In the midst of the constant Bearish market sentiment, Shiba Inu (Shib), the popular and second largest meme in the world, receives enormous attention from whales and holders in the long term.

Whale eyes on shib

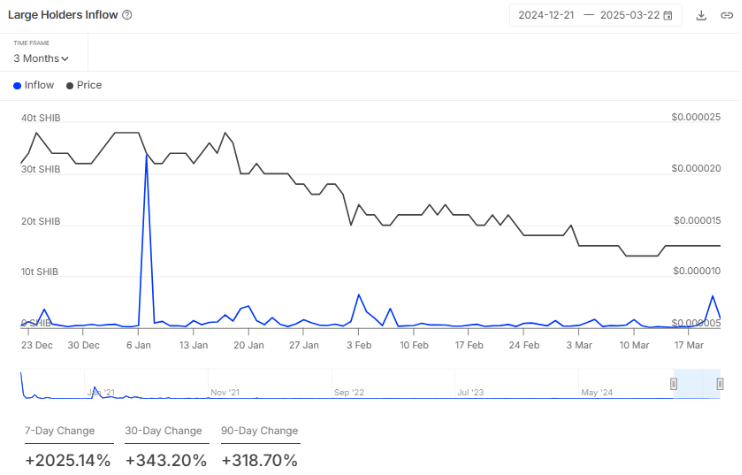

Data from the On-Chain Analytics company Intothlock showed that ShIB has seen a significant increase of 2,025% in the inflow of large holders, which indicates an increased interest in the meme-mint.

This suggests a potential soil for Shib, because whales tend to buy large quantities during considerable market corrections. Moreover, this considerable jump in large inflow of large holders also suggests potential buying options, because trade shows have recently witnessed remarkable Shib outflows, indicating that assets go from exchanges to cold portfolios.

Current price momentum

With this enormous participation and bullish activity, SHIB has registered an impressive profit of 2.50% over the past 24 hours and is currently being traded near $ 0.00001288. During the same period, however, the trade volume fell by 22%, indicating lower participation of traders and retail investors compared to the previous day.

This fall in trade volume seems to be due to high volatility, which seems to cause confusion among traders and investors.

Shiba Inu (ShIB) Technical analysis and upcoming levels

According to the technical analysis of experts, the recent price butt from Shib suggests an outbreak of a falling trendline that has booked strong resistance since mid -January 2025. Moreover, the MEME MUNT is currently near a crucial support level of $ 0.000012. With this recent breakout, the general sentiment for Shib seems to be shifting from wider areritary to bullishness.

Based on recent price action and historic momentum, if Shib sticks and closes a daily or four hour candle above the level of $ 0.0000132, there is a strong possibility that it could rise by 50% to reach $ 0.0000203 in the coming days.

From now on, the meme-mint is traded under the 200 exponential advancing average (EMA) on both daily and four hours of time frames, indicating that Shib is in a downward trend on both longer and shorter time frames.