- Ton hit a zone with a low risk of Sharpe Ratio & NMR! Despite weak performance.

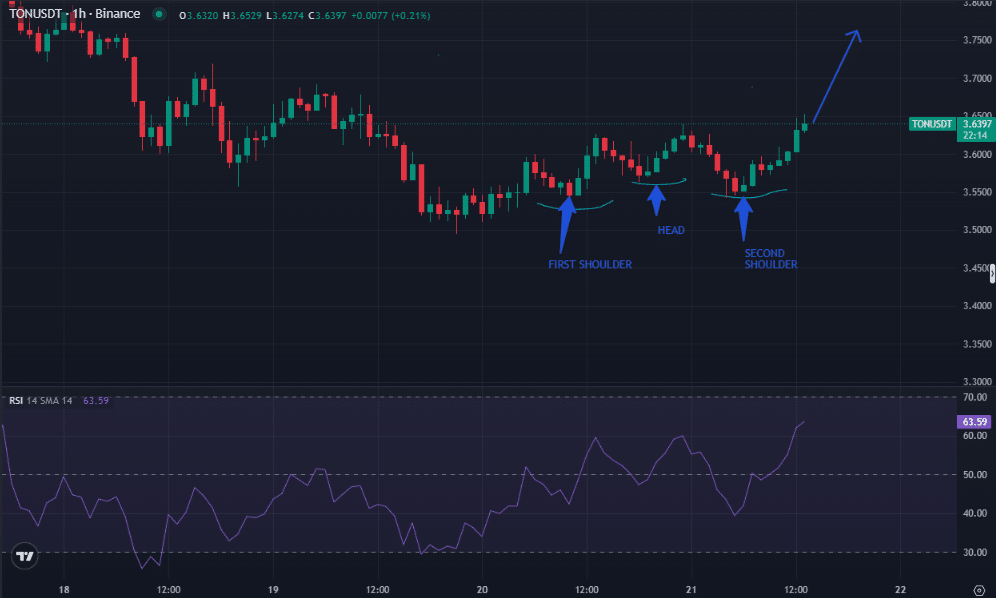

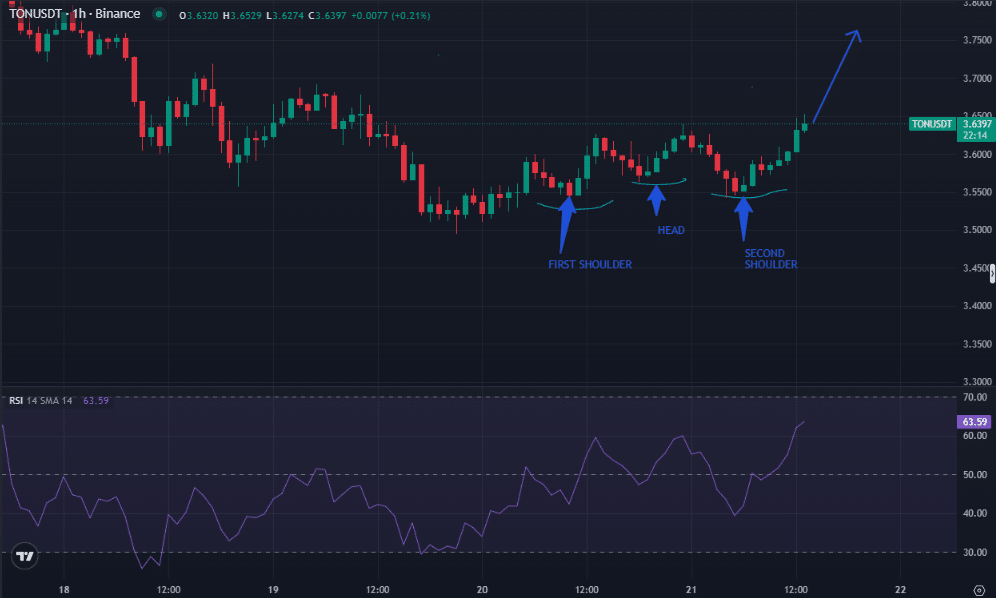

- Ton’s Binance graph of one hour showed a main pattern of the head and shoulders, a historic bullish turning signal.

