- TRX has consolidated after the rally fueled by SunPump hype petered out.

- The narrowing Bollinger bands showed low volatility, preventing significant price changes.

Tron [TRX] has underperformed most altcoins this week and recently lost its spot in the top ten largest cryptocurrencies by market cap after being flipped Cardano [ADA].

Last month, TRX was one of the top crypto gainers amid a period of memecoin boom on the blockchain. However, since the hype surrounding Tron meme coins has died down, TRX is now struggling with low volatility.

Tron Price Prediction

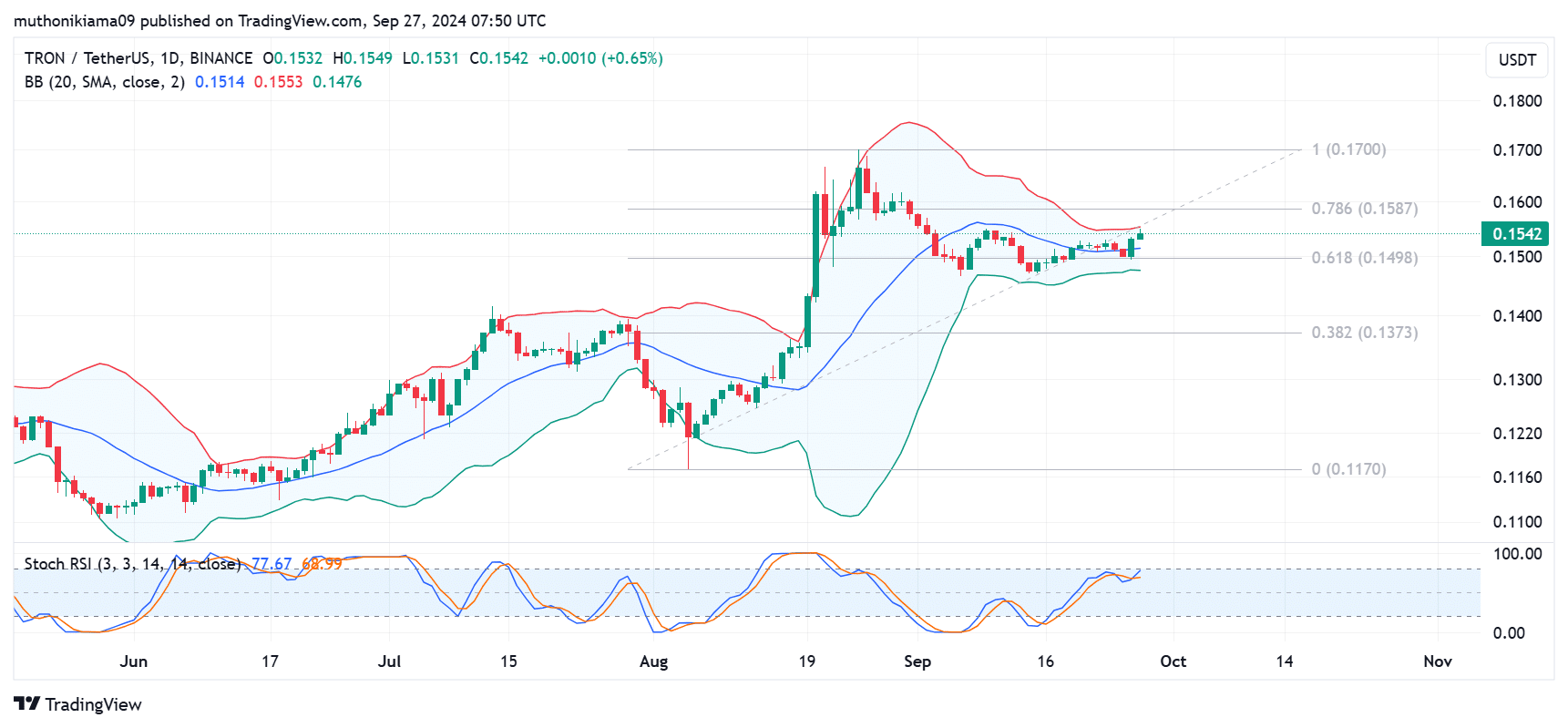

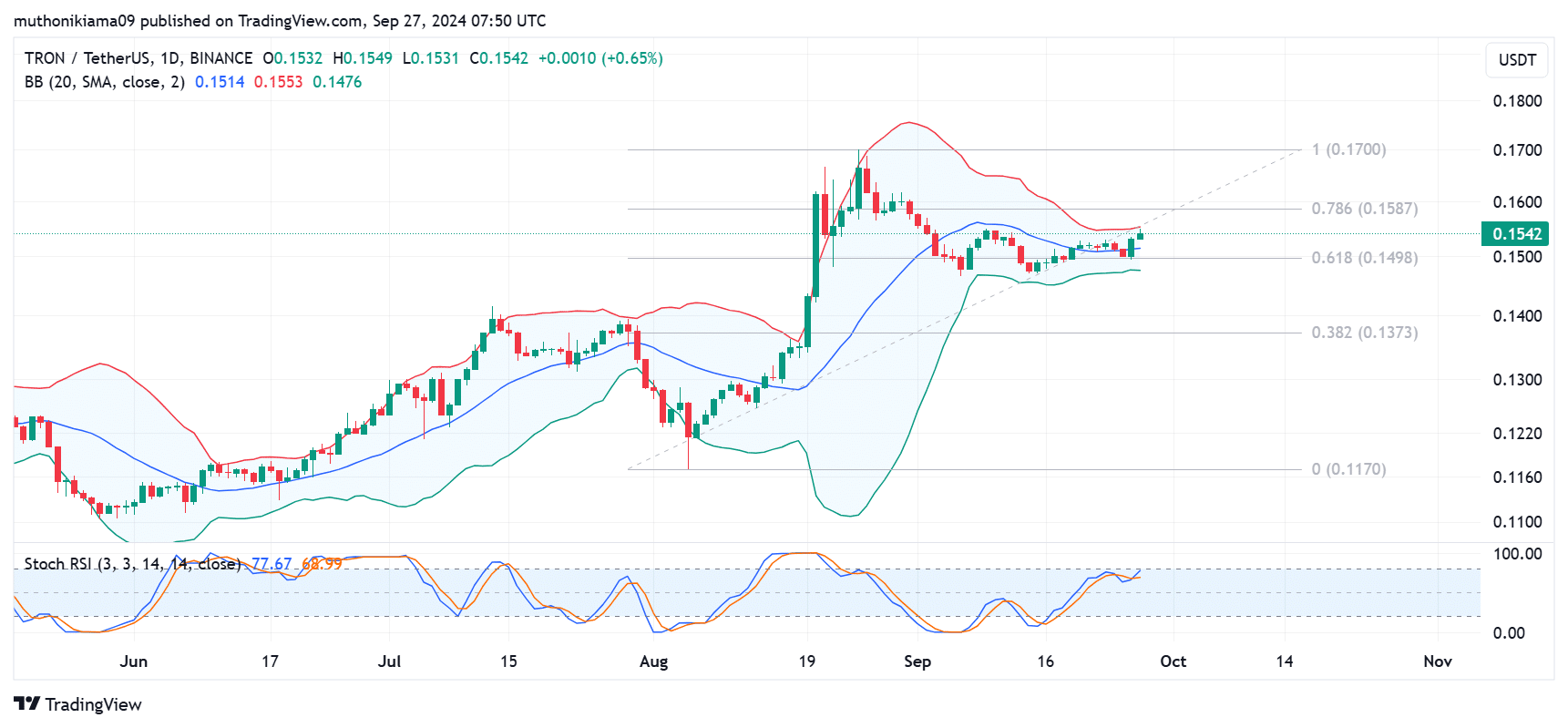

TRX was trading at $0.154 at the time of writing, having gained 1.57% in 24 hours. Trading volumes increased by 32% per CoinMarketCap. During this period, the price fluctuated between $0.151 and $0.155.

The TRX Bollinger bands have narrowed, indicating that volatility has decreased and the price may be in a consolidation phase.

However, this indicator also suggested a bullish bias as TRX price broke above the middle band and tested a breakout above the upper band.

Source: TradingView

If a breakout occurs above the upper band, it could trigger an uptrend to the next target at $0.17.

However, the narrowing range also shows that the TRX rally is exhausted, and more buying activity is needed to drive further gains.

The Stochastic Relative Strength Index (RSI) has shown a value of 77. While this is within the overbought range, it has not reached extreme levels, negating the chance of an immediate reversal.

