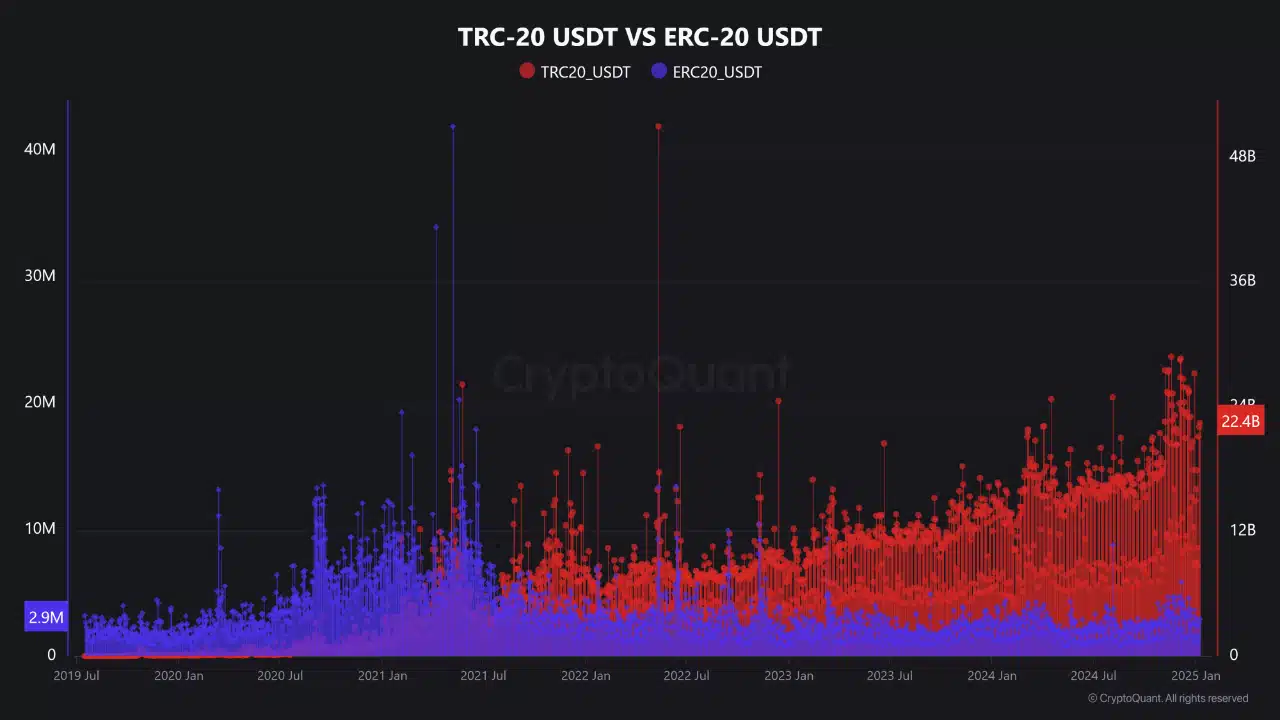

- Total transfers of USDT on TRC-20 amounted to 22 billion, surpassing ETH’s ERC-20 USDT by 2.6 billion.