Despite weak recent performance, Toncoin [TON] Remains one of the few altcoins near his all time and shows resilience.

Unlike many altcoins that have been taken considerably, Ton maintains a stronger market structure in addition to BTC, TRX and SOL.

A historical buy signal for Ton?

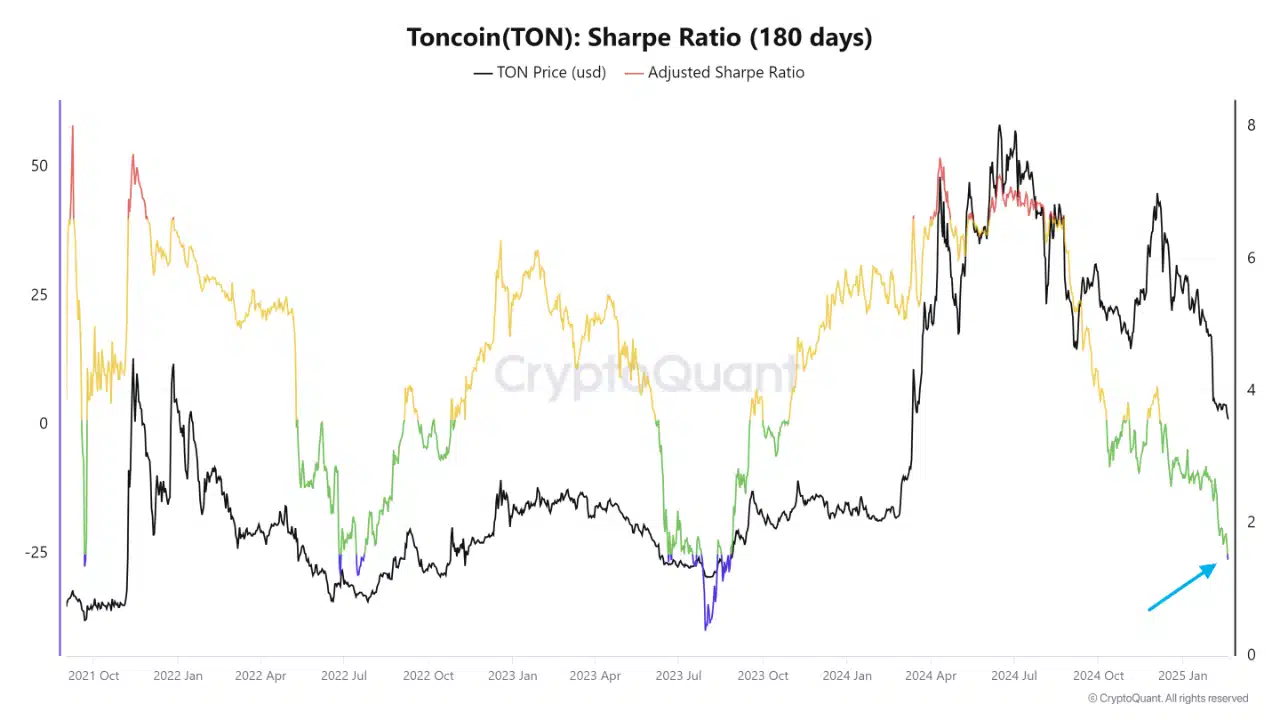

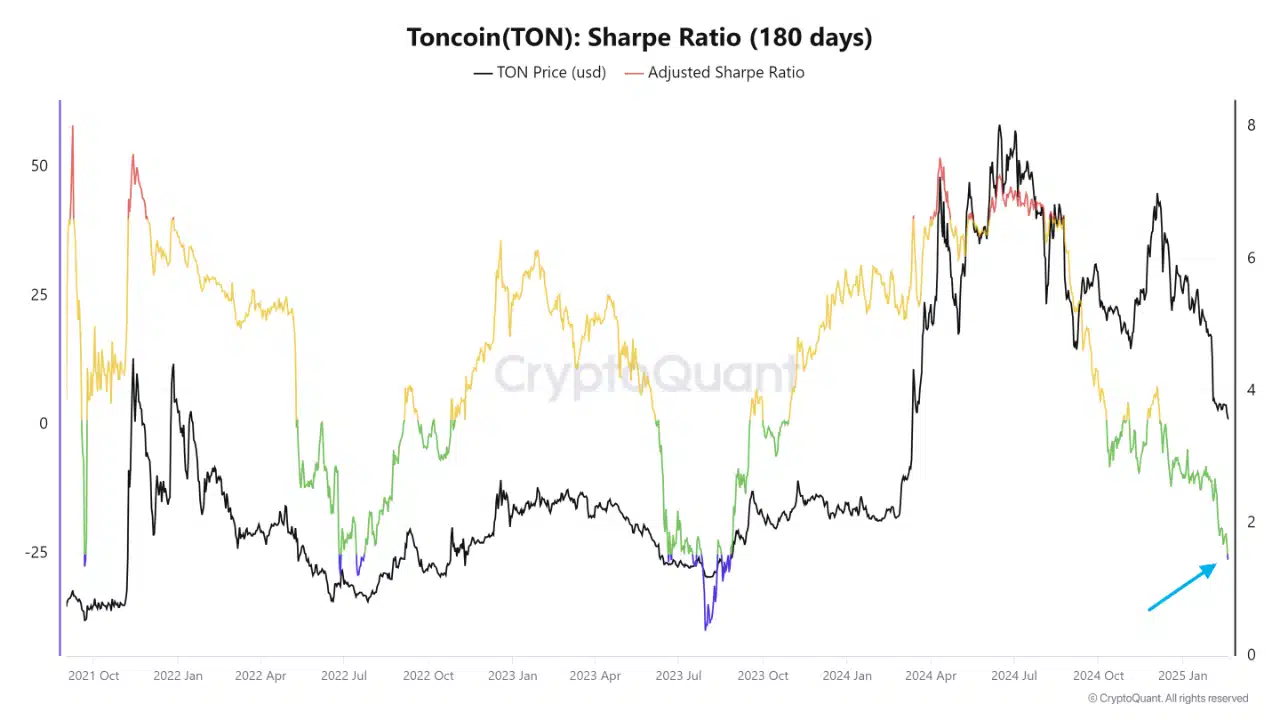

The Sharpe ratio (180 days) has fallen to historically low levels, which indicates a reduced risk-corrected return.

This trend is previously tailored to the price bases of Ton and accumulative phases.

Source: Cryptuquant

Similar decrease in the Sharpe ratio in the past signaled the marketbounds, which suggests that Ton might enter a different battery phase.

If history repeats itself, this can mark an optimal long -term entry point for traders looking for favorable risky setups.

