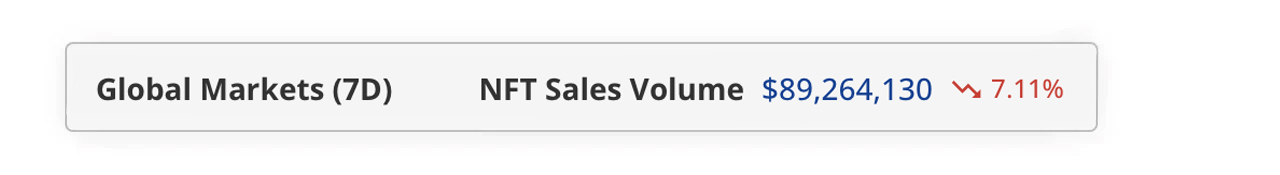

Recent data shows that between October 19 and 26, non-fungible token (NFT) sales fell 7.11% lower than the previous week.

Top NFT collections of the week: Froganas, Mythos Dmarket and BAYC Lead Sales

This week’s total NFT sales were $89.26 million, down 7.11% from last week’s figures. Despite this decline, the number of NFT buyers increased by 42.20%, while the number of digital collectible sellers grew by 52.55%.

Ethereum, which registered $31.20 million over the past seven days, led the blockchain pack in NFT sales, down slightly by 2.96%. Solana ranks second with revenue of $18.42 million, up 12.39% according to cryptoslam.io statistics.

Seven-day statistics between October 19 and October 26, 2024, according to data from cryptoslam.io.

Bitcoin claimed the third spot, trading at $14.37 million, reflecting a significant drop of 34.02% from the previous week. This week, Solana’s Froganas topped the NFT pack, taking the top spot with $4.98 million in proceeds, an impressive 123% increase from last week.

Following close behind the compilation was Mythos’ (Polkadot) Dmarket, which amassed $4.92 million. In third place was Ethereum’s Bored Ape Yacht Club (BAYC), which earned $3.96 million and rose 110.90%.

Other collections making double and triple digit waves include Mutant Ape Yacht Club (MAYC), Cryptopunks and Pudgy Penguins. The most expensive NFT sale went to an Ethereum-based Autoglyph, which fetched $495,000 just three days ago.

The second highest sale was Paraluni Perpetual Bond #966 on BNB, which fetched $150,610 last week, and in third place was a Bitcoin-based Uncategorized Ordinal, which sold for $101,621 six days ago. This week’s varied sales are an example of the evolving digital asset ecosystem, where rising buyer interest contrasts with an overall decline in overall sales.

Ethereum saw a slight dip, Solana continued to rise and Bitcoin suffered a steep decline. This indicates that while major blockchains have endured, new collections are attracting more and more attention and reshaping the competitive field. These shifts suggest an adjustment in the tactics of buyers and sellers, possibly reflecting a preference for different blockchain ecosystems.

With standout collections like Froganas and BAYC riding the wave of triple-digit growth, it seems certain projects are effectively tapping into the current excitement. Yet, as ever, the NFT sector remains as dynamic as ever, with interest rates moving up and down in response to the latest trends.