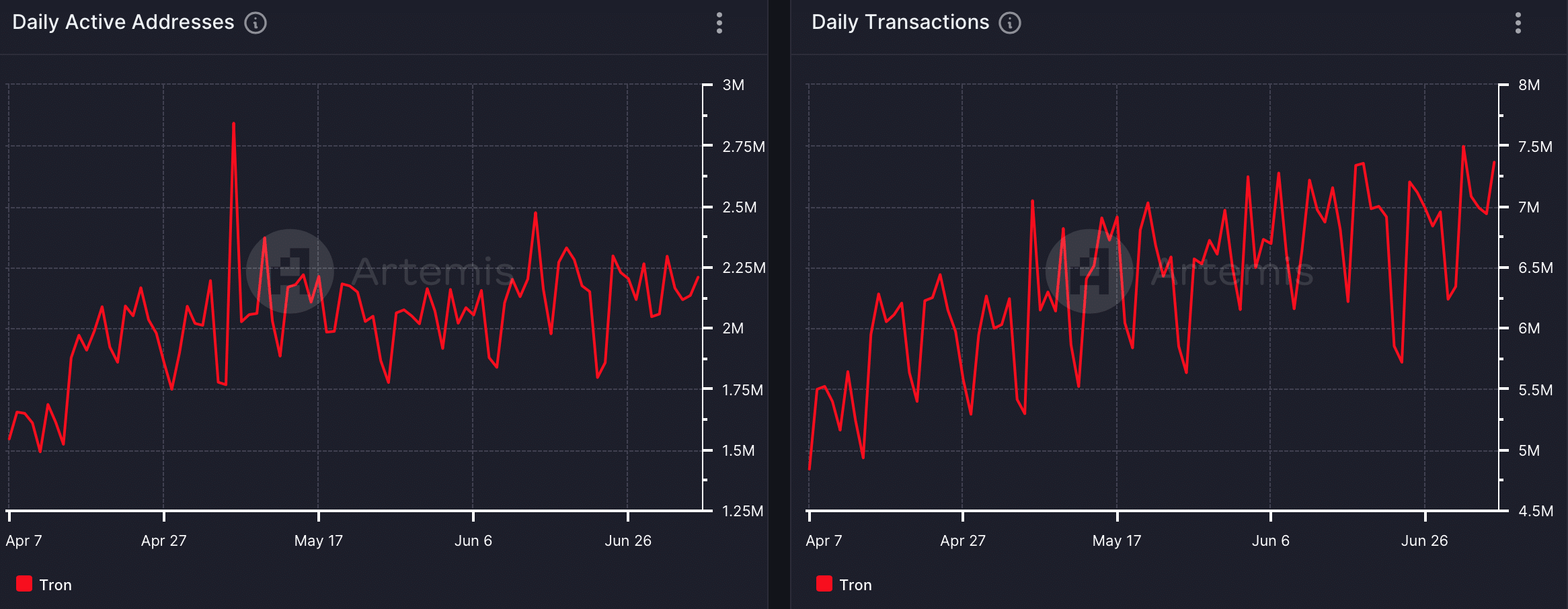

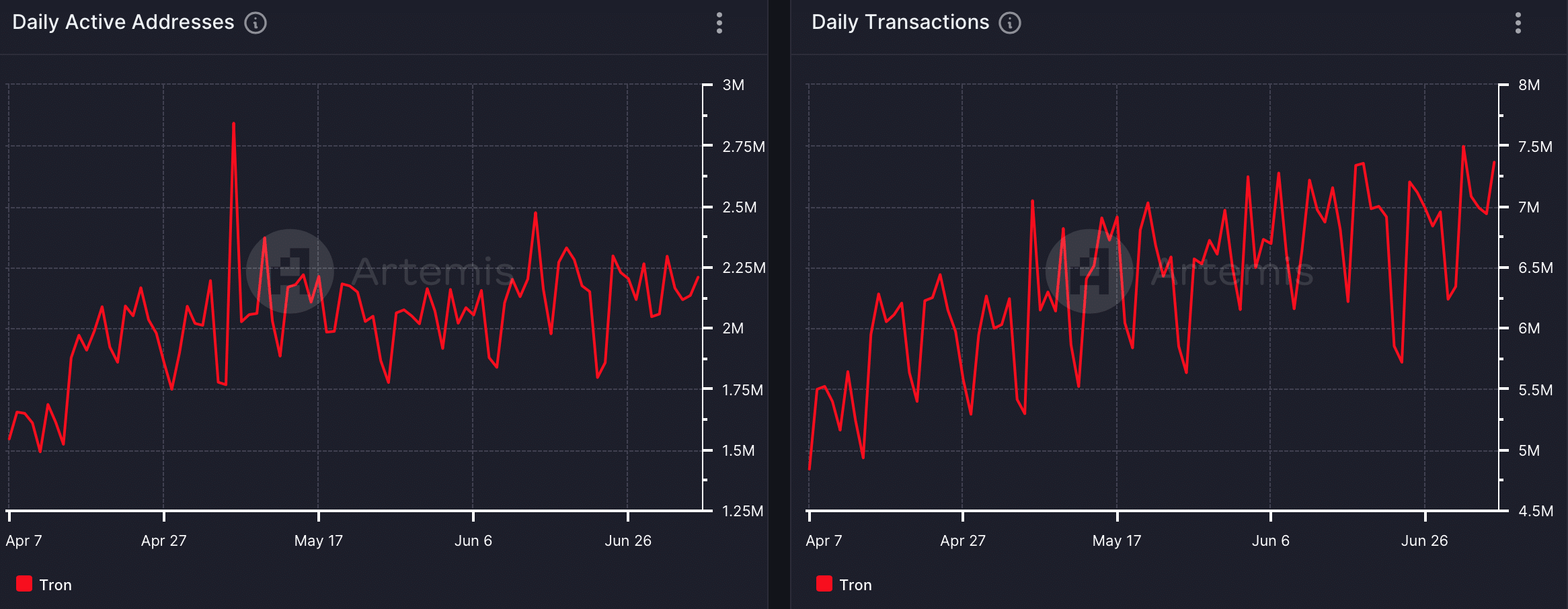

- Tron’s daily active addresses rose consistently.

- The price of TRX is up more than 13% in the last 30 days.

Tron [TRX] has been known for its robust networking activity in recent years. The good news was that the blockchain managed to maintain its growth again last month. ‘

The price of the blockchain’s native token also followed a similar growing trend.

A look at Tron’s network activity

TRONSCAN, a popular X-handle that posts updates related to the blockchain ecosystem, posted tweet highlighting the blockchain’s recent achievements.

The tweet stated that the average daily transactions on TRON over the past 30 days were 6.84 million. This represents an increase of 6% compared to the previous 30 day period, clearly reflecting an increase in blockchain usage.

To check TRX’s long-term growth, AMBCrypto took a look at Atremis’ facts. We found that the blockchain’s daily active addresses have been growing steadily over the past three months.

Thanks to that, the daily transactions of the blockchain also followed a similar trend. This meant consistent growth in TRX adoption.

Source: Artemis

The better news was that the blockchain’s performance in terms of value captured was good.

We found that both TRX’s fees and revenues have remained consistent and stable over the past three months. However, Tron’s performance in the DeFi market was not comparable.

This seemed to be the case, as TRX’s TVL fell sharply over the past three months.

