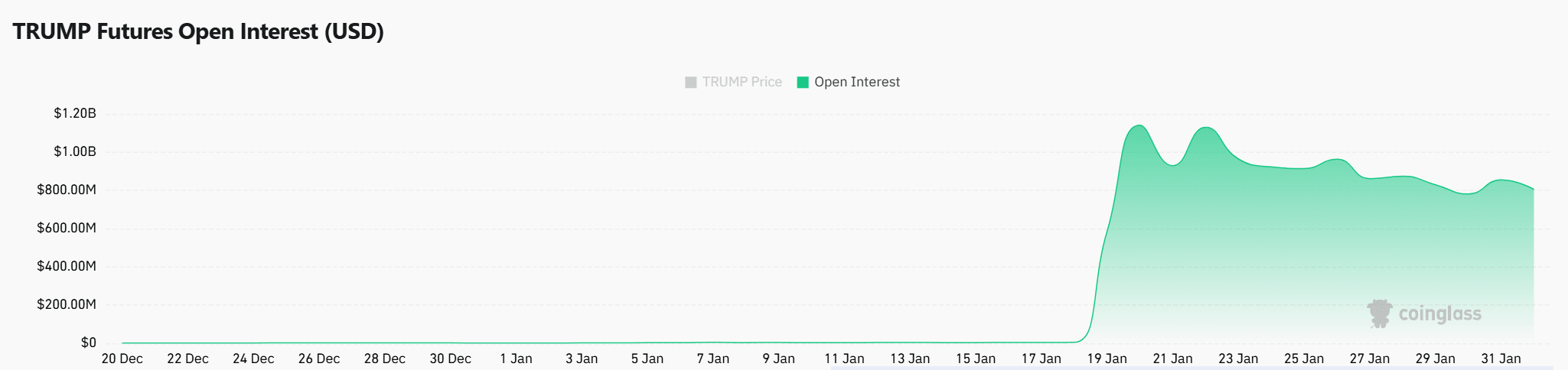

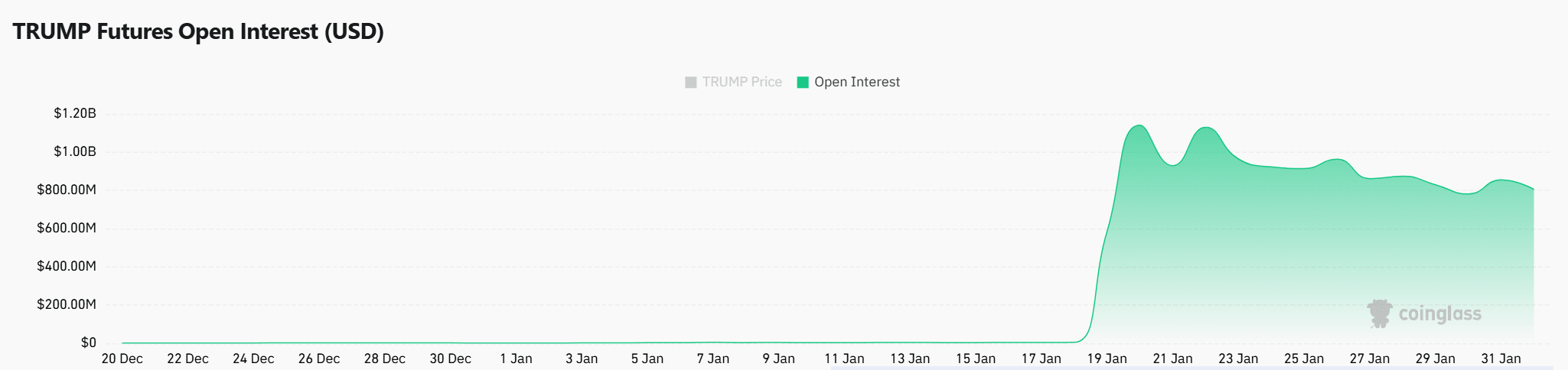

Open interest – do traders trust trust?

Open interest rate fell by 4.54% to $ 833.39 million, which indicates a reduced activity of traders. Usually increasing open interest means trusting a possible movement, but the last decline seemed to point to hesitation.

Moreover, this deterioration can mean that traders close positions, rather than betting on a large price opportunities. If open interest continues to fall, this can refer to a further downward risk.

Source: Coinglass

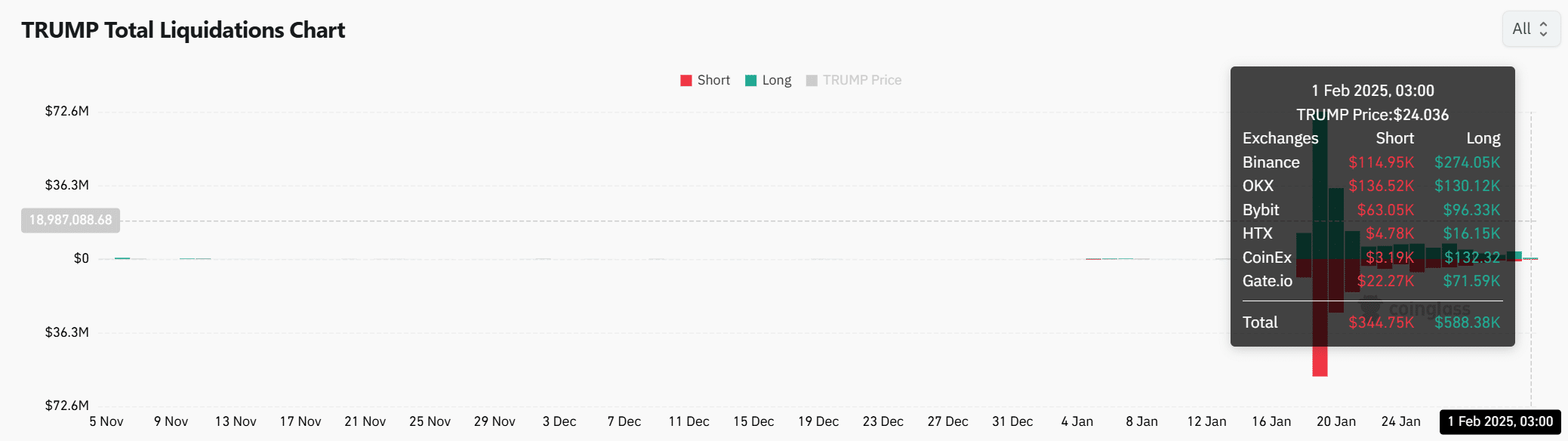

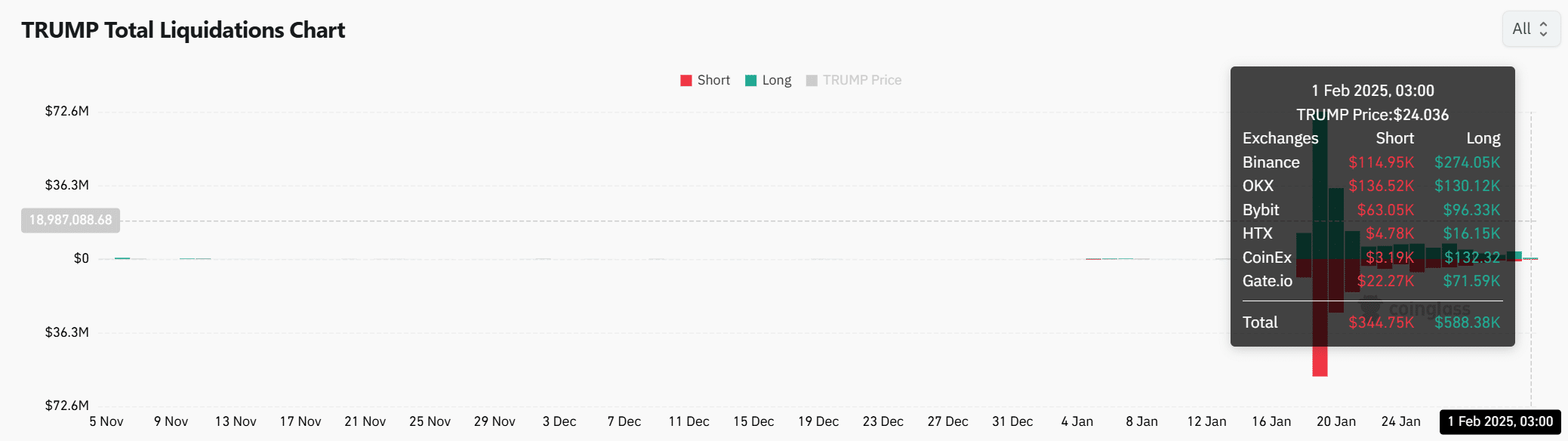

Total liquidations – what do they reveal?

Data from the liquidations showed that $ 344.75k on short positions and $ 588.38k were wiped out in long positions. Simply put, both bulls and bears face challenges as the price volatility increased across the board.

However, if short liquidations intensify, a short squeeze could bring the price of Trump higher in the charts. That is why traders must keep a close eye on the liquidation trends for signs of a coming outbreak.

Source: Coinglass

Trump’s price remains at a critical moment, where breaking above $ 28.13 could cause a bullish reversal. On the contrary, failure to support can lead to more losses.

Read official Trump’s [TRUMP] Price forecast 2025-26

With a decreasing social volume and open interest, the market sentiment may seem somewhat careful. However, if Bullish Momentum builds up, Trump could reclaim lost terrain in the coming days.

For now, traders must view the most important levels before they confirm a clear trend shift.