Furthermore, the Stoch RSI gave a buy signal after crossing above the signal line, an indication that the current momentum is in favor of buyers.

If the RSI continues to rise and rises above 80, indicating that TRX is overbought, it could mark the start of a bearish reversal, as we saw in late August, with prices falling to the Fibonacci level of 0.382 ($0.137).

Tron transaction volumes are down

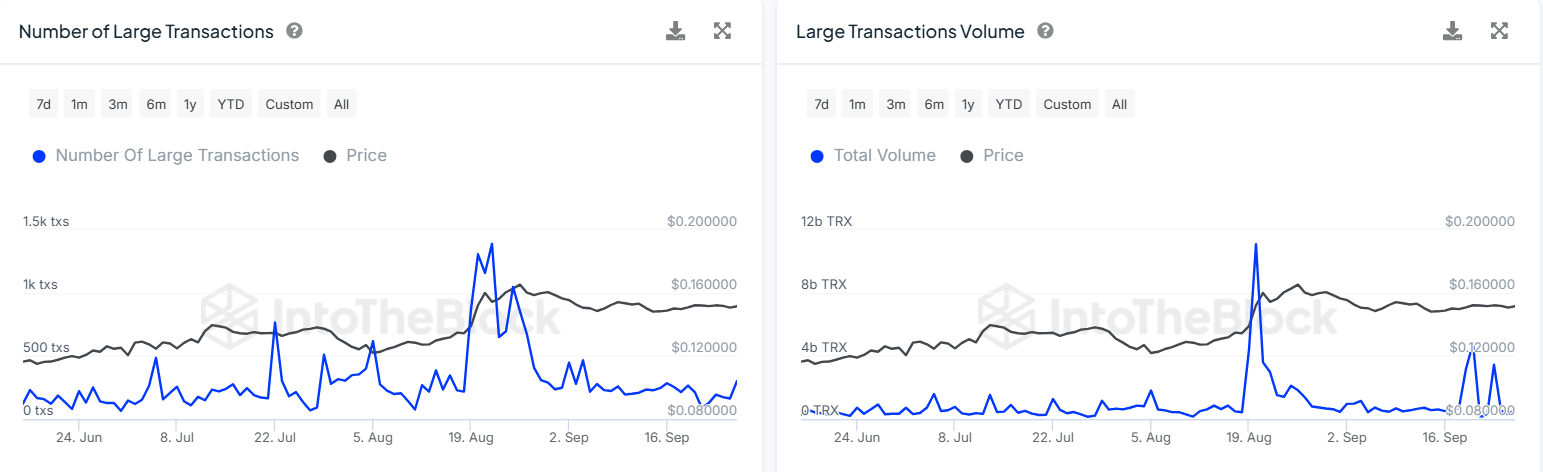

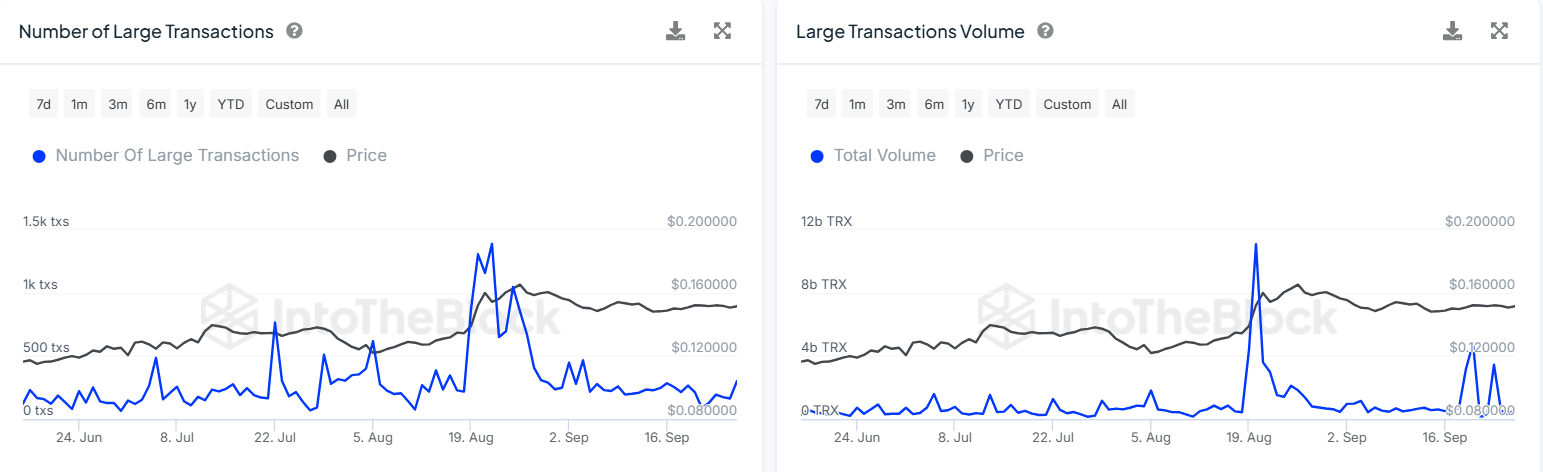

Data from IntoTheBlock shows a notable decline in transaction volumes on the Tron blockchain. After peaking in mid-August, these volumes have since fallen sharply and are currently at their lowest level in three months.

Source: IntoTheBlock

This decline could account for TRX’s lack of significant gains this month. Large trades are usually accompanied by high trading volumes that cause volatility and therefore price breakouts.

