- The integration of Grok AI into Telegram could considerably stimulate the demand and the Ecosystem of Toncoin

- Despite a positive sentiment, long liquidations hinted on volatility, making $ 4 resistance of crucial importance for continuing growth

The integration of Grok AI in Telegram has a considerable interest in the Toncoin (Ton) Ecosystem. This development follows the confirmation of Elon Musk about the partnership, which means a sense of optimism among investors.

At the time of writing, Toncoin was on the charts with 8.10% and reached a price of $ 3.90. The total value locked (TVL) on the TON -Ecosystem was $ 163 million, which indicates strong confidence of market participants. In addition, the open interest rose by 14.66%, with figures for the same $ 176.23 million in total.

How will the integration of Grok AI and Telegram influence?

Elon Musk’s confirmation From the grok AI integration in Telegram marks a crucial moment for Toncoin. The presence of Grok AI within the social network of Telegram will enable projects on the Ton Blockchain to use the improved functionality.

This collaboration can significantly improve users’ involvement, which further improves the TON -Ecosystem. If developers and users completely embrace grock AI, this can generate a higher demand for Toncoin.

That is why this step can bring more usefulness to the Ton Blockchain, which may make the price higher.

Can the Toncoin price promotion hold over its $ 4 resistance?

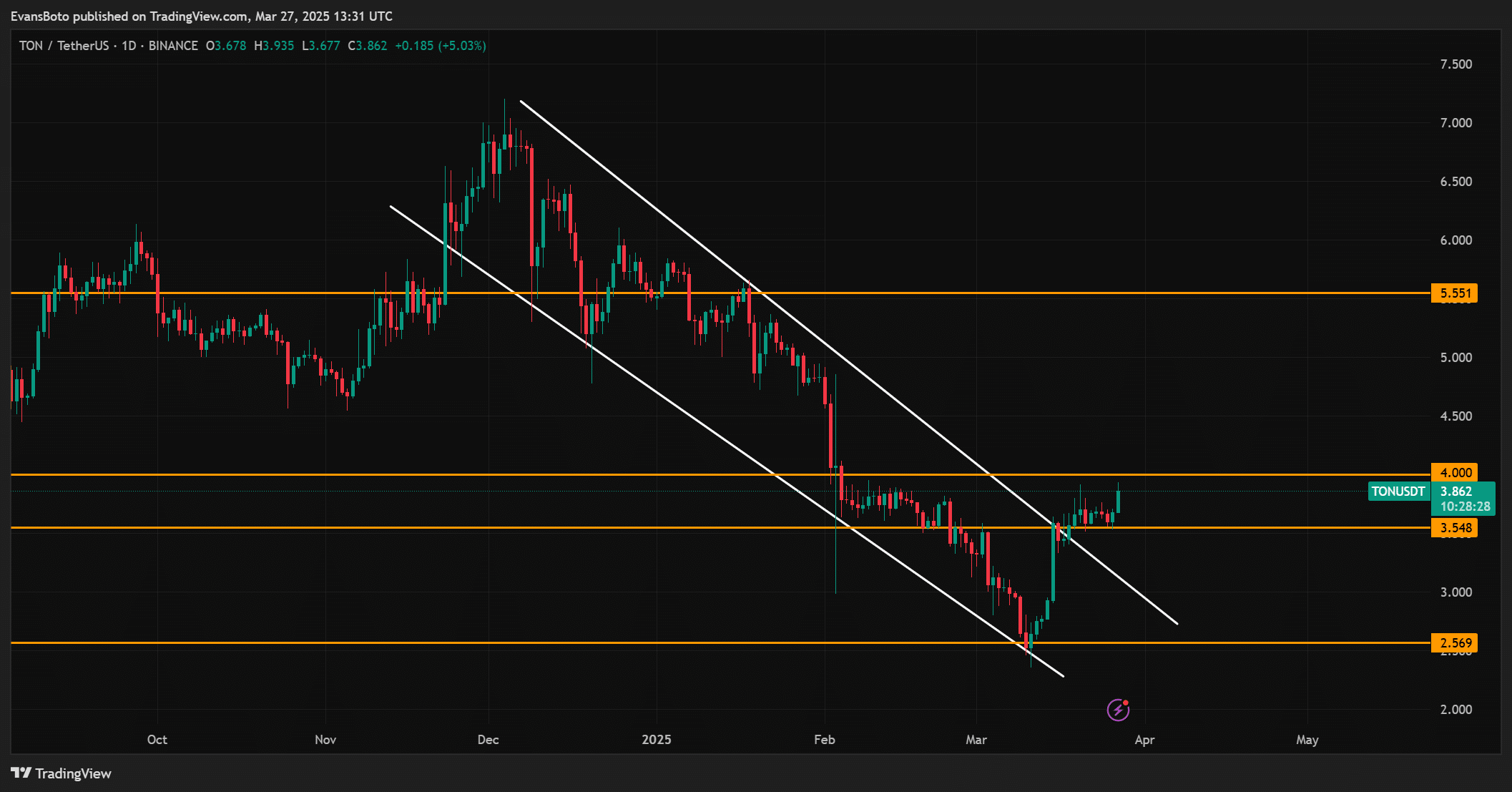

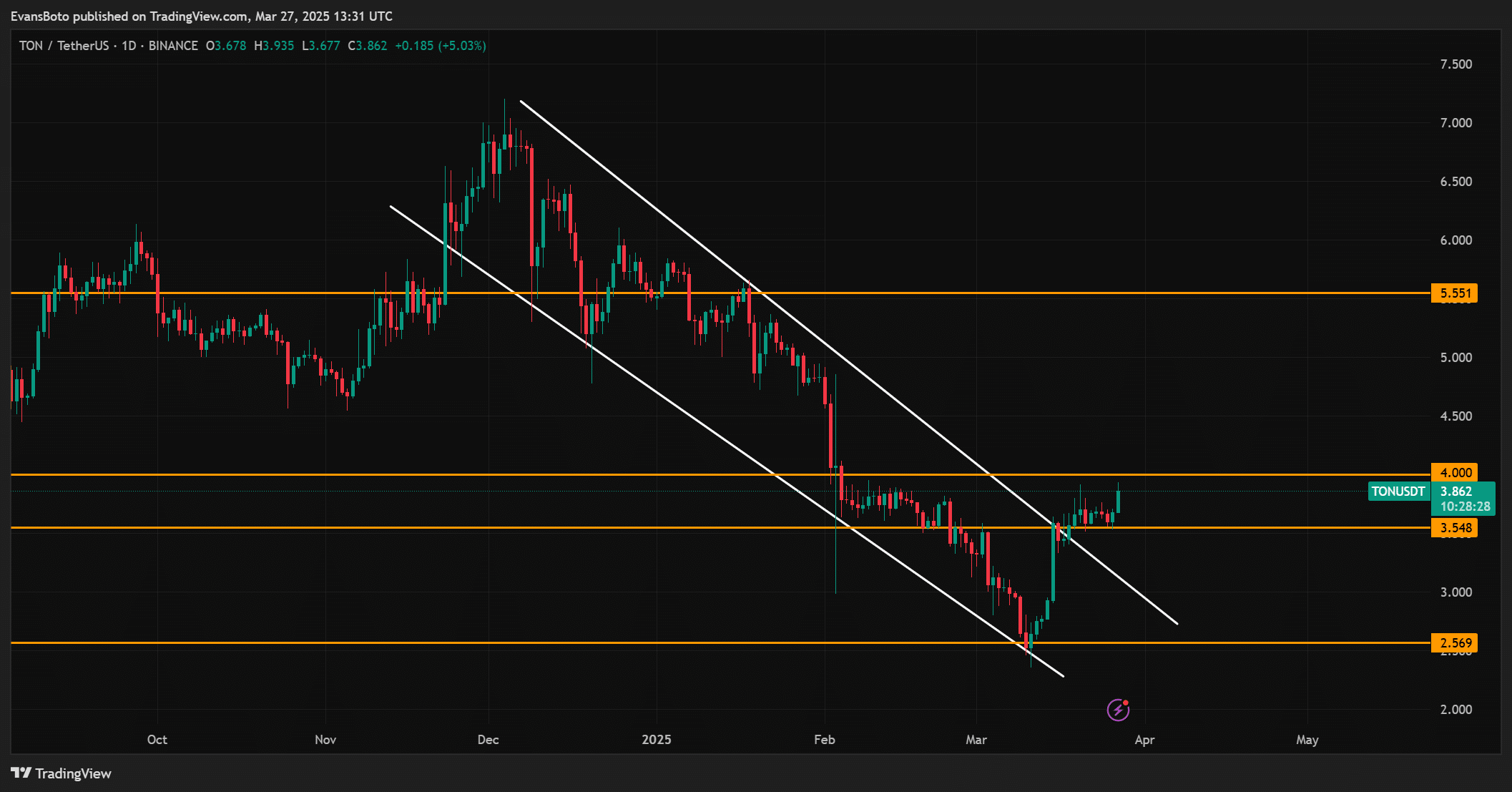

Toncoin recently broke from a falling Wigkanaal, an indicator for potentially bullish momentum. The prize was approaching the key resistance around $ 4-mark at the time of the press. If Ton maintains this momentum and succeeds in breaking above $ 4, this can clear the road for further growth, making the range of $ 5.55 possible.

In the coming days, the market will keep a close eye on Toncoin to keep a close eye on this resistance. However, a clean break above $ 4 is crucial for Toncoin to continue his upward process.

Source: TradingView

What do open interest and liquidations say?