TRX investors are rejoicing

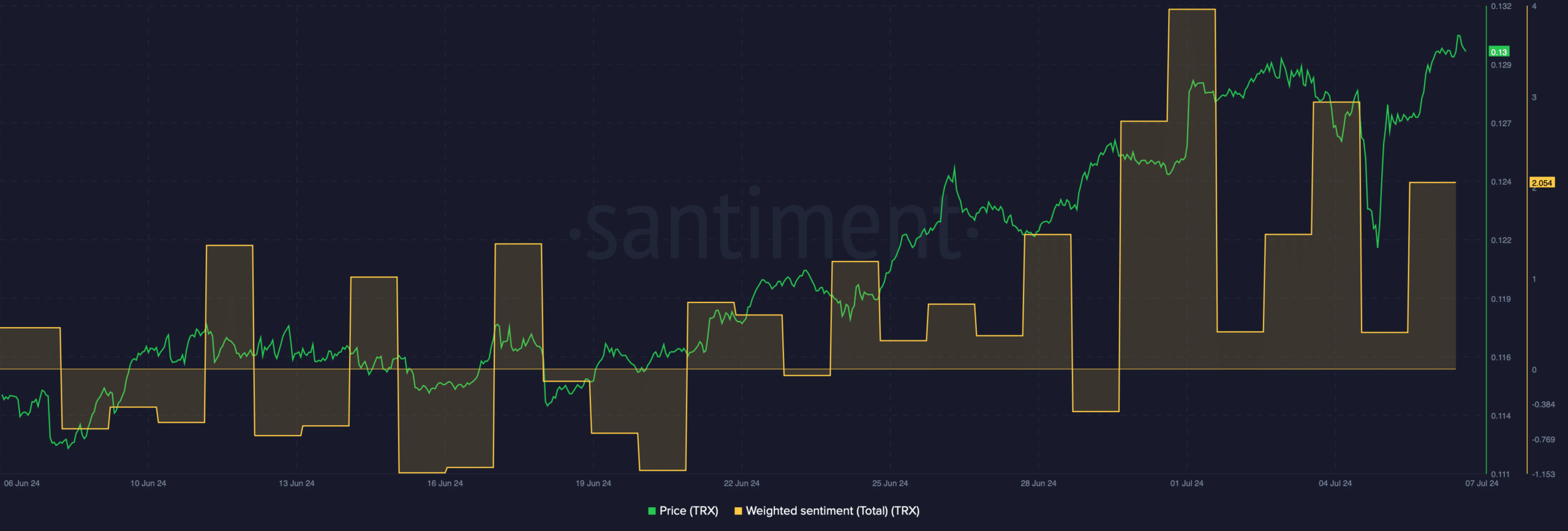

While blockchain network activity has been robust, TRX’s performance on the price front also seemed bullish.

CoinMarketCaps facts revealed that the token’s price has increased by more than 13% in the past 30 days. Over the past seven days, things have also looked pretty good, as the token’s value has risen by over 3.5%.

At the time of writing, TRX was trading at $0.1297 with a market cap of over $11.3 billion. Investor confidence in TRX also remained high over the past month.