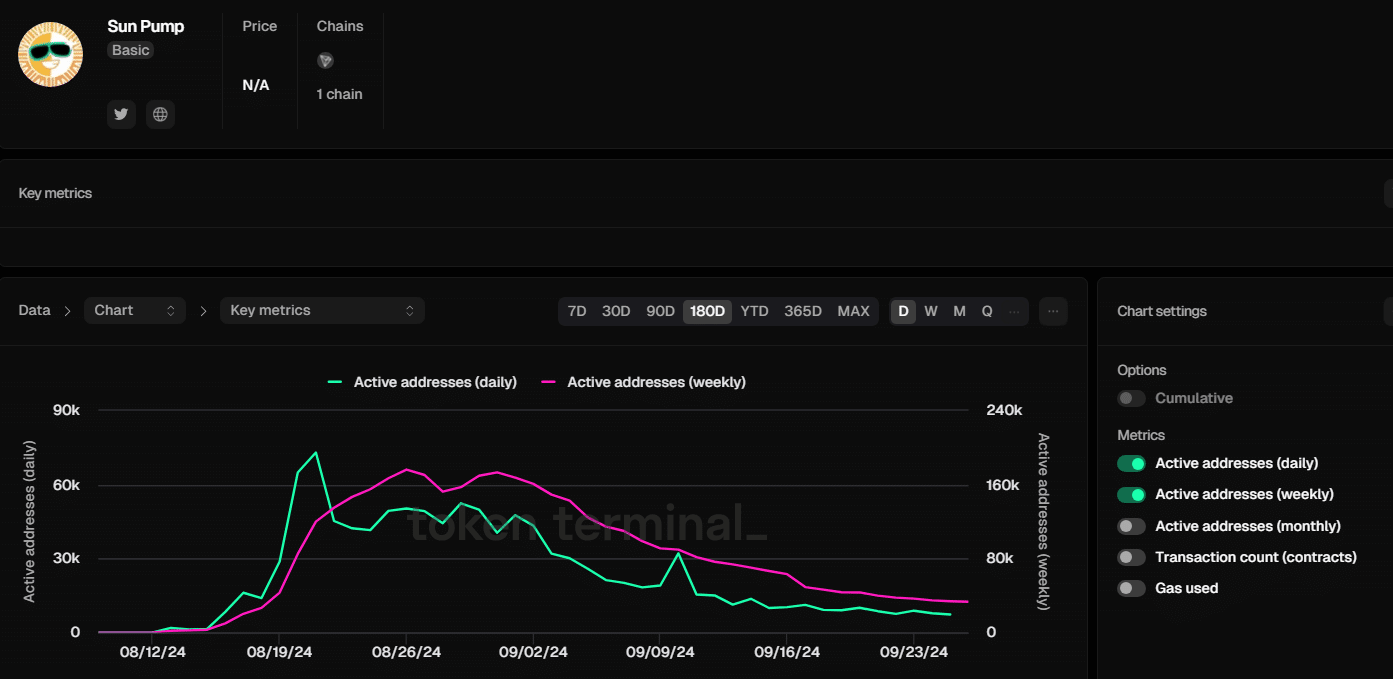

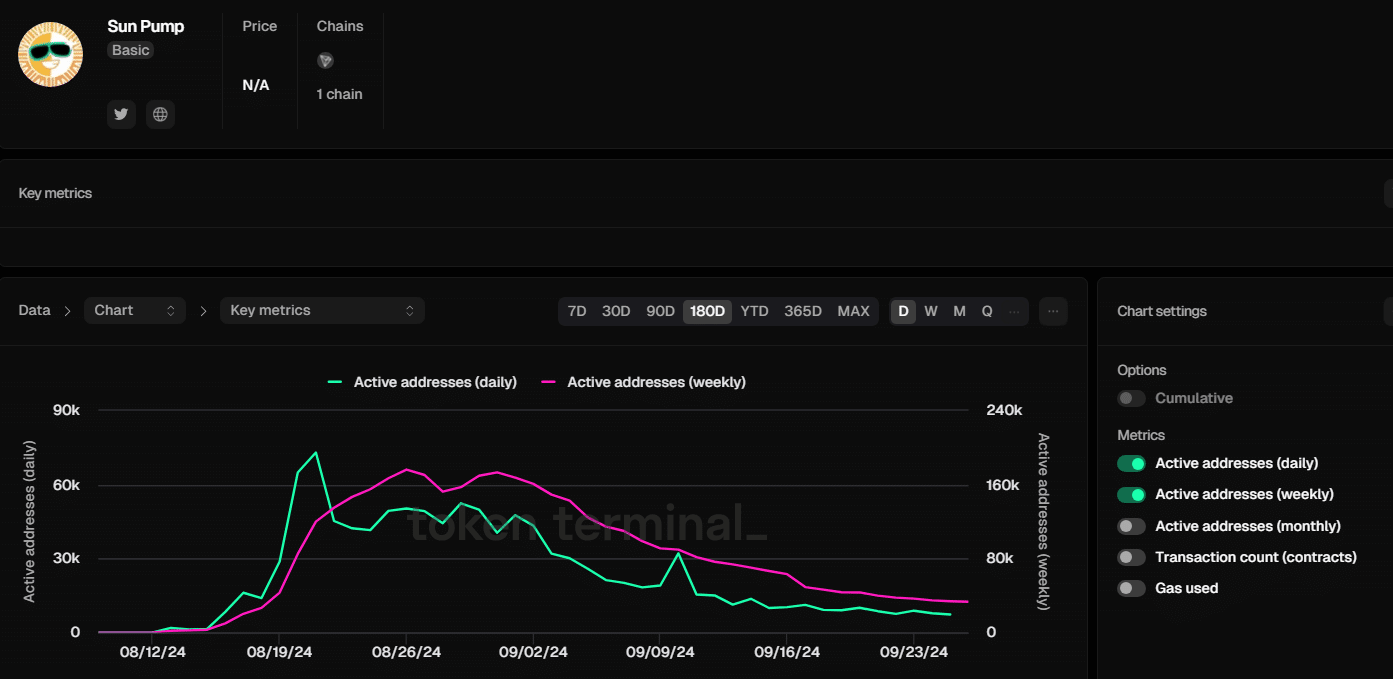

The spike in large transactions in August likely came from the SunPump launch pad. According to TokenTerminal, daily active addresses on Tron are currently approaching a record low.

Source: Token terminal

This shows that in addition to the broader marIn short, there is no major catalyst within the Tron ecosystem that can drive TRX’s price appreciation.

Read Tron’s [TRX] Price forecast 2024–2025

Nevertheless, a majority of TRX holders are above the breakeven price per InHetBlok. These traders might choose not to sell as they expect further price movements.

