- Toncoin Price Movement has had a low correlation with large crypto assets last month.

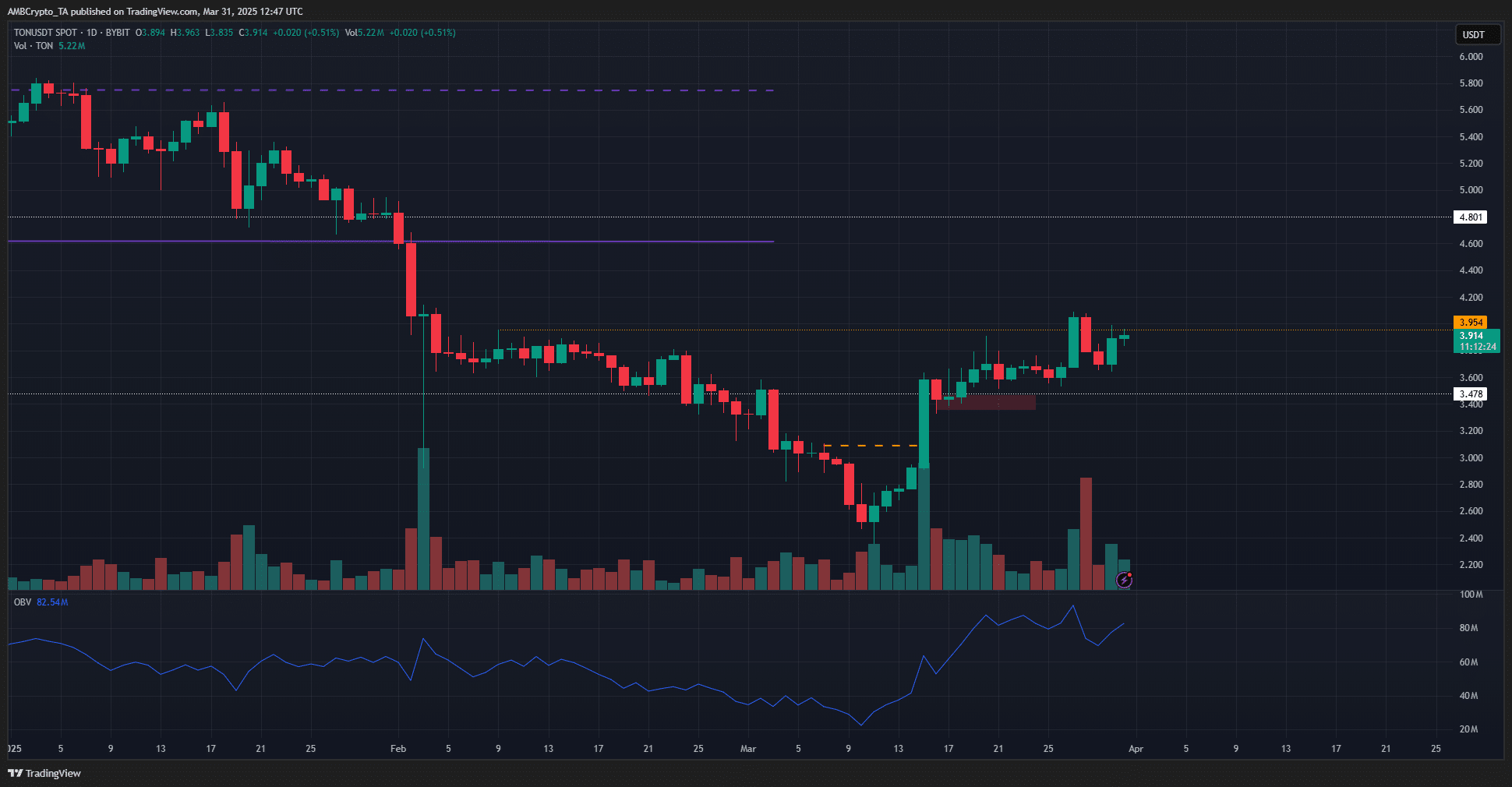

- The emerging OBV and the Bullish market structure meant that there was room for more profit.