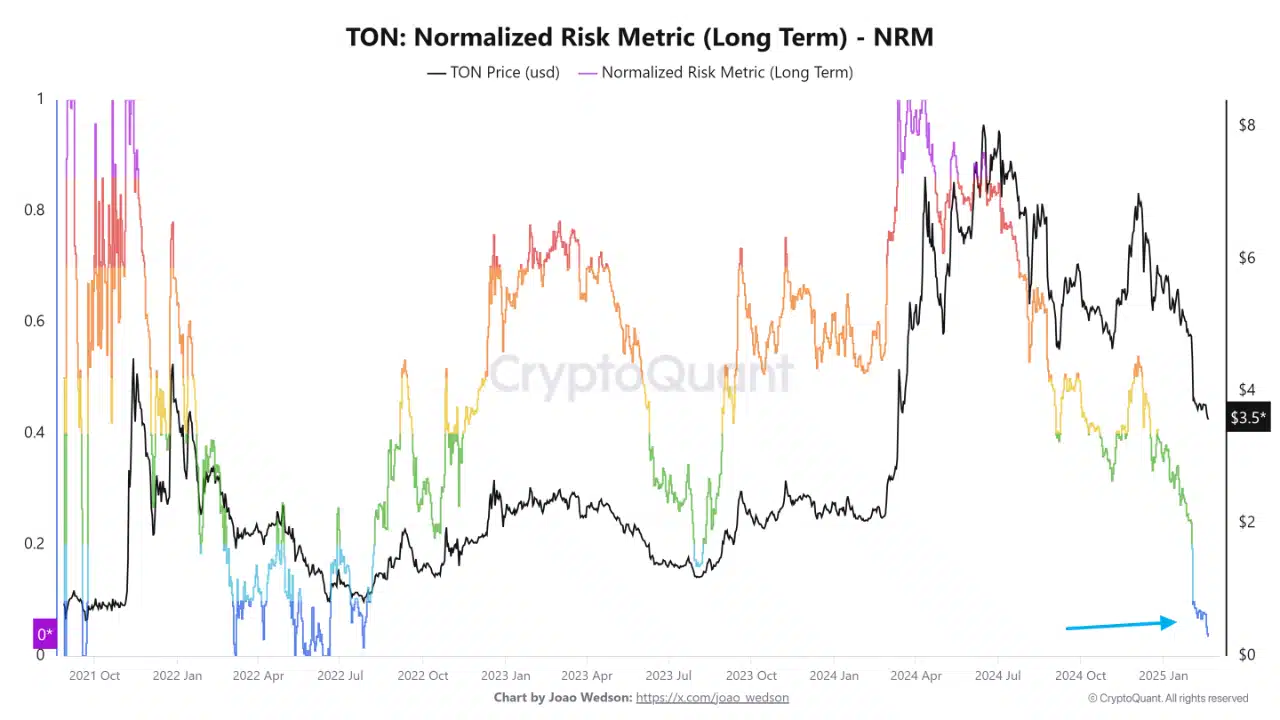

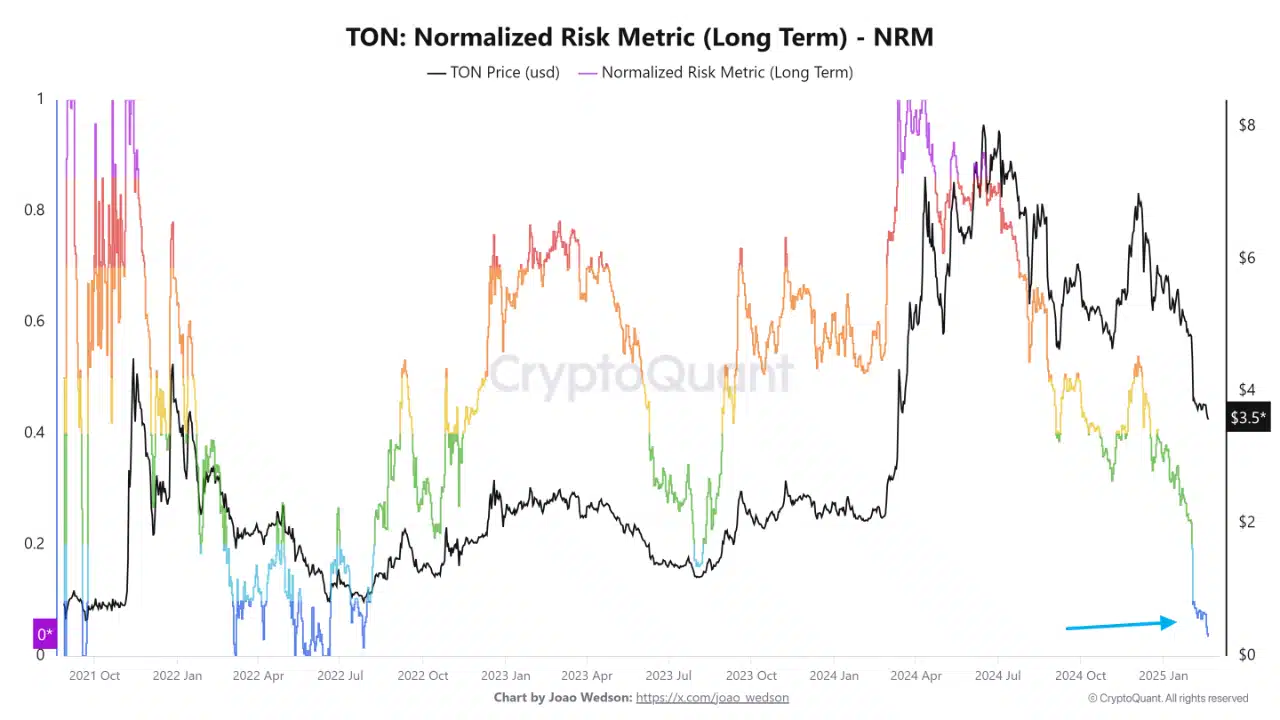

The Normalized Risk Metric (NRM) reflects this trend and reaches levels with a low risk comparable to previous accumulation zones.