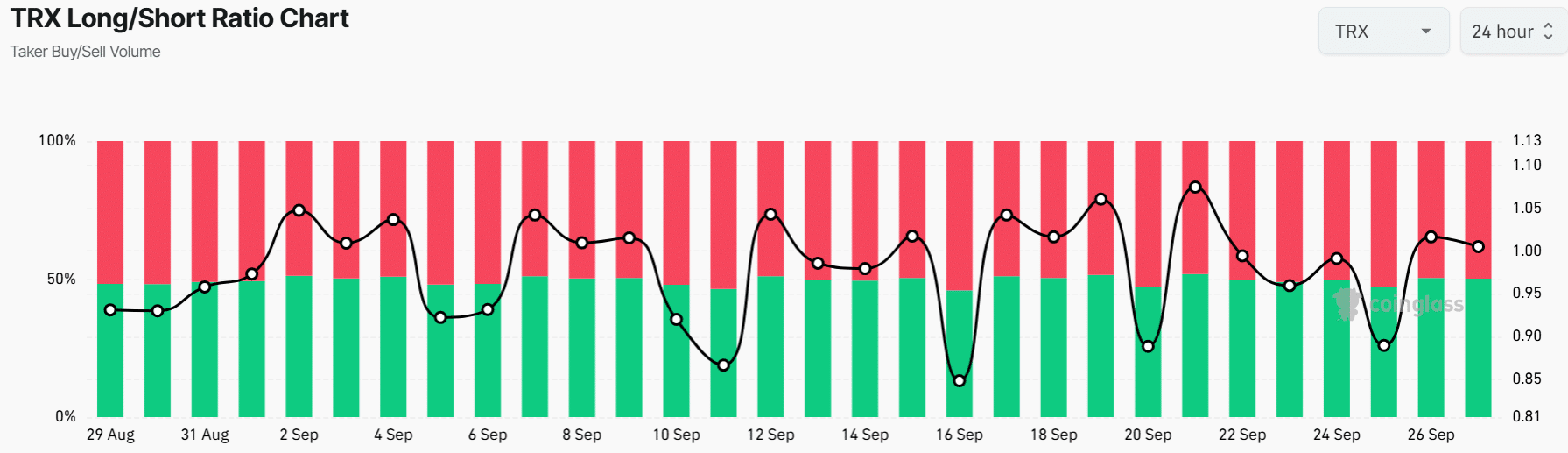

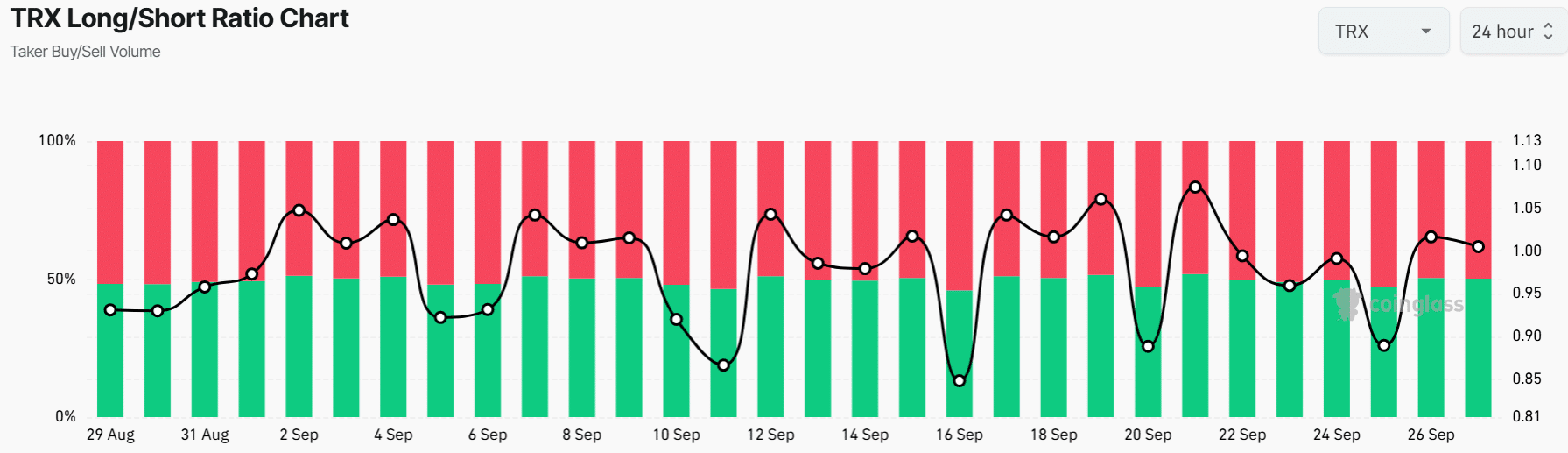

This bullish bias is also reflected in the long/short ratio, which has risen from 0.88 to above 1. This shows that short traders are closing their positions as long positions increase, indicating confidence in future price movements.

Source: Coinglass