- Tron closes the USDT -Dominance of Ethereum thanks to low costs and strong support from large fairs.

- Ethereum still attracts institutional importance, with rising daily active addresses and profitable whale activity.

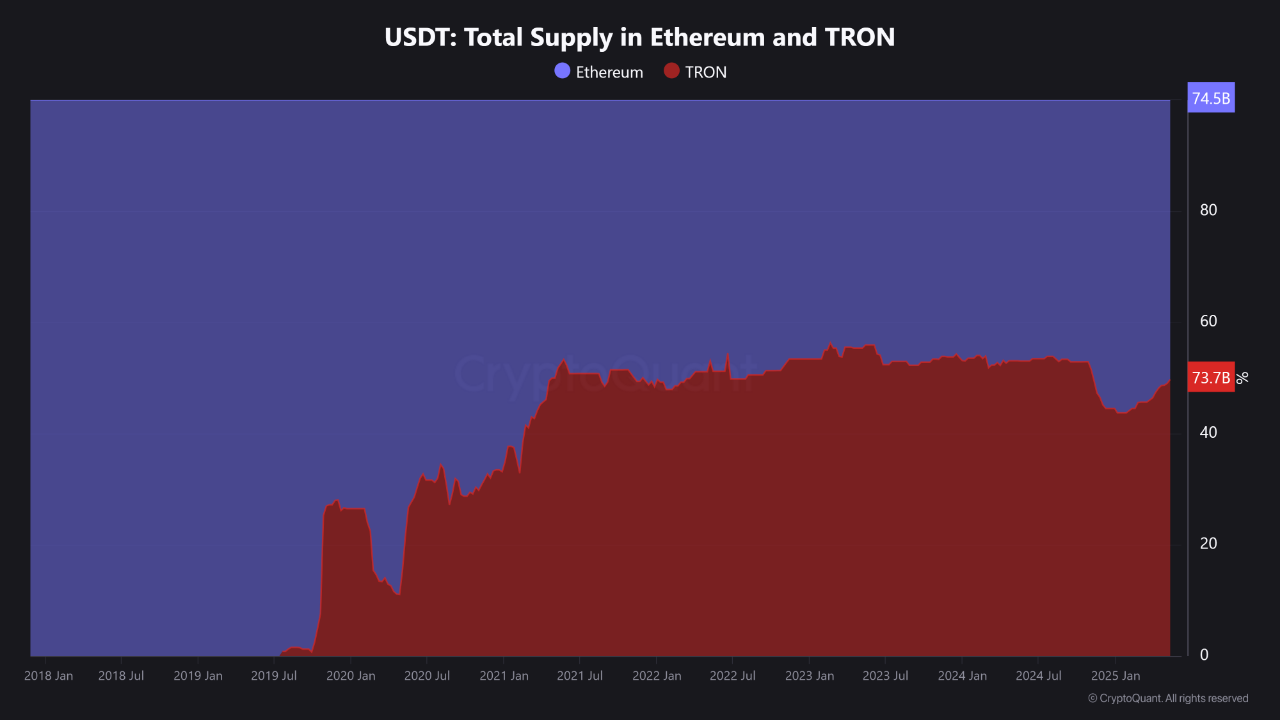

A few years ago, Ethereum was perhaps the most important house for USDT. But now the story is different. The battle has been warmed up since 2021 and tron, without much hassle, is slowly catching up.

Currently, according to Cryptoquant, Ethereum is still slightly ahead with a total USDT offer of around $ 74.5 billion. But Tron follows $ 73.7 billion. These figures reflect how players in the industry are increasingly concerned about efficiency and speed.

Source: Cryptuquant

Behind this shift there are several things that TRON make a new choice for many people. The gas costs of Ethereum that can let your bag scream are one of the triggers. But not only that, large exchanges such as Binance, OKX and Bybit also insist on using the TRC20 standard.

Even on the Asian market, Tron is increasingly being used for freely available transactions. All these factors no longer make Tron underestimated.

Tron is becoming more mature, Ethereum is still fascinating

If we look further, Ethereum once had almost all control over USDT, especially in 2019. But now? The proportions are almost the same – Ethereum is around 50.26% and Tron is 49.73%. It is not just about who is larger, but who is more agile and more efficient. Imagine that you had to transfer a large amount of stablecoins and the gas costs were equal to a chic dinner. You would think twice, right?

Moreover, Tron is not only about low costs. CNF previously reported that Tron maintained a daily block production -efficiency of 99.7%. This stability is important, especially for a network that is the backbone of stablecoin transactions. Moreover, their super representative (SR) system shows a healthy rotation, which reflects a reasonably competitive administration.

On the other hand, Ethereum is not standing still. The latest data show an increase of 15% in daily active addresses that break through 450,000. There was even one ethwalfish that managed to make a loss of $ 21 million in a win of $ 21.7 million. Are total assets value now? $ 104.5 million. This type of activities indicates that institutional interest in Ethereum has not been broken down – it is even burning hotter.

Interesting is that, as we have previously reported, Ethereum is currently acting above its price. This means that many holders in the long-term Binance users-in are a comfortable position, also known as profitable. Binance itself remains a large liquidity hub for ETH, even during large portfolio shifts.

Tron, however, also shows an interesting pattern. Despite the recent decline of new portfolios and transactions, many analysts see it as an accumulation phase. Delaying activity does not mean weakening, but rather preparing for the next wave.