Source: Cryptuquant

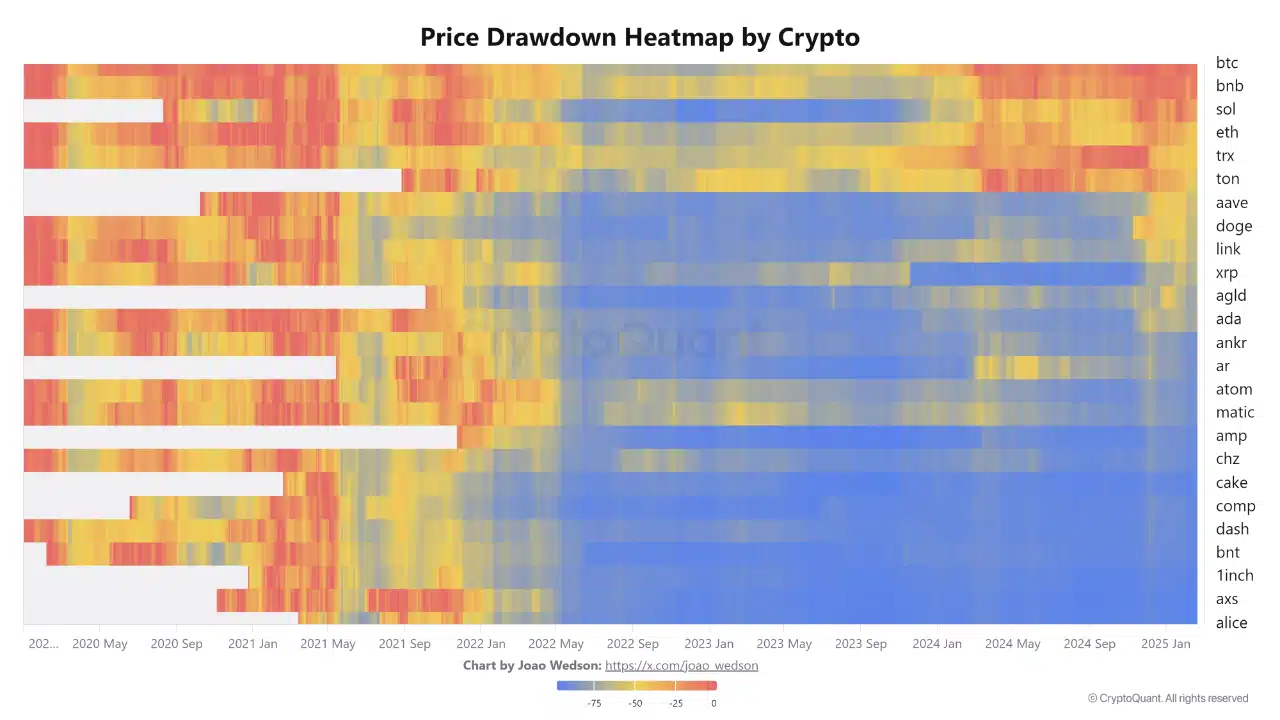

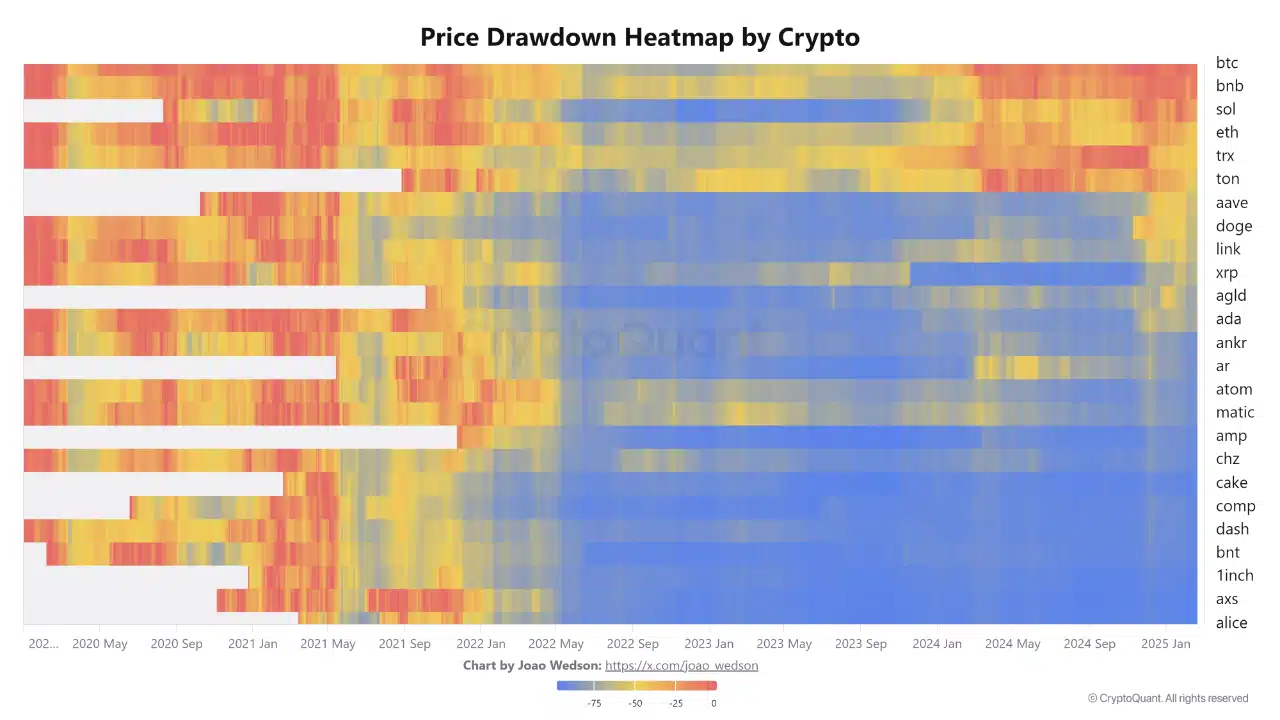

The price decrease -hittemap shows that although many altcoins are deep under water, Ton remains structurally stronger.

Source: Cryptuquant

These indicators together reinforce the argument that Ton is approaching an optimal battery phase, because traders reduce exposure to weaker assets in favor of well -performing, resilient cryptos.

Pattern refers to potential outbreak

Ton’s Binance graph of 1 hour shows a reversing pattern of the head and shoulders, a historic bullish reversal signal.

This formation suggests a potential outbreak above the neckline, which can lead to ongoing upward impulse.

Source: Coinglass

At the time of writing, the relative strength index (RSI) was at 63.59. This indicates increased purchasing pressure, but the RSI remains under the overbough area, which makes room for further profit possible.

If Ton surpasses the most important resistance levels, this can confirm a bullish reversal. This would be in line with the historical price rebounds observed when the Sharpe ratio and NRM reached comparable lows.

The confluence of these indicators reinforces the argument for a coming trend shift in favor of Ton.