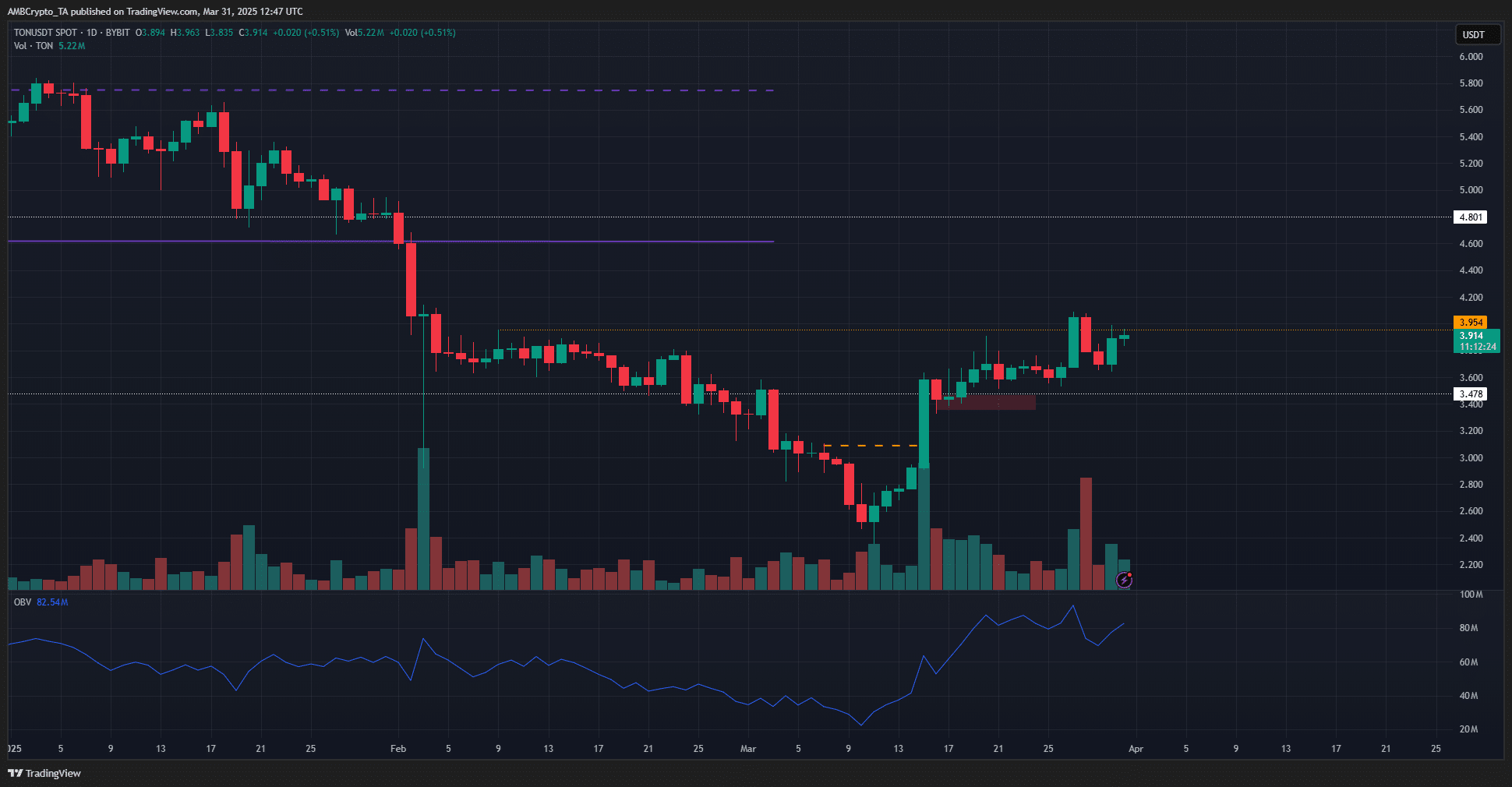

Toncoin [TON] Organized an aggressive recovery of $ 2.5 earlier in March. Since forming the monthly lows at $ 2.35, Ton rose by 66%in three weeks.

