A rare bullish crossover between two on-chain metrics could soon form for Bitcoin. This is when this analyst believes the cross would occur.

The Bitcoin realized prices of two UTXO age groups are moving towards a cross

As explained by an analyst in a CryptoQuant Quicktake afterA bullish crossover is expected to occur soon for BTC. The indicator of interest here is the “realized price,” which essentially tracks the price at which the average investor in the Bitcoin market acquired their coins.

The indicator calculates this value by going through the on-chain history of each coin in circulation to see what price it last traded at. The metric assumes that this price is the purchase price and thus, after averaging this value across all tokens on the network, the average cost basis of all coins is obtained.

When the price of the cryptocurrency is below this benchmark, it means that the average holder in the industry is in a state of loss. On the other hand, the fact that the price is above the indicator means that the overall market enjoys a net profit.

The realized price of the entire user base is not relevant in the context of the current discussion, but two specific UTXO age categories, namely 6 months to 12 months and 12 months to 18 months. What these age groups mean is that the coins (or more accurately, UTXOs) associated with them last moved within their range.

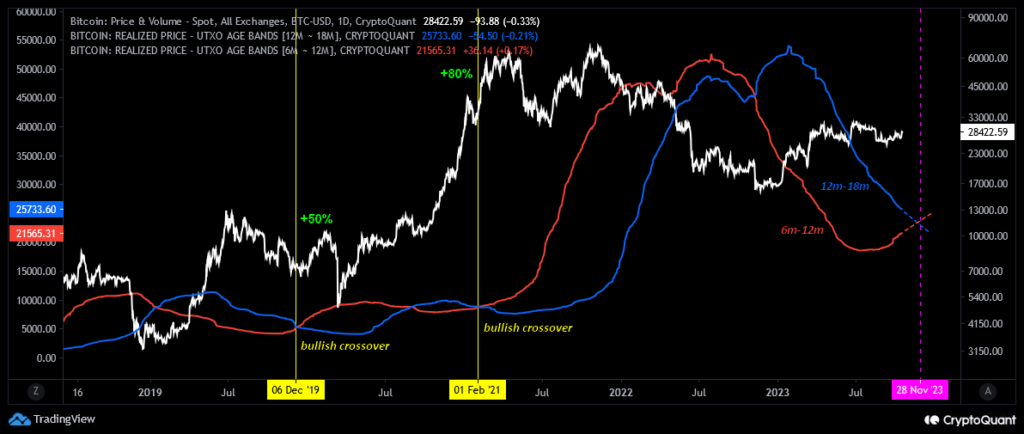

Here is a chart showing the trend in Bitcoin’s realized price for these two UTXO age ranges over the past few years:

Looks like the the two metrics have been approaching each other in recent days | Source: CryptoQuant

As shown in the chart above, the realized price of the UTXOs that were inactive between 12 and 18 months ago have been declining for some time. The 6 to 12 month age range showed a similar trajectory earlier this year, but the statistic plateaued a while ago and has since turned around.

The reason the average cost basis of investors in this age group has changed course is that the six-month mark for the group is now in April, meaning those who bought during the rally in the early months of the year are now counted among this cohort.

Earlier this year, bear market buyers were part of the group, which naturally caused the average to fall. In contrast, the twelve to eighteen month old group are still these bear market buyers, and therefore the realized price is still declining.

If these two metrics continue on their current trajectory, they will undergo a crossover. As the quant highlighted in the chart, such a crossover where the 6-month to 12-month band breaks above the 12-month to 18-month cohort has historically proven bullish for the asset.

In total, there have only been four such crossovers in the entire history of cryptocurrency, so if this crossover continues to develop, it would be only the fifth ever. The analyst believes that November 28, 2023 is when this bullish crossover for Bitcoin could occur.

BTC price

Bitcoin had made a push towards the $29,000 level yesterday, but it appears that the rise has already calmed down as the coin has retreated towards $28,400.

BTC appears to have overall moved sideways in the last two days | Source: BTCUSD on TradingView

Featured image from Shutterstock.com, charts from TradingView.com, CryptoQuant.com