- TRX has shown remarkable growth, with its market capitalization that exceeded $ 20 billion in December 2024 and established a new of all time.

- If the market trends are down, ADA runs a higher risk of losing this support compared to TRX.

Tron [TRX] Get grip and Cardano is approaching [ADA] In market capitalization, with a current valuation of around $ 22 billion.

A weekly profit of 4% and an increase of 33% in trade volume -signal -growing investor’s interests and increased network activity. If this trend is holding, can TRX close the gap and secure its place between the best blockchain networks?

Support levels in danger: TRX keeps stronger than ADA

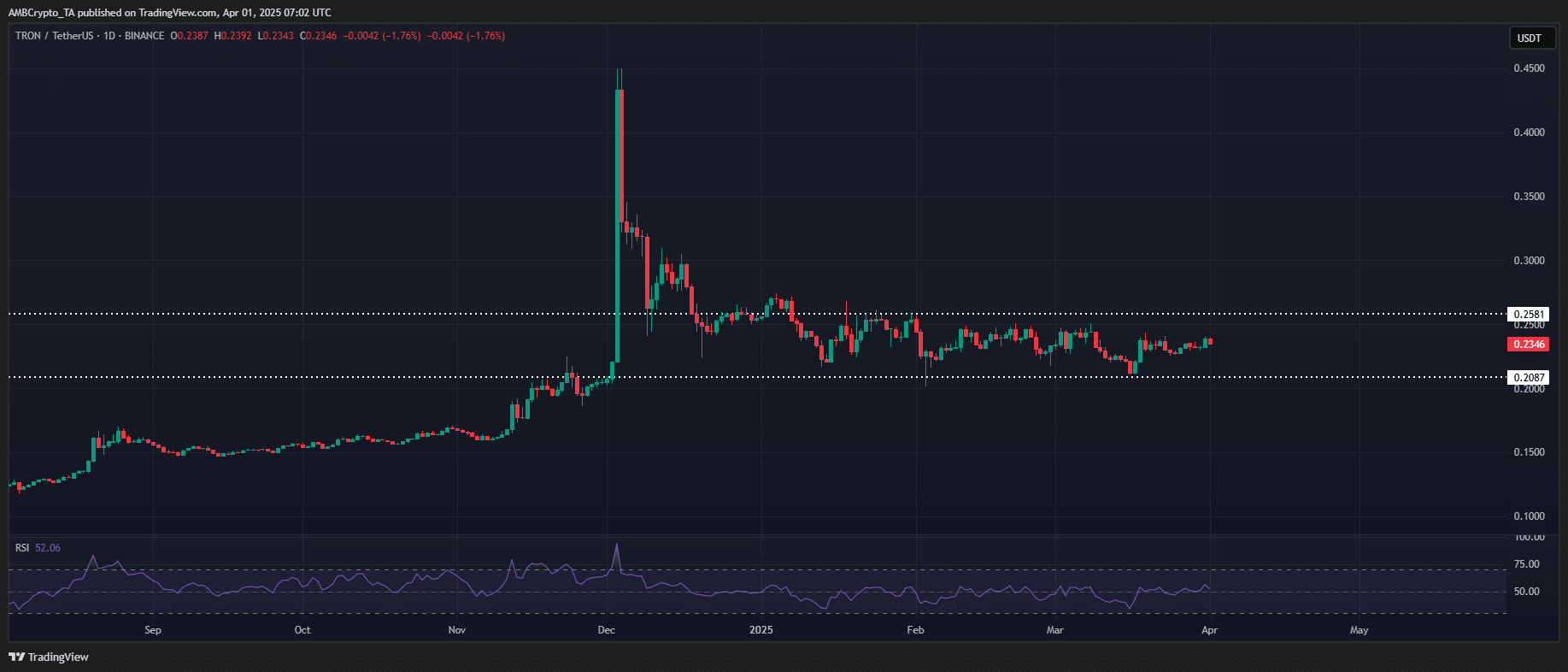

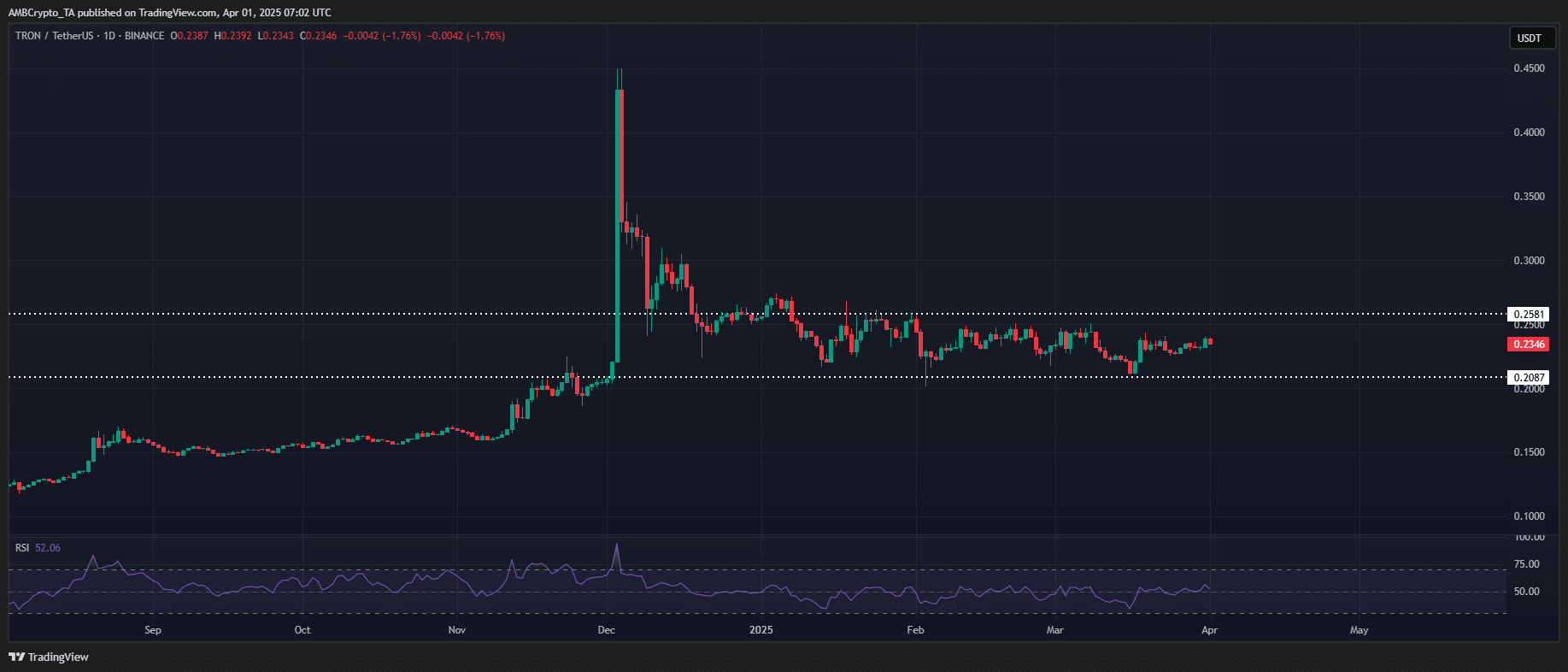

Bitcoin had his worst Q1 in seven years and ended with 11% compared to the opening price of the new year. The Altcoin market was not spared, where both TRX and ADA -trade act well below their highlights and lose important support levels.

Ambcryptos Analysis shows a striking trend: TRX raises $ 14 billion market value Since Q4 last year, while Ada at the same time lost more than $ 20 billion.

In short, the struggles of Ada have brought it closer to TRX. If Tron’s five -month consolidation leads to an outbreak when the market recovers, catching up Cardano can become a real possibility.

Since the peak of December of $ 0.44, TRX has stuck around $ 0.20, which has tested it four times.

Ada, on the other hand, strongly holds at $ 0.60, but it has only tested this level twice. If the market drops further, Ada loses its support rather than TRX.

Source: TradingView (TRX/USDT)

The derivaten market emphasizes remarkable differences between Cardano and Tron. According to Coinglass -Data Cardano leads in high-risk futures trade with an open interest (OI) of $ 766 million, a decrease of $ 1.12 billion earlier this year.