The rally also meant that the market structure was bullish on the 1-day graph, and traders and investors could expect that the trend would continue.

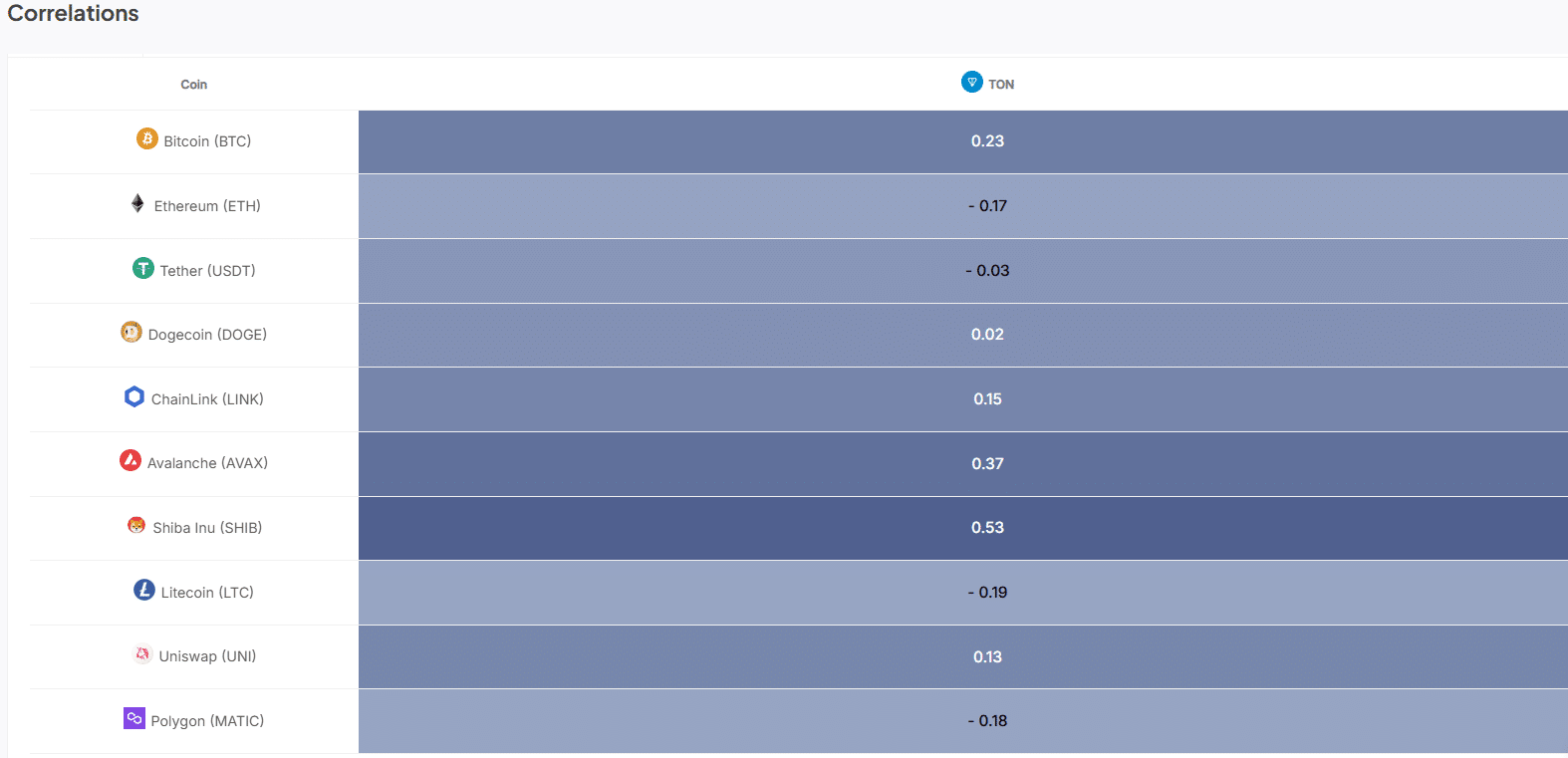

The Token noticed a remarkable lack of correlation with other popular crypto assets. Data from Intotheblock showed that it had a +0.53 30-day price correlation with Shiba Inu [SHIB] and a +0.23 correlation with Bitcoin [BTC].

