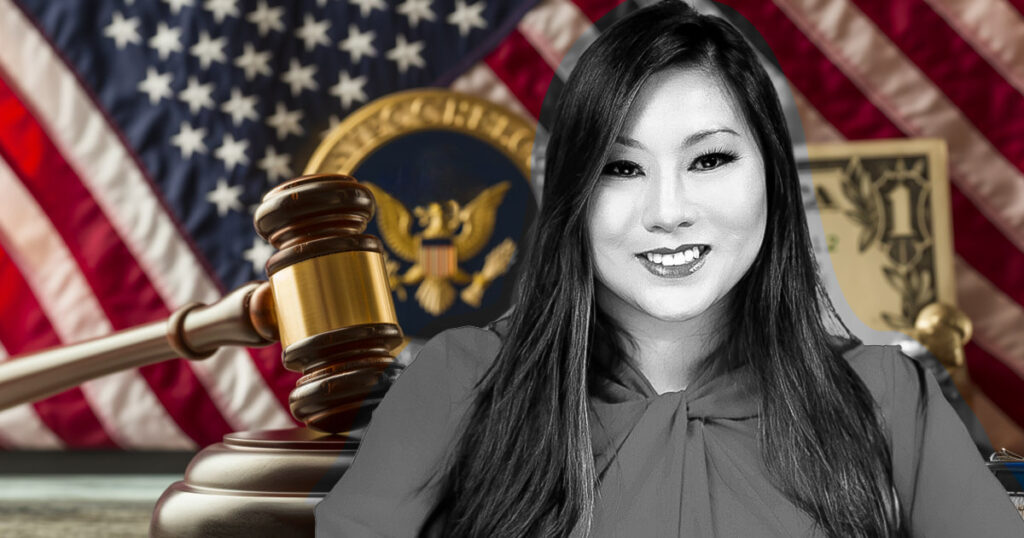

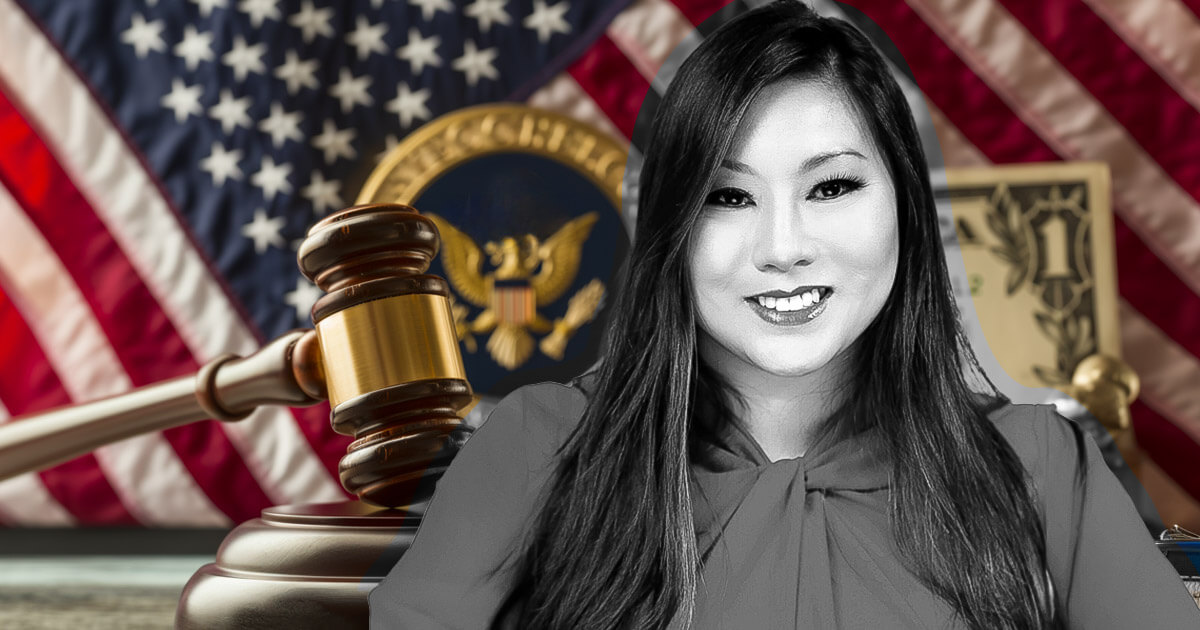

President Donald Trump has reportedly selected Caroline Pham, a junior commissioner at the Commodity Futures Trading Commission (CFTC), as the agency’s acting chair, Bloomberg News reported on January 20, citing sources familiar with the matter.

According to the news outlet’s sources, the CFTC’s five commissioners voted Monday to confirm Pham as acting chairman as the appointment had not been officially announced. Traditionally, the committee supports the new government’s candidate for the acting role.

Pham was appointed commissioner by former President Joe Biden in 2021 and has emerged as a prominent advocate for regulatory clarity in the U.S. crypto industry.

During her tenure, she has championed innovative frameworks such as regulatory sandboxes, which allow companies to test their products and services under strict supervision without the burden of full compliance.

In September 2023, speaking at a think tank Cato Institute event, Pham proposed a government-led pilot program to promote the development of compliant digital asset markets and tokenization.

She sees the program as a joint effort involving regulators and industry stakeholders to establish guidelines for risk management, transparency and fraud prevention.

As a result, Pham stated that the program would boost liquidity and competition while addressing risks and preventing fraud in the crypto market.

Furthermore, the reported new acting chairman of the CFTC noted that the US risks falling behind international counterparts that promote strategic and long-term crypto policies.

Nominations for a permanent role

While Pham will assume the role of acting chairman, the search for a permanent CFTC chairman continues, according to the report.

Other contenders include Summer Mersinger, the top Republican member of the CFTC, and Brian Quintenz, a former commissioner who now leads policy for Andreessen Horowitz’s crypto division, a16z Crypto. Both nominees are pro-crypto and they were reportedly the ‘prospective front runners’ for the role.

Whoever is ultimately named permanent chairman will face increasing pressure to navigate the intersection of traditional financial markets and the increasingly influential digital asset sector.

The Financial Innovation and Technology for the 21st Century Act, currently up for a vote, could give the CFTC more authority over digital commodity markets, including exchanges.