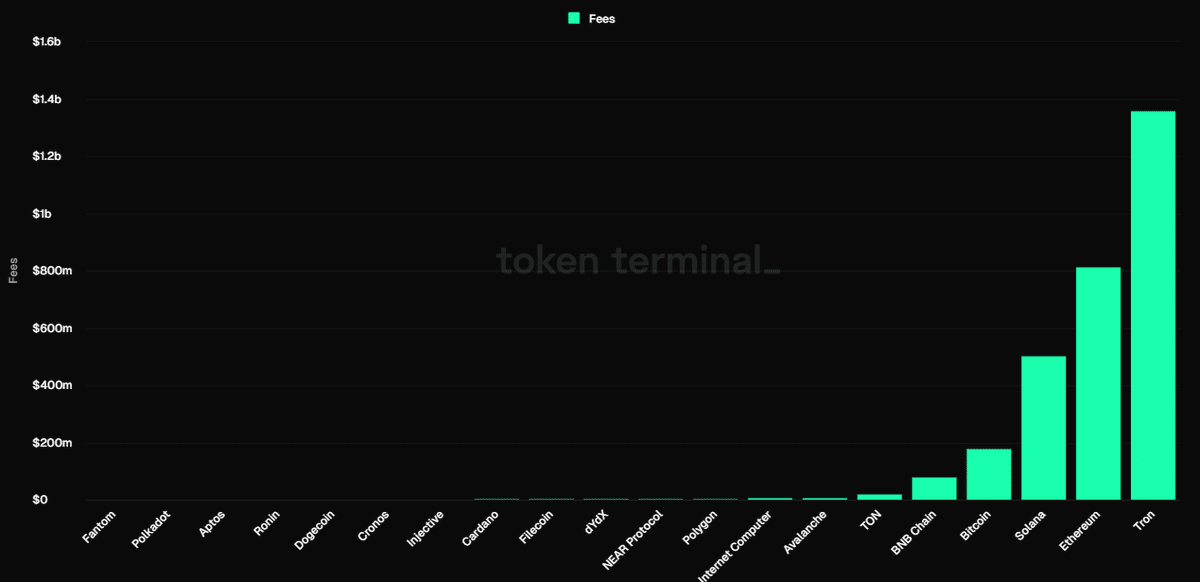

- TRON tops the list of L1 blockchains based on fees generated over the past six months

A comparative analysis of TRC-20 and ERC-20 USDT clearly showed TRON’s dominance in transaction volume since 2021. TRC-20 USDT transactions spiked, reaching 22 billion, also eclipsing ERC-20’s 2.6 billion.

This trend was consistent with TRC-20 showing spikes much larger than those of its Ethereum counterpart.

Significant spikes in TRC-20 activity, especially noticeable in mid-2024, highlight TRON’s advantage in terms of lower fees and faster processing times, attracting more users and exchanges to stablecoin transactions.

Source: CryptoQuant

The marked increase in the number of TRC-20 transactions in September, almost doubling those on the ERC-20, highlighted the efficiency and growing user base.

This robust performance by TRON supported its leading role in the stablecoin sector and underlined a continued preference among digital asset operators.

TRON fee income and TVL

Furthermore, TRON’s fees generated over the past six months amounted to $1.36 billion, once again placing TRON among the top Layer 1 blockchains, ahead of Ethereum.

Growth in the number of USDT transactions on TRON has continued strongly, with transaction volume for TRC-20 USDT far exceeding that of ERC-20. This is despite the high average cost of $1.2, such as Token Terminal noted on X.

This trend hinted at TRON’s increasing dominance in stablecoin transactions, which is favored for its faster processing times and security.

Source: Token terminal

This increase in transactions correlated with a notable increase in the number of daily active accounts on TRON. The figures for this have now exceeded 2.62 million, with an average of 174,000 new accounts per day.

This pushed the total value of TRON (TVL) above $23.4 billion, demonstrating its growing influence and user confidence.

The escalating activity on TRON, coupled with its efficient transaction settlement capabilities, pointed to a potential upside for TRON, strengthening its position in the blockchain ecosystem.

This could likely influence a continued rise in market value given the robust usage and trust shown by the crypto community.

AI integration and price prediction

In other news, the development of AI on TRON could catalyze further investor interest and speculative trading, potentially pushing the price higher in the medium term. The announcement was made by Justin Sun on X,

“A groundbreaking AI will be developed on Tron and steep. Stay tuned.”

