- TON has fallen in the last 24 hours.

- Statistics showed that there were more active sellers than buyers.

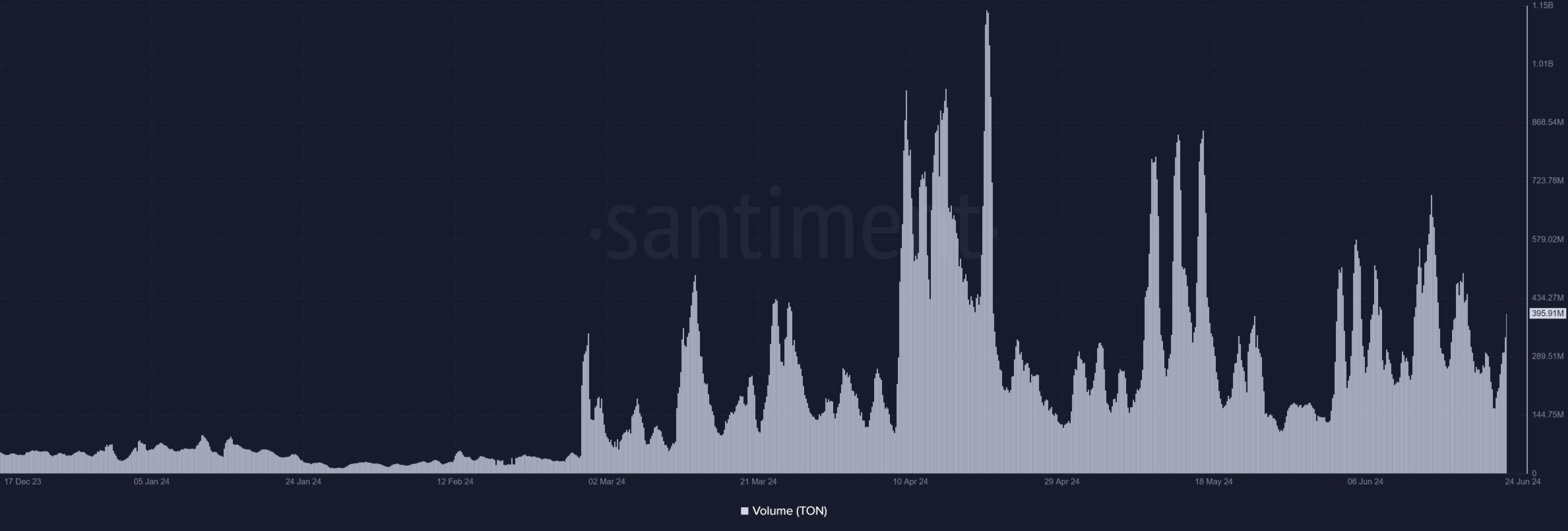

The significant spike in trading volume for Toncoin [TON] of the past 24 hours makes it a focal point for market observers. As traders intensify their activities, analyzing their behavior becomes crucial for predicting possible price directions.

Moreover, derivative statistics for Toncoin have also shown interesting trends.

Toncoin volume has a 24-hour peak.

The recent data analysis of CoinMarketCap indicates that Toncoin has experienced a significant spike in trading volume over the past 24 hours. The data showed an increase of more than 80%.

Currently the volume is approximately $398 million. This significant increase in volume was noted after a period of lower activity, during which it had previously fallen below $200 million.

An analysis from Santiment further supported this observation and supported the increase in activity. At the end of trading on June 23, volume of $270 million was recorded.

The dramatic increase in volume within such a short period is notable as it indicates increased trading activity, which could lead to greater price volatility.