TRX, on the other hand, has a considerably lower speculative activity, with an OI of $ 195 million, making it less susceptible to large liquidations. In the last 24 hours, more than $ 2 million were liquidated by Ada Longs, compared to only $ 57.7k in TRX.

In Bullish markets, the strong presence of Cardano in derivatives could increase its price higher than that of Tron. In bearish circumstances, however, Ada is more vulnerable to steep liquidations, while TRX probably remains more stable.

This supports the earlier observation of Ambcrypto that Cardano is more likely than Tron to lose important support levels.

In addition to speculation: what the data tell us?

The on-chain statistics in the past year show some important differences. The struggle of Cardano to reclaim the $ 1 marking is supported by a significant decrease in daily active addresses -42.6% on an annual basis, now only 23,477.

In the meantime, TRX has seen an increase of 53.1% in active addresses, with 2.6 million. This growth extends over Other important statistics.

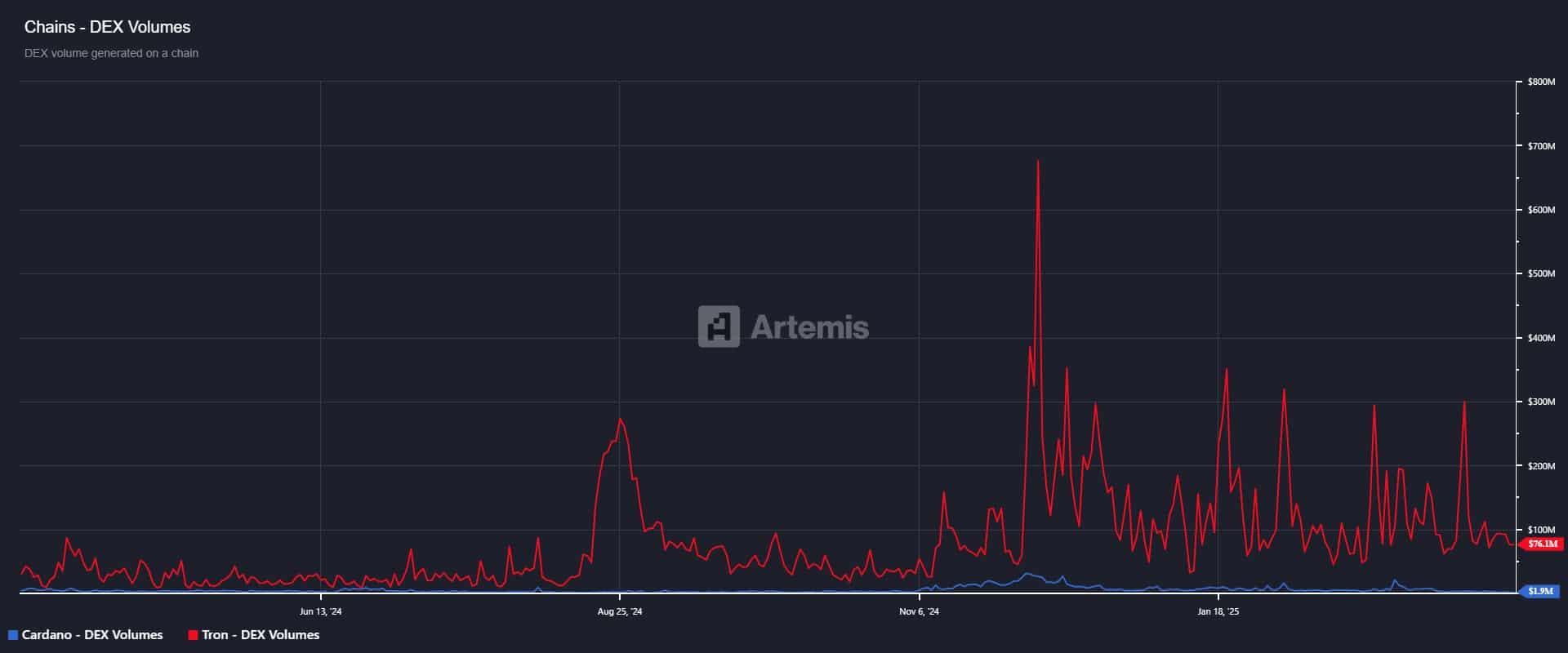

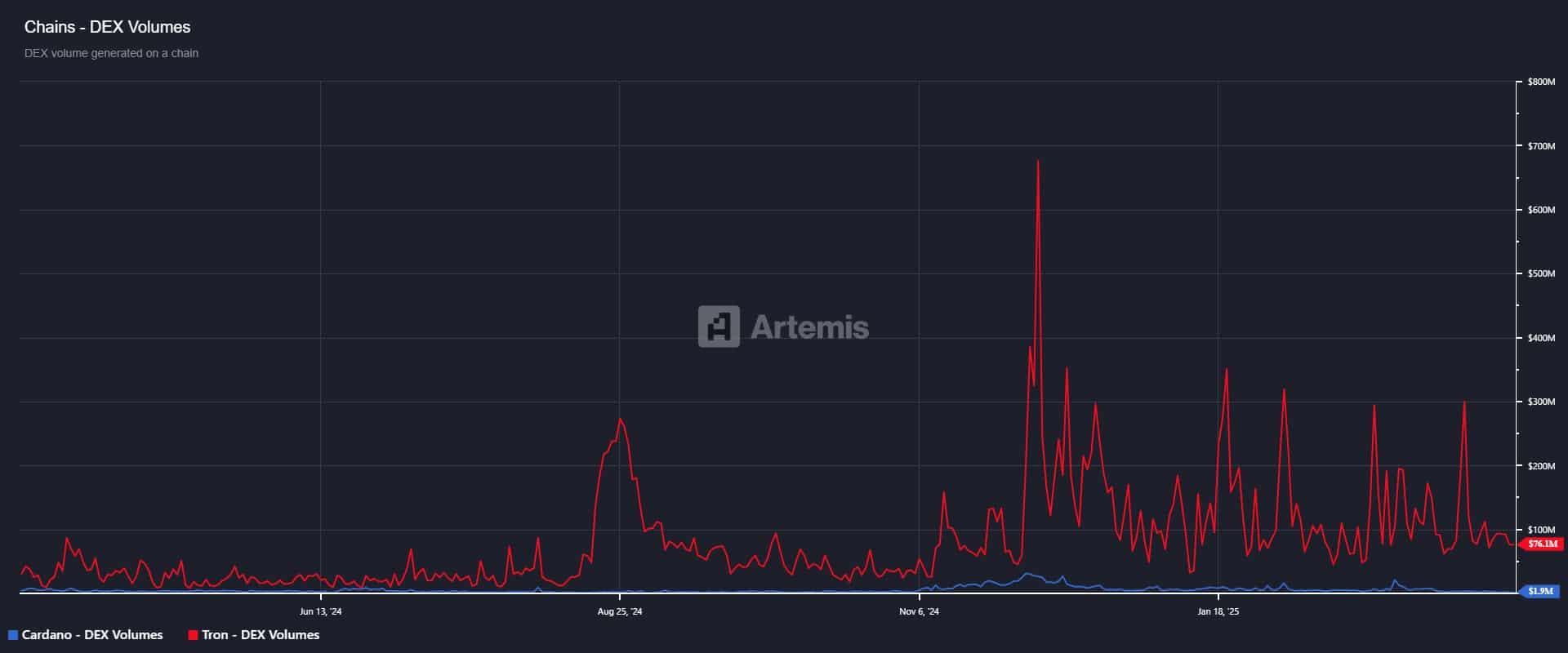

TRX, for example, has crossed the 1 million figure in generating costs, a grim difference with 8.9k from Ada. Despite a dip in Dex volume, TRX still dominates with 76.1 million, leaving Cardano’s 1.9 million far behind.

Source: Artemis Terminal

In general, these statistics suggest that Tron performs much better than Cardano in terms of network activity and acceptance. With the momentum, Tron has a solid chance of exceeding the market capitalization of Cardano $ 23 billion.