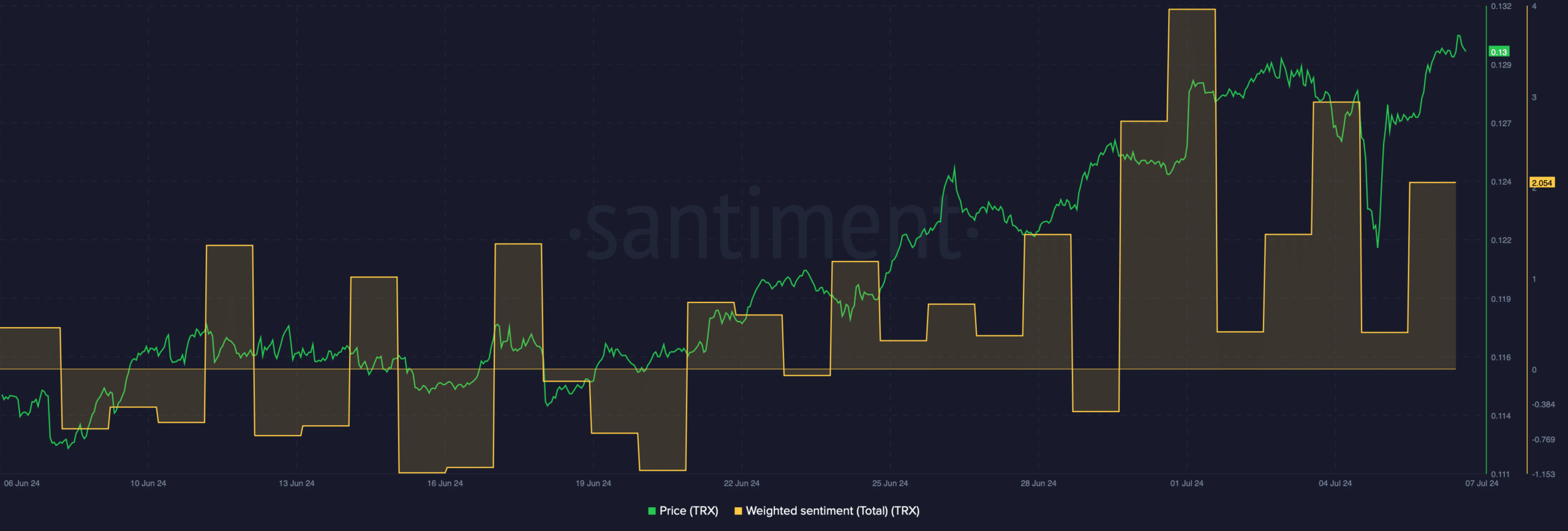

This was evident from the highly weighted sentiment graph.

Source: Santiment

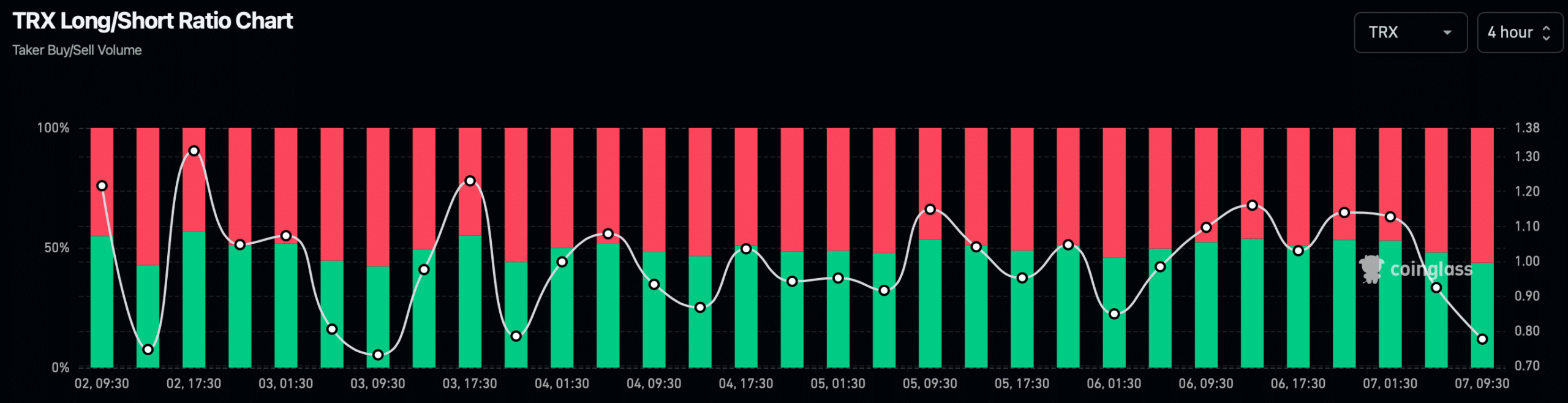

AMBCrypto then checked Coinglass’ data to find out what to expect from the token.

According to our analysis, TRX’s long/short ratio had fallen. A decline in the measure means that there were more short positions in the market than long positions, which can be considered a bearish signal.