Source: Santiment

Vendors dominate the Toncoin business

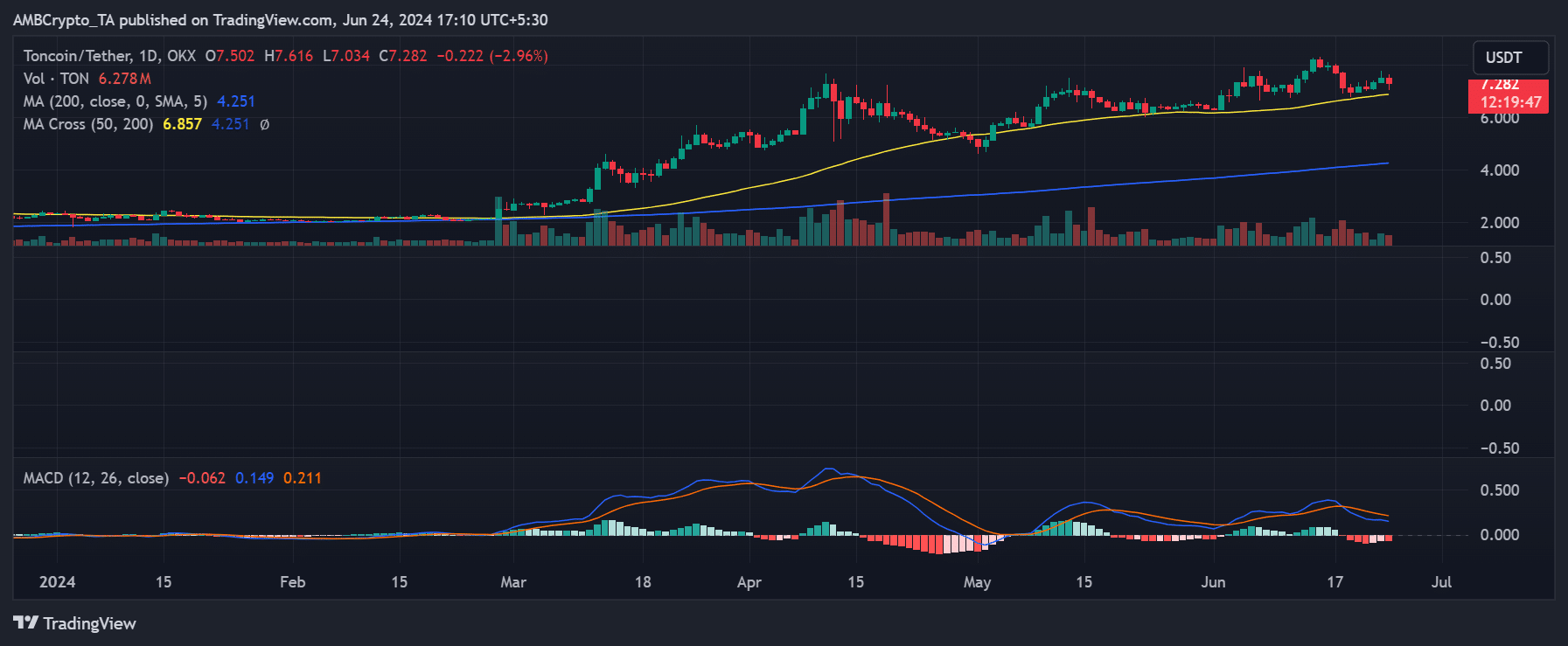

AMBCrypto’s analysis of Toncoin on a daily timeframe chart revealed an overall positive trend, despite a recent downturn in the past 24 hours. The chart indicated that TON closed trading on June 23 up more than 2%, to around $7.5.

However, the latest data showed a reversal, with TON experiencing a drop of almost 3%, dropping its trading price to around $7.2.

Source: TradingView

Toncoin’s current analysis showed it trading above its short-term moving average (yellow line). Moreover, the yellow line acted as a support level around $6.8.

This indicates that despite recent declines, the price is still supported at levels above recent lows.

However, the fact that it has fallen from a higher point suggests that Toncoin is experiencing selling pressure. The selling pressure could cause the price to test the support level, and if this level continues, it could stabilize or recover.

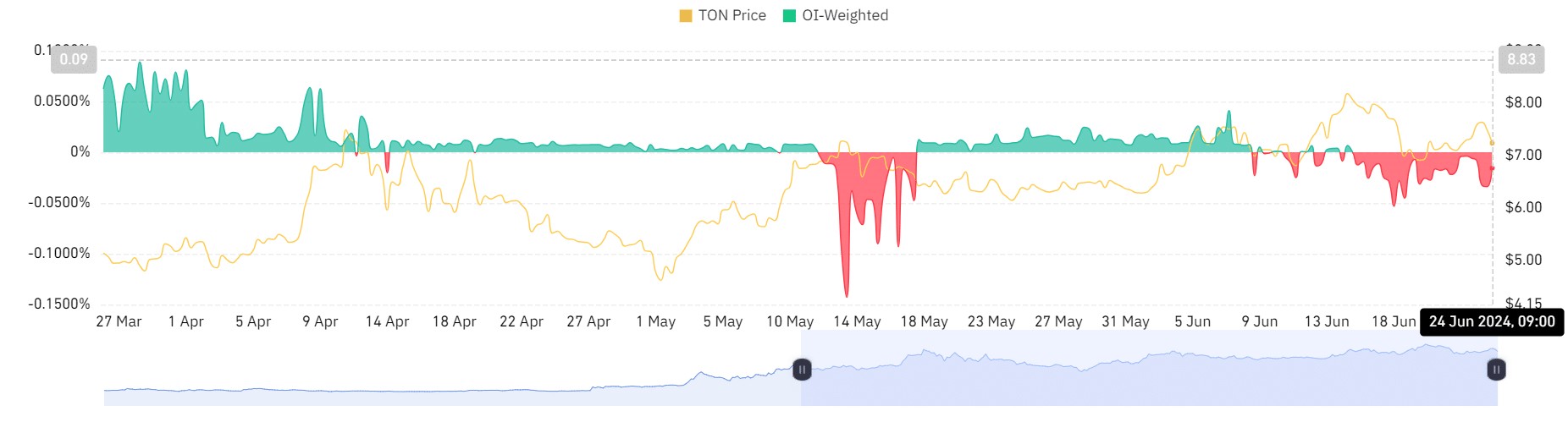

High open interest, low financing interest

The derived statistics for Toncoin suggest some intriguing trends. It is striking that there has been an increase in Open Interest over the past 24 hours. The total now stood at almost $306 million Mint glass.

This level of Open Interest is the highest in recent months. It indicates a growing involvement in derivative contracts related to TON, indicating increased speculative activity or hedging by traders.

However, despite this increased Open Interest, market sentiment remains negative. This is evident from the analysis of the weighted coverage ratio, which has remained below zero and is currently around -0.015.

Source: Coinglass

Read Toncoin (TON) price forecast 2024-25

A negative funding rate generally implies that shorts are producing long positions, indicating that there are more sellers than buyers in the market.

This condition suggests that while interest in Toncoin derivatives trading has increased, overall market sentiment is bearish, with traders possibly expecting further price declines.