This indicated that Toncoin followed none of the big tokens, but just had his race.

Toncoin will soon be able to go further than $ 4

The lack of correlation with BTC in the past month was a slight encouragement for the bulls. It meant that Ton had not already been lowered and the bullish momentum could continue, even when BTC fell to $ 80k.

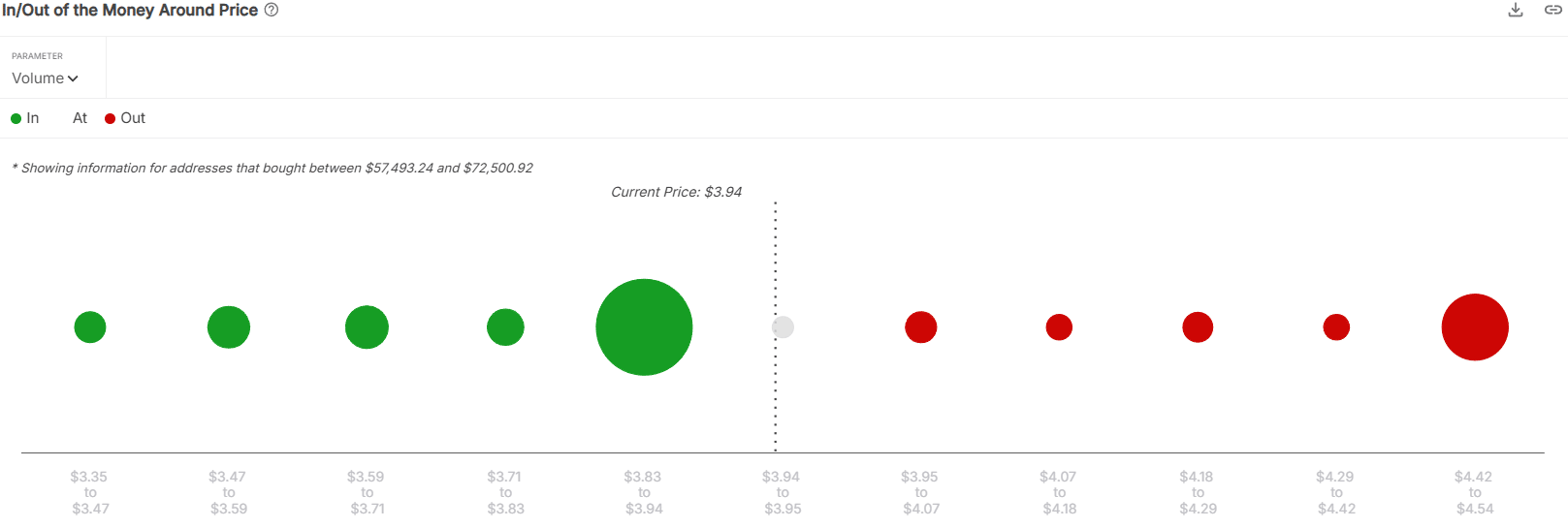

The in/out of the money around the price showed that the region of $ 3.83- $ 3.94 had bought 673 million tons.