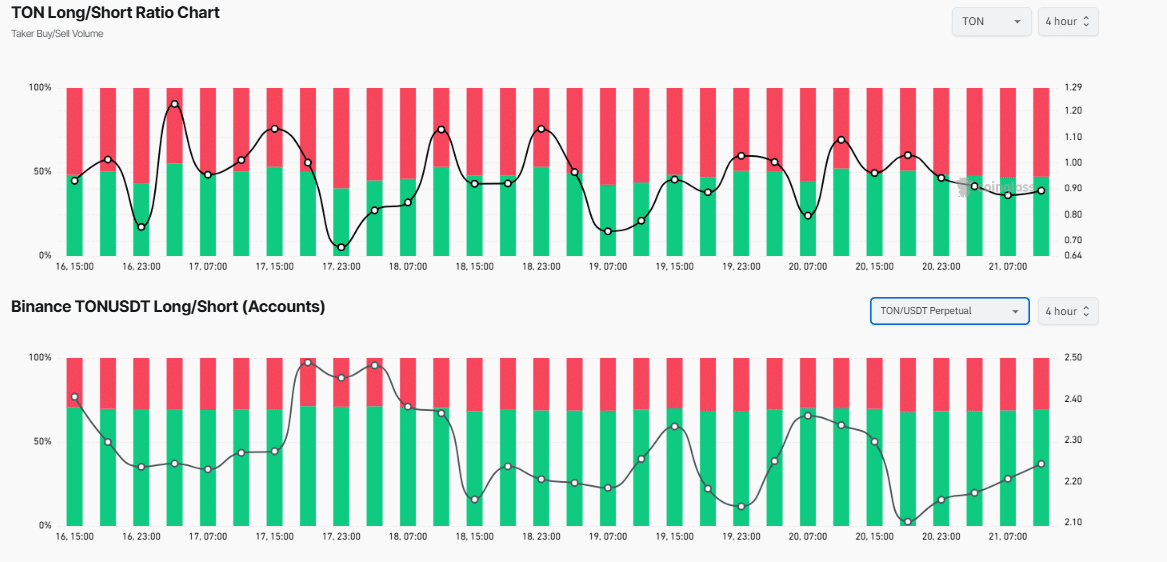

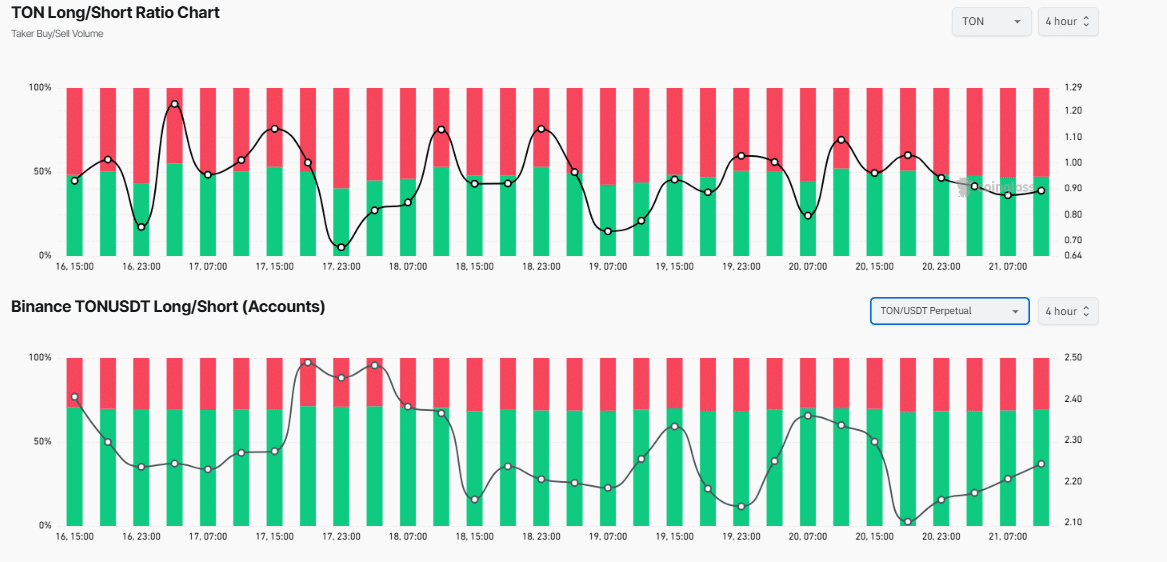

Rising long positions can cause a short squeeze

A further consideration of the long/short ratio on Binance indicates that long positions have gradually been dominance, which indicates growing optimism among traders.

The fluctuations in short positioning suggest persistent skepticism, but the recent trend shift in the direction of a higher long ratio indicates that traders may position for a breakout movement.

Source: Coinglass

Historically, comparable shifts in long/short positioning preceded strong upward movements, especially with bullish indicators such as a low Sharpe ratio and inverse head and shoulder spatrons.

If a long positioning continues to rise while shorts remain trapped, a liquidation cascade could feed further price profits, which strengthens the bullish prospects for Ton.

Normally, when the Sharpe ratio and NRM reach low levels, they indicate potential soils or accumulation zones.

That is why the low Sharpe ratio of Ton, falling NRM and resilience of price collection suggest an optimal long-term accumulation option.

The reverse head and shoulder pattern supports the potential advantage, while long/short positioning hints with the rising bullish sentiment.