A widely followed crypto analyst believes that an altcoin artificial intelligence (AI) project is gearing up for a move to the upside.

The Analyst, pseudonymously known as The Flow Horse tells According to its 199,800 followers on social media platform

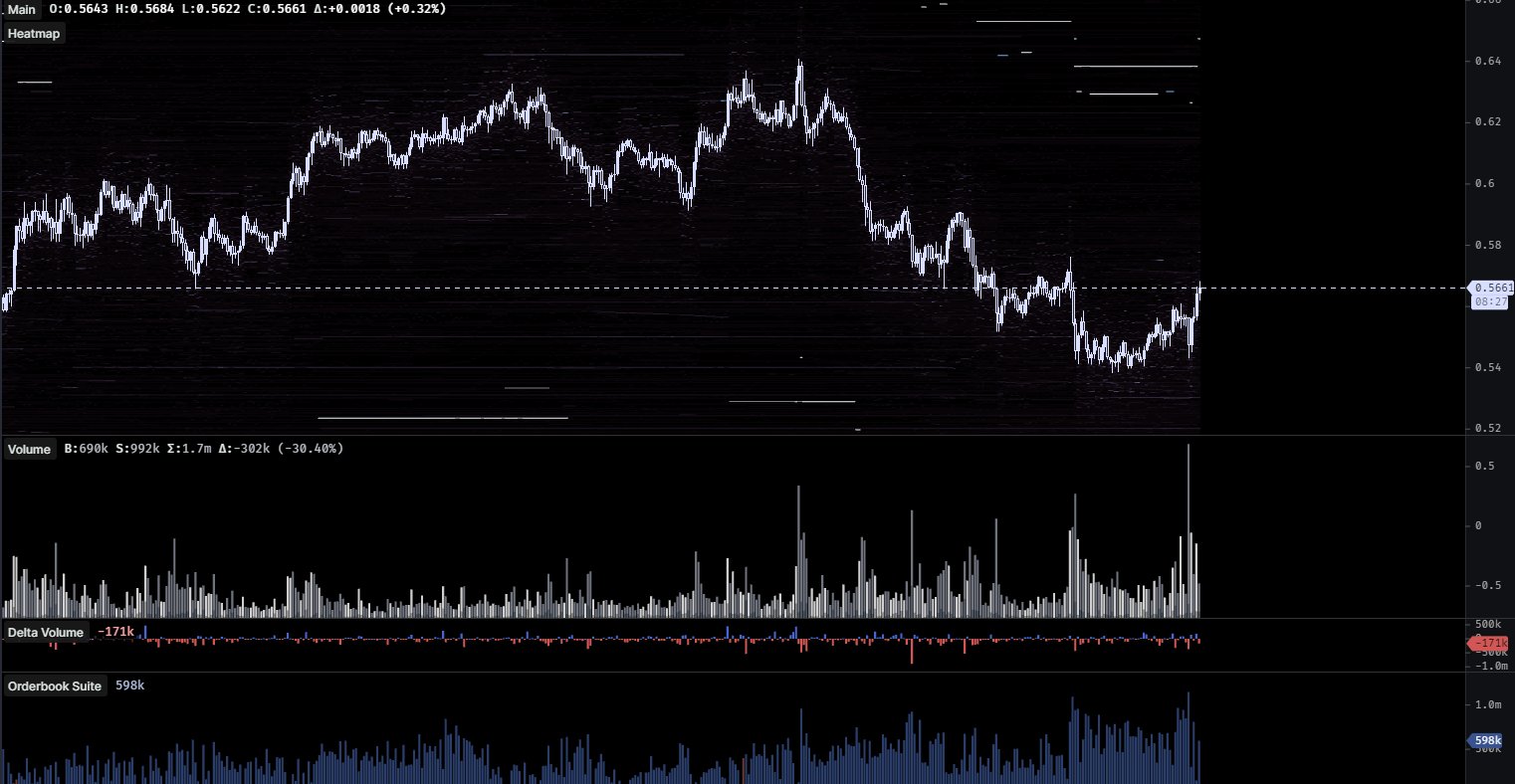

OI is a measure that tracks the amount of open long and short positions of a crypto asset.

According to the analyst, FET bulls are aggressively taking on the supply coming to market, using leveraged long positions.

“FET could be quite a rebound from here. OI up due to seller absorption, high volume to low in January with a pretty skewed bid/ask.”

Looking at its chart, FET is on the verge of potentially turning the $0.56 level into support.

FET is trading at $0.566 at the time of writing, up over 4% in the last 24 hours.