These holders were of profit on their Toncoin and a retest of this demand zone may not cause a sales pressure. That is why it can be expected to serve as a support.

The resistance levels higher seemed much smaller compared to the area of $ 4.42- $ 4.54, it was expected to offer strict opposition.

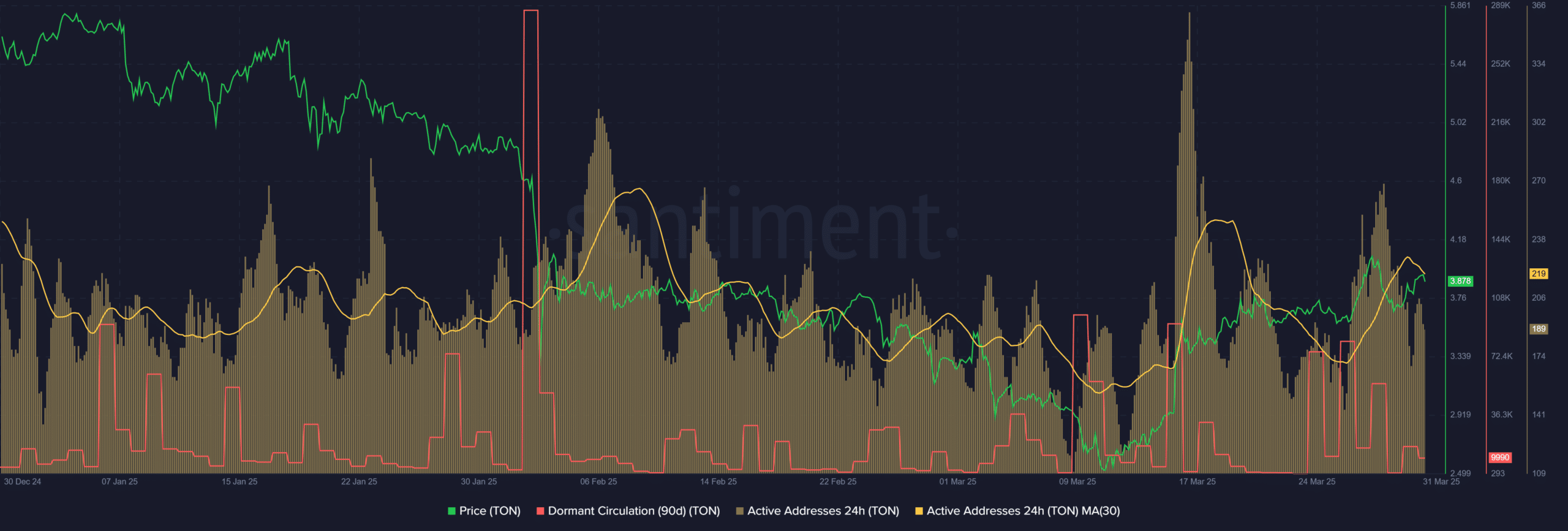

Network activity increased in addition to the price in March. The 30-day advancing average of the daily active addresses has made a higher low compared to the second week of March.

This meant increased activity and ask for Ton.

The rally saw the sleeping circulation worry several times last week. This implied raised token movements and was probably the result of holders who took a profit after the rally.

However, this does not reduce the chances of further profit.

Source: Ton/USDT on TradingView

The Toncoin price chart was Bullish after breaking the lower high from February at $ 3.95. The prize has made a series of higher lows and higher highlights on the lower schedules, which indicates a bullish trend.

The Bullish Market Structure Shift meant that the daily period could do the same in the coming weeks. The OBV has risen higher, surpassed the highlights that were made earlier in 2025 and challenge the level of December.

This indicated a strong purchasing pressure.

In general, further profits were probably for Toncoin. The next resistance levels to view were $ 4.5 and $ 4.8.