- BTC hit a two-week high above $65,000 after Trump’s attack.

- The macroeconomic and US political situation looks great for BTC, despite Mount Gox’s offer.

Bitcoin [BTC] rose 7% weekly and traded above $65,000, boosted in part by the crypto market and updates from the US political scene.

Last week, the German government lifted supply pressure on $50,000 worth of BTC, setting the stage for BTC’s recovery. After bottoming below $55,000, BTC recovered to reclaim $60,000, gaining 8.8% last week.

Trump Boosts Bitcoin Recovery?

The recovery continued into the current week, pushing the largest digital asset above $65,000. This week’s bullish momentum coincided with the botched assassination attempt about Donald Trump on July 13.

Additionally, the crypto market has positively rated Trump’s Vice President (VP), Senator James David Vance of Ohio, as pro-crypto. JD Vance has reportedly supported several crypto legislations, including the repeal of SAB 121, and owns BTC.

In response to Trump’s VP pick, Ryan Adams of Bankless declared,

“JD Vance is Trump’s VP pick and the likely next Vice President. He is a big supporter of crypto. He voted for the repeal of SAB121. He is a holder – he owned $250,000 worth of Bitcoin in 2022 – probably more now. He has criticized Gensler in open letters. Further evidence that the Trump White House is pro-crypto.”

Interestingly, Trump’s choice on July 15 also coincided with a 6% rally for BTC, accounting for the biggest daily gain this week.

Can BTC Break Above $67,000?