Then the trader suggests that April’s Bitcoin (BTC) halving could be more bullish than previous events as BlackRock, the financial giant with around $9 trillion in assets under management (AUM), is now likely to market it around their recently launched spot BTC exchange-traded fund (ETF).

“This Bitcoin halving is unlike any other because it is the first time a trillion-dollar asset manager has brought it to market.”

Bitcoin is trading at $43,167 at the time of writing, up slightly in the past 24 hours.

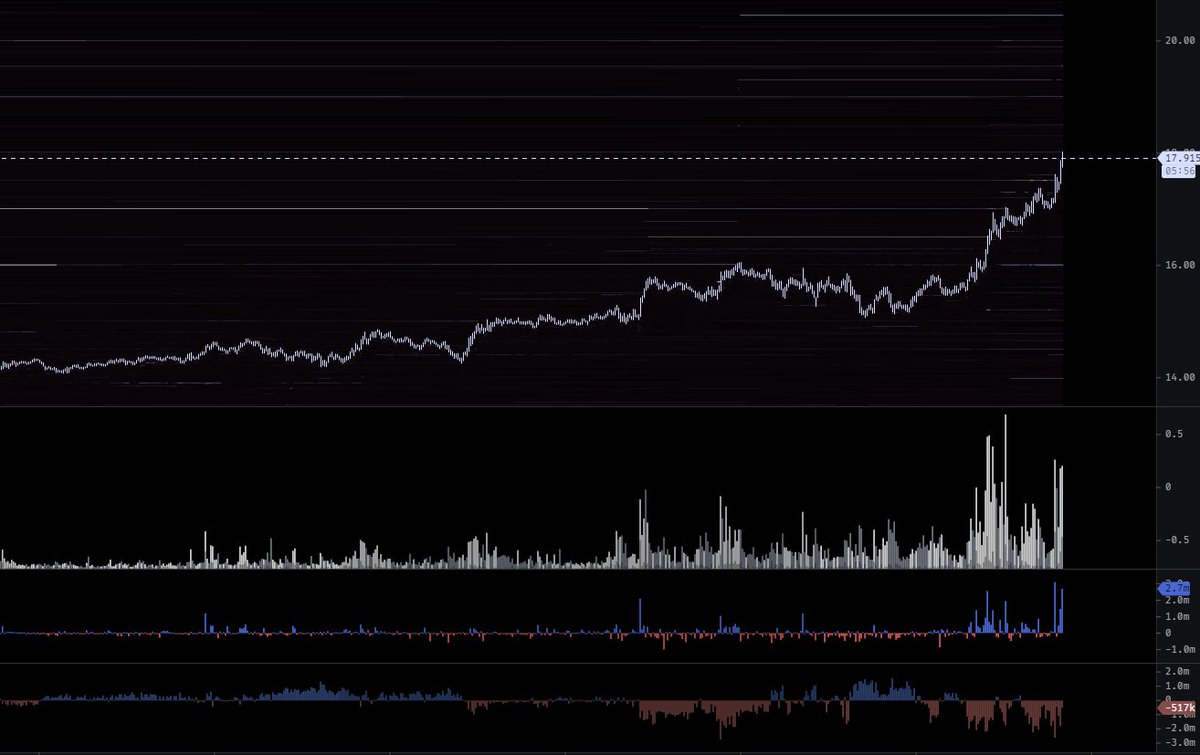

Next on deck, the trader say that decentralized oracle provider Chainlink (LINK) appears to remain in an uptrend as the token bumps into the $18 resistance level.

“Impressive continuation-type move. I think I closed my LINK bag too early.”

LINK is trading at $17.83 at the time of writing, down slightly in the last 24 hours.

Finally, it is the trader’s turn optimistic on Solana-based decentralized exchange (DEX) aggregator Jupiter (JUP).

“Start by buying a small JUP. Mindshare is high and I think negativity outside of the airdrop mechanics ultimately creates an unbalanced auction. Short-term airdrop plays are pretty predictable…

VWAP (volume weighted average price) is your friend, especially in the newly named alts. JUP VWAP is already anchored from a catalyst, which makes it very useful. Regardless of what happens in the long run, you know this is going to provide a really good long setup soon.

Traders use the VWAP to help them determine whether an asset is trading underbought or overbought based on its intraday price action.

Jupiter is trading at $0.579 at the time of writing, down more than 3% in the last 24 hours.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Featured image: Shutterstock/Fortis Design/VECTORY_NT/PurpleRender