Source: Coinglass

Realistic or not, here it is TRX market cap in BTC‘s conditions

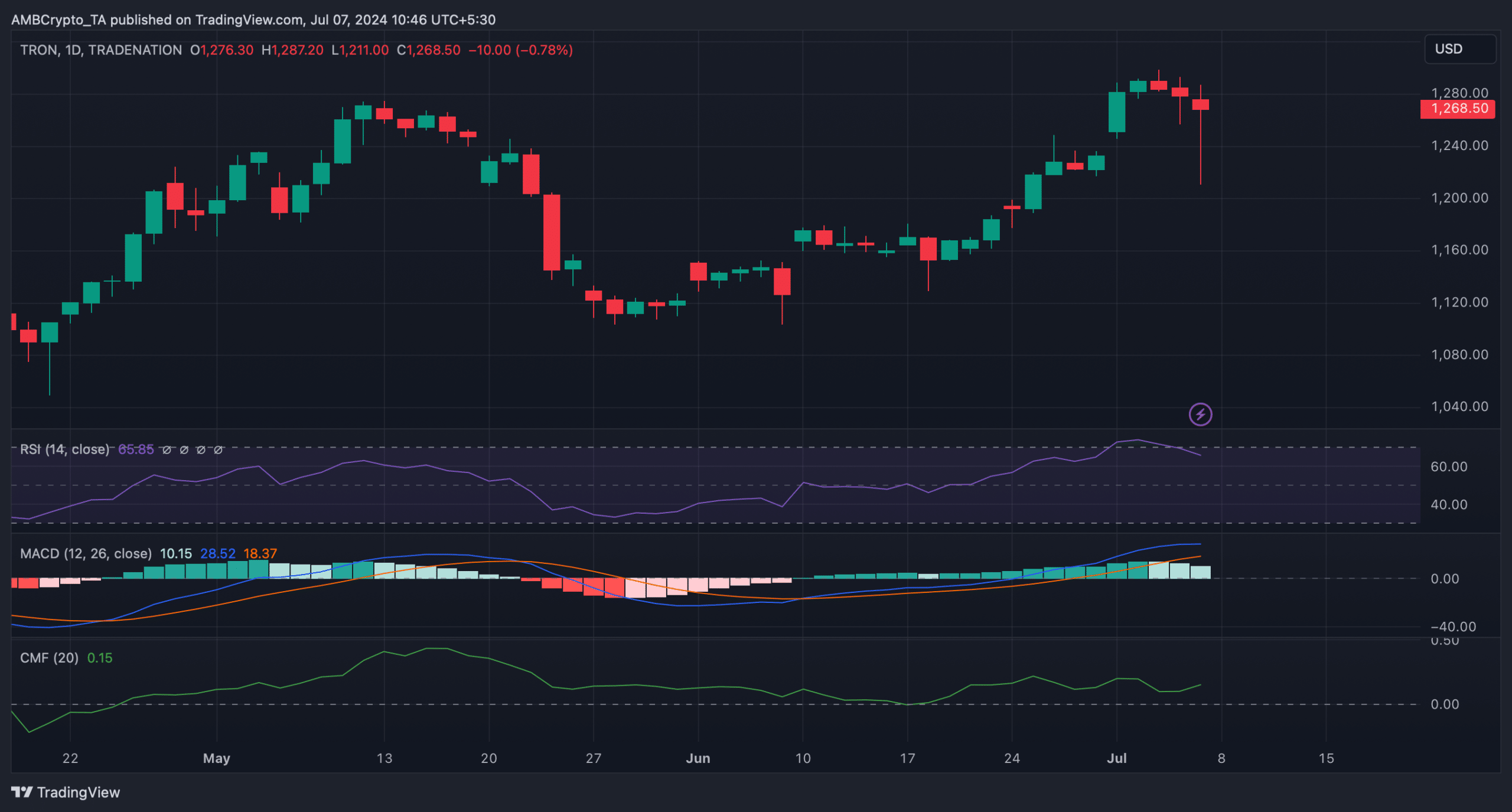

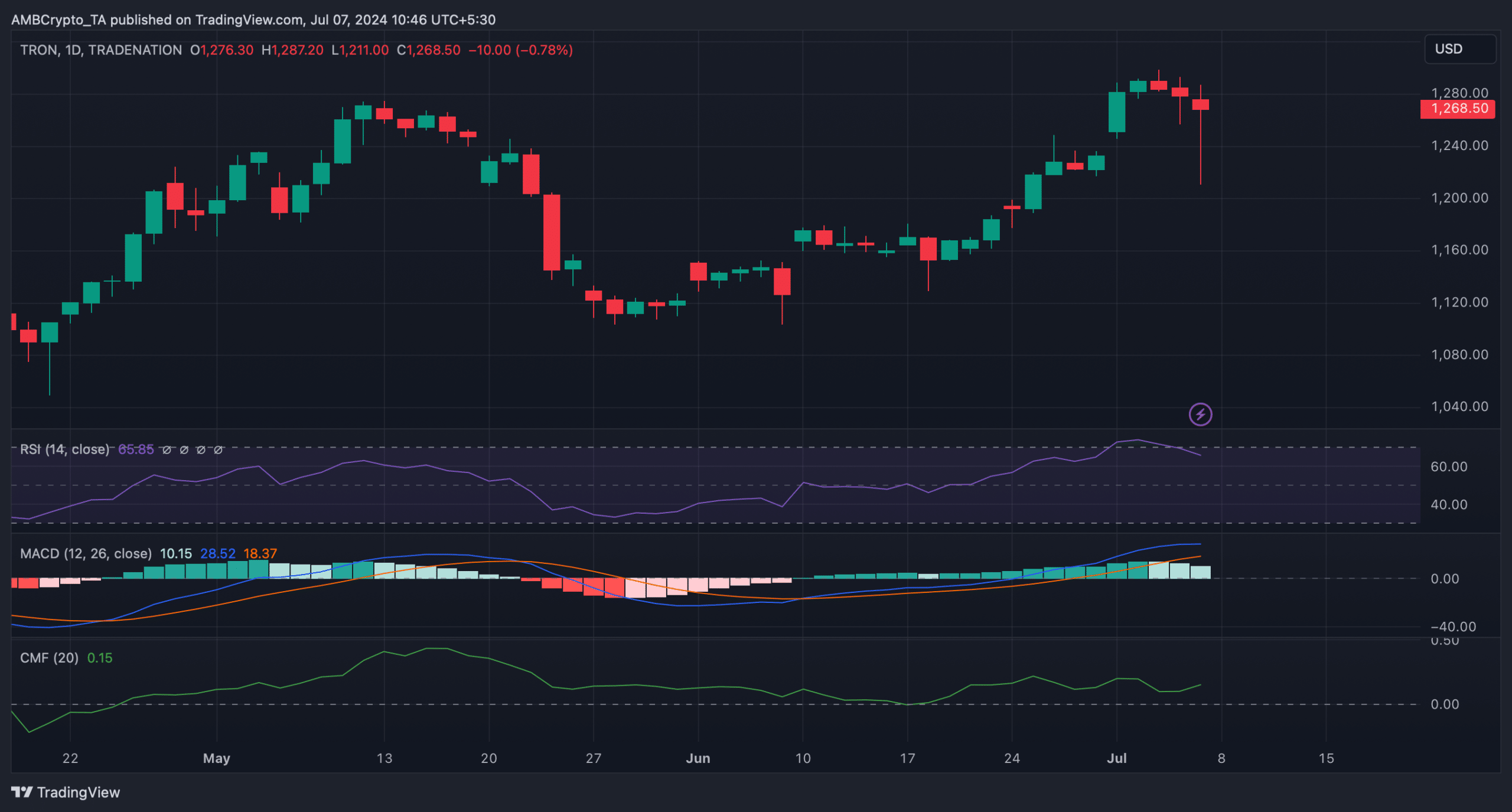

Moreover, the Relative Strength Index (RSI) recorded a decline, indicating a possible price decline in the coming days.

Nevertheless, the technical indicator MACD showed a clear bullish advantage in the market. The Chaikin Money Flow (CMF) moved south, indicating continued price appreciation.

Source: TradingView