A widely followed analyst thinks a big price move is coming for Bitcoin (BTC) after months of consolidation.

Pseudonymous analyst Checkmate tells his 91,900 followers on social media platform

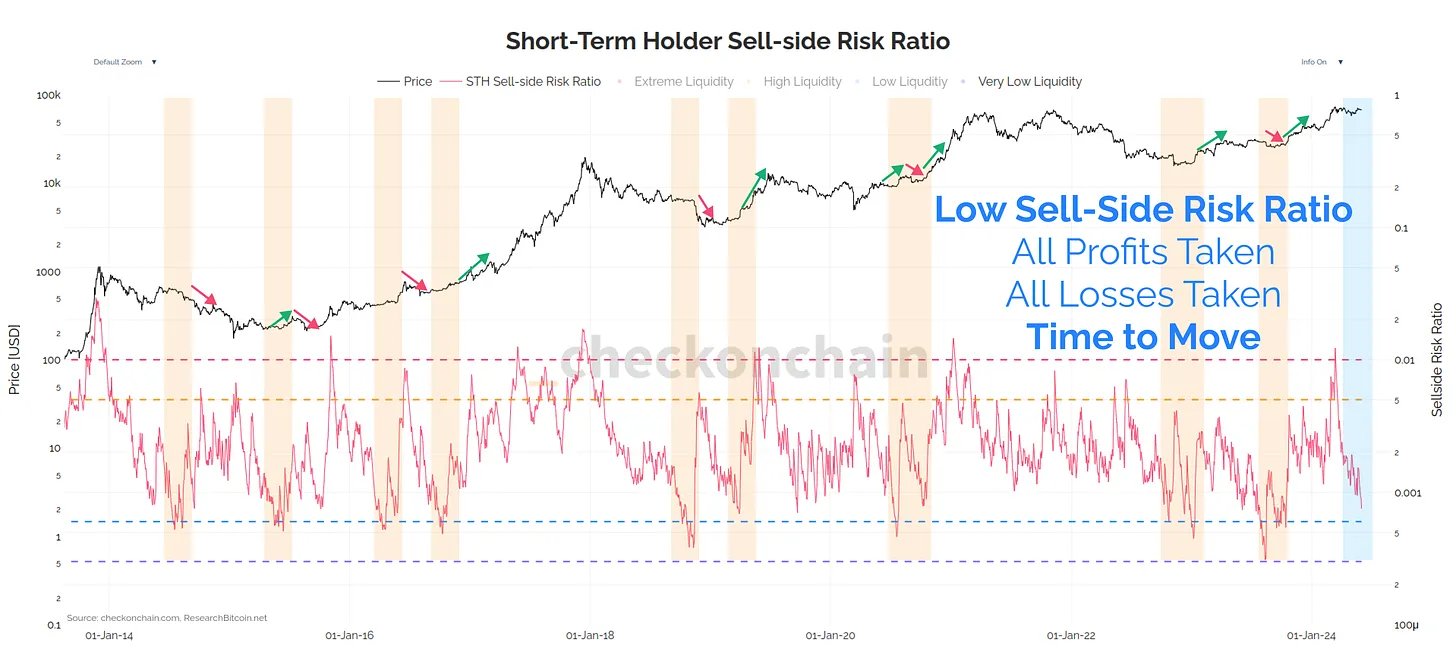

According to the analyst, BTC’s sell-side risk ratio for short-term holders is rapidly decreasing, indicating that sellers are losing ammunition. Checkmate notes that he is looking at the cohort of short-term holders or entities that have held BTC for less than 155 days because they are the ones driving short-term price action.

“Range contraction (consolidation) leads to range expansion (trending).

Bitcoin is coiled like a spring and usually doesn’t stay that still for long.

The sell-side risk ratio for short-term holdings is dropping like a stone, which tells us it’s time to make a move.”

As for what could catalyze the next big Bitcoin move, Checkmate says he is keeping an eye on the US bond market. According to the analyst, the 10-year yield (US10Y) is on an uptrend and conditions could turn sour for Bitcoin and crypto if they trade close to 5%.

Checkmate emphasizes that “higher returns mean stricter terms, less valuable collateral and reduced overall risk tolerance.”

“I have highlighted in red the severe bond sell-off we saw between August and October 2023 in the chart below. During this period, the US 10-year yield approached 5.0%, stocks sold off -10%, and Bitcoin sold off -12% in one day. That said, BTC then consolidated for two months and moved +30% higher.

The 10-year yield rising to 5% is where the Fed and Treasury have previously worried about the dysfunction in Treasury markets and stepped in to halt the price slide. This is a reasonable argument as to why Bitcoin initially sold off but then rose higher again.

The bond market is the one that gets to spend time on risky assets and financial stability. If yields increase from now on, it will be close to the area where things could become difficult, and quickly.”

Bond prices and yields tend to move in the opposite direction. When interest rates rise, the prices of older bonds plummet because they have to compete with newer bonds that offer higher interest rates.

At the time of writing, US10Y is hovering at 4.394%, while BTC is trading at $68,643.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on X, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: DALLE3