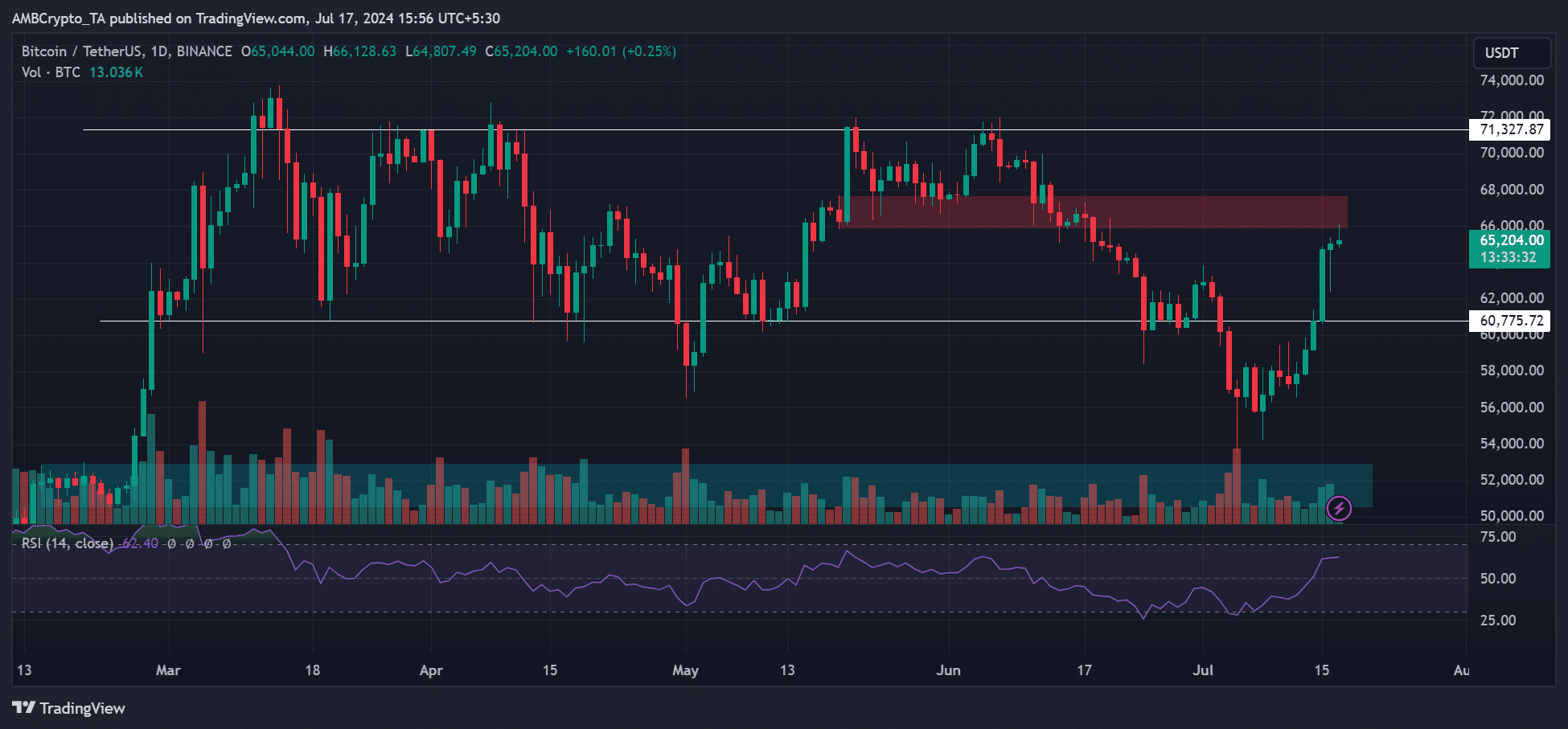

Source: BTC/USDT

However, the recovery has hit a roadblock and breaker, highlighted in red, near $67,000. The asset could reach the $70,000 level despite this short-term hurdle, according to BTC price chart analyst Cryp Nuevo. The analyst projected that BTC could reach range highs above $70K.

According to some market analystseven Mount Gox’s continued redemption, with over 30% of BTC in flux, may not impact the recovery. At the time of writing, BTC was above $65,000 despite Mount Gox’s massive move.

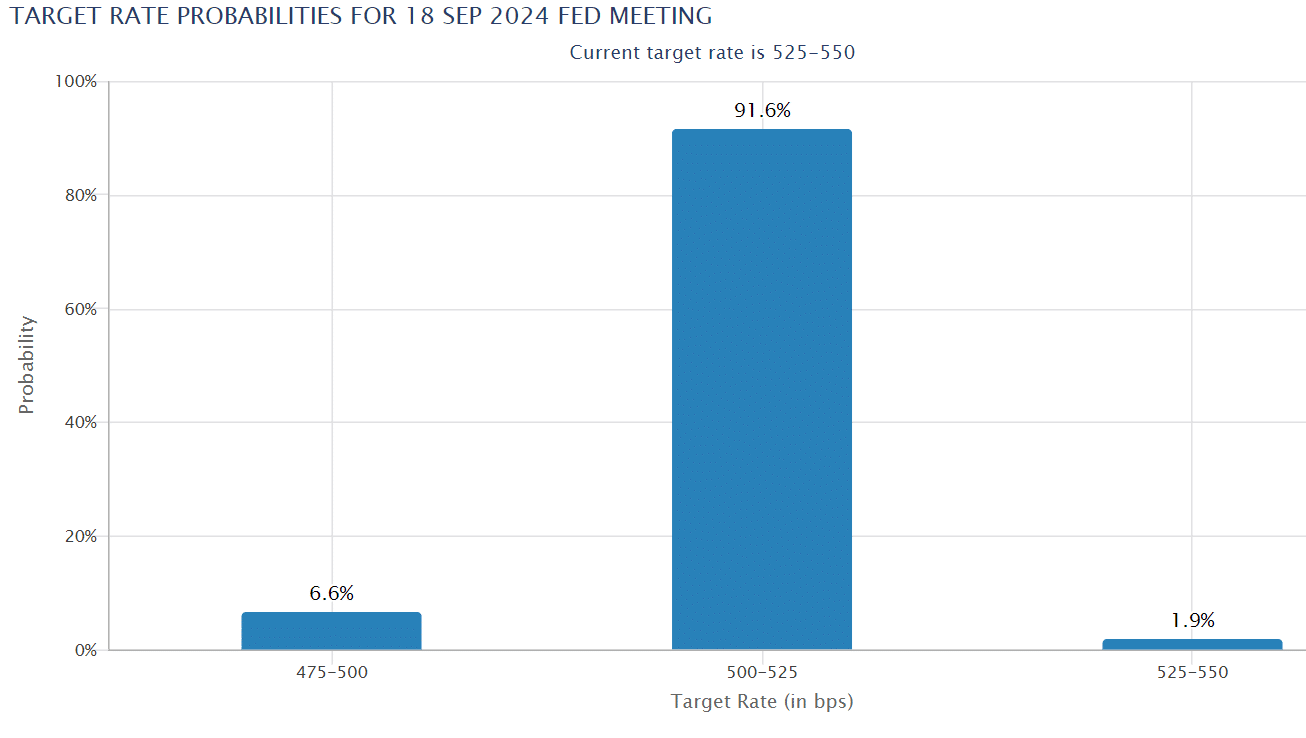

Meanwhile, the long-term outlook remains bullish, especially from a macro perspective. About 90% of interest rate traders expect Fed rate cuts in September, which could fuel risk assets including BTC and crypto markets.

Source: CME Fed Watch Tool