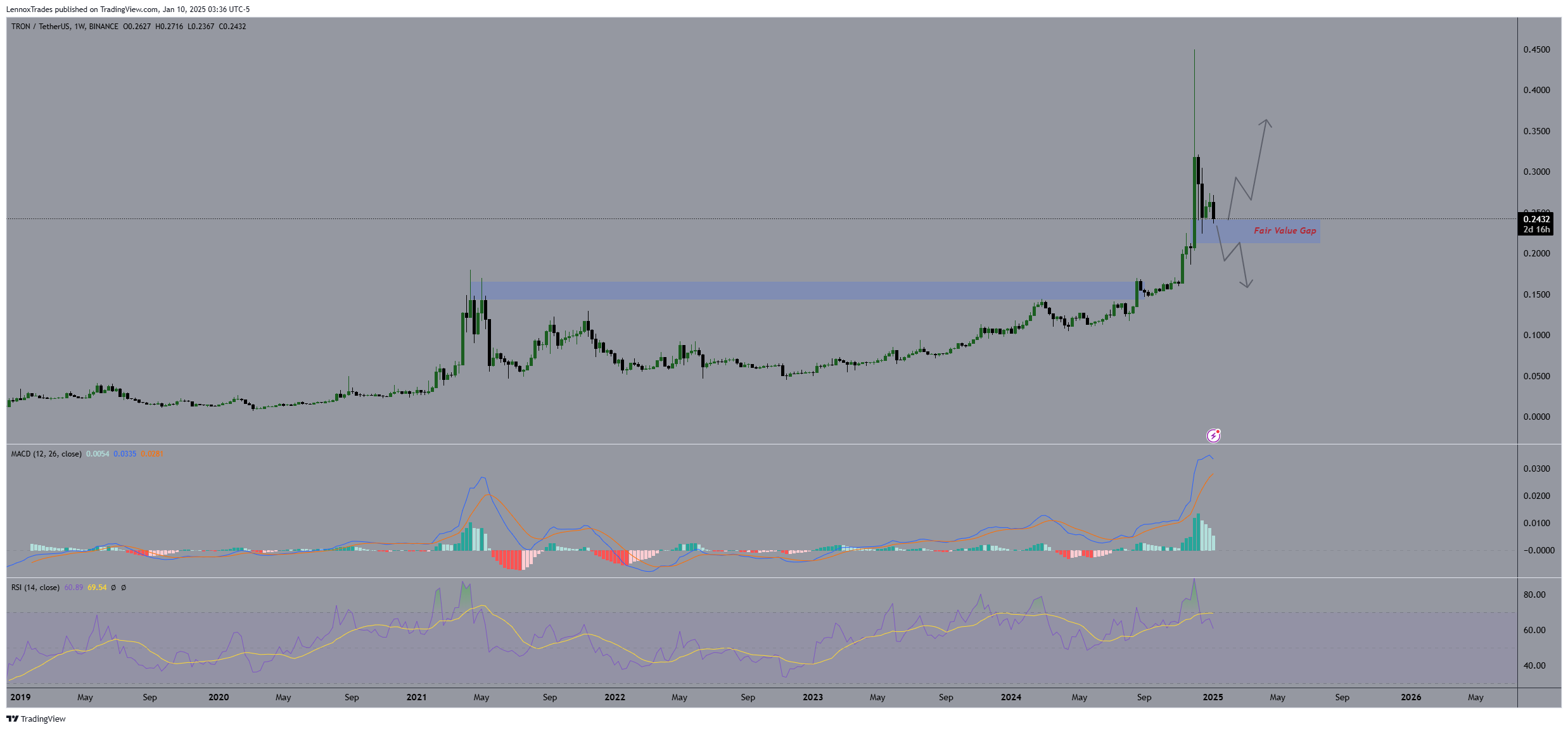

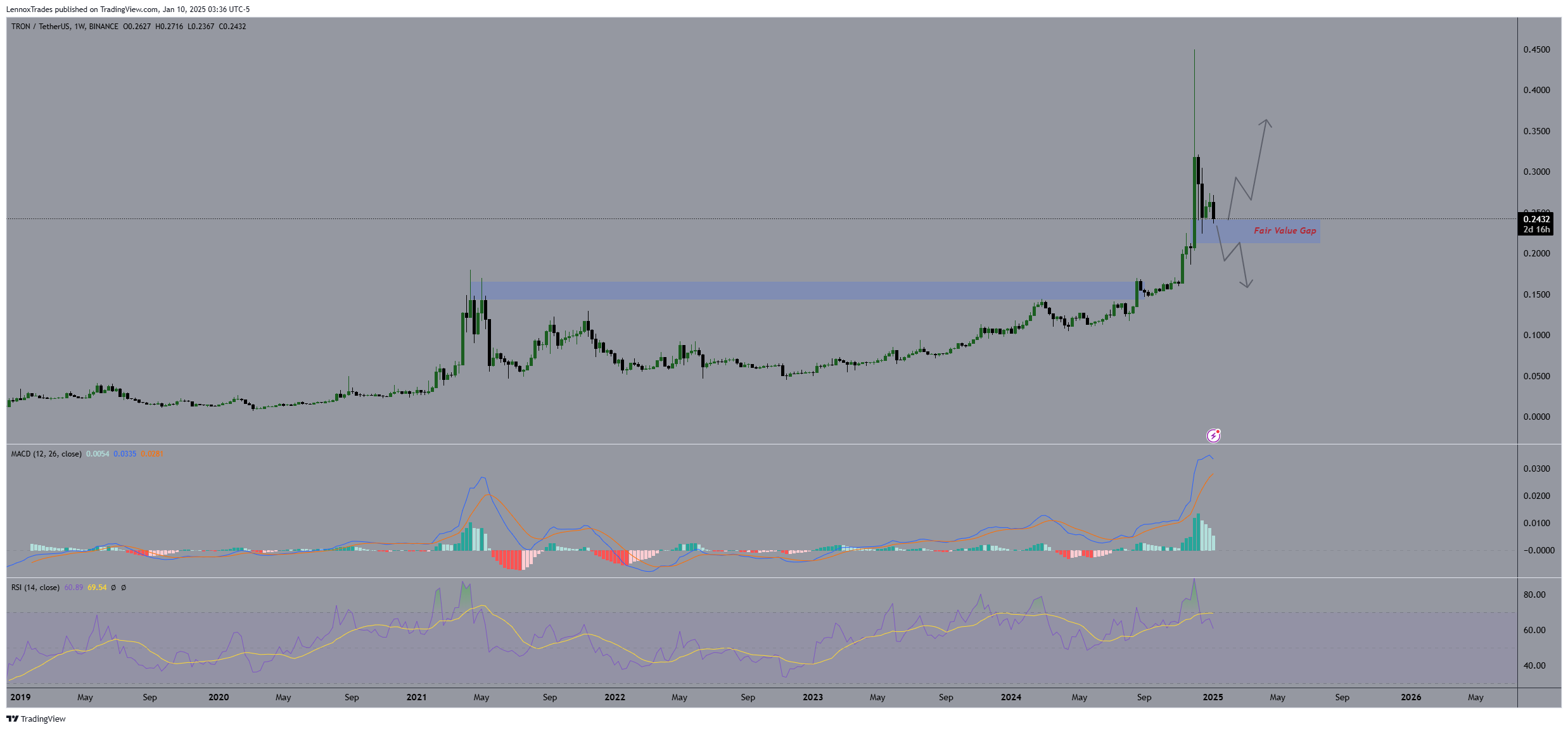

Looking at TRX’s price movement within the weekly time frame, it showed a spike to $0.30, followed by a decline to a fair value differential around $0.24. This level serves as both a support point and a pivot point for potential future price directions.

Source: trading view

At the time of writing, the MACD was positive, suggesting momentum could continue to rise, while the RSI near 70 indicated TRX was approaching overbought territory. This indicated a possible consolidation or decline in the charts.

Going forward, the price could retest the $0.30 peak or, if the support at $0.24 fails, fall back to lower support levels.