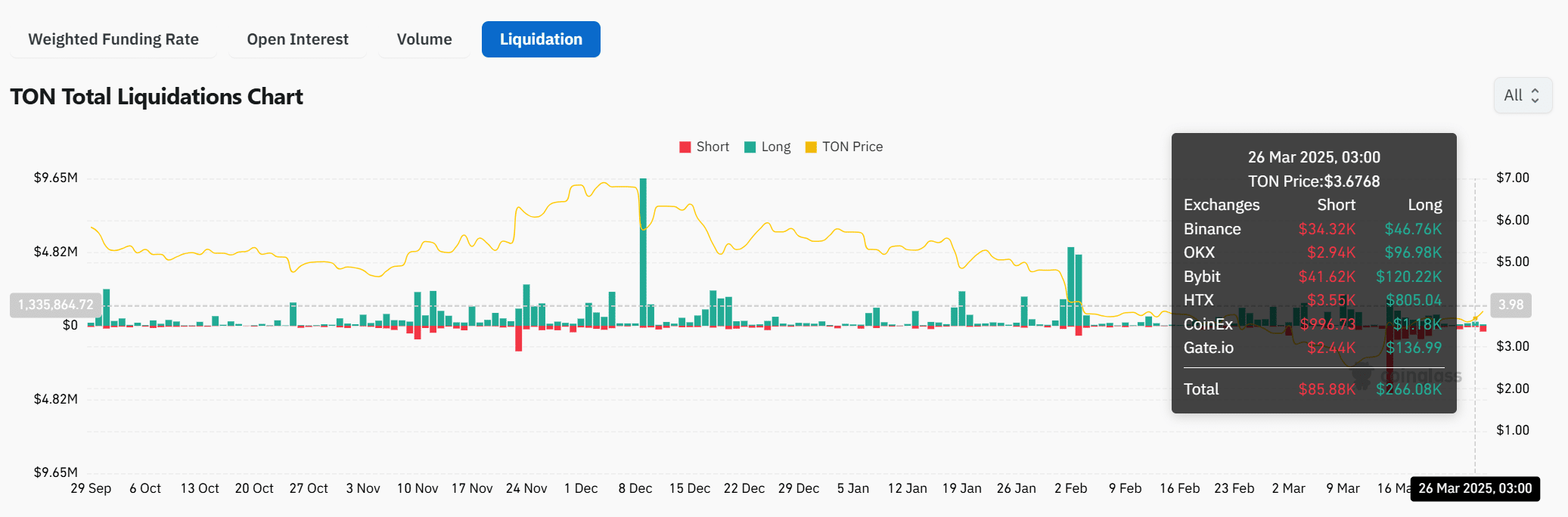

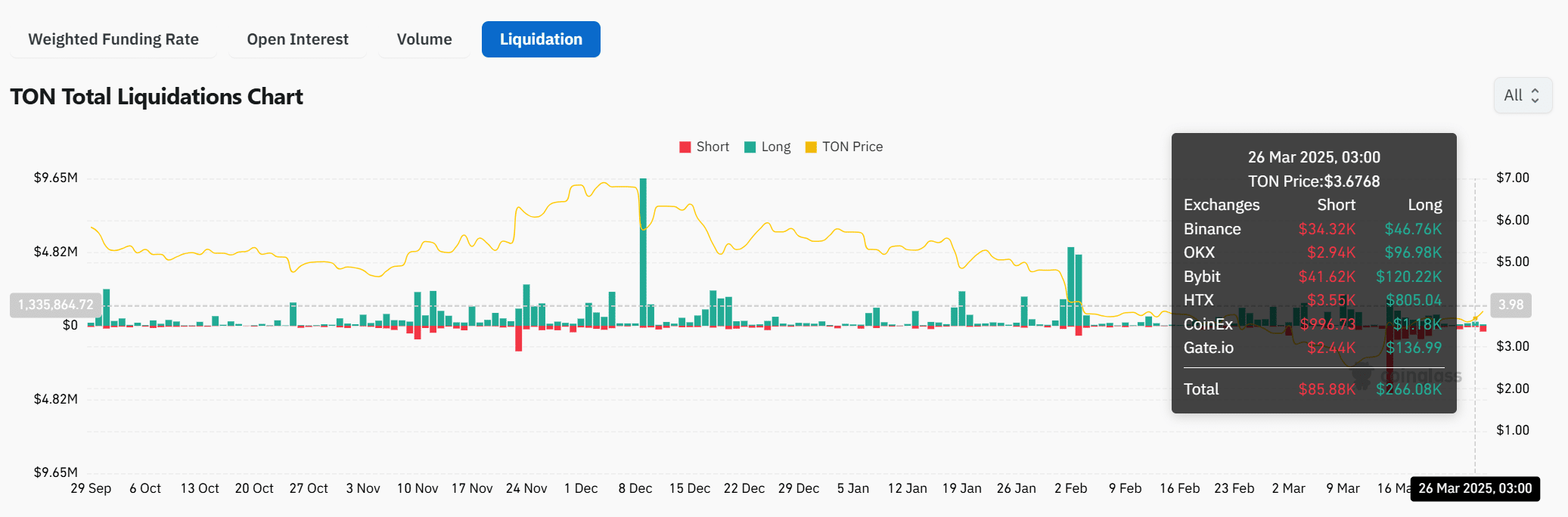

Toncoin’s open interest rate rates of $ 176.23 million suggested that traders were optimistic about future performance. However, the liquidation data revealed an interesting trend – more long positions are liquidated than short positions.

This meant that although there is bullish sentiment, traders are confronted with volatility and potential price corrections, because the price occasionally goes against their positions. Despite the positive open interest, the higher number of long liquidations were warned in the prevailing market environment.

