- The post-election market rally will see Bitcoin gain 30%, with XRP and ADA outperforming.

- Analysts predict a potential Bitcoin correction amid mixed altcoin performance and investor caution.

The cryptocurrency market saw a remarkable rise following the victory of Donald Trump as the 47th President of the United States.

This post-election boom has led to widespread optimism among investors, with many attributing the bullish momentum to the election outcome.

However, discussions are emerging about a possible slowdown as historical data on market trends during US election years suggests the rally could decline after Trump’s inauguration on January 20, 2025.

These insights add caution to the otherwise optimistic sentiment in the crypto market.

What do historical trends suggest?

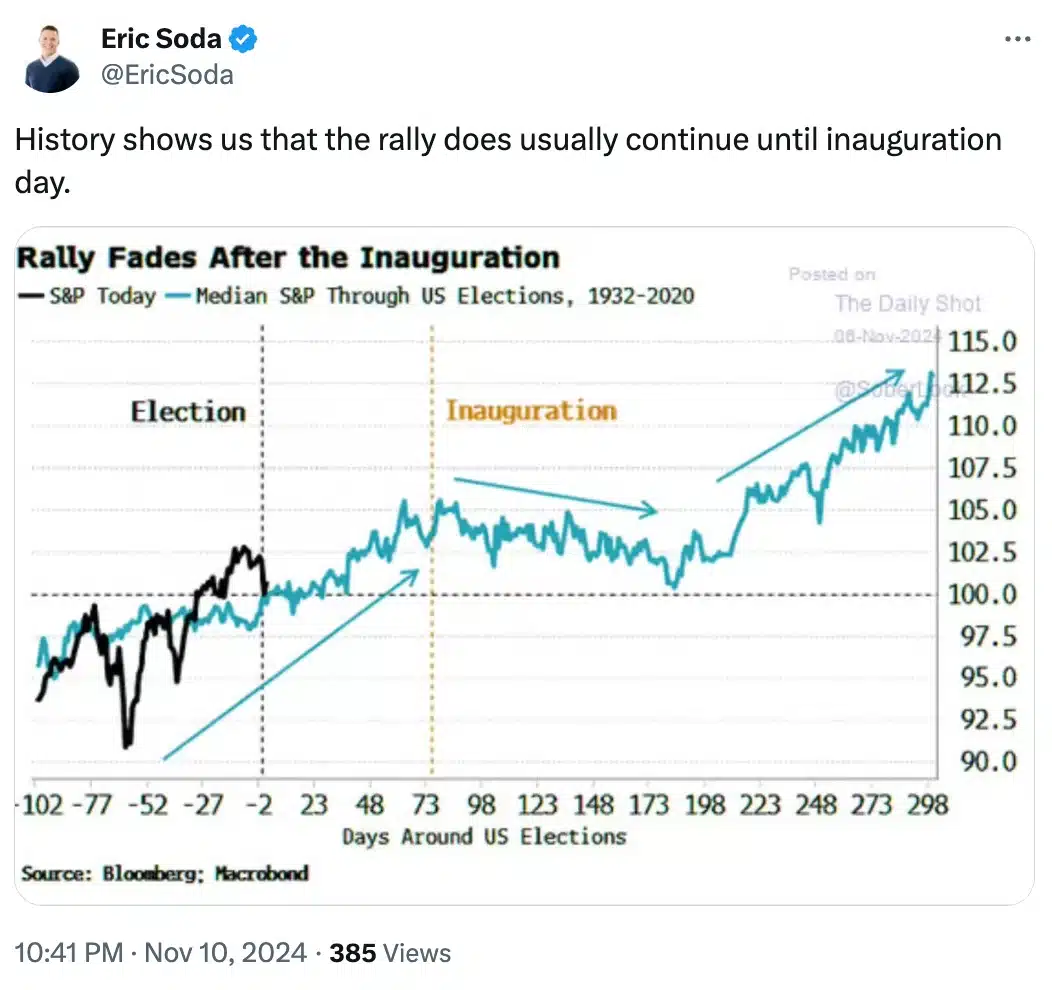

Historical patterns analyzed by Bloomberg and Macrobond Financial show that US markets, including stocks and cryptocurrencies like Bitcoin, [BTC]often rise in the weeks following presidential elections, but often lose momentum once the president-elect takes office.

The current market rally, fueled by optimism surrounding the new administration, reflects this trend, with the S&P 500 recently closing in on its 50th record high of the year.

However, with more than two months remaining until Inauguration Day, analysts warn that investor enthusiasm could exceed realistic expectations, signaling a possible cooling-off period ahead.

Managers weigh in

Scott Chronert, Citi’s U.S. equity strategist, wrote as much about this in a November research note.

“[I]Investors should tactically abandon a post-election rally if the S&P 500 exceeds our year-end target of 6,100, which roughly equates to a +5% index gain from Election Day.”

Data from research group TS Lombard shows that market euphoria tends to be stronger when the president-elect belongs to the Republican party, which is often perceived as more business-friendly.

This dynamic amplifies post-election rallies as investor sentiment aligns with expectations of pro-business policies, tax incentives and deregulation initiatives that typically come from Republican administrations.

Such trends underscore the heightened optimism that has fueled recent market gains, especially in the wake of the current Republican victory.

Entrepreneur and investor Eric Soda confirmed this pattern even further with a chart in which he stated:

Source: Eric Soda/X

Trump’s crypto impact after the election

For those unaware, Bitcoin’s post-election surge has been particularly notable, with its value increasing by over 30%, cementing Bitcoin’s status as the leading cryptocurrency.

So is Solana [SOL] reflected these gains and highlighted bullish sentiment in the broader market.

So while analysts are optimistic that Bitcoin’s upward trajectory will continue beyond the inauguration, they caution that the path ahead may not be without challenges as the market adapts to the evolving economic and policy landscapes.

As expected, Ash Crypto put it best when he said:

Source: Ash Crypto/X

However, not all analysts share the prevailing optimism about Bitcoin’s uninterrupted rally.

For example, Ryan Lee, chief analyst at Bitget Research, warns that Bitcoin’s price could undergo a significant correction of up to 30% before regaining its bullish momentum.

Current market trends

Currently, according to CoinMarketCapBitcoin traded at $96,198.85, reflecting a slight decline of 0.08% in the past 24 hours.

Meanwhile, altcoins have shown mixed performance: Ethereum [ETH] is priced at $3,663.51, down 0.26%, while Solana has risen to $229.68, with a gain of 1.03%.

Especially Ripple[XRP] and Cardano [ADA] have emerged as standout performers, with impressive daily gains of over 13% and 15% respectively, demonstrating the divergent momentum within the crypto market.