Source: Coinglass

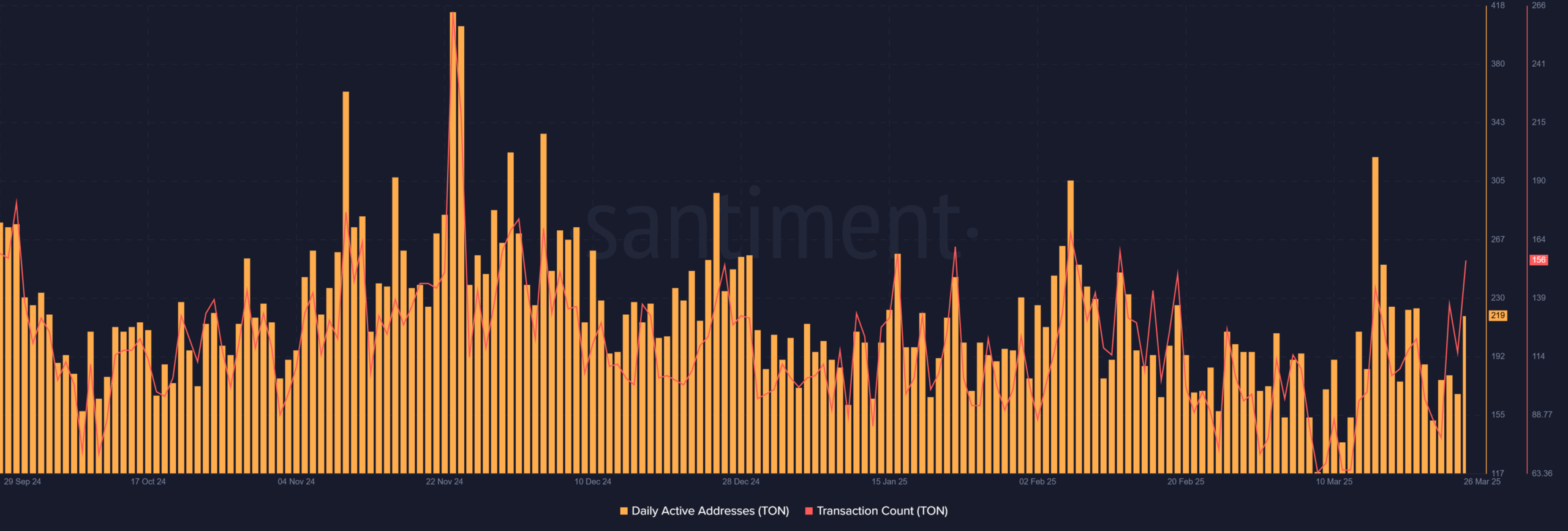

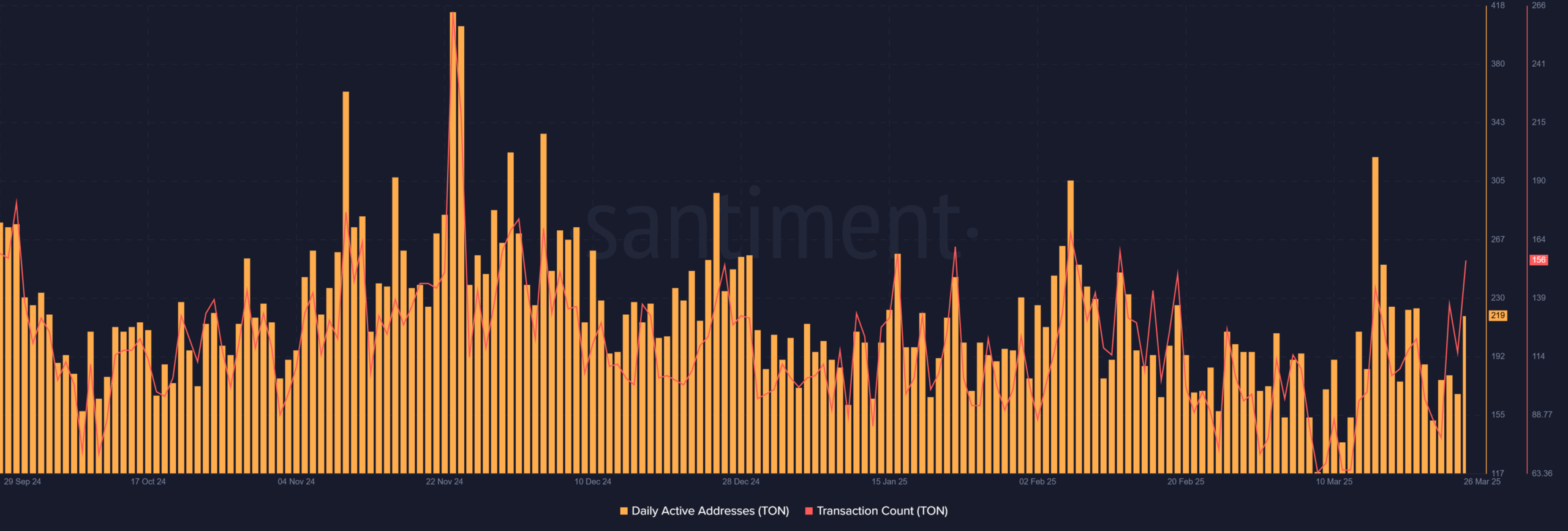

Does Toncoin show more activity on the chain?

Activity at the chain registered a light walk, with daily active addresses that reached 219 at the time of writing. The number of transactions also revealed a small increase of 156 transactions, which indicates a higher user involvement in the network.

Although the increase is not dramatic, these figures refer to the growing interest in Toncoin, because the integration of grok AI comes into effect. This increase in activity could further support Toncoin’s momentum. Especially if more users and developers deal with the ecosystem in the coming weeks.

Source: Santiment

Conclusion

The price performance of Toncoin has promising, especially with the integration of Grok AI in Telegram. Although open interest and on-chain activity suggested a positive prospect, the higher number of long liquidations that the market has to do with some volatility meant.

Although the integration of Grok AI could catalyze an important rally for Toncoin, it will therefore remain whether it will push the price after $ 4 uncertainly. However, if Toncoin manages to break and keep it above $ 4, this